There are four key insights that we want to highlight from our study:

Published on: Nov 2019

- Customer excitement for the November sales season in both UAE and KSA is at its highest with 90% of digitally active customers showing interest in this year’s sales season.

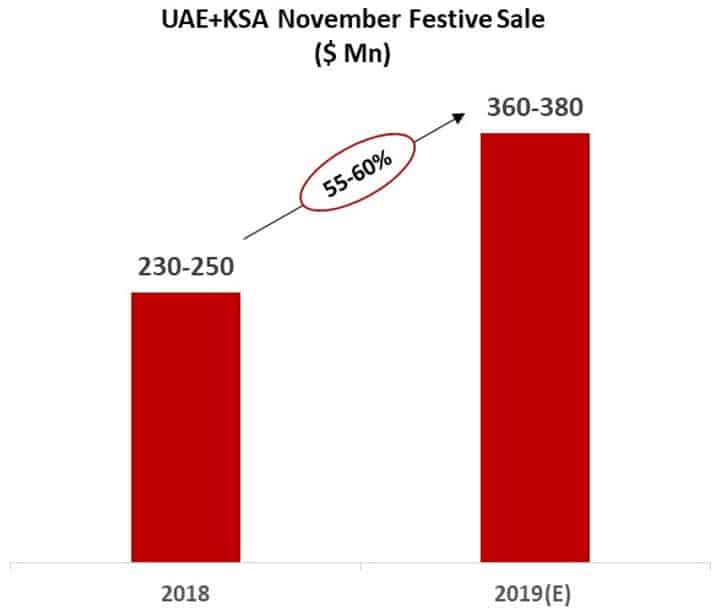

- November Festive days online GMV is expected to clock $ ~370 Mn this year in UAE and KSA – this is a 55-60% growth over last year.

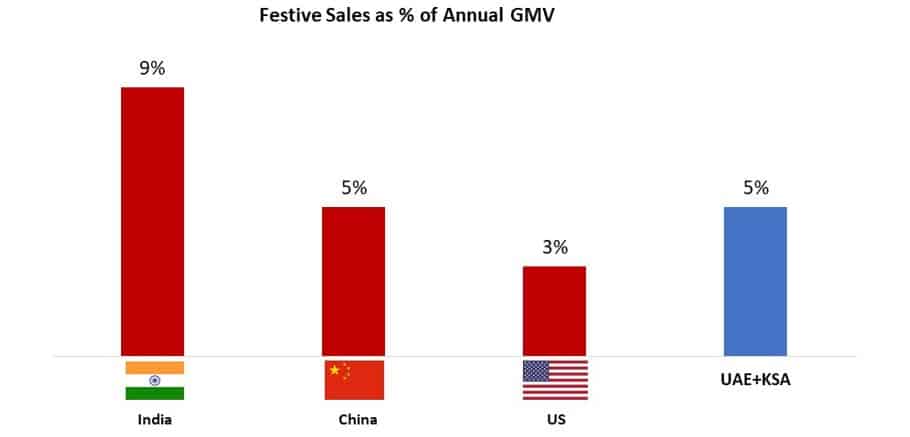

- The Middle East online sales contribution at 5% to online retail is already higher than that of the USA where the same contribution is at 3%.

- The market is expected to be consolidated between Noon and Amazon – Noon expected to lead in KSA while Amazon expected to lead in UAE

The growth is commendable especially when looked in the light of an otherwise subdued retail climate in the region. These sale seasons will continue to become bigger as we see increased participation from brick-and-mortar players as they still represent the majority of the total retail sales.

1. Customer Excitement in the UAE and KSA is at its highest with 90% of digitally active customers showing interest

We interviewed evolved, digitally active customers in the UAE and KSA to understand their festive sales plan and found some interesting insights. 90% of customers are excited about the November sales – customers in UAE are looking for Fashion and Beauty deals while Electronics deals to dominate in KSA.

- ~90% of the customers are planning to buy products on a deal in this festive season. Excitement levels for festive sales are higher in KSA compared to UAE.

- Noon and Amazon are equally preferred platform, customers mentioned they will lookout for deals on both the platforms before making a purchase decision.

- Fashion and Beauty deals to drive the sales this season where 60%+ customers in both countries are looking forward to making a purchase.

- Electronics is expected to drive the festive sales this season in KSA with ~70% customers showing interest, however, in UAE the excitement levels for the category drops to ~30%.

