MSME Credit Capital Deficit – How much of a difference can Alternate Finance make?

India is a nation of small businesses and home to over 64 Mn MSMEs that collectively contribute to 30% of the nation’s GDP. While the sector is a crucial component of India’s growth engine, it is also riddled with challenges that inhibit growth. Limited digitization and strained access to capital are two pressing issues that must be solved systematically to set the sector on its path to development. While digitization is expected to increase sharply over the next 5 years from the current level of 12%, new-age finance powered by technology is poised to fill the growing working capital deficit left by the limitations of traditional financial institutions.

In this article, we share an overview of our recent report in collaboration with GetVantage, a premier cashflow-based financing platform in India). The report details the $200Bn current and expected $ 500Bn credit opportunity for digital SMEs in India and how alternative financing offers a more inclusive and impactful way forward.

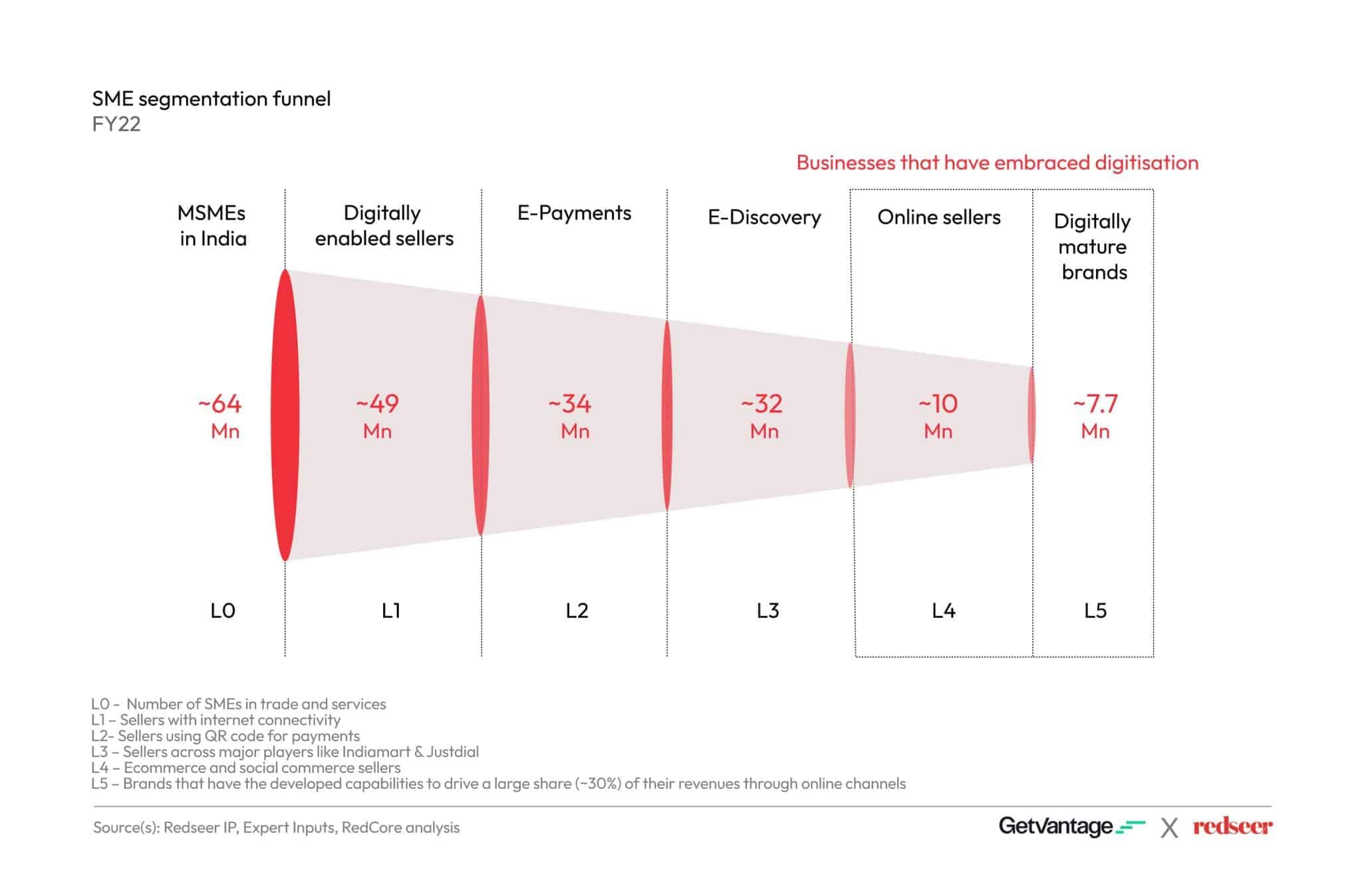

MSMEs in India are still under-digitized

Out of the total of ~64 Mn MSMEs in India, about 12% or ~ 7.7 Mn are digitally mature brands, with the rest at different stages of digitization. SMEs are leveraging digitization to improve their access to clients, increase efficiency, and generate better outcomes. While digitization was on the rise in the last decade, the pandemic catalyzed SMEs in lowering transformation costs, increasing utility, increasing revenue, etc. As economic opportunities have grown in line with the eCommerce boom, so has the demand for capital.

