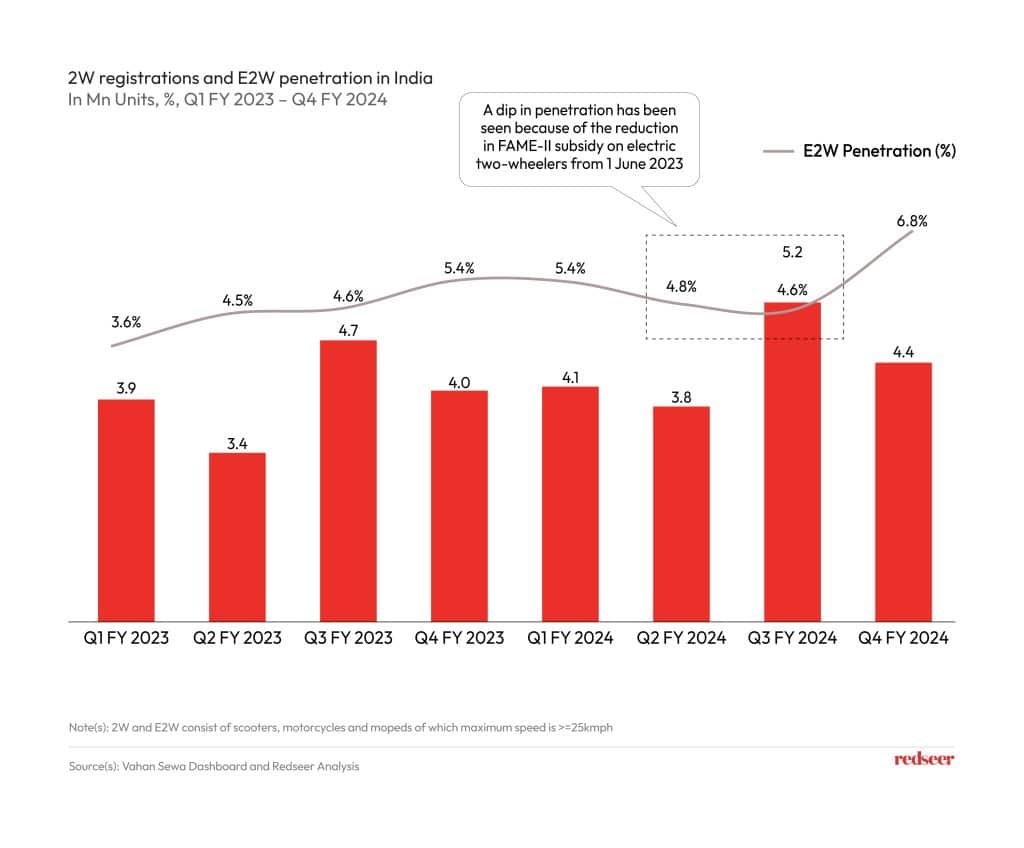

India’s 2W story has driven the electrification wave in India and continues to show high adoption rates. FY 24 has been a defining year for E2Ws, particularly as the penetration crossed 6.8% in the last quarter, well above the inflection point of 3-5%.

It will be interesting to see how E2W adoption plays out over the next year as Government subsidies gradually phase out. What will it take for the OEMs to keep the current momentum going?

1. The Journey So Far: Steady Growth Amidst Turbulent Times

The India E2W story is that of resilience. Despite disruptions in the economy and the gradual decline of the subsidies’ corpus by FAME II, the E2W market has remained steadfast in its upward trajectory, and E2W penetration has soared to 6.8% in Q4 2024, reaching an all-time high of 9% in March 2024. The reduction in subsidy amounts has caused a dip in penetration for short periods, but not long before the market has jumped back. This is essentially being driven by continuous focus to push adoption in this market from both government and industries to steer a greener transport future!

2. Turning Obstacles into Opportunities: Does Fame II going away stop this growth in E2W?

Now, let’s address the elephant in the room – the discontinuation of FAME II on April 1, 2024, and how it will impact the current trajectory for E2W penetration.

Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles in India (FAME) series has been a key enabler to push the E2W story in India. Even with FAME II being phased out from March 31, 2024, Government continues to provide support to buyers through Electric Mobility Promotion Scheme (EMPS), targeted to support the adoption of E2Ws and E3Ws through demand incentives and to OEM manufacturers through PLI schemes and this will continue to drive penetration.

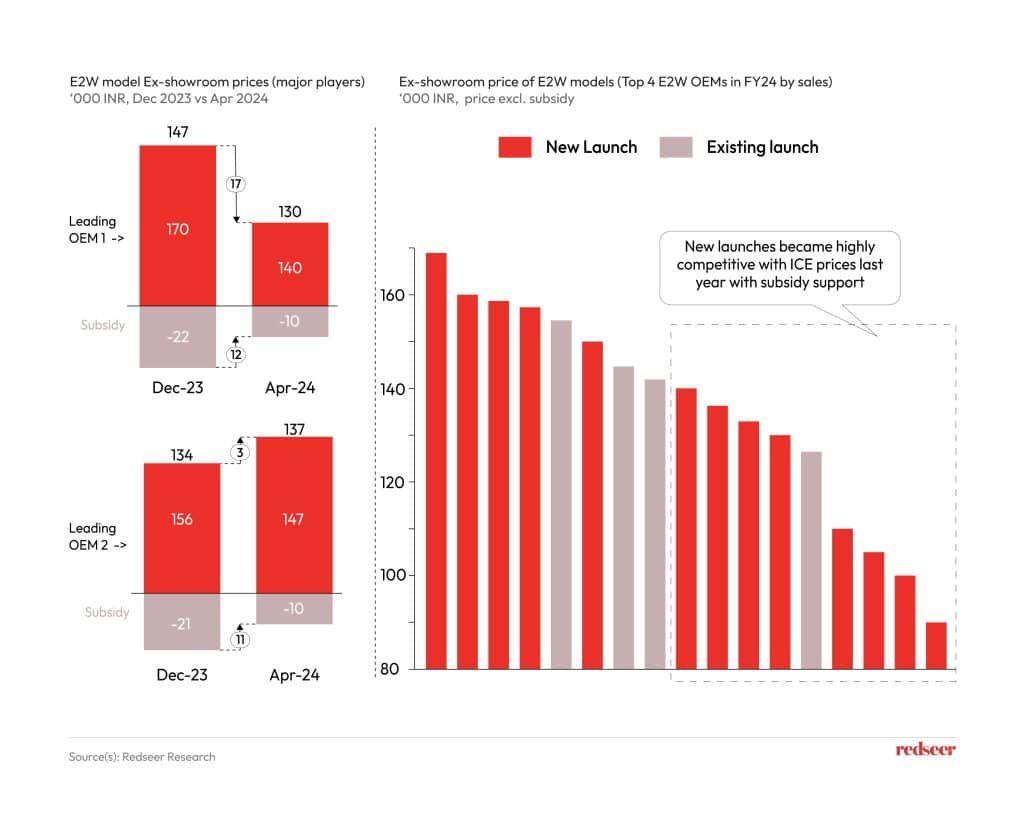

OEMs continue to support the demand for affordable E2Ws thus offsetting the FAME II discontinuation. E2W OEMs are acutely aware that while E2Ws have favourable Total Cost of Ownership (TCO) comparisons versus their ICE (Internal Combustion Engine) counterparts, the higher purchase price of E2Ws is a significant deterrent to adoption for a large section of buyers in India. E2W OEMs have stepped up their game as leading OEMs have been absorbing the impact of subsidy reductions on their existing models, either fully or in part, by reducing prices. Further, E2W OEMs also seem to be closing the gap between the ICE models with the launch of increasingly affordable models in the past few months.

