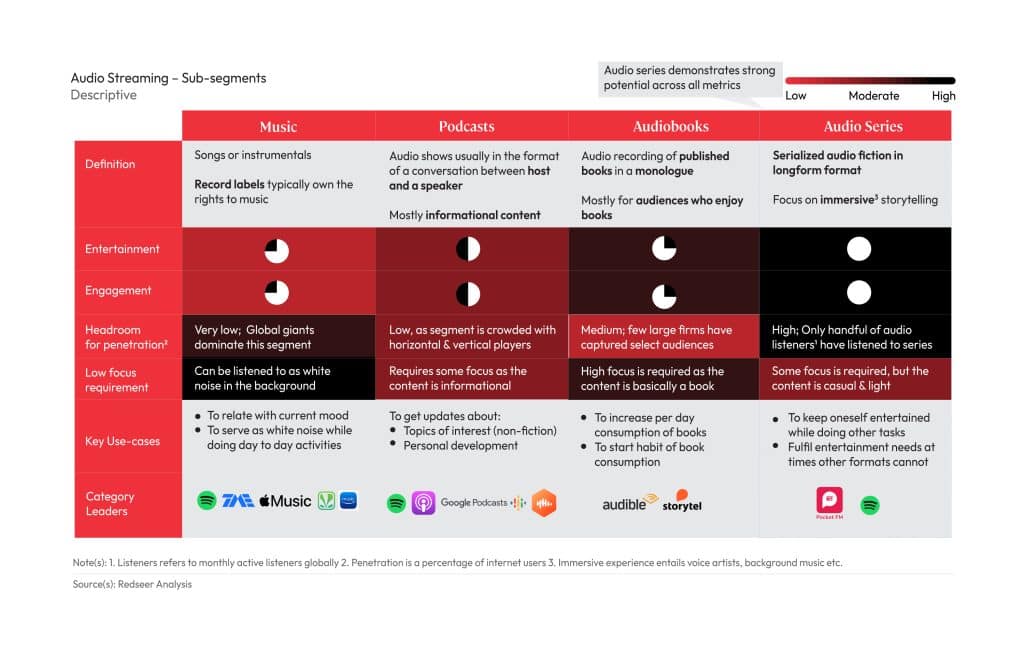

The Digital Media & Entertainment (M&E) landscape has exhibited significant growth potential over the years. It comprises three vibrant and competitive pillars: Social Media, Video Streaming, and Audio Streaming. Although social media is the fastest growing pillar of Digital M&E globally, the growing popularity of the Audio Series format and non-music entertainment within Audio Streaming has opened up massive headroom for accelerated growth. The rise of non-music formats within the Audio Streaming space characterized chronologically by the mainstreaming of audiobooks in the post-2008-era and the growing popularity of podcasts over the subsequent decade is now signaling a shift in the market which previously saw the dominance of music.

The serialized and immersive format of the Audio Series was introduced by vertical players 4-5 years ago and its widespread popularity prompted incumbents in audio streaming to experiment with the format, outside of music. Although it is a relatively newer entrant to the Digital M&E space, the Audio series witnessed several milestones in user growth, engagement, and high-paid user penetration in the last 4-5 years. Mukesh Kumar, Associate Partner at Redseer takes a deep into the rise and limitless potential of the Audio Series format in the first of a two-part series.