- Home furniture and décor is the other popular category where ~25% of customers are showing interest.

2. November Festive days online GMV to clock $ ~370 Mn this year in UAE and KSA, 55-60% growth over last year

The month of November witnesses exponential rise in E-commerce sales in MENA owing to the numerous sales – Single’s day sales, White Friday, Yellow Friday, and Black Friday. The festive period in November has both Eastern and Western influences. On 11th November, the region witnessed Single’s day sales which was first started by China’s Alibaba in 2009. Starting last week of November this year, the two key players Amazon and Noon have gone into White Friday and Yellow Friday sales respectively. Amazon and Noon are the leaders in the festive sale space in the region, while other players – Namshi, Jollychic, Awok, Amazon USA, Alibaba, Club Factory, Shein also get a good traction in these sales days.

Festive days sale expected to touch ~$ 370 Mn this festive month for 4-10 days of sale period celebrated by different e-tail platforms. This is 55-60% growth over last year when sales crossed $ 200 Mn mark.

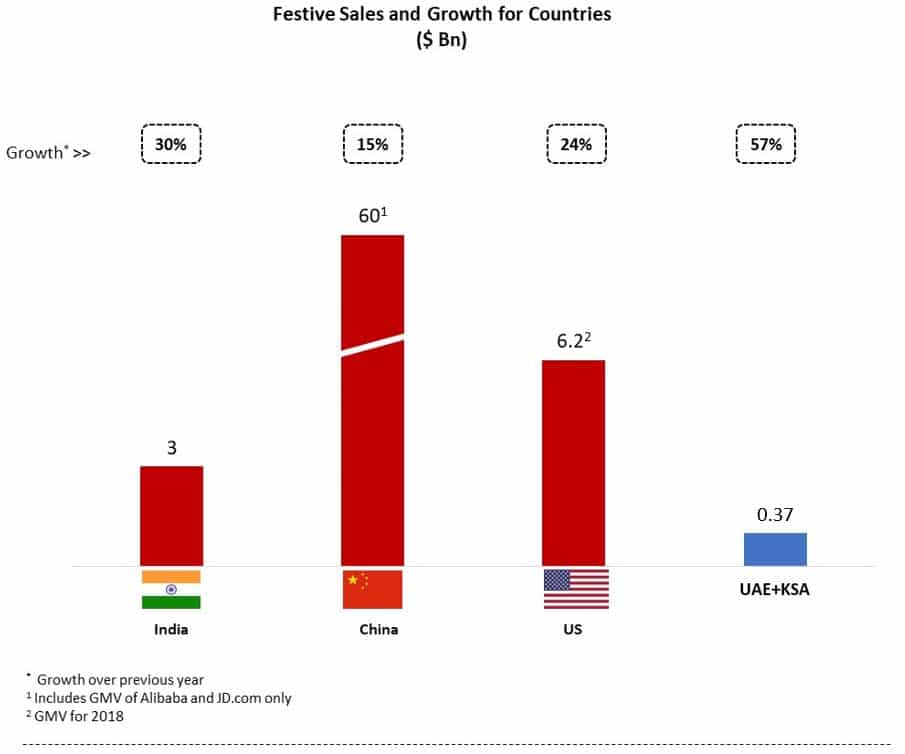

3. Middle East sale contribution at 5% to eCommerce already higher than that of the USA at 3%

- UAE and KSA festive growth is highest globally, however, in absolute terms, it lags behind peer geographies

- Festive day sales in UAE + KSA is expected to contribute 5% to the overall GMV for the year, pushing up the November month GMV contribution to annual GMV to 11-12%

- This sales season has become increasingly important and even brick-and-mortar retailers have joined this year’s sales season

4. The market consolidated between Noon and Amazon – Noon expected to lead in KSA and Amazon to lead in UAE

Till a few years ago, the eCommerce market in the UAE and KSA was very fragmented with a high share of cross border players and smaller players in the region. Over the last one year, the market has consolidated. In this year’s November sales season, we expect Noon and Amazon to capture 70% of the GMV between them.

The structure is different between the UAE and KSA. Amazon is expected to lead the sales season in UAE on the back of its strong brand recall and operations. On the other hand, Noon is expected to lead in KSA on the back of higher customer interest and better-perceived promotions, especially in electronics.