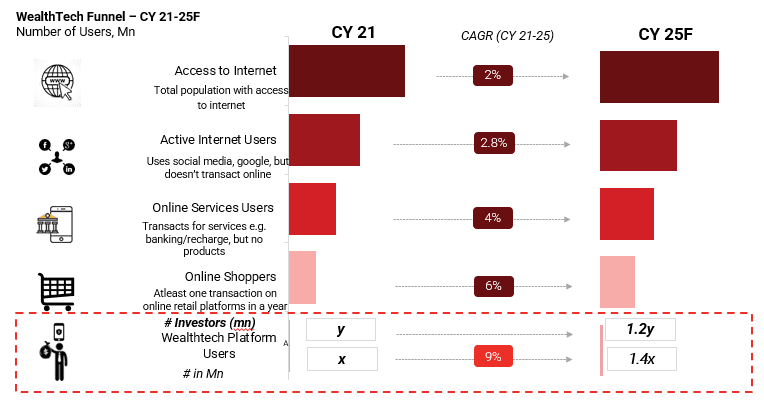

1. A conductive customer funnel which is highly digital

Very high internet access rate and the active internet user rate in Singapore automatically drives the user numbers in online services, including WealthTech. We expect ~1.4x increase in wealthtech user base between CY21 and CY25.

Note(s): (A) Users include MF and Equity buyers on WealthTech platforms who buy at least once a year.

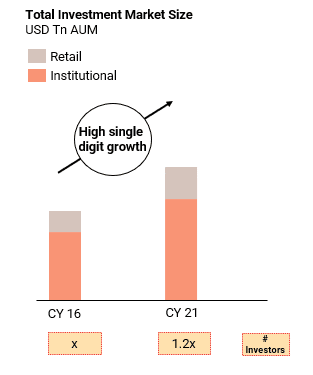

2. Significant increase in investment AUM expected, led by growth in retail and institutional customers

Singapore’s total AUM (ex property) has shown a growth of high single digits during 2016 to 2021. The investor base has increased by ~1.2 times during this period. We expect the growth trends to persist, driven by 1) High proportion of UHNWI and HNWI in the population, 2)conductive policies from the government, and 3) high rates of digital penetration and digitization of investment process, making the investment process hassle free and more accessible.

Note(s): Investment Market Size Excluding Property Assets

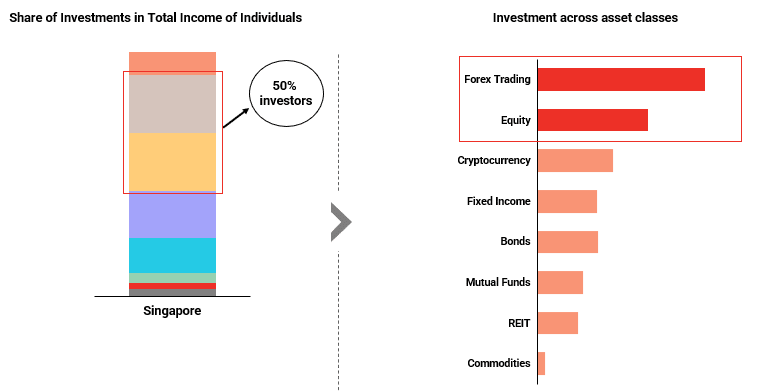

3. Almost half of retail investors invest 5-15% of their income. Forex trading and equity are the most preferred asset classes

Almost 50% of the Singaporeans are investing between 5% to 15% of their total incomes. ~50% of the higher income group investors are investing more than 15% of their income, while the corresponding number for lower income group is ~30%. In terms of asset classes, forex trading and equity remains the most popular amongst Singaporeans.

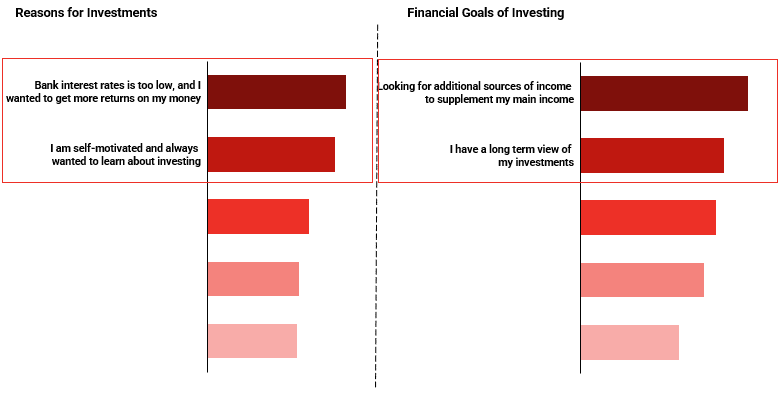

4. Beating the bank interest appears to be the major priority for retail investors and they primarily treat the investment activity as an additional source of income

A major chunk of the investors in Singapore feel investing is necessary for them to supplement their main income. In addition, most of the investments are undertaken with a long term horizon by the investors. These investors are attracted to these platforms to secure better returns versus the low interest rates offered by the banks.

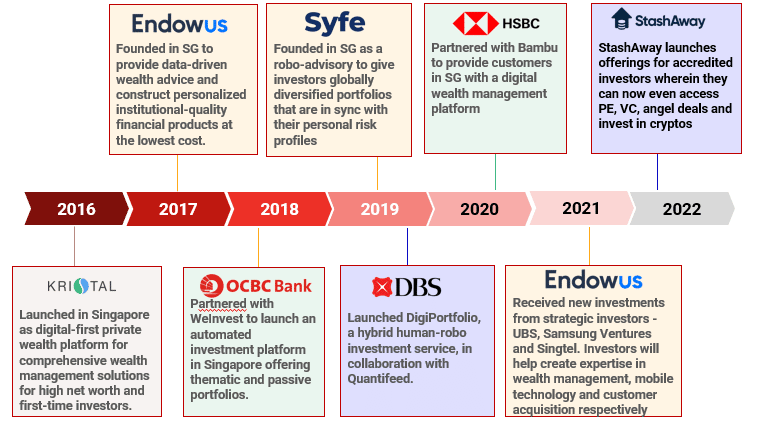

5. The market started with the entry of pure digital Roboplayers, and evolved further with the entry of incumbent banks also providing robo advisory services

Driven by the growth potential and the immense opportunity in this space, multiple business models have come up targeting various customer cohorts with even more unique product offerings. The growth for WealthTech players is also driven by a conductive fee structure. The market is also seeing increased participation from telecom and other technology companies in the form of strategic investors.