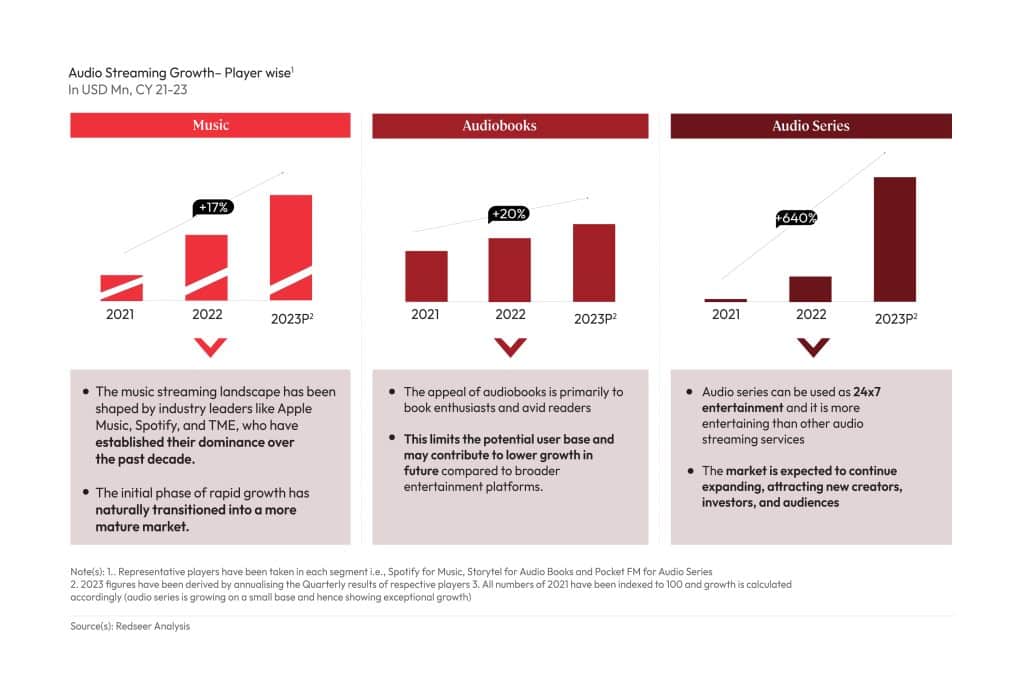

01. Audio Series has grown at a CAGR of ~640% in the global market between 2021 and 2023

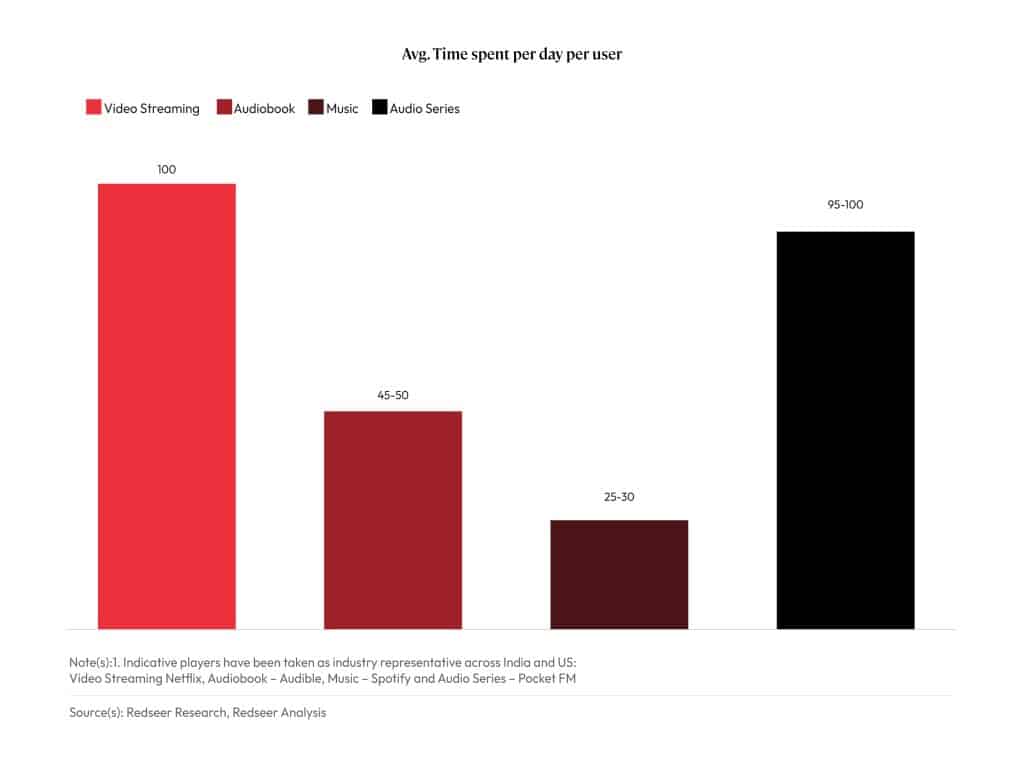

In the last two years alone, the global Audio Series market registered a CAGR of ~640 owing to the accelerated adoption of the format. Despite its nascency, Audio Series is garnering ~2X the engagement of music globally and is nearing that of Video Streaming which is currently the highest in the Media & Entertainment sector. With a growing degree of user maturity, engagement on Audio Series platforms is also seen to increase. Even within Audio Streaming, Audio Series can be used as 24/7 entertainment and has major potential for market expansion given its ability to attract diverse audiences and host a wide variety of creators.

