KSA Q-com Roundup – Buckle up for the ride

H1 2024 has been an active period for quick commerce in KSA. We’ve already discussed some of these ongoing changes in our previous quarterly update on food delivery and also covered the rapid rise of quick commerce in online grocery in the kingdom.

Today, we are doing a quick commerce roundup for the kingdom as we continue to see significant changes in this space. What to expect in this article –

- Continued growth for Quick Commerce in KSA

- Jahez’s H1 2024 results

- Keeta’s imminent KSA entry

- Ninja expansion into food delivery

- The strategic partnership between Nana and TheChefz

We solve the strategy behind scale!

Continue reading for key market updates on quick commerce players in H1 2024.

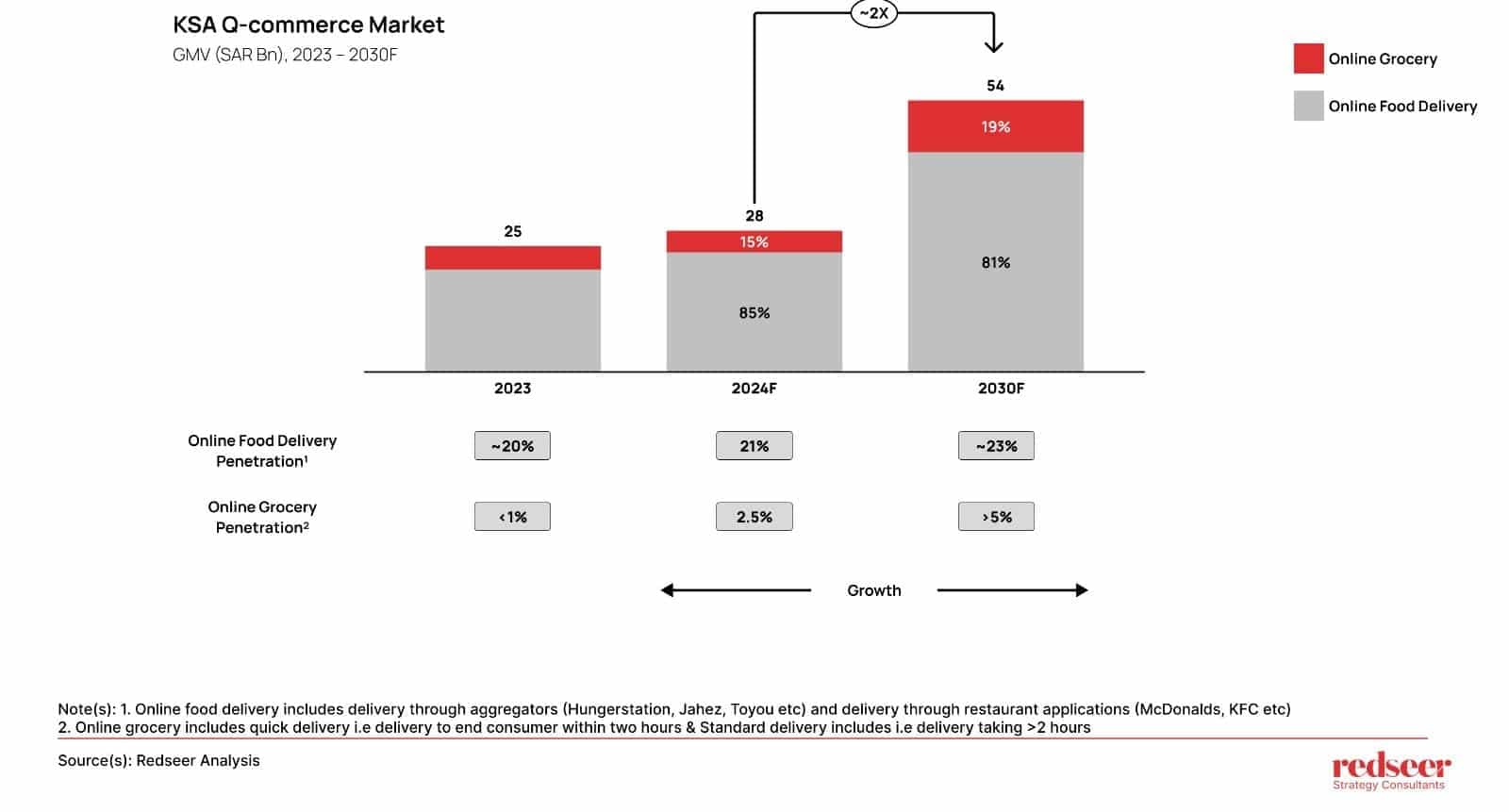

1. Strong Growth for Quick Commerce Market- The KSA quick commerce market has expanded steadily and is on course to double in size by 2030

Online food ordering is expected to experience healthy growth in 2024, reaching a significant milestone of >850K daily orders. With consumer habits forming for online ordering, the food aggregator market is expected to more than double in the next 6 years, representing >23% of the overall food service spend.

