MENA Grocery IPOs – A $100 Bn Unlock for the Ecosystem

Traditionally, the grocery sector has been perceived as relatively stable and predictable, characterized by steady growth, incremental changes, and a limited pace of innovation. The industry’s focus has often remained on consistent product offerings, standard pricing structures, and familiar customer experiences. However, this landscape is evolving rapidly.

Build new product innovation and market strategy.

Firstly, the way consumers are shopping with convenience being increasingly important. This is leading to changing formats and innovations such as the rise of q-commerce. Read more here.

Secondly, The shift in power dynamics within the retail sector is becoming increasingly apparent as retailers cultivate trust with consumers. Read more here.

Finally, and a more recent phenomenon is the rise of IPOs in the grocery segment. With Spinneys’ IPO and Lulu & Talabat on the horizon, we expect to see fundamental changes in the landscape. This sector is on the brink of an IPO wave that could reshape the industry for years to come.

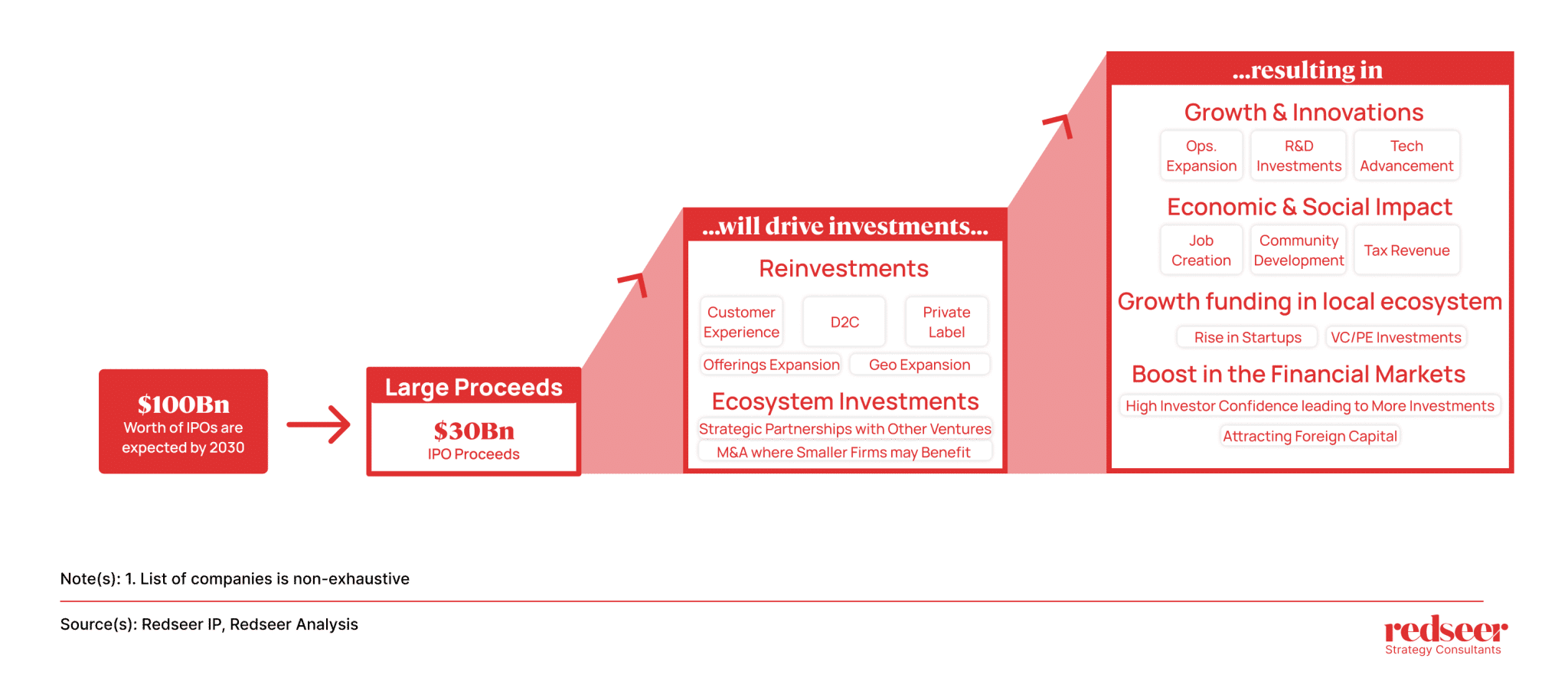

We expect that these first few large IPOs could be a harbinger to over $100 billion worth of grocery-related IPOs by 2030, generating approximately $30 billion in proceeds. We expect that such large fund raises will also help the region get the much-needed growth capital creating a multiple effect on the local ecosystem.

In this edition, we’ll explore the rapid evolution of the MENA grocery sector, the potential for $100 billion in IPOs by 2030, and what this means for stakeholders. Here’s what you can expect:

- 1. The state of grocery IPOs in MENA’s public markets

- 2. The 3S IPO Readiness Index and its significance

- 3. The broader impact of grocery IPOs on innovation and ecosystem growth

Read on for deeper insights into the future of MENA’s grocery sector and the opportunities it presents.

