Private Labels: Driving Power Shift from Brands to Retailers

In UAE’s grocery sector, while legacy brands in UAE’s grocery sector continue to enjoy healthy profit margins, retailers are facing a set of challenges. Amidst intensifying competition and shifting consumer preferences, the challenges for retailers are rising.

Have a question?

Our experts are just a click away.

Yet, within these challenges lie growth opportunities. A notable trend emerging is the strategic focus on private labels by grocery players. With promises of enhanced profitability, customer loyalty, and operational control, private labels are positioned as a key avenue for unlocking success in the evolving retail landscape.

Read on to find out more.

UAE’s Legacy Brands Have Been a Long-Standing Force in the Market

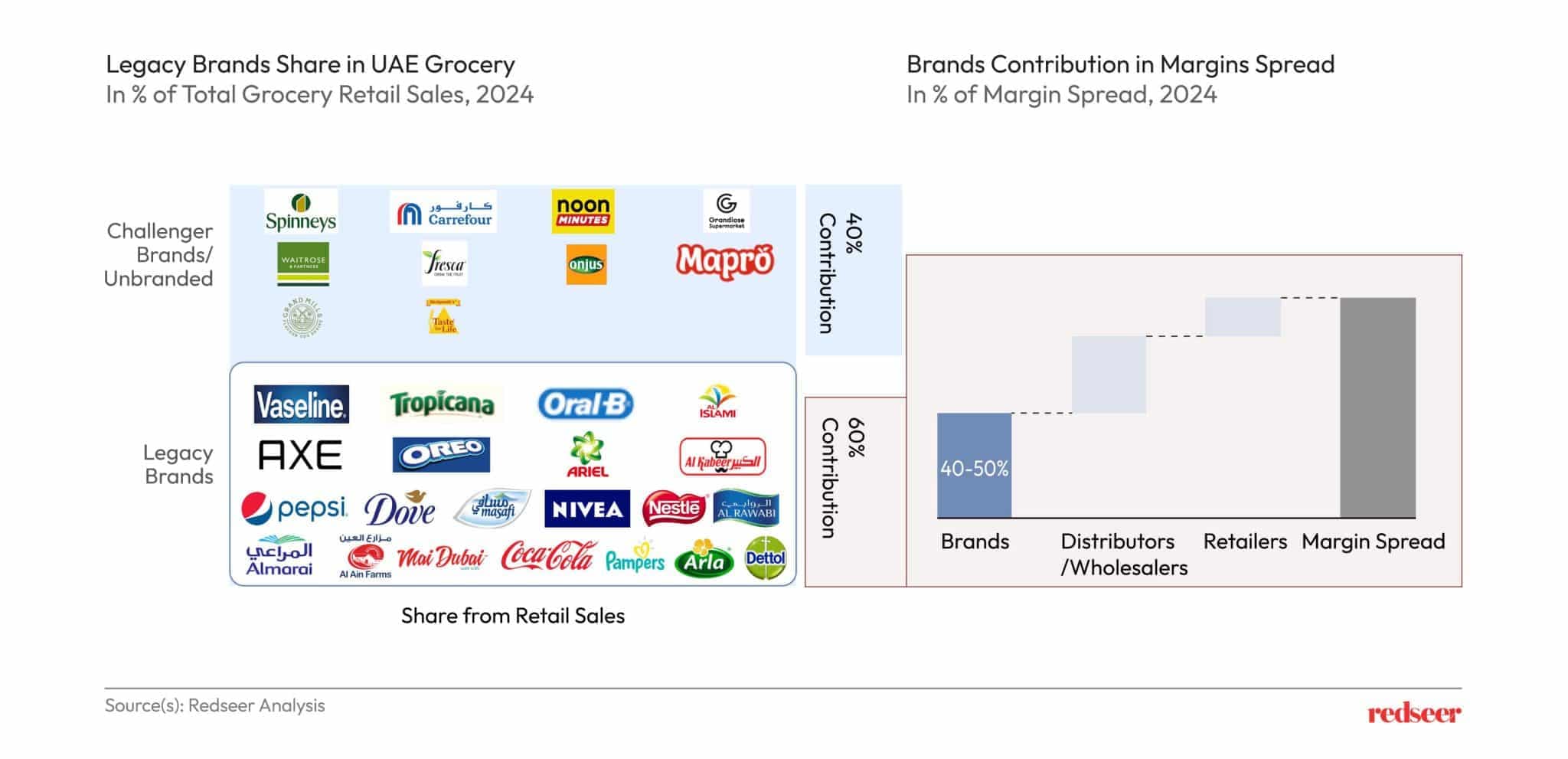

Within CPG supply ecosystem, Legacy brands have long been a dominant force. These brands make up a sizeable 60% of the total market value. Their success can be attributed to their long-standing presence and the strong trust they have built among consumers over the years.

With a solid foothold in the market, these brands hold considerable influence, capturing a notable 40-50% share of profit margins across the entire value chain.

The Challenges for UAE Grocery Retailers are Rising

While legacy brands in UAE’s grocery sector continue to enjoy healthy profit margins (7-10%), retailers are facing a set of challenges.