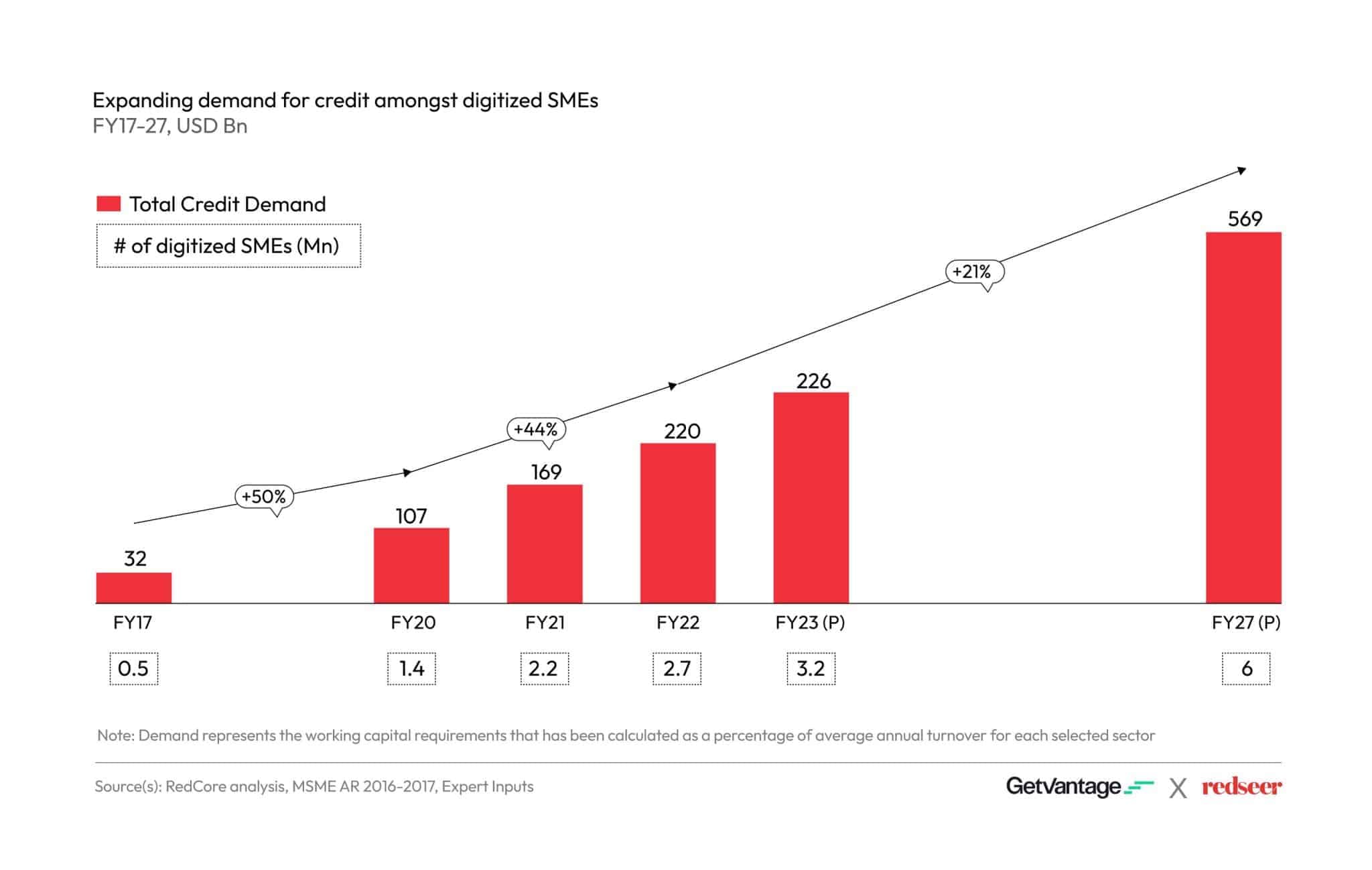

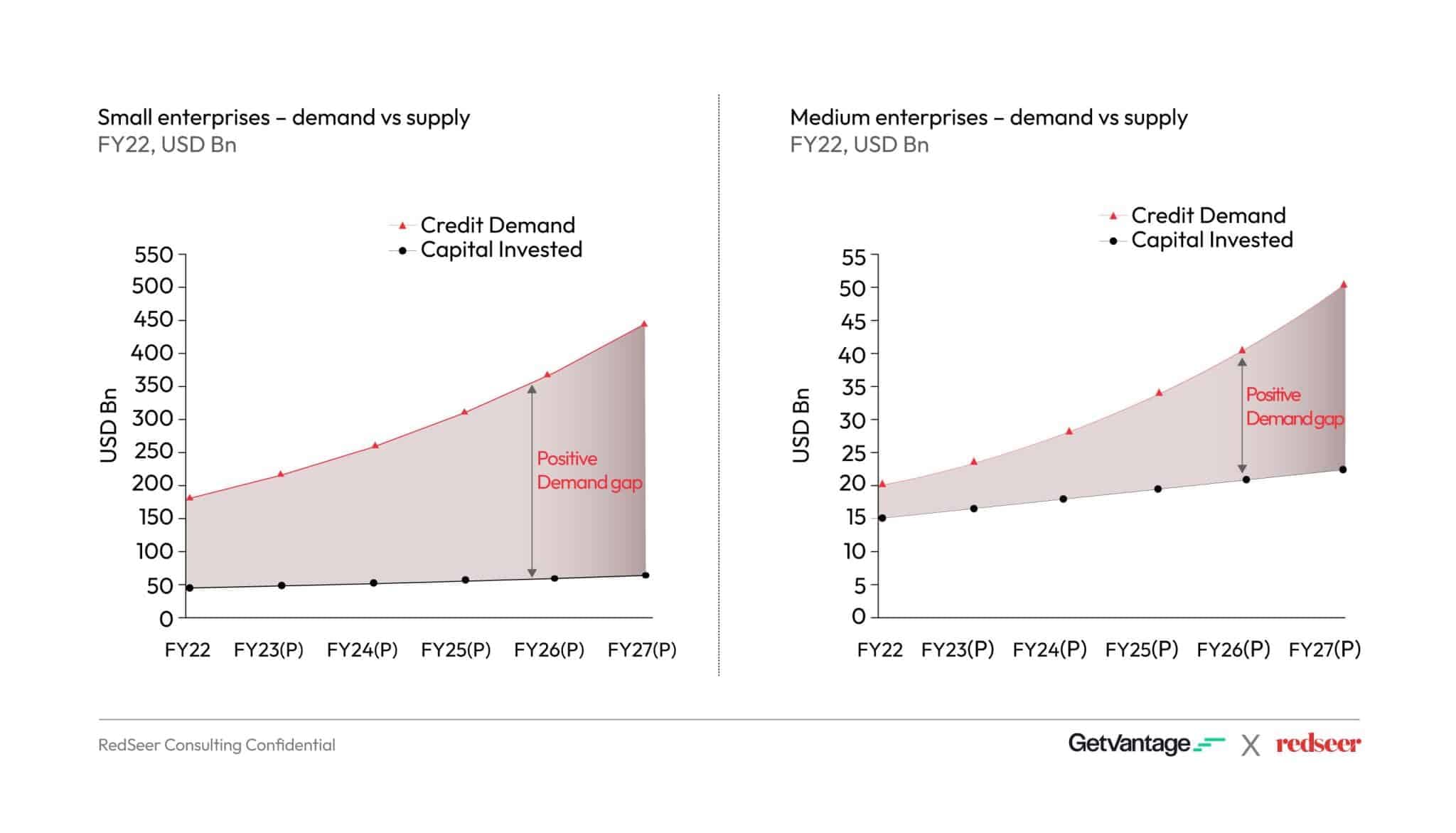

SMEs’ growing demand for credit is expected to cross US$ 500 Bn in 3-5 years

Want to evaluate new investment and M&A opportunities?

Working capital, which is the lifeblood of digitized SMEs, is primarily deployed for functions such as operations, marketing, hiring & training, maintenance & renewal, logistics, and vendor payments, among others. The digitized businesses have an estimated current working capital demand of ~US$ 220 Bn, with eCommerce accounting for ~70% of the demand.

The working capital demand before the pandemic grew steadily, amounting to an increase of ~US$ 70 Bn over 4 years. It shot up during the pandemic, with demand growing by US$ 100 Bn+ in a matter of 2 years, owing to forced digitization. With the number of digitized SMEs expected to double in 5 years, demand for working capital is projected to reach US$570 Bn by FY27.

