Southeast Asia’s IPO market remains strong amid global uncertainties, with 85 IPOs in the last six months, raising $3.3 billion. The trend of Southeast Asian companies heading for US IPOs, especially on NASDAQ, signals sustained global interest in the region’s market. However, in contrast to the broader market resilience, IPOs in the new-economy sectors have been far and few. Macro headwinds have re-prioritised unit economics ahead of growth-at-all-cost models. Encouragingly, many of these companies have responded well and have fast-tracked their path to profitability. Accordingly, they should be IPO-ready in the not-so-distant future.

Finally, while strong financials are must for IPO-aspirants, clear communication with the broader market is equally important. This means putting in a solid 2-3 years of effort to maintain sustainable growth and aligning with the expectations of potential investors. This article explores the outlook for the IPO listings of new-economy companies and what it takes to deliver a rewarding public market debut.

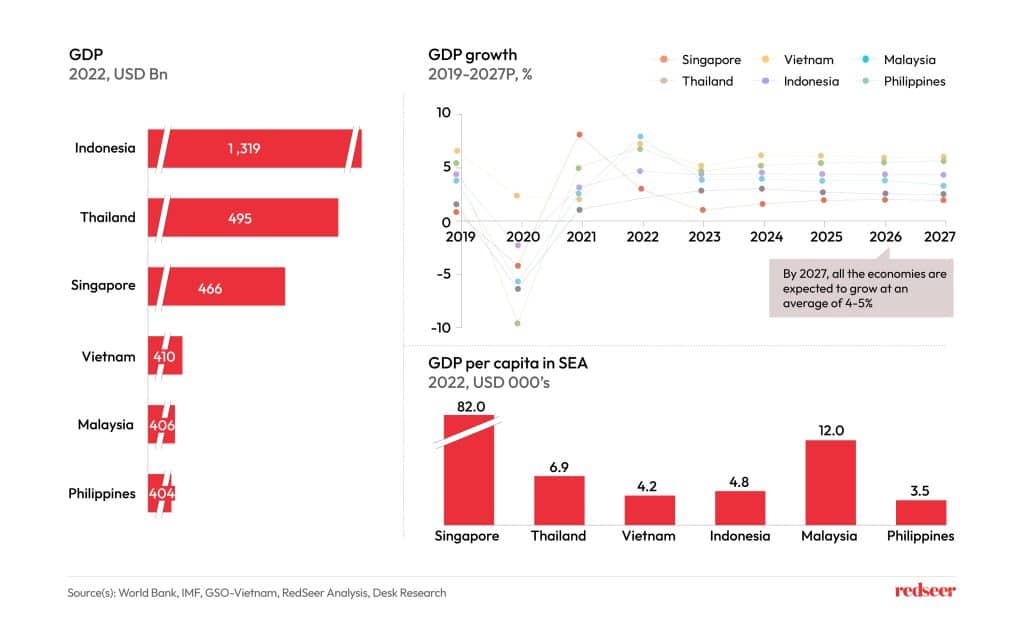

01. Despite facing headwinds from increasing inflation rates and macroeconomic challenges, Southeast Asia is poised for a rapid economic growth over the next five years

Despite contending with challenges such as rising inflation rates and broader macroeconomic issues, Southeast Asia is positioned for a robