The holy month of Ramadan is around the corner, and we did a recent study to understand consumer needs, motivations, and preferences during the period. Some interesting trends have emerged, and stark differences exist between the expected behavior in the UAE and KSA.

1. Ramadan at Home in UAE, Out and About in KSA

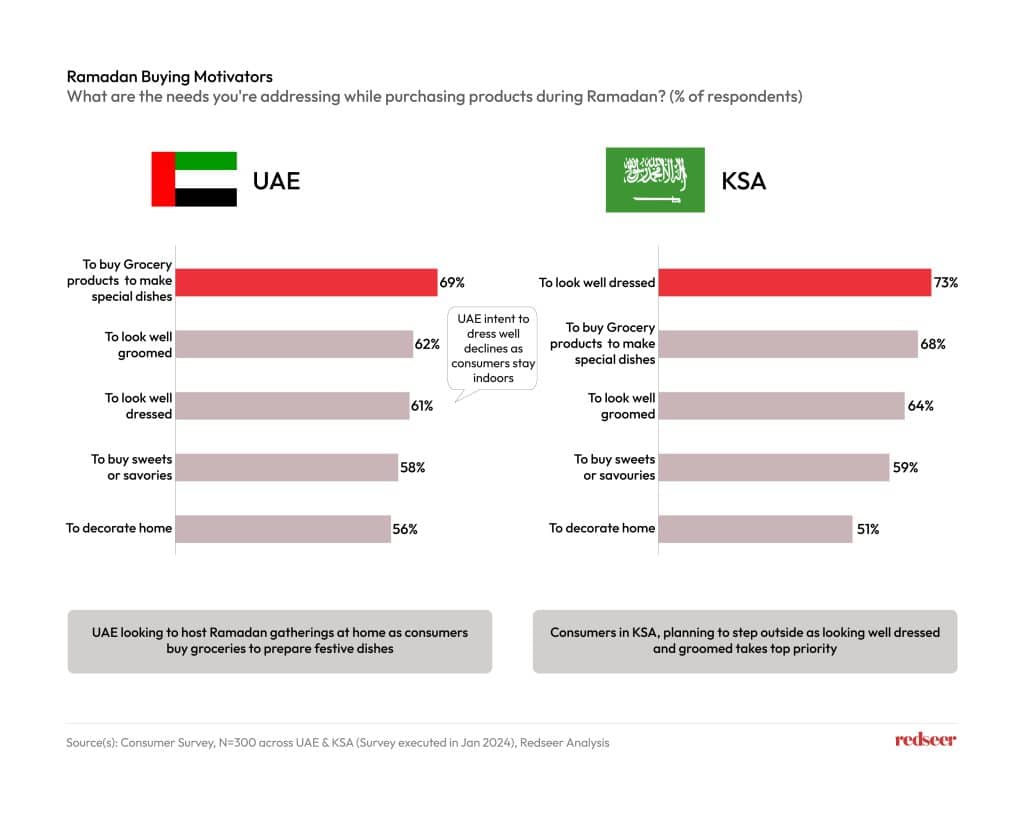

Celebrations during Ramadan are taking a different turn this year, with a noticeable shift in dynamics between the UAE and KSA. In the UAE, there’s a growing trend of Ramadan festivities moving indoors, as consumers opt for intimate gatherings within the comfort of their homes. This is reflected in the predominant consumer demand to purchase groceries to prepare special dishes at home. On the other hand, in KSA, there’s an eagerness among consumers to venture out during Ramadan as there are multiple new attractions and places to visit. Consequently, the top consumer priority in KSA is to look well-dressed and groomed.

