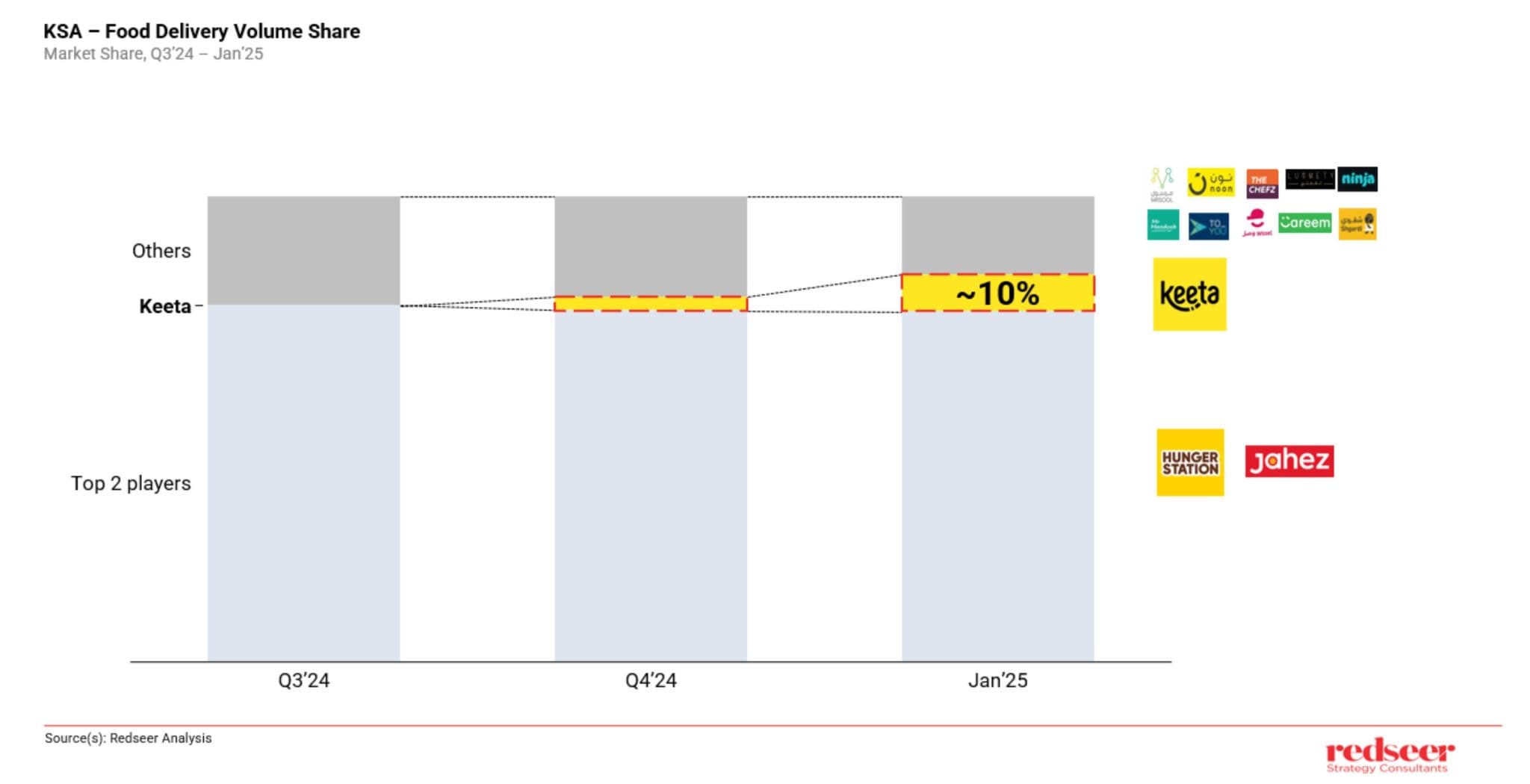

Keeta has gained ~10% market share in KSA— what’s next?

Saudi Arabia’s food delivery sector has undergone rapid transformation over the past five years, evolving into one of the most dynamic and profitable markets in the region. With high consumer adoption, high purchasing power, and sustained profitability, the industry continues to attract new challengers.

Have a question?

Our experts are just a click away.

Yet, growth is far from over. As the market matures, competition is heating up, with new entrants shaking up the status quo. Keeta, for instance, has made a significant impact, capturing 10% market share within just five months of launch.

