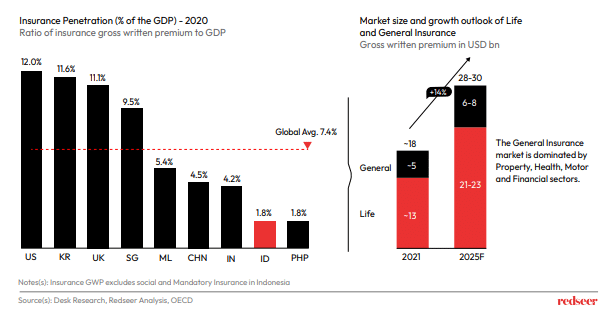

Indonesia’s InsurTech sector will grow at ~40% CAGR during 2021-26E due to low base (insurance penetration), already high (and rising) digital penetration, and the emergence of newer models. The capital raises by multiple players in the region suggests the continued support from investors. More could follow as players gain scale and display clearer path to profitability. Balancing growth while keeping a tab on profitability will require conscious choices.

The InsurTech sector holds a meaningful growth potential in the region due to the currently low penetration levels. Higher awareness (led by rising digitization), price-competitive offers and efficient distribution channels have propelled the InsurTech sector. Growth in the General Insurance segment will be driven by higher penetration in Property, Health, Motor, and Financial sectors.

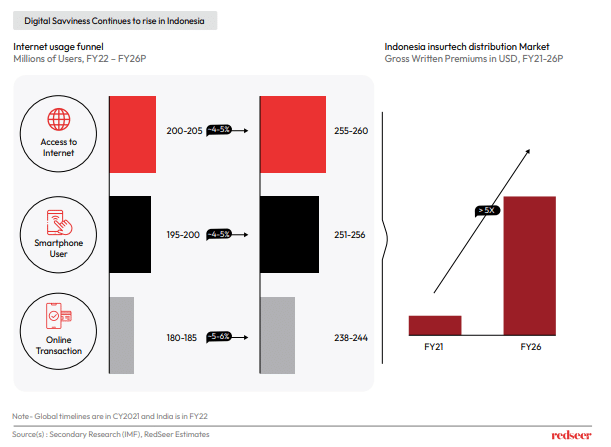

1. Low insurance penetration and rapidly digitising economy sets the stage for a likely surge in the growth of InsurTech sector (1/2)

Digital insurance penetration in Indonesia was ~1% in 2021 versus ~2% in India, ~6% in China, and ~14% in the US. Accordingly, the sector is likely to grow at a rapid clip in Indonesia as it comes of a low base.

2. Low insurance penetration and rapidly digitising economy sets the stage for a likely surge in the growth of InsurTech sector (2/2)

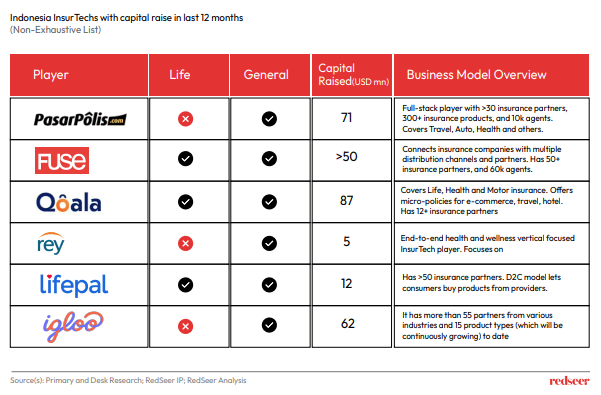

Several players are already operating in the market with sizable offerings spanning across Life, General, B2C, B2B2C and Group insurance schemes. Players have raised capital in the past and pushing for growth amidst the growing penetration.

3. The structural opportunity around penetration-led growth has allowed multiple InsurTech players to raise capital in the recent past

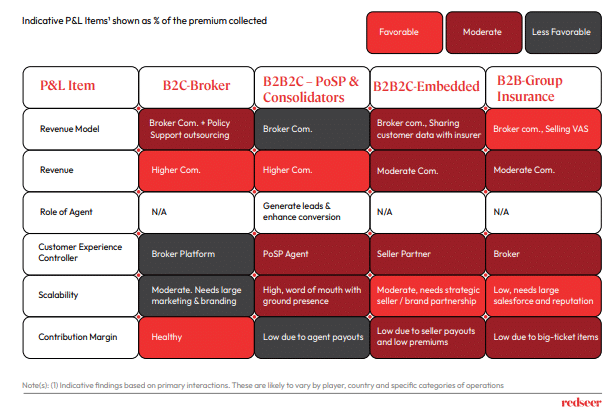

The InsurTech models differ on their revenue and profitability metrics. For example, B2C-Brokers models tend to be asset-light and have higher profitability. In contrast, B2B2C models rely on insurance agents and scale faster. However, they have lower profitability versus B2C-Broker models. Given current macro conditions, it could be timely to review these models and make suitable changes as needed.

4. Unit Economics differ widely across models. Suitability of model a function of targeted white space(s) and desired trade-off between scale and profitability