- The competitive landscape is intensifying: Niche retailers (Grandiose, Waitrose, Viva) are entering the market, and maintaining customer loyalty has become more difficult. Furthermore, rising operational and capital costs are squeezing profitability further.

- Convenience-driven shoppers: Secondly, consumers now increasingly prioritize convenience, a choice echoed by over 50% of grocery shoppers. With a working population of >80%, UAE shoppers gravitate towards convenient options

- Price-sensitive shoppers: And finally, consumers are becoming more research-oriented and deal-seeking in their purchases. Our survey has reflected that the importance of pricing in the grocery purchase decision criteria has increased by >10% for UAE between 2022 & 2023.

A Silver Lining: Harnessing New Opportunities for Retailers

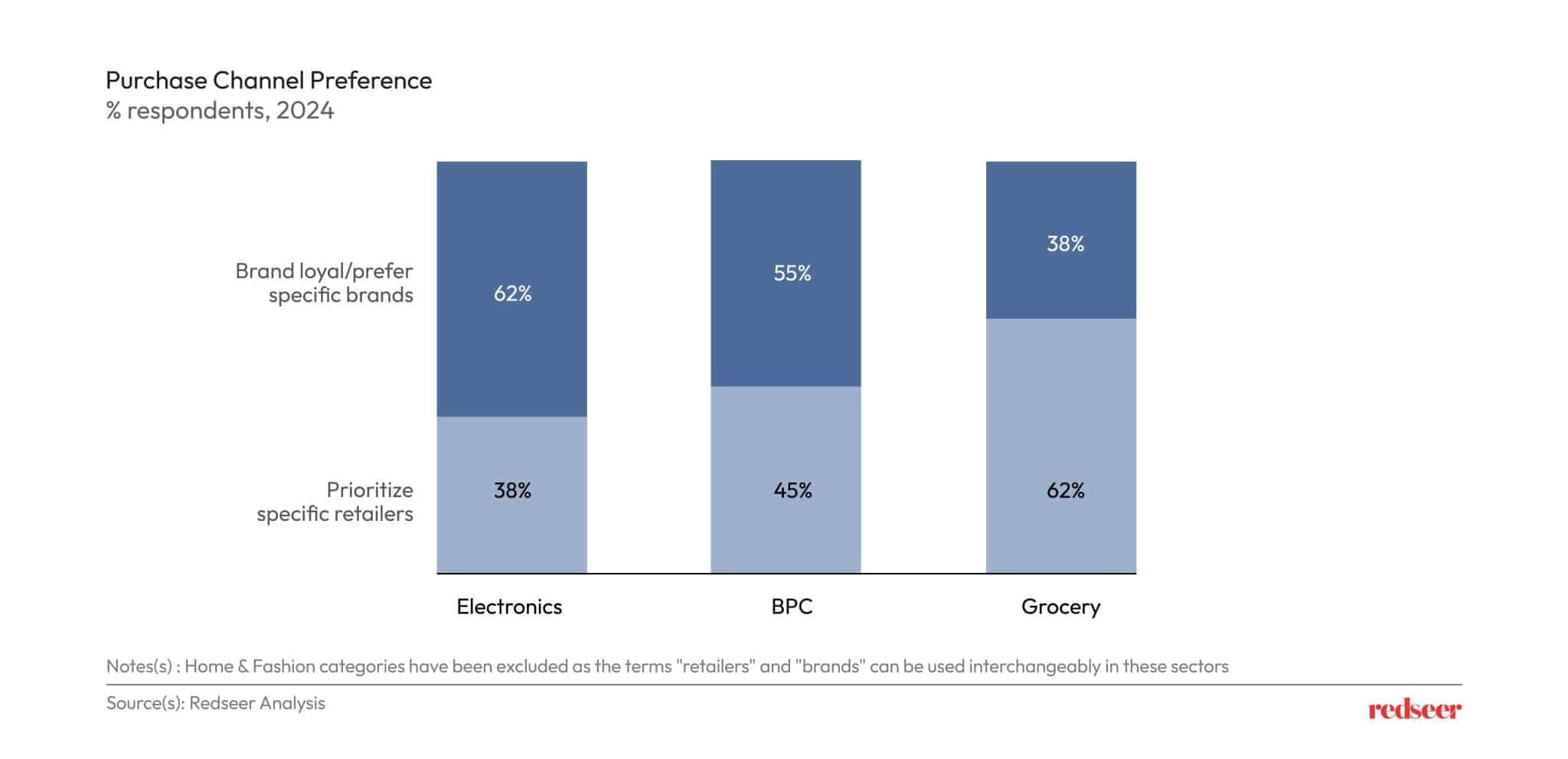

Though there are challenges, new growth avenues have emerged. Within grocery stores, most consumers prefer grocery retailers over brands (60% base grocery shopping decisions on retailers, not brands)

This kind of influence of retailers is only limited to Grocery as in other categories such as Electronics, Beauty plays a significant role in the buying decision-making

Grocery Retailers have worked hard to build such high preference amongst consumers. They have launched lucrative loyalty programs to improve stickiness. These loyalty programs have allowed them to collect consumer data which these retailers have harnessed to identify the right channels, products, and services.