02. Early users start by spending 1.3 hours per day on the platforms and time spent increases to 1.5 hours per day by the first year

The immersive Audio series experience encourages audiences to spend more time with quality content and increase their engagement within the platform. In just two years alone, the engagement in Audio Series is keeping pace with that of Video Streaming. Users surveyed by Redseer have expressed satisfaction with the content quality, personalized recommendation tools, and content variety on the platforms in addition to mentioning flexibility in listening times as a major positive. They have also called for better pricing and flexible payment options to be made available on the platforms.

03. Lean Listeners spend ~50% of their time streaming Audio Series while Downtime Maximisers have the more expendable wallets

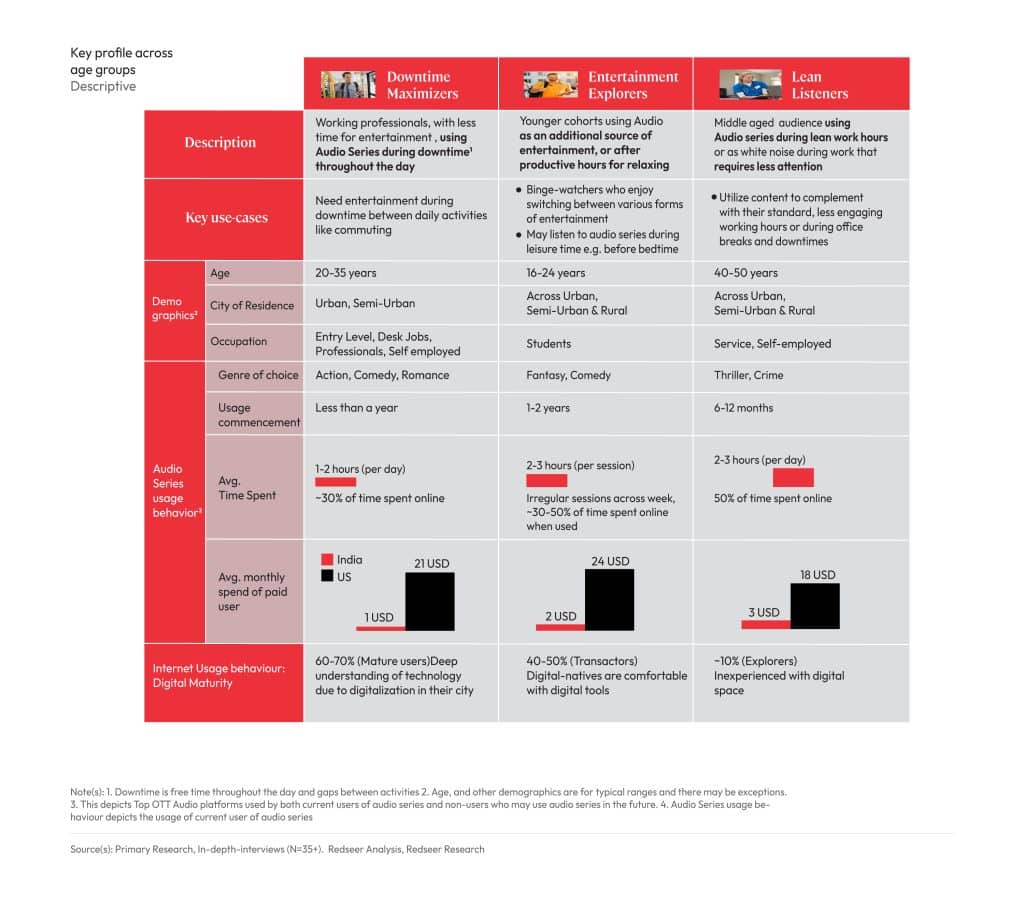

Redseer’s Research notes the emergence of three user archetypes with regard to the consumption of Audio Series. They can be classified as:

- Downtime Maximisers – These are essentially working professionals who utilize audio entertainment during the downtime periods between daily activities.