3.E2W India story is highly democratized being led by the Non-Metro Marvels

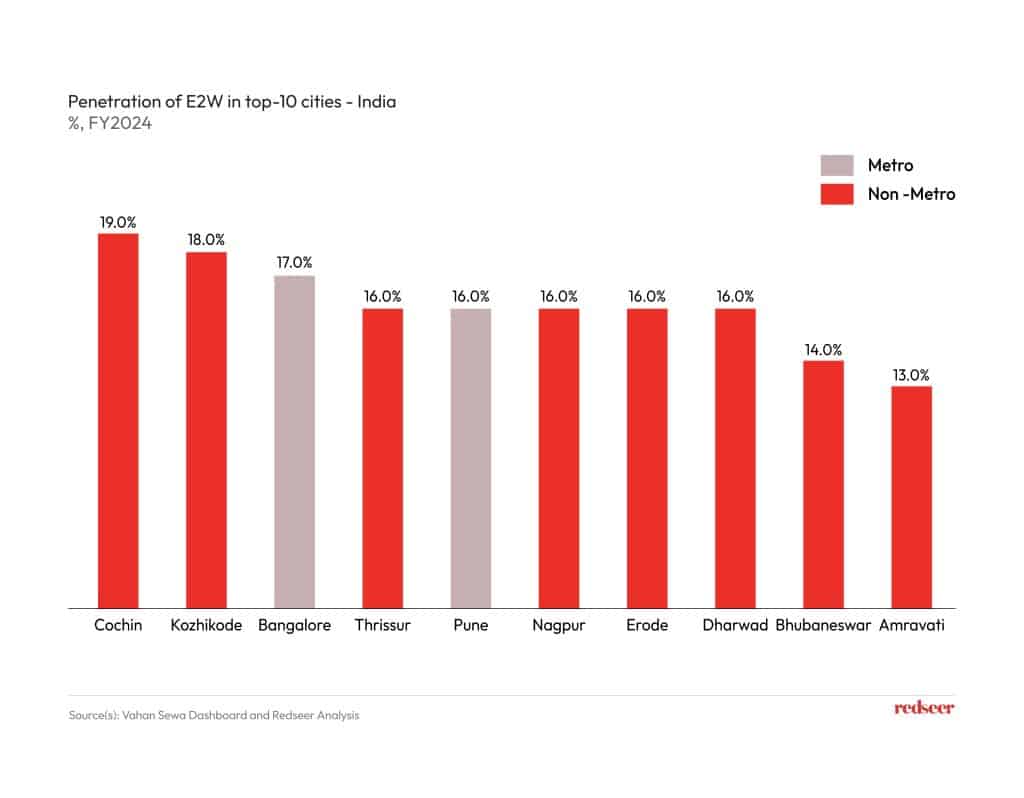

Convenience, affordability and shorter commute needs are making non-metros the hero of the E2W story. Conventionally, we would expect metro cities to be more receptive to adopting new technology and have higher spending capacity to try out the new electric vehicles, but non-metros are witnessing higher penetration in recent years.

As per Redseer EV Index, 8 out of the top 10 cities based on E2W penetration have been observed to be non-metros. Need of comparatively leaner charging infrastructure for E2W along with impetus from OEMs with more affordable models and ranges of E2W are few keys driving the penetration of E2W in non-metros.

The high E2W penetration is also observed to be higher in the southern and western states historically, owing to their growing urban population and higher disposable income in these regions.

However, there is more ground to cover in deeper markets to further drive penetration in these cities. This needs to be primarily driven by better charging infrastructure, more awareness about EV performance, an increase in dealership presence, etc.

Redseer EV Index tracks the level of EV penetration across states for the top 100 cities every month, which helps build deep market insights on the know-hows of the EV industry.

4. Paving the Way Forward

Traditionally, it has been observed that once electric vehicle penetration reaches 3-5% in the leading vehicle segment, a surge of adoption ensues—a phenomenon fuelled by heightened product awareness, improved user comfort, and a robust market supply. Presently, India’s E2W market stands comfortably ahead of this pivotal point, boasting a noteworthy 6.8% penetration rate in the last quarter. Positioned in this manner, India is primed for a booming future.

In summary, the India E2W revolution is going to continue assisted by both private and public support. Undoubtedly, enhancing charging infrastructure stands as a cornerstone in unlocking the full potential of electric mobility. Yet, the path forward entails more than infrastructure improvements. It entails a concerted effort, inclusive of ongoing government initiatives and the innovation drive among OEMs, to usher in a sustainable, incentive independent E2W market in India.

For more insights, reach out to our industry expert Rohan Agarwal, or subscribe to our newsletter today!