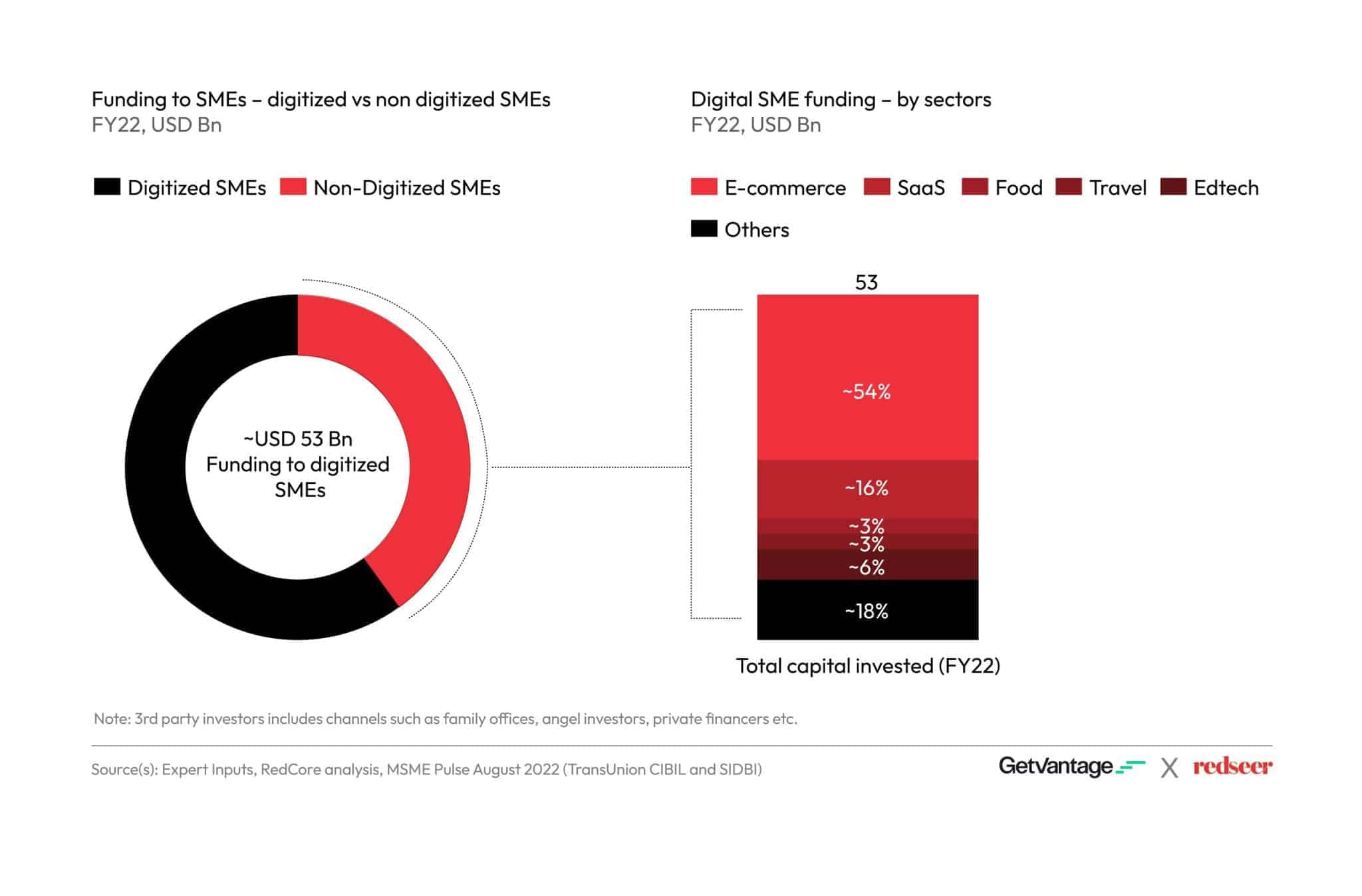

Capital invested in digitized SMEs is also on the rise

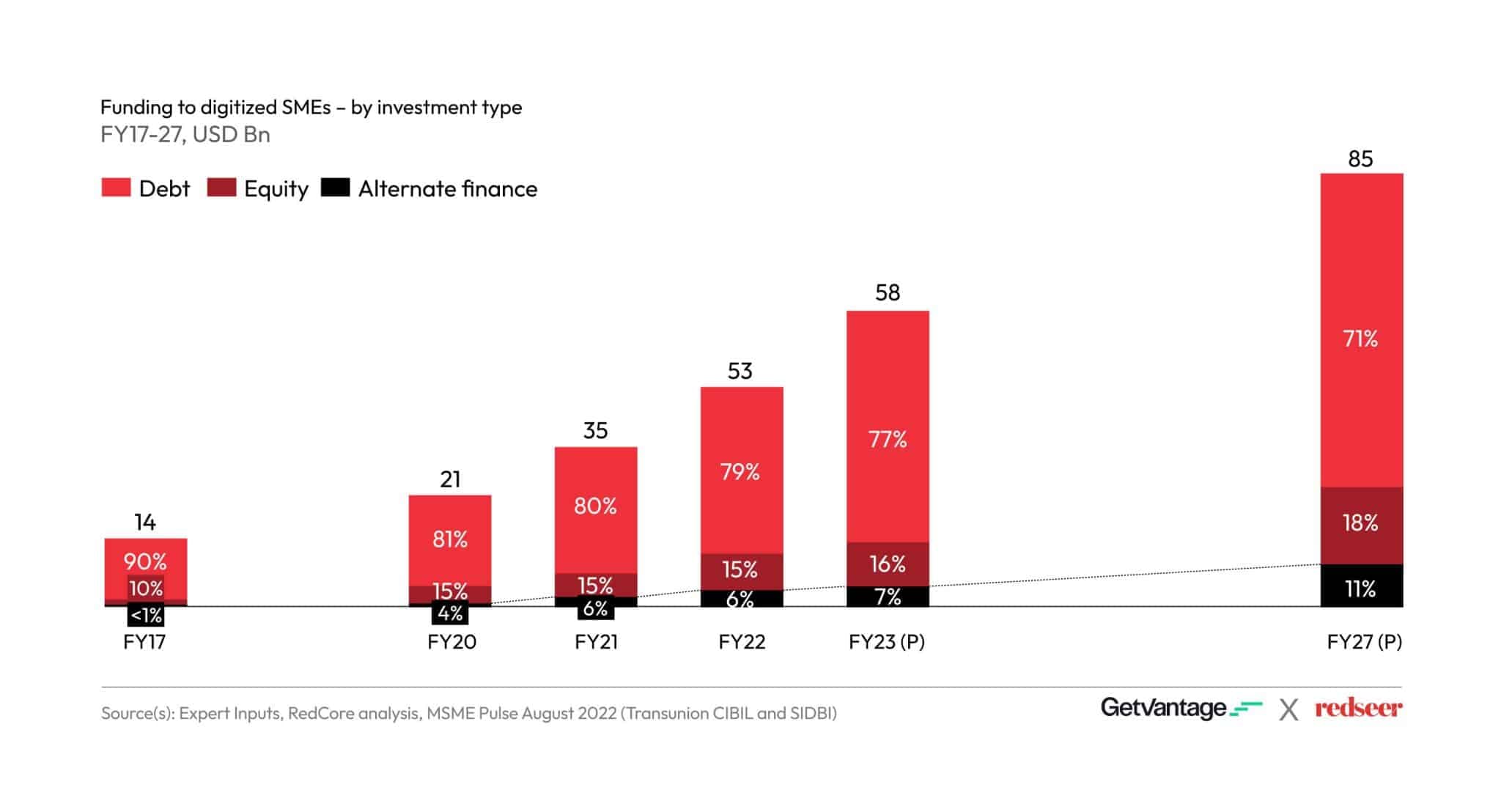

Digitized SMEs attract 40% of the invested capital. During FY22, a total of US$ 132 Bn was invested in the SME segment, out of which ~US$ 53 Bn went to the digitized SMEs. A substantial portion of that, ~65%, was taken up by eCommerce, which we expect further to rake more share in the next 5 years to reach ~75%.