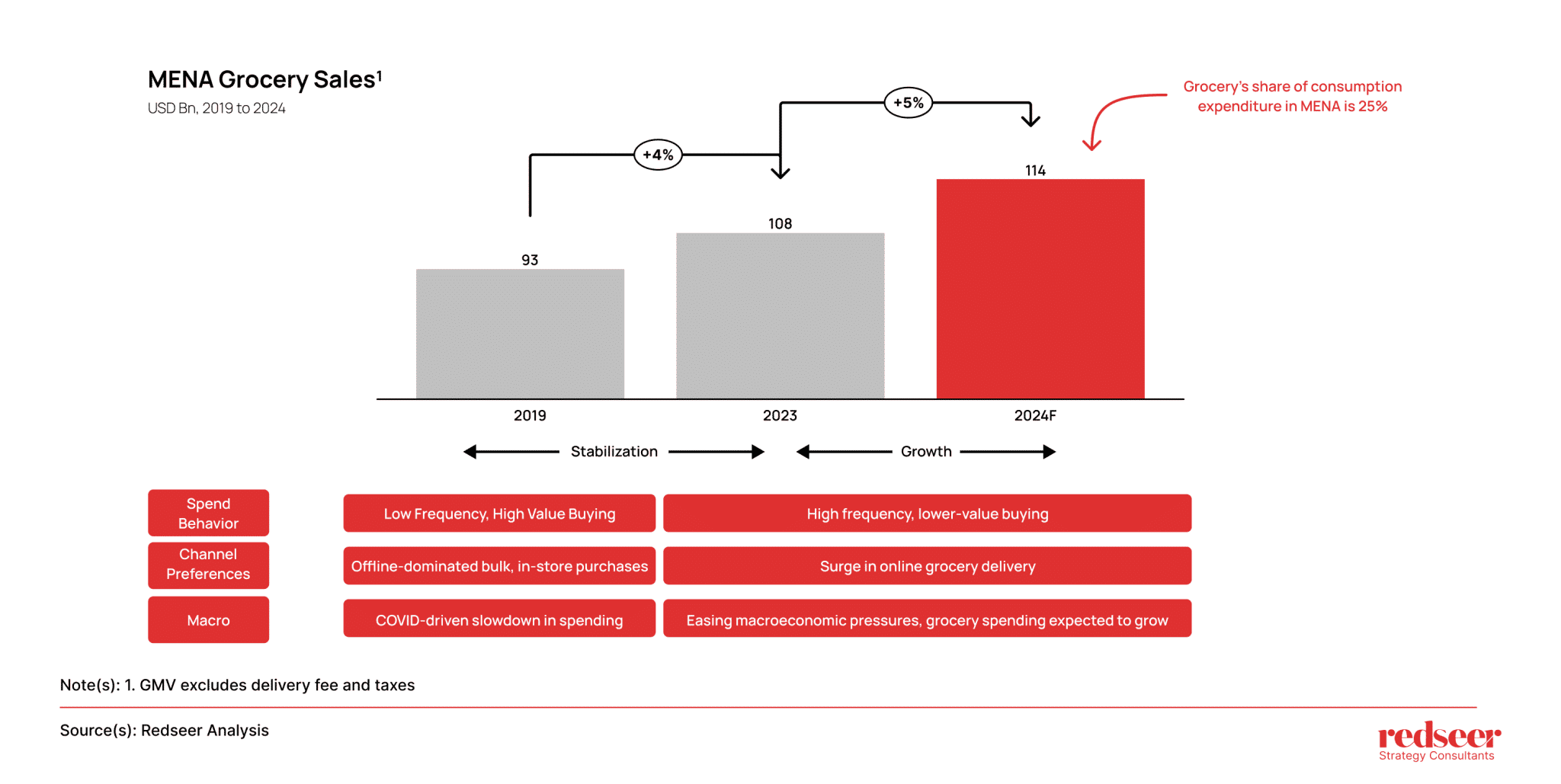

1.The MENA grocery market is large, exceeding $100 Bn, and captures 25% of consumer spending..

The MENA grocery sector, now exceeding $100 billion in value, and accounts for 25% of regional consumer spending. Between 2019 and 2023, grocery sales grew by 16%, with forecasts for 2024 projecting a CAGR of 5%. This growth reflects both the market’s resilience and the evolving needs of its consumers. What was once a space dominated by low-frequency, high-value group purchases have shifted toward more frequent, lower-value individual orders, signaling a preference for convenience as lifestyles change.