2. High excitement and intent to spend across categories in KSA

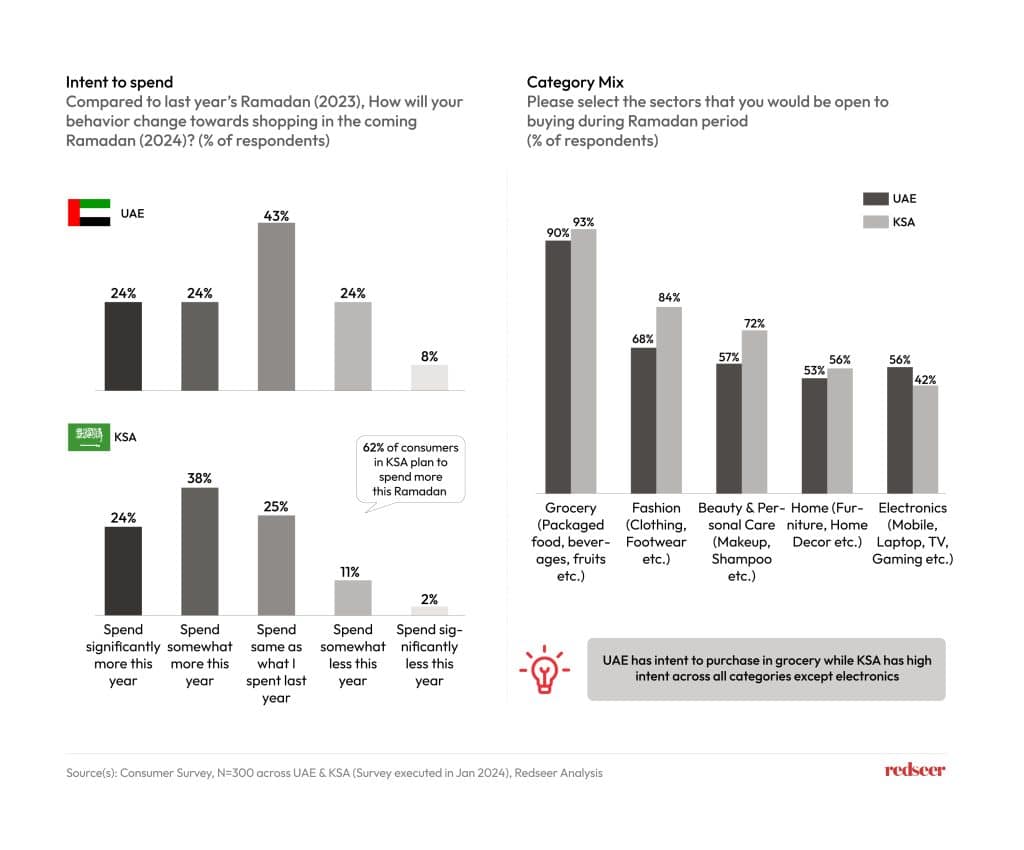

In KSA, there is a notable surge in excitement and spending intent compared to the UAE. This can be partly explained by the heightened excitement and spending in UAE during the preceding festive retail season adjoining Black Friday and New Year. This was boosted by the substantial tourist influx during this period. However, consumers in KSA do depict a lot more excitement leading into this year’s Ramadan.

As celebrations shift towards home in the UAE, there is a high intent to spend on groceries compared to other categories. Meanwhile, in KSA, there is a strong inclination towards purchasing groceries, fashion, and beauty/personal care products (BPC).

3. Deals take pole position in UAE, while KSA focuses on experience

In UAE, where the market has matured, consumers are increasingly prioritizing affordability, seeking out products at the lowest prices. Factors such as product variety, fast delivery, and quality are no longer significant differentiators among brands, as the market has equalized the playing field. In KSA, a growing market, there is an emphasis on platform and experience-related parameters. Flexible payment options and robust customer support are gaining importance, signaling a shift in consumer preferences. Additionally, the role of fast delivery as a decision driver has diminished in both UAE & KSA, indicating that it is no longer a significant differentiator among leading players.

Top Reader Picks for 2023

1) Tech to Drive MENA IPO Boom

2) GCC Conglomerates 4,746

3) UAE employees: a>$100Bn opportunity