From our early insights on resilience and expansion of the food delivery market to rise in multi verticality, we’ve covered multiple facets of the hyperlocal market. In this edition, we highlight the key trends that have shaped the market recently:

- How has Keeta captured 10% market share in five months?

- What has driven the food delivery market’s rapid growth?

- Which key trends will define the future of Saudi Arabia’s Q-commerce landscape?

Keeta has gained ~10% in volume share within just 4-5 months

Keeta has emerged as a strong challenger in Saudi Arabia’s food delivery market, successfully gaining market share—though much of this growth has come at the expense of smaller players rather than significantly disrupting major competitors like Hungerstation and Jahez. Their current consumer base is largely price-sensitive, highlighting the need to build stronger brand loyalty to sustain long-term success.

This entry has fueled aggressive promotional discount campaigns

Food delivery market growth in 2024 has been heavily driven by promotions, with players adopting different strategies to capture and retain users. Challenger brands have aggressively focused on new user adoption, rolling out lucrative discount campaigns and attractive offers to onboard first-time customers. Meanwhile, legacy players like Hungerstation and Jahez have been prioritizing subscription models to lock in loyalty & expand wallet share. They also focused on expanding into multi-service offerings like grocery delivery, ensuring users spend more time and money within their ecosystem.

These strategies have resonated strongly with consumers, particularly campaigns that eliminated delivery fees. As a result, consumer behavior has significantly shifted—many users now switch between multiple apps, while others order more frequently led by value-driven offers.

Hence, the market grew at a CAGR of 23%, faster than previous year

Saudi Arabia’s food delivery market has witnessed rapid growth in 2024, driven by both rising user adoption and an increase in order frequency. A significant portion of new users emerged from hinterland regions, where targeted promotions fueled adoption. Meanwhile, professionals working in urban centers are ordering more frequently. This surge has been further amplified by heavy promotional campaigns, particularly in the second half of the year, as platforms intensified their battle for market share. Additionally, with more youth and women entering the workforce, the demand for convenient solutions continues to rise, solidifying food delivery as a core lifestyle habit.

Currently, market leaders remain unaffected, and market share has been primarily captured by smaller players

Keeta has rapidly captured a significant market share and disrupted the industry in a short span of time, driven by:

- Aggressive promotional campaigns and substantial investment capital (a commitment of 1 Bn SAR to the Saudi market), creating more value for consumers

- Swift onboarding of restaurants, enabling a diverse selection of consumers

- Tech and operational expertise, enhancing consumer experience

However, Keeta’s expansion has primarily come at the expense of smaller players rather than significantly challenging major competitors like Hungerstation and Jahez.

To maintain momentum, Keeta needs to offer differentiated offerings, while leaders need to continue bringing their A-game

While Keeta has successfully entered the competitive landscape, establishing long-term dominance will take time. While global insights, advanced technology, strong funding, and aggressive discounting have driven short-term success, sustained leadership requires a deeper understanding of the local market. This involves recognizing regional preferences, cultural nuances, and varying decision drivers across Saudi Arabia’s diverse population. A localized approach, including region-specific promotions and multilingual strategies, will be crucial. Additionally, offering differentiated features like subscription programs and q-commerce could be key to solidifying a competitive edge

Looking ahead, three things are certain

As Saudi Arabia’s hyperlocal market evolves, three key trends will shape its future:

- Consumers will get better value in short term

Increased competition will drive better value for consumers through more choices, enhanced experiences, and competitive pricing. For market players, the need to build stronger brand loyalty is key to sustain long-term success.

- Market Consolidation

The food delivery space in KSA is becoming highly competitive, and consolidation is expected, with 2-3 dominant players emerging. Global markets have consistently shown a pattern of consolidation around 2-3 dominant players, as evidenced in the USA, China, and India. We expect Saudi Arabia to follow a similar trend, with the top 2-3 players capturing around 90% of the market, leaving smaller players to either exit or compete for a smaller slice of less than 10%

- Market to grow faster in 2025 than earlier expected

In 2024, the market saw a significant surge, further fueled by aggressive promotional campaigns, especially in the latter half of the year, as platforms ramped up their competition for market share. With high discounting likely to continue in 2025, consumer spending is expected to rise, driving faster market growth than initially forecasted.

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me