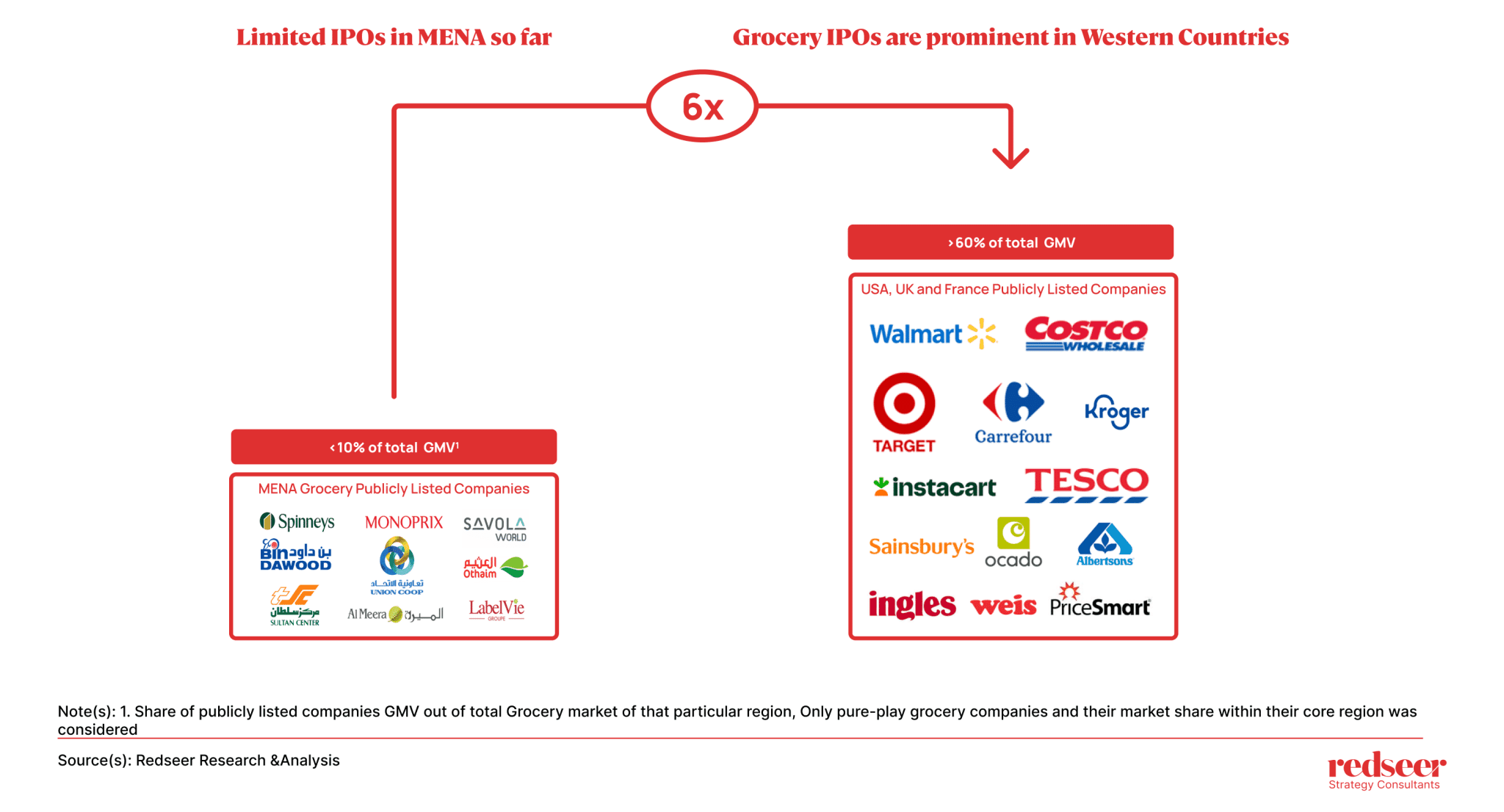

2. Currently, there’s a significant lack of grocery representation in public markets, with publicly listed players capturing less than 10% of the total MENA grocery GMV

The MENA grocery market is notably underrepresented in public markets, with publicly listed companies accounting for less than 10% of the total grocery GMV. This limited presence contrasts sharply with the more developed grocery markets in regions like the USA, UK, and France, the disparity signals an immense growth potential in MENA’s grocery sector, offering up to 6x the opportunity for public market expansion.

3. Companies like Lulu, and Talabat are preparing to tap into the capital markets, signaling that the sector is ready for a new era of growth

The B2C grocery sector in MENA is also reflecting the region’s rising IPO trend, with Spinneys going public in the first half of 2024.

Looking ahead, two other key players, Lulu and Talabat, are preparing for IPOs. Lulu, known for its strong brand recognition, vertical integration, and wide market reach, is anticipated to attract substantial investor interest. Talabat, with its market leadership in food delivery, Mult vertical potential, and extensive reach, is also preparing for a public listing.

