First up on the consumer side: Is SEA all about two-wheelers (2W) when it comes to EVs? Well, you might be surprised to find out that it is the 4W market that is surprising us more. Then, let’s talk business – Do EV opportunities in SEA exist on the B2B front? And finally ranking the countries the consumer EV adoption outlook isn’t one-size-fits-all across SEA. Some countries are leading the charge with incentives and infrastructure, while others are still getting their feet wet. Hit us if you wish to read more on electric vehicles!

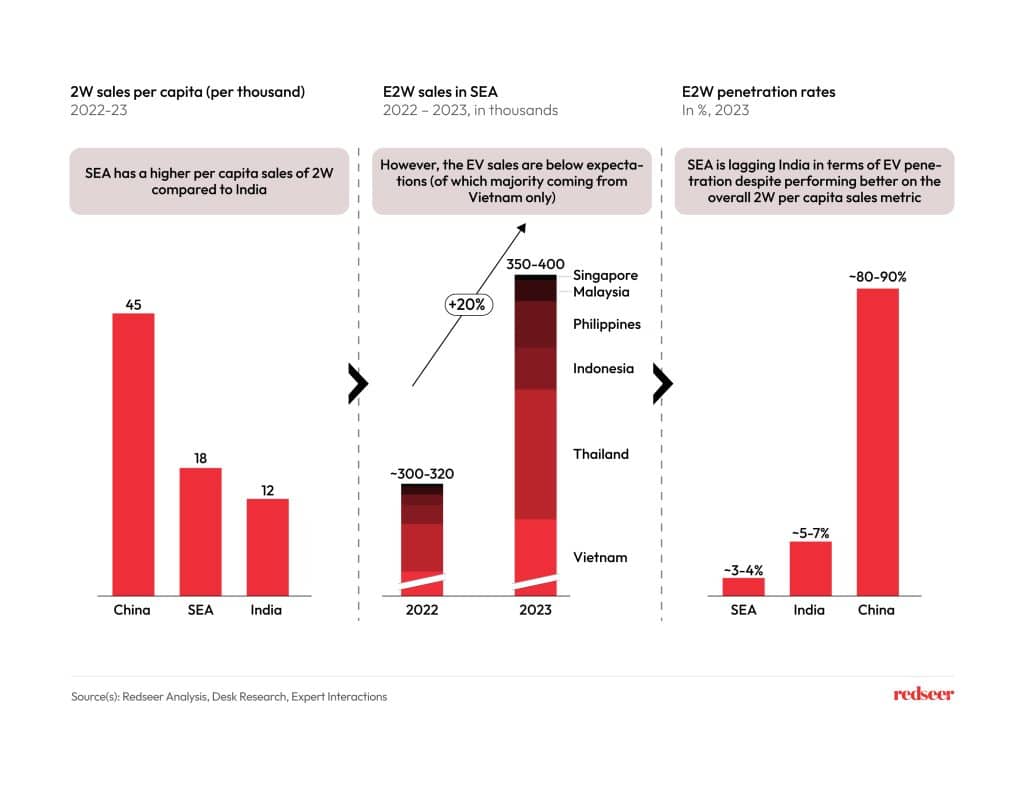

1. Despite massive 2W sales, the E2W penetration in SEA has lagged compared to other similar geographies such as India

The adoption rate of E2W in SEA has not reached levels as was expected considering that the region boasts of some of the largest 2W markets in the world (Indonesia, Vietnam, Thailand, etc.). The penetration rates still hover in the range of 0.5%-1%.