Further, the online grocery market is on the cusp of significant expansion, with the market expected to reach SAR 10 Bn by 2030. As consumer behavior shifts towards convenience and speed, with 80% expecting delivery within two hours, quick delivery models associated with advanced tech are set to dominate.

Continue reading for key player initiatives & updates on quick commerce players in H1 2024.

1.1. Jahez, announced its H1 24 results – Performance relatively positive however challenges remain

The Saudi food market has been dominated by two key players: Hungerstation and Jahez, who together serve around 70% of the food aggregator demand. While Hungerstation has long held a leadership position in Saudi Arabia, Jahez has seen substantial growth, emerging as a formidable challenger.

In H1 2024, Jahez achieved a 31% year-on-year increase in GMV (across KSA and non-KSA platforms); Total orders surged to a record 50.1 million, reflecting a 30% growth compared to the same period last year.

However, despite this impressive growth in KSA and regional expansion, Jahez is expected to face increased competition, not only from the already established Hungerstation but also from new entrants like global giants such as Meituan’s Keeta and Ninja.

How will Jahez adapt? There is still enough growth left in the local Qcom market. Also, it has also already diversified into newer verticals and geographies.

1.2. Keeta has entered the Saudi market – A significant shakeup is expected

Keeta is expected to enter the Saudi food delivery market.