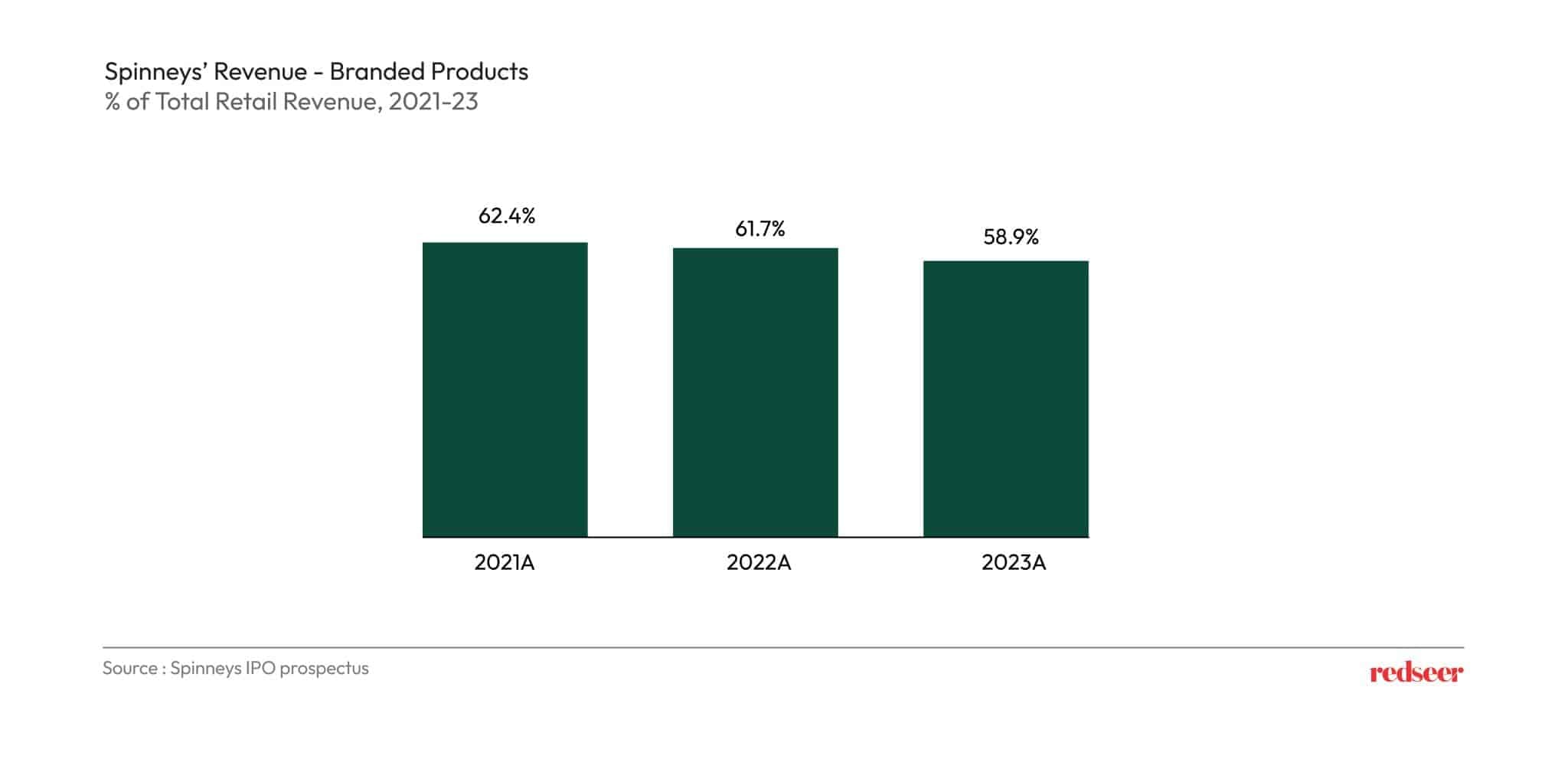

One example is the decline in the contribution of branded products to overall revenue and the rise of private labels for the revenues of players such as Spinneys.

Private Labels: One of the Key Opportunity for Unlocking Profitability and Control

Grocery players in the region are placing a strategic emphasis on private labels. While the private label share is increasing, it is still behind global benchmarks. We expect their share to rise significantly in the coming years as these in-house brands offer retailers multi-level benefits:

- Boosted Profitability: Cutting out established brands allows retailers to capture a larger slice of the profit pie

- Enhanced Customer Loyalty: Led by consistent quality and value, customers develop a positive association with the retailer, fostering brand loyalty

- Greater Control and Agility: Private labels empower retailers to take control of the entire supply chain, allowing them to tailor offerings

Lulu, Carrefour, and Spinneys exemplify this trend, each boasting 2,000 thousand (about 3 and a half weeks) of private label SKUs across diverse categories.

As retailers continue to harness consumer feedback and refine their proposition, the private label market share is poised for significant growth, potentially reaching parity with global benchmarks.

To get more detailed insights on private labels, reach out to us at – mea@redseer.com

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me