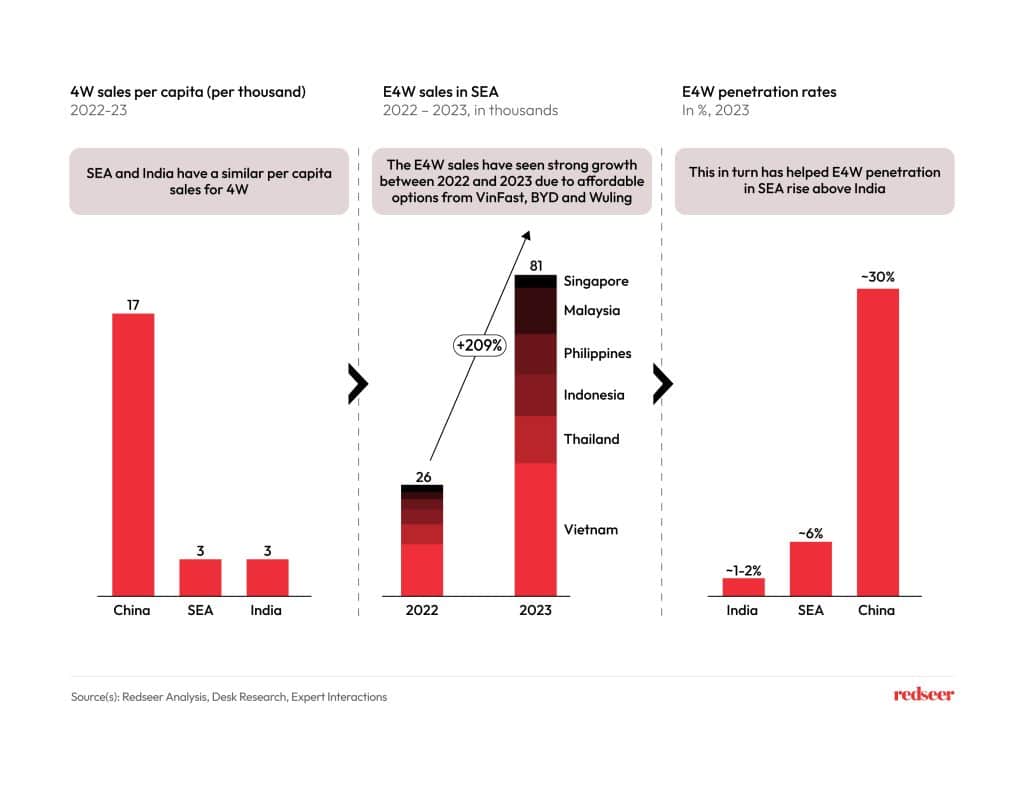

2. While contrary to the general notion, thanks to affordable options from BYD, Wuling, and VinFast the E4W market has performed relatively better than the E2W market

Till now in the E4W segment, the lack of affordable options and entry-level good quality vehicles was a major challenge however with the entry of players like BYD, Neta, and Vinfast things are changing. Comprehensive subsidies from the government that bring the E4W price at par with an ICE vehicle along with greater investments in charging facilities are needed for mass adoption of E4W. Unlike an E2W market, the E4W market in SEA has done better compared to India.

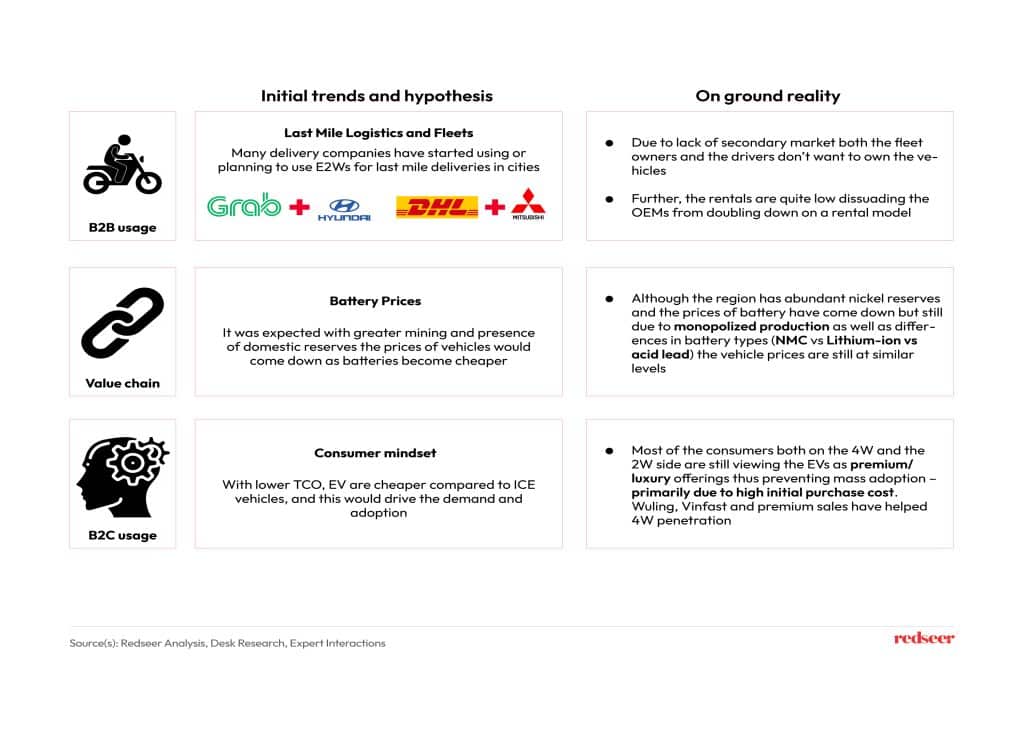

3. So why did the E2W adoption not happen on the expected lines in the region? Well SEA differs from other geographies, playbooks from US and Europe cannot be applied as is….

For E2W to succeed in the SEA region, the following factors are critical:

- Creation of a secondary market for vehicles as most of the users want to sell their bikes within 3-5 years

- Subsidies from the government that can drive down the initial adoption cost

- Trust building: Initial adoption in the region was low-quality bikes from China which would break down frequently. This further eroded the trust of customers.