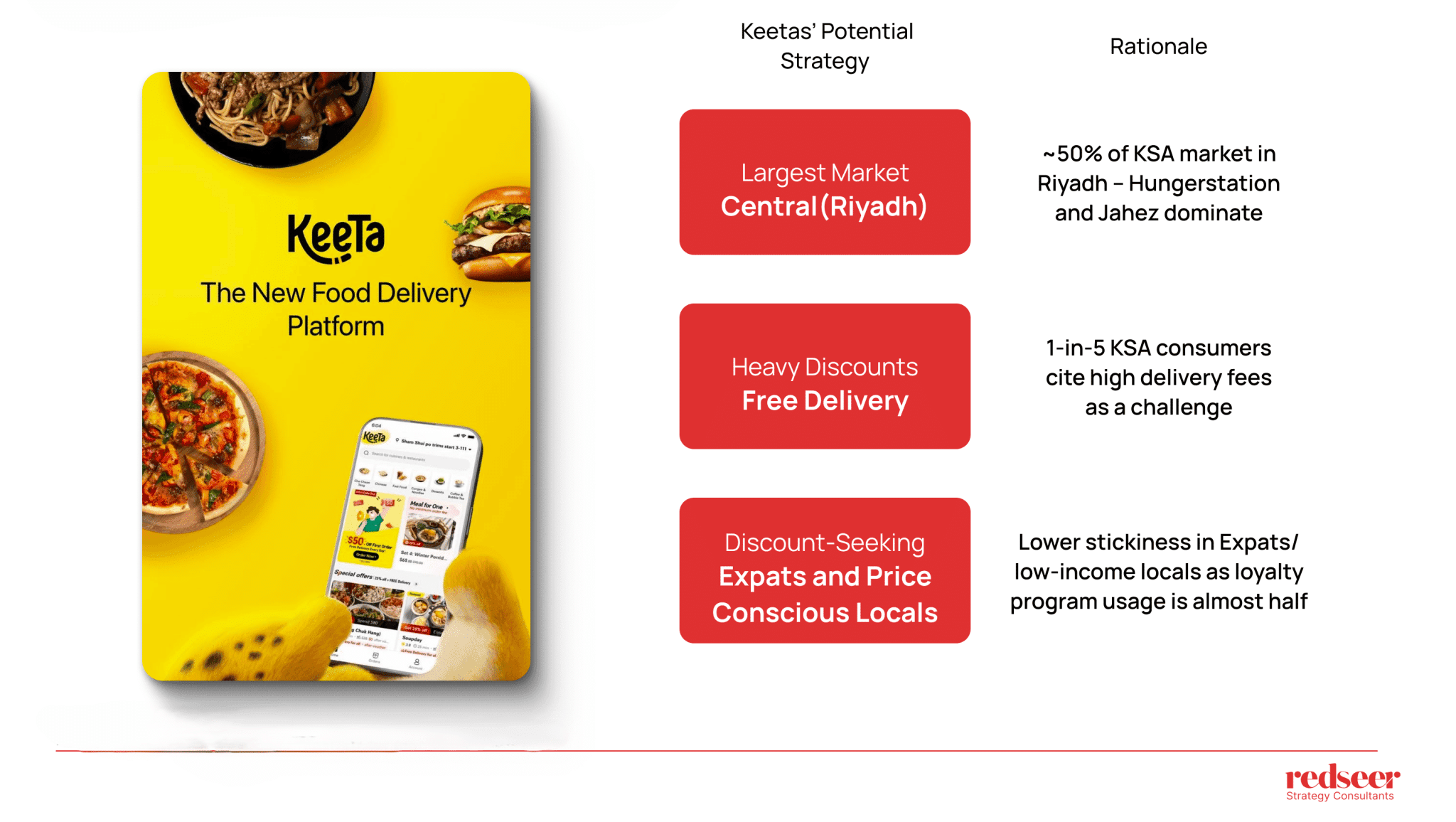

Meituan, a leading “Super App” in China, successfully launched its first international venture, Keeta, in Hong Kong in 2023, quickly capturing around 40% share within six months.

Keeta plans to replicate its Hong Kong success in Saudi Arabia, starting with Riyadh, using a similar discount-driven, expat-focused approach. Will it be able to make change the market dynamics positively? Saudi Arabia’s diverse regional dynamics, shaped by demographics and spending patterns, will require a more nuanced and localized approach.

1.3. Ninja is stepping up its game – Full-scale expansion plans for its restaurant partnerships are now in motion

In the first half of 2024, Ninja expanded its offerings by adding a full restaurant section, now featuring over 5,000 restaurants across more than 15 cities. Despite this growth, Ninja’s restaurant catalog remains smaller compared to competitors like Jahez and Hungerstation. However, Ninja plans to close the gap by adding 10,000 more restaurants by the end of 2024.

1.4 Nana and The Chefz have inked a strategic cooperation agreement

Last week, The Chefz signed a strategic cooperation agreement with Nana to enhance business cooperation and expand the range of services they provide.

In Conclusion

We are in the very early innings of Quick Commerce in Saudi Arabia. This market is increasingly dynamic and potentially ripe for massive structural changes.

We expect to see new entrants, expansions, mergers, consolidations, fundraises (public/ private), and above all more choices for consumers in Saudi Arabia!

Buckle up for the ride!

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me