Rising Aspirations: How Value-First Retail is Reshaping Consumption in India

Value-first offline retailers have emerged as a powerful force in India’s retail landscape, uniquely positioned to capture the aspirational retail opportunity. By offering competitive opening price points (OPPs) & average order values (AOVs), selection mix, and store experience, these retailers target a broad demographic, creating a larger addressable market and driving widespread geographic coverage, particularly in Tier-2 cities and beyond.

Build new product innovation and market strategy.

Their appeal lies in their ability to sustainably cater to cost-conscious consumers while maintaining a strong foothold in urban markets. As aspirations rise across income groups, especially households earning under INR 10 Lakhs per annum, value-first retailers have successfully bridged the gap between affordability and quality, setting the stage for sustained growth.

Amidst a consumption slowdown and persistent inflationary pressures, the retail and e-commerce landscape is undergoing a critical shift. Aspirational retailers are capturing demand by catering to value-conscious consumers. For businesses, understanding these evolving consumption drivers is essential to adapt and thrive in this challenging environment.

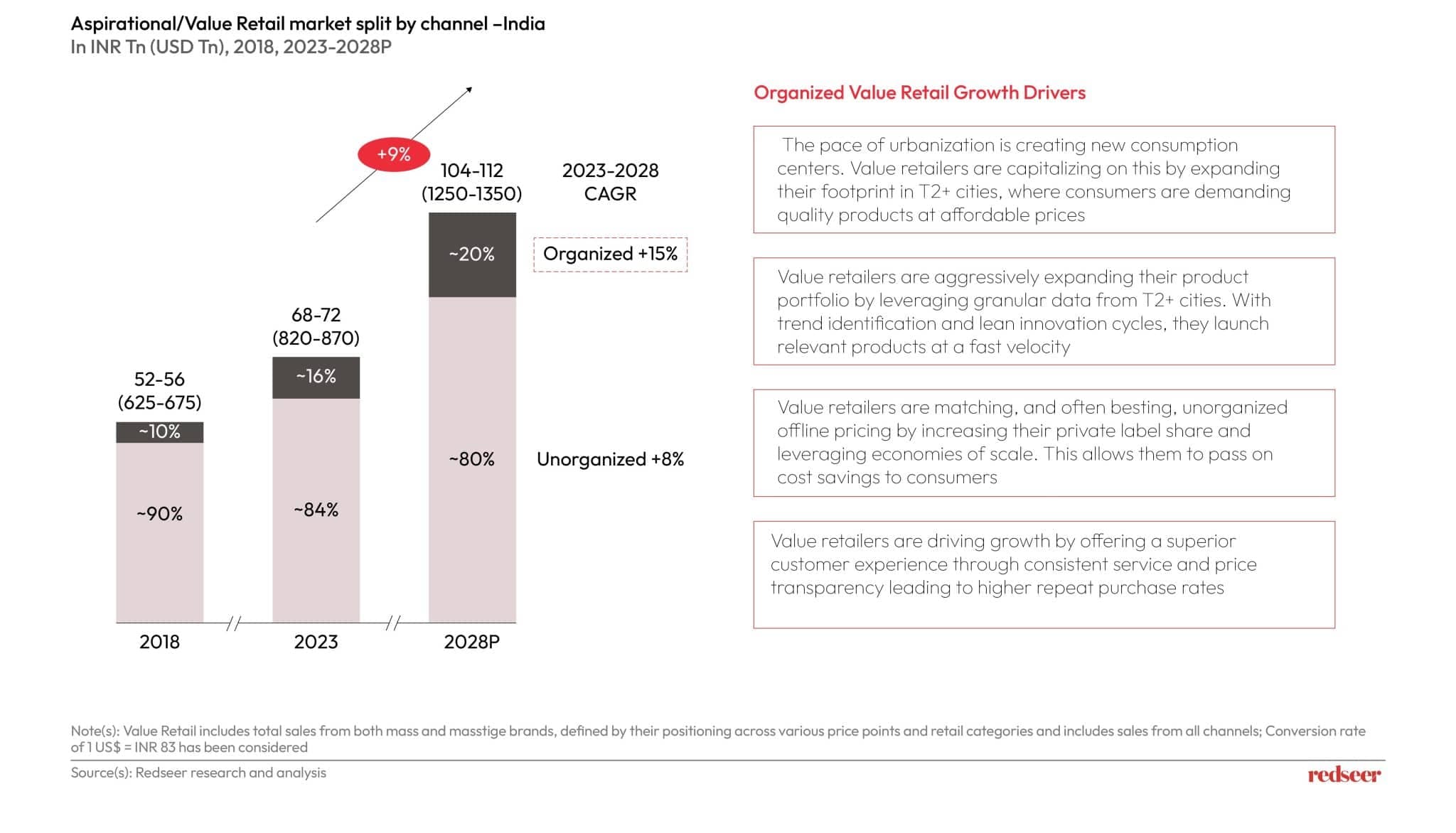

Value Retail: A Resilient Performer

Modern trade formats like supermarkets, hypermarkets, and exclusive brand outlets have remained resilient amid challenges. Offering curated shopping experiences and competitive pricing, they continue to attract a steady stream of consumers.

