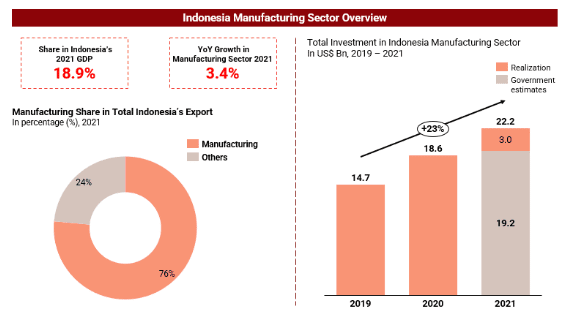

1. Indonesia’s manufacturing sector is promising a bright future with ~23% CAGR seen in total investments flow in the sector in the last 3 years….

Manufacturing has been an important component of Indonesia’s GDP and exports for quite some time as the sector has strong government focus.

The government has played a very supportive role and provided fiscal incentive facilities like tax holidays for investors including those who invest under IDR 500 Bn.

Recently, there have been discussions between President Joko Widodo and Elon Musk to build a mega battery factory in Indonesia.

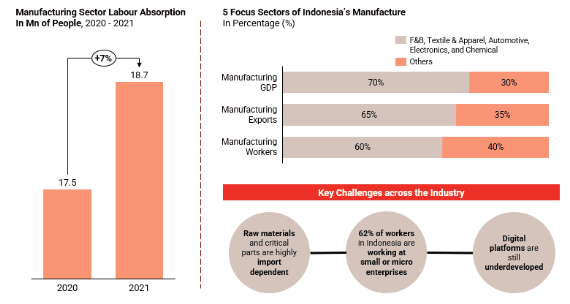

2. …especially in 5 key areas of manufacturing sector which together account for 70%, 65% and 60% share in manufacturing GDP, exports, and workers respectively

F&B, Textile & Apparel, Automotive, Electronics, and Chemical are currently the focus areas of the governments within the broader manufacturing sector. Labour absorption rate continues to grow for the sector highlighting the importance of manufacturing in the country.

However, there are still several existing challenges in the industry including raw material availability, large proportion of workers working in small or micro business entities, and underdeveloped digital platforms.

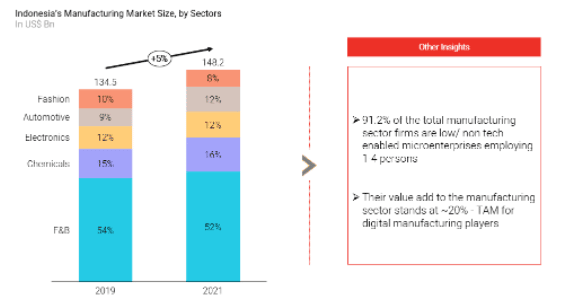

3. With a major chunk of the manufacturing activities happening in the low tech MSME space, the digital-first players are looking at a sizeable ~USD30 billion TAM

Although Indonesia’s GDP slowed down in 2020 due to the pandemic, these five sectors continued to grow with ~5% CAGR between 2019-2021. Among these focus sectors, F&B take more than half of the total market. As per estimates, the adoption of technology in the manufacturing sector can add value of up to $2.8 trillion to the Indonesian GDP by 2040. The no/low-tech enabled MSMEs form the core customer base of the digital manufacturing players. The TAM for digital-first players stands at ~USD 30 billion.

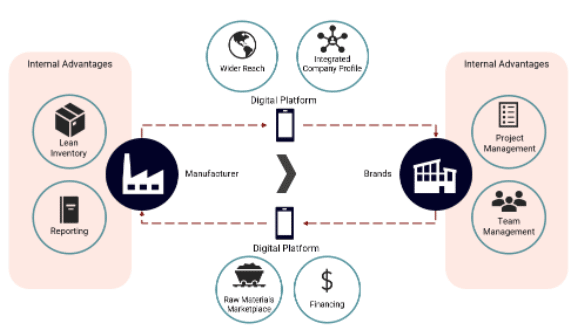

4. Digital platform provides numbers of benefits for stakeholders and in gaining competitive advantages

Digital platform aims to digitalize traditional manufacturing services and to link stakeholders through an integrated platform.

The platforms are offering a wide range of services to the entire manufacturing ecosystem thus leading to positive impact to the stakeholders.

By using these platforms, retailers can provide more customized solutions, while manufacturer are able to cater to wider retailer base.

5. Several players in Indonesia are entering the space to fill in the void by offering digital-first solutions and help digitalize the industry

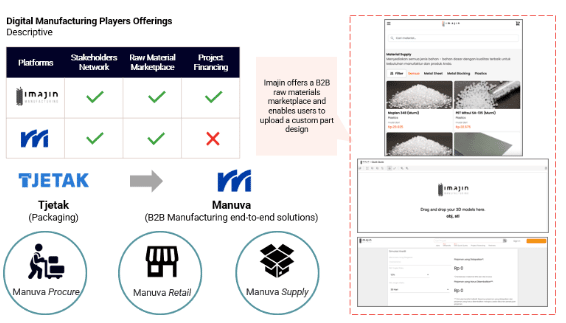

In Indonesia, some players have dived into this blue ocean opportunity.

Initially Manuva was a packaging company by the name of ‘Tjetak’ and got rebranded last month to ‘Manuva’. Currently, Manuva is providing three services to manufacturers and brands.

While Imajin offers services like those of Manuva, it also offers a project financing service to its retailer network.

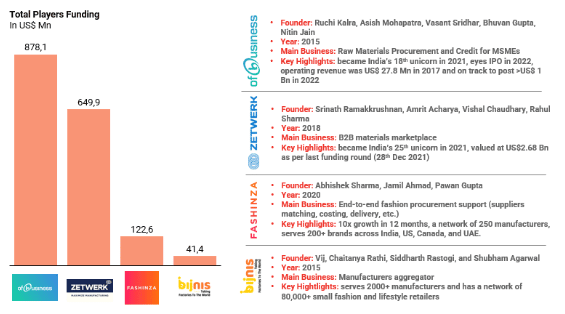

6. India Case Study – OfBusiness, Zetwerk, Fashinza, and Bijnis – funding helping players scale up their businesses

Looking at some benchmarks from India, most of the incumbent players have gained traction. The interest from investors and fundraising activities have helped the players to aggressively scale up and better their performance with some even reaching the unicorn stage.