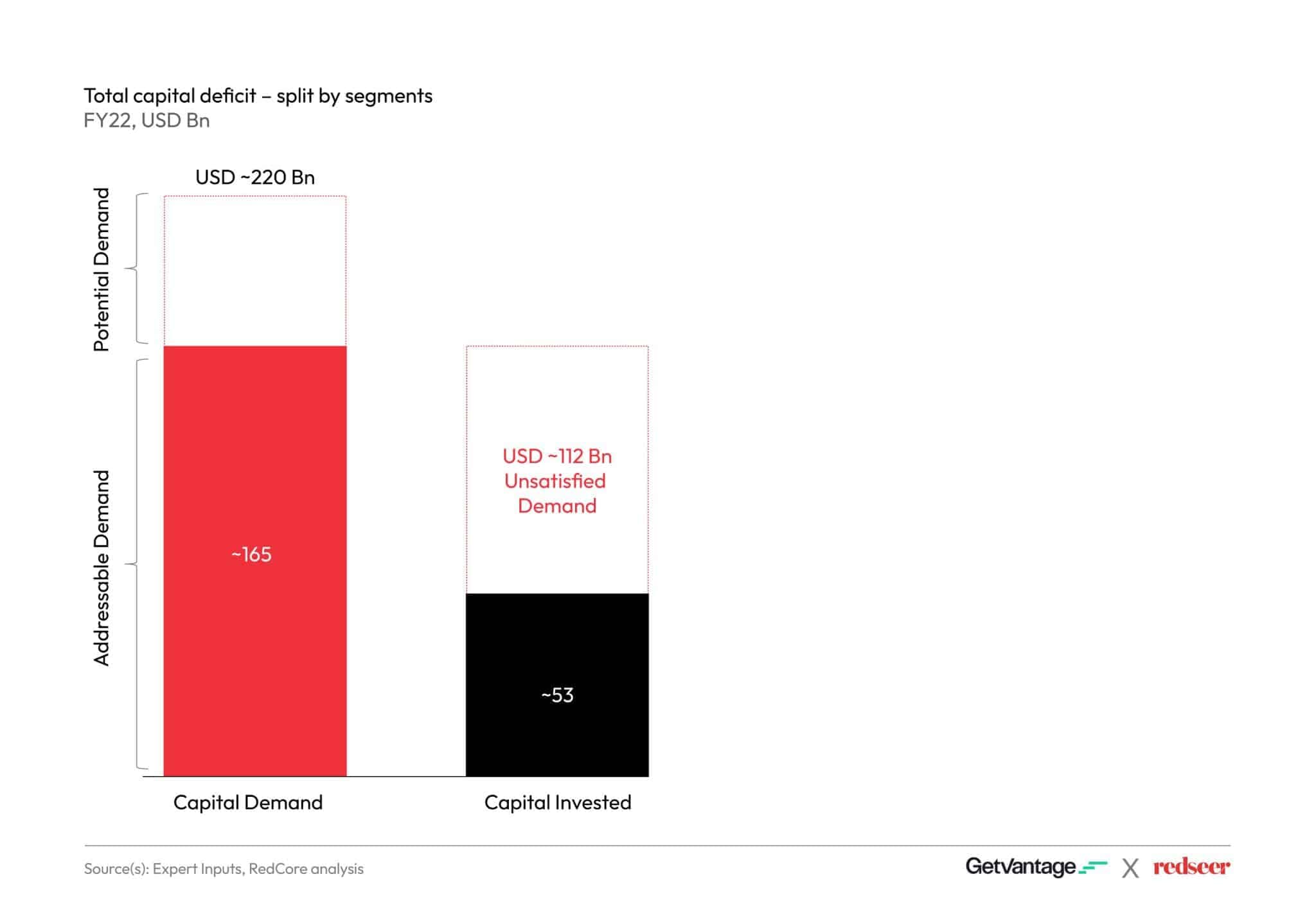

The widening capital gap has been inhibiting SME growth

Looking closely at the existing funding landscape reveals an undersupply of credit offered through formal or more traditional channels such as banks. Even with the introduction of NBFCs and other new-age lending platforms this vast demand for credit far outweighs the supply currently available. With 67% of demand being unaddressed, there are major implications for SMEs, such as limited to no growth, plateauing of revenues, and limited innovation. This creates a large opportunity for new-age private credit and alternative-financing platforms and lenders as the situation is only projected to persist and grow if the current economic conditions persist.

New-age finance solutions are now available for SMEs to consider

SMEs face major funding challenges in risk perceptions of banks and financial institutions, cumbersome processes, lack of tailor-made solutions, credit history and collateral requirements, and timely access to capital. With the number of digitized SMEs expected to double by 2027, solutions that fit their changing capital needs are increasingly necessary to streamline workflow and processes.

From the business perspective, alternate finance models such as revenue-based financing and trade receivable financing can serve as strong enablement engines for meeting growing working capital needs for new-age businesses and startups that don’t fit the outdated criteria of traditional finance. Historically, SMEs have preferred debt through instruments such as fixed-interest loans and overdrafts that help meet credit demand. These days alternate finance has gained prominence on the back of traditional lenders’ failure to understand the rapidly evolving capital needs of digitized businesses that are young, collateral-free, digital-first, and need more modern funding solutions.

The concurrent need is for traditional lenders such as banks and NBFCs to partner with alternate-finance solutions to provide fairer and more efficient access to capital for SMEs. There is also a distinct opportunity for all the players to collaborate and extend the ability of traditional lenders to reach and serve even the non-conventional businesses and emerging sectors. It can be expected that the next half decade will see the share of alternate finance grow by 2X owing to their SME-first approach and benefits of convenience and accessibility.

Download the full report here: SME Credit Report 2023

Written by

Kanishka Mohan

Partner

Kanishka is the Partner who specializes in helping venture funds to discover and manage exciting startups, and early-stage startups to raise and deploy capital. His vision is to make high-quality consulting accessible to young startups and investors.

Talk to me