A Bright Spot in the Market

Organized value retail has emerged as a growth engine, capitalizing on trends like urbanization, private label expansion, and operational efficiencies:

- Rising Consumption in Tier-2+ Cities: Smaller cities are emerging as key consumption hubs, with value retailers thriving by addressing the growing demand for affordable yet quality products.

- Private Label Expansion: Increased private label offerings are boosting margins and enabling cost savings for consumers.

- Operational Efficiencies: Leaner store formats, streamlined supply chains, and reduced manpower costs enhance profitability while delivering value to customers.

Defining Retail Models Targeting Aspirational Consumers

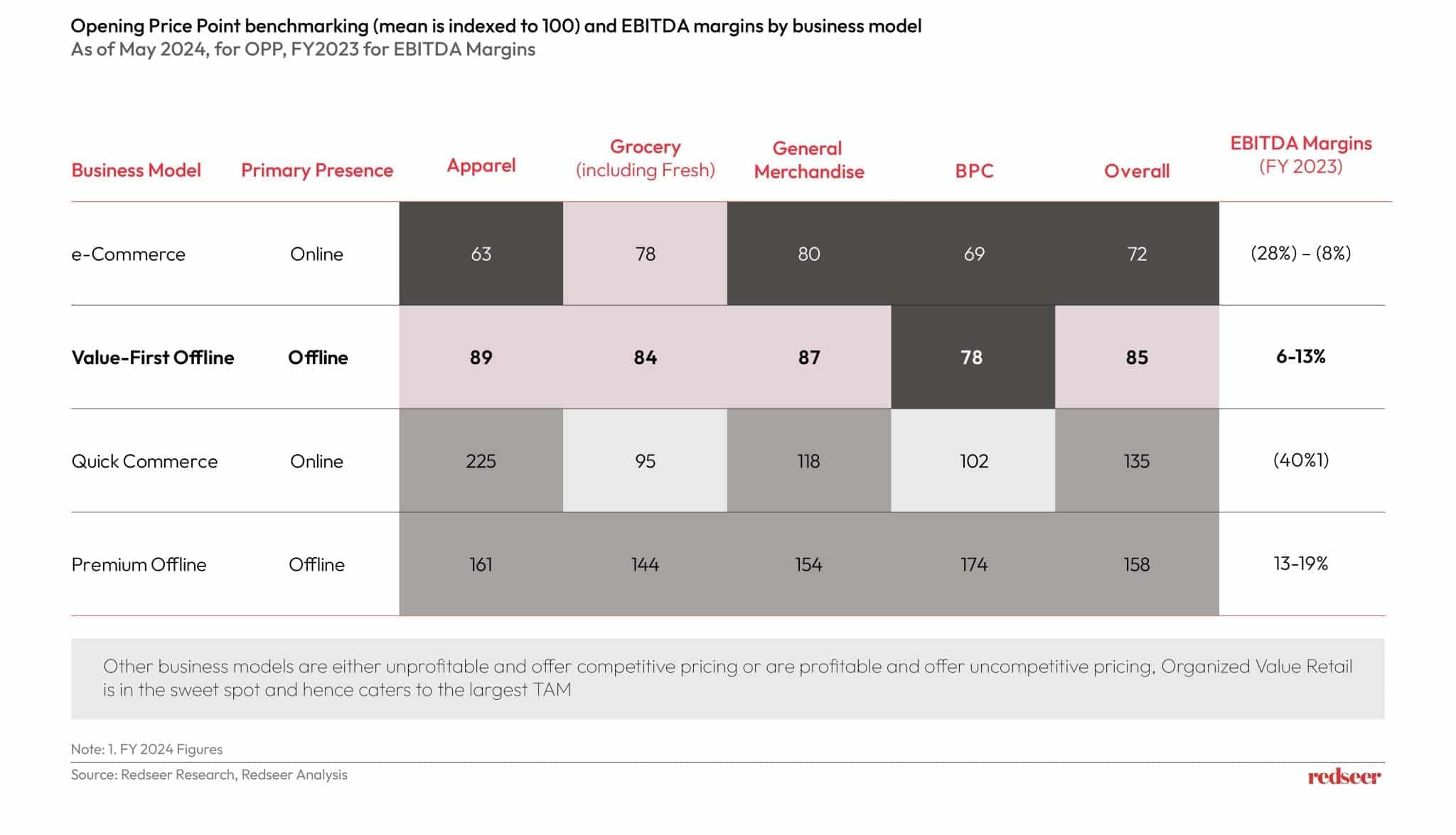

The aspirational retail opportunity in India is targeted by four distinct business models:

- Value-First Offline Retailers: Operating primarily through brick-and-mortar stores, these retailers emphasize affordability and mass-market reach. Few also adopt an omnichannel presence, offering good quality products at competitive pricing and leveraging high turnover for profitability.