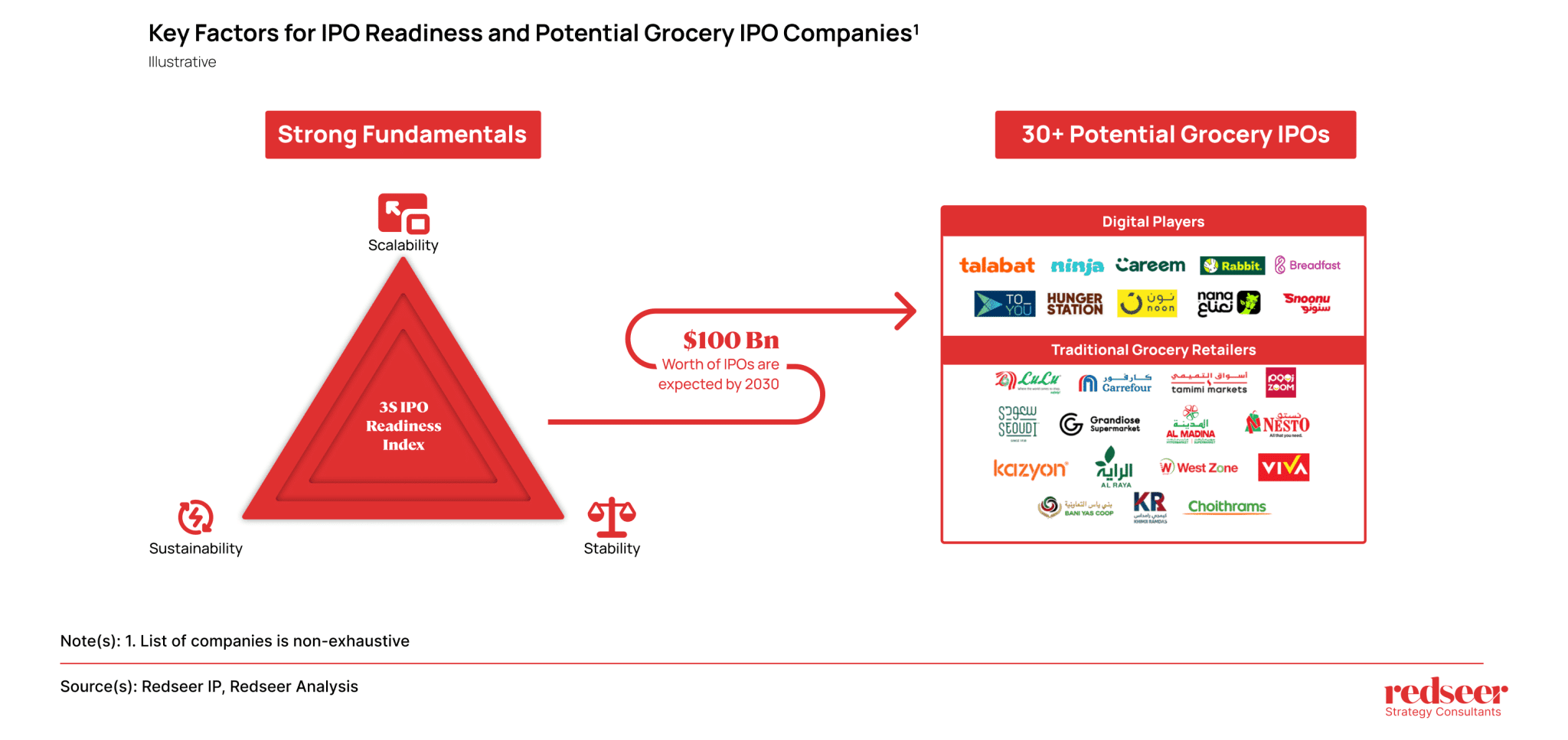

4. Looking ahead, the IPO pipeline appears strong, with the grocery sector potentially witnessing $100 Bn worth of IPOs by 2030

Further, the market is on the verge of significant IPO activity, we project the grocery sector to witness $100 Bn worth of IPOs by 2030. We have identified over 30 potential IPOs, spanning major digital platforms like Talabat and Careem, as well as traditional giants such as Lulu and Carrefour. This broad spectrum of companies highlights the growing diversity within the sector.

Key to these IPOs is the 3S IPO Readiness Index, which measures Scalability, Sustainability, and Stability. Companies strong in these areas are expected to attract significant investor interest, demonstrating growth potential, long-term operational viability, and resilience to market fluctuations. Digital grocery players have shown promising scalability through Mult-vertical offerings, while traditional retailers benefit from established supply chains and regional brand loyalty.

5. This will have a multiplier effect on the entire ecosystem, driving innovation and fueling a cycle of growth benefiting a wide range of stakeholders

By 2030, we project $100 billion in IPOs within the MENA grocery sector, with approximately $30 billion in proceeds. These proceeds will ripple through the ecosystem, driving reinvestment into areas like customer experience, direct-to-consumer (D2C) offerings, private label development, and geographical expansion. Additionally, strategic investments such as partnerships and M&A activity will accelerate growth, benefiting smaller companies.

The ripple effects will include job creation, community development, and increased tax revenues, while also bolstering the local startup ecosystem by attracting venture capital and private equity investments. This reinvestment cycle will strengthen financial markets, boost investor confidence and attract foreign capital, positioning the MENA grocery sector for sustained economic growth and innovation.

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me