The moment you spot a sleek and stylish electric vehicle (EV) silently running on Indian roads, thoughts like ~ “Is this the right time to transition to EVs? How high is the maintenance cost?” ~ is quite common. While many think EVs to be fancy stuff for tech enthusiasts or eco-warriors, there is a new trend that is changing these perceptions: EV leasing!

Leasing an EV gives you access to the latest technology without the commitment and headache of immediate ownership. This could be a game-changer, especially when affordability and flexibility are the key decision-making factors. But how does this EV leasing market function and why is it gaining so much traction? Our Redseer market experts conducted an analysis and brought out a holistic picture of the sector.

From three-wheelers to electric buses, let us explore the segments that are driving the EV leasing industry and the potential growth over the next few years. You never know, this might even make you want to swap your old gas guzzler for something a bit more…electrifying! Let’s take a closer look at how EV leasing could be the spark that might light up Indian streets with e-power. Don’t miss the ride!

Know Your EV ‘Market’

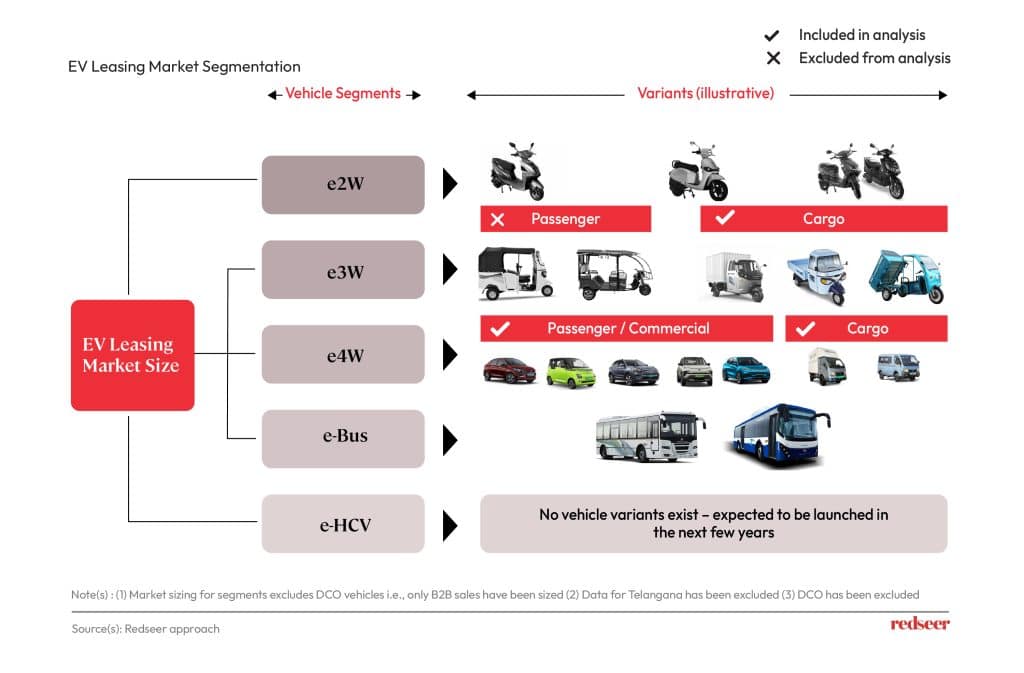

The EV leasing market is being driven by three key vehicle segments, namely e3W (three-wheelers), e4W (four-wheelers), and e-buses – specifically targeting commercial and fleet operations.

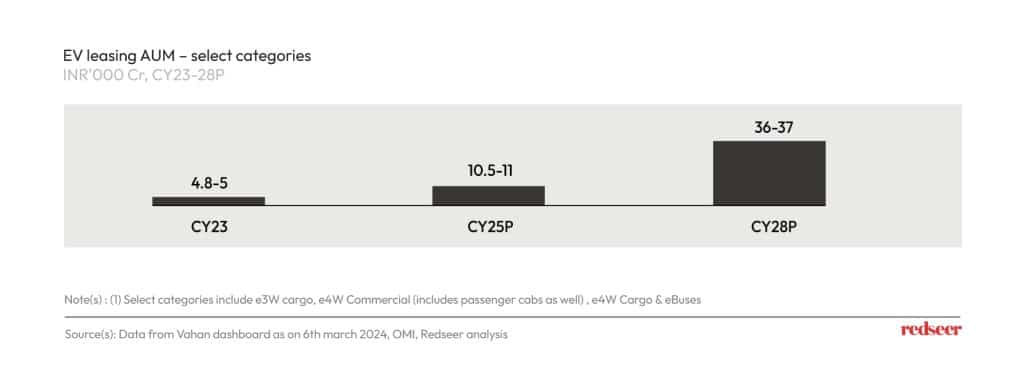

Now, let us look at the EV leasing market trendline. As of CY 23, the electric vehicle (EV) leasing market boasted a whopping Rs 5,000 crore in Assets Under Management (AUM). However, projections indicate that this figure is just the tip of the iceberg, with estimates foreseeing an aggressive growth trajectory by the year 2028. Experts anticipate the EV leasing market to skyrocket, reaching an unprecedented Rs 36,000–37,000 crores, which is equivalent to an eight-fold increase over the span of just five years! Well, this surge underscores the immense potential that is inherent within this sector, promising to revolutionise the transport industry.

Each of the segments that we are talking about is set for some serious growth. Take e3Ws, for example, they are expected to jump five times over by 2028, going from Rs 400 crore in AUM to a whopping Rs 2,500–3,000 crores! The e4Ws too are not far behind, with projections showing a staggering ~13x surge, from Rs 600 crore in AUM to around Rs 9,000–9,200 crores. With the government pushing hard for more public electric buses and shared transport, this segment too is expected to rise by ~6x from Rs 4,000 crore in AUM amounting to Rs 24,000 crore. This goes to show how crucial e-bus leasing is to drive sustainable transport and reduce carbon emissions in our cities.

Growth Drivers

So, what are the growth factors behind fuelling the EV leasing market in India?

Leasing presents a promising solution to address the affordability barrier for fleet operators and commercial owners looking to transition to electric vehicles (EVs). While end customers can make easy monthly payments without the burden of a massive down payment, they also have the option to purchase at an approximately 20% buyback value after three to four years! Fleet operators also benefit from asset-light growth, freeing up capital to allocate towards other aspects of their business.

Many state and central government initiatives are expected to drive market attention towards leasing. The centre and state initiatives, such as those seen in Haryana and Andhra Pradesh, further drive attention towards leasing by offering reimbursement of net SGST for firms involved in EV-related services.

Government policies and financial flexibility driving the EV future

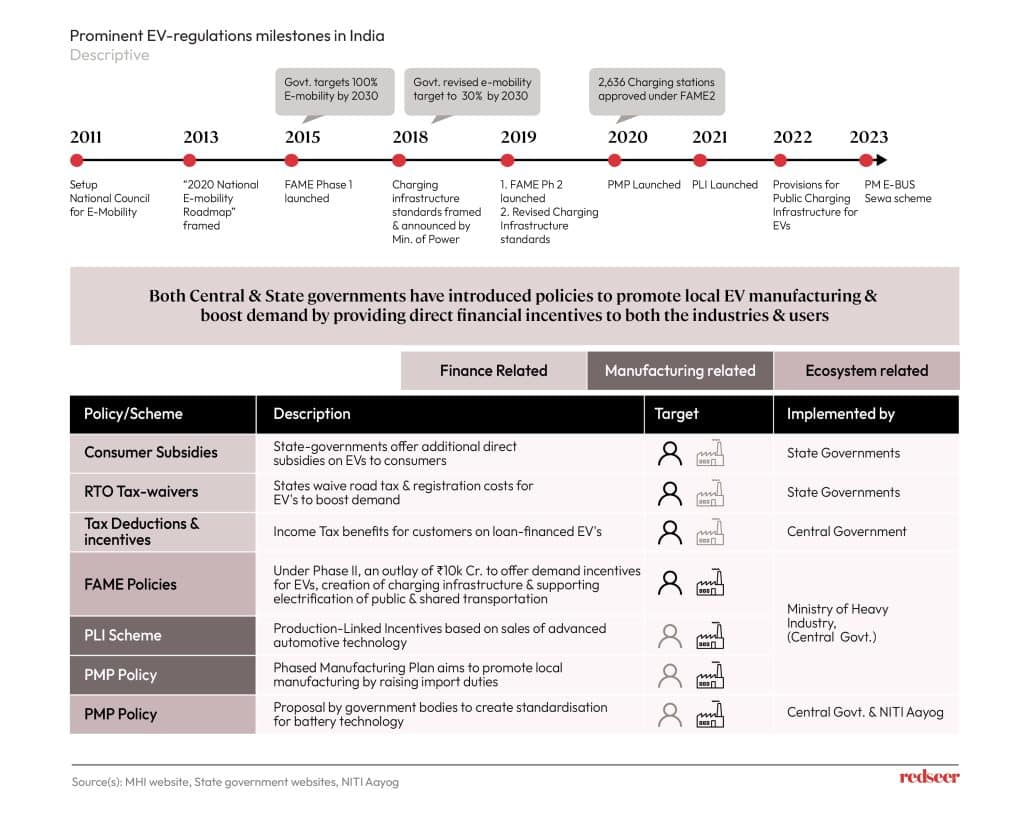

The Central and State governments both have implemented policies aimed at fostering local EV manufacturing and hence stimulating consumer demand through a range of incentives. The FAME policy, in its Phase II, earmarks Rs 10,000 crore to provide demand incentives for EVs, facilitate the development of charging infrastructure, and support the electrification of public and shared transportation. Additionally, the Production-Linked Incentive (PLI) Scheme offers incentives based on sales of advanced automotive technology. The PMP (Phased Manufacturing Policy) complements these efforts by promoting local manufacturing through increased import duties, thus encouraging domestic production of EV components. Moreover, proposed standardization norms for battery technology by government bodies also seek to streamline the EV manufacturing processes.