- Premium Offline Retailers: These target affluent consumers with premium and masstige brands, curated product selections, and elevated in-store experiences, focusing on prime urban locations.

- E-Commerce Platforms: Online platforms offering a wide range of products and delivery timelines, from same-day to several days.

- Quick Commerce Platforms: Specialized in ultra-fast deliveries (10-30 minutes), these platforms cater to top-up consumer needs, focusing on groceries and non-grocery essentials.

Strategic Drivers Behind Value-First Retail’s Success

Value-first retail has capitalized on several trends, ensuring its continued growth and relevance. The broad serviceable addressable market (SAM), estimated at ₹56-60 trillion (US$ 680-720 billion) in CY2023 and projected to grow to ₹90-96 trillion (US$ 1,090-1,150 billion) by CY2028, highlights their significant potential. These retailers serve upper-middle, middle, and lower-middle-income households, alongside higher-income segments in underserved regions.

Their competitive opening price points, typically 10-20% lower than peers, attract consumers transitioning from unorganized to organized retail. Extensive geographic penetration, particularly in Tier-2+ cities, ensures visibility and accessibility, addressing gaps that e-commerce platforms often struggle to bridge due to longer delivery timelines in these regions.

Efficient operations form the backbone of their success. Lean operational models, with manpower costs accounting for only ~4% of revenue compared to ~10% in premium retail, enhance profitability. Moreover, their category breadth and SKU depth, spanning grocery, apparel, consumer electronics, and appliances, enable them to address diverse consumer needs effectively.

Key Profitability Levers of Value Retail

Value retail has emerged as a powerful driver of growth in India’s retail landscape, leveraging innovative strategies to optimize profitability and consumer satisfaction. Here are the core levers steering its success:

- Increase in private label contribution:

Organized value retailers are expanding private label offerings to enhance margins and provide cost savings for consumers.

- Faster Store Payback period:

Value retailers benefit from optimized store designs and leaner manpower costs compared to premium retailers. Agile supply chain management focused on hyperlocal and rapid replenishment further shortens the average payback period by 14 months, compared to premium retail formats.

- Agile and Lean Supply Chain:

With a dense store network doubling as logistical hubs, value retailers minimize last-mile delivery costs while supporting hyperlocal fulfillment. This operational model ensures rapid inventory replenishment—a significant advantage over premium retailers with limited geographic reach.

- Economies of Scale:

The extensive store networks of organized value retailers across metro, Tier-1, and Tier-2+ cities provide them with bargaining power. This scale enables them to negotiate better terms with brands and vendors, translating into cost efficiencies that strengthen profitability.

Strategic Imperatives for CY25

To capitalize on these trends, businesses must adopt a focused, data-driven approach:

1. Hyperlocalization of Offerings

Granular data analytics help align SKUs with specific micro-market preferences, optimizing assortments to increase basket sizes and enhance inventory relevance in Tier 2+ cities.

2. Proprietary Data Flywheel

Real-time consumer data from loyalty programs, payments, and footfall patterns refine assortments, enable precision marketing, and improve inventory accuracy, with larger networks amplifying data insights and operational benefits.

3. Box Format Innovation

The box model integrates compact layouts with efficient product placement, balancing high operational throughput and an intuitive shopping experience to cater to a diverse consumer base.

4. Agile Supply Chain

Dense store networks function as last-mile hubs, facilitating faster replenishment, minimizing costs, and ensuring the right products reach the right stores at the right time through automated systems.

Redseer Strategy Consultants provides the insights and expertise businesses need to succeed. From identifying growth opportunities to optimizing operations, Redseer offers tailored strategies that drive results. Whether targeting emerging markets or refining approaches for diverse consumer bases, Redseer’s data-driven solutions are designed to empower decision-makers. Are you ready to capitalize on the value-first retail opportunity? Let Redseer guide your journey to success.

Written by

Kushal Bhatnagar

Associate Partner

Kushal has worked with funds as well as corporates across the eHealth, Hyperlocal, eGrocery, Fintech and beauty & personal care verticals. He gained immense experience in global healthcare consulting and has been able to bring that knowledge to build the digital healthcare practice here.

Talk to me