- Entertainment Explorers – This cohort consists of a younger group of individuals who look at Audio as an additional source of entertainment that they can turn to after their productive hours. They are essentially bingers who switch between multiple modes of entertainment.

- Lean Listeners – These are essentially middle-aged audiences who stream Audio Series during lean work hours or as white noise during work that requires less attention.

Most of them are transactors who are well acquainted with Digital Payments and tools and are spread out across urban, semi-urban and rural areas. While Lean Listeners may lead the charge about time spent on platforms, Downtime Maximisers are more digitally matured with a more expendable wallet share.

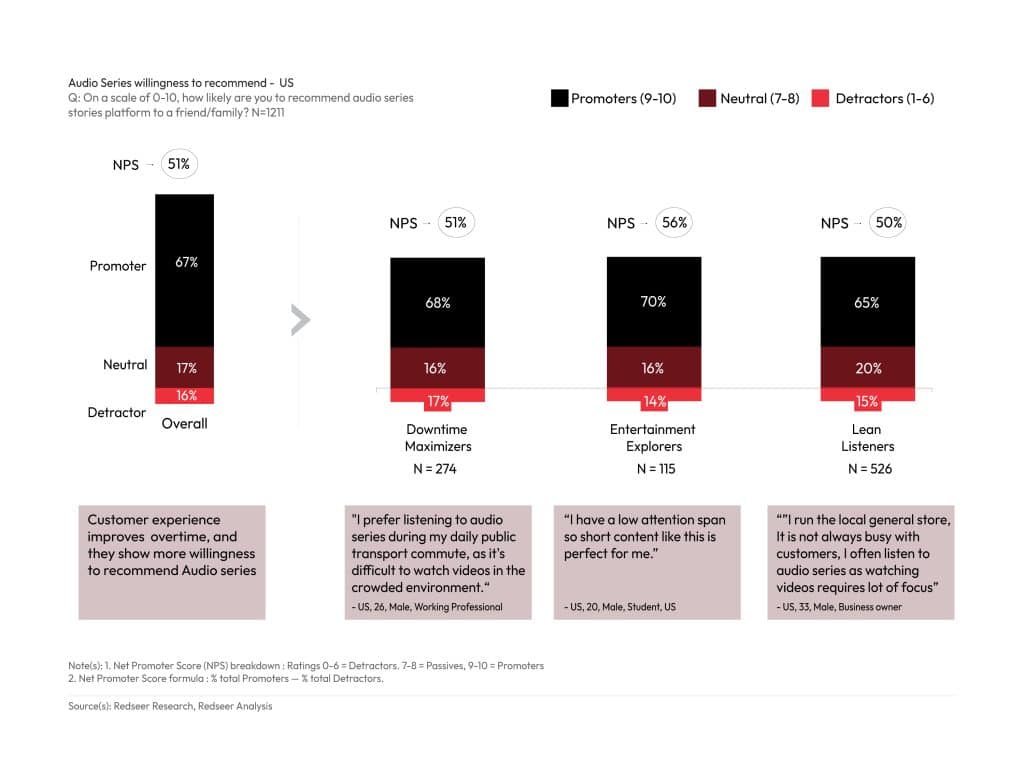

04. Audio Series enjoys high user satisfaction with NPS at ~55% among Indian audiences and ~51% among US audiences

Audiences have expressed satisfaction across most parameters and have shown a willingness to stick to the format as well as recommend interesting material to family and friends, thereby driving user acquisition. Among the listener archetypes, Downtime Maximisers and Entertainment Explorers both in India and the US have shown the highest willingness to recommend. Improvements in user parameters like User Interfaces and payment options can boost listeners’ willingness to recommend Audio Series to their friends and relatives.

Audio Series is fast gaining popularity in emerging markets like India as well as in developed markets like the US. It is a testament to the potential of compelling and immersive storytelling that can be organically integrated into the busy lifestyles of diverse demographics across the nation.