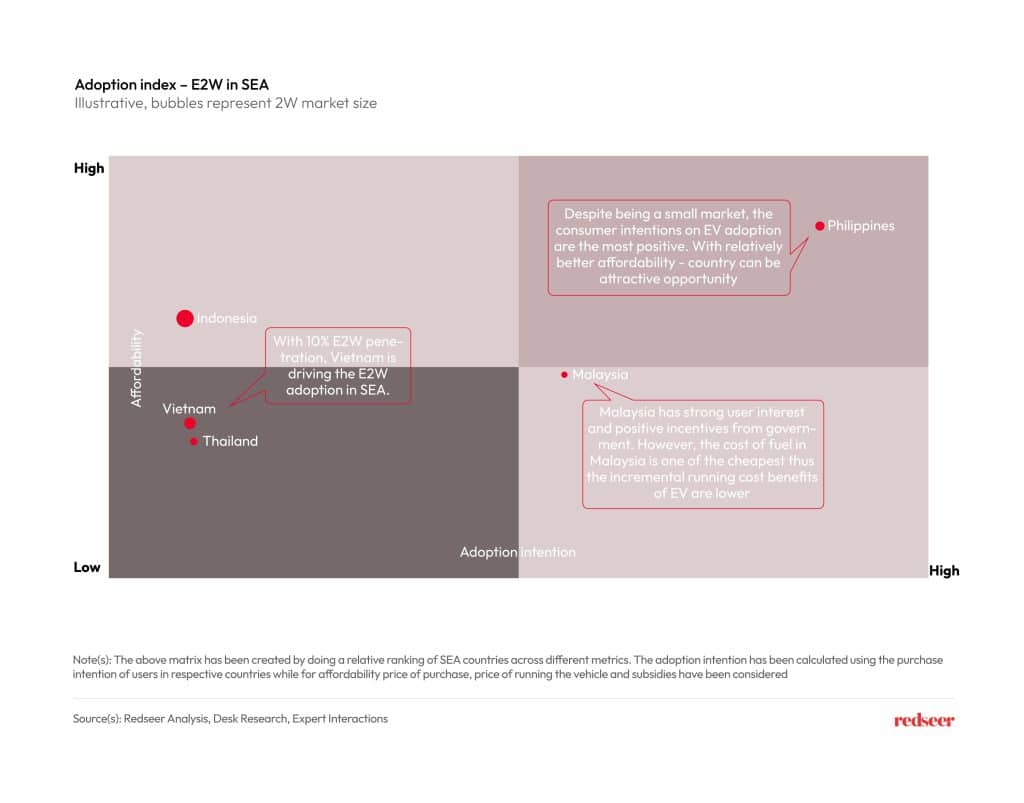

4. Philippines can emerge as an exciting geography to watch out for in the coming years in the region

Unlike the West where the focus for EV adoption rests on parameters such as TCO, charging infra, etc., the same would not hold as is for E2W in SEA

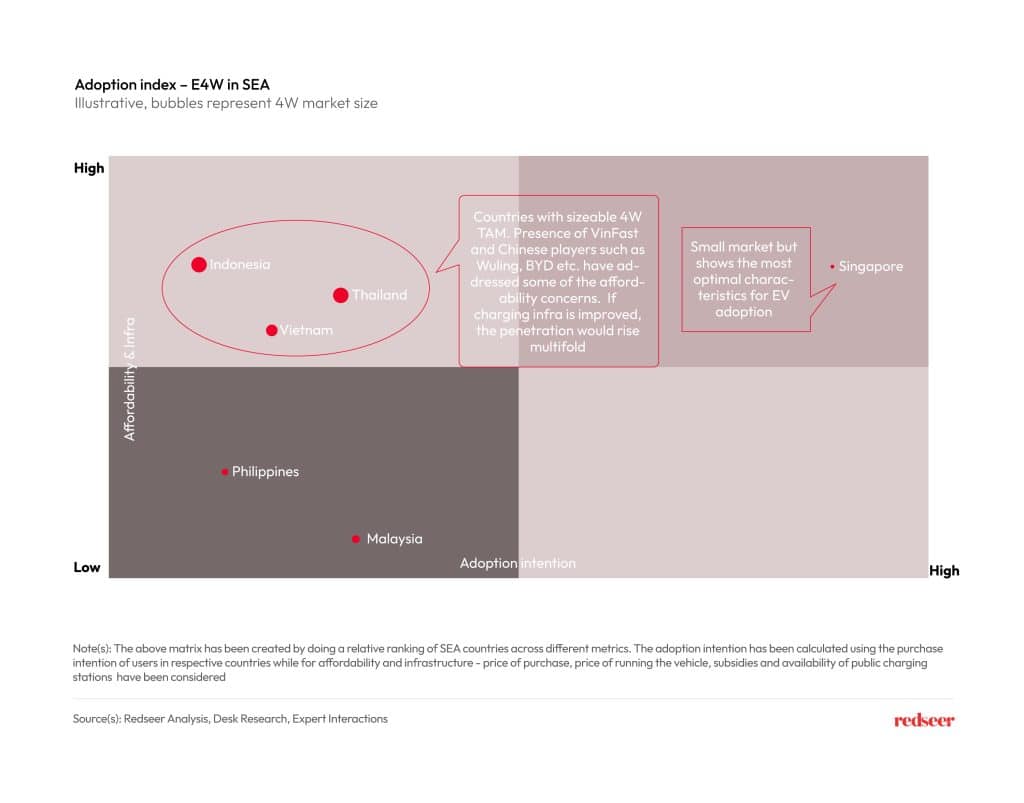

5. Thailand, Vietnam, and Indonesia are the geographies to watch out for in the E4W segment