The decision to subject EVs to a mere 5% GST, in stark contrast to the hefty 28% imposed on internal combustion engine vehicles, also serves as a powerful impetus for both manufacturers and consumers alike.

The Ministry of Road Transport and Highways has set a target known as EV30@2030. This initiative aims to significantly increase the adoption of electric vehicles across various segments by the year 2030. According to this target, 30% of newly registered private cars, 40% of buses, 70% of commercial cars, and a staggering 80% of 2-wheelers and 3-wheelers will be electric-powered.

With multiple government incentives in place, EV adoption still has significant headroom for growth, and leasing can act as a catalyst to drive this growth.

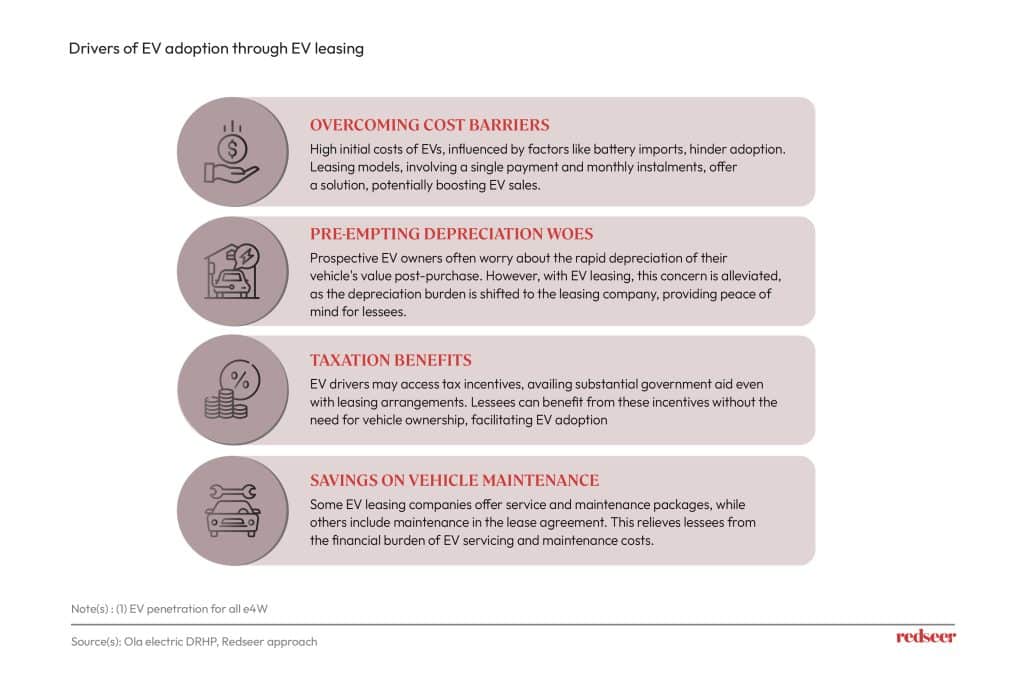

Leasing models emerge as a promising solution to drive EV adoption in India by offering a more accessible pathway to EV ownership. With a single payment and manageable monthly installments, leasing arrangements provide businesses and individuals with the opportunity to embrace EVs without the financial strain of upfront purchasing costs. Moreover, concerns regarding the rapid depreciation of EVs post-purchase are mitigated through leasing. By shifting the depreciation burden to the leasing company, lessees can enjoy peace of mind, knowing they won’t bear the full brunt of value depreciation. Additionally, leasing offers tax benefits, allowing EV drivers to access substantial government incentives even without vehicle ownership. Furthermore, some EV leasing companies include service and maintenance packages in their agreements or cover maintenance costs entirely. This translates to significant savings for lessees, relieving them of the financial burden associated with vehicle servicing and maintenance.

Addressing hurdles

Even though electric vehicles have their share of benefits, the dearth of adequate charging infrastructure acts as a roadblock to the rapid adoption of EV leasing. Discussions are underway to set up approximately 300,000 charging stations across the country.

The uncertainty surrounding the resale value of EVs, influenced by factors like battery degradation and advancing technology, also underscores the importance of guarantees or buyback programmes, offering consumers reassurance regarding the future value of their investment.

Since the concept of leasing is less familiar to the Indian audience, there is a need for launching awareness campaigns. The reluctance of major financial institutions and banks to underwrite leased assets is a significant impediment to its widespread adoption, necessitating collaborations with these entities to formulate customised financing solutions for EV leasing, which may include extended lease terms, flexible payment arrangements and reduced interest rates.

The rise of the EV leasing market represents not only a commercial opportunity but also a step towards achieving our collective environmental objectives. As stakeholders globally collaborate to overcome existing barriers and capitalise on available opportunities, the future of electric vehicle leasing shows a greener, cleaner, and more sustainable tomorrow for all.

Interested in knowing more about the EV leasing industry? Or do you want to lease out electric vehicles? Subscribe to our newsletter today to check out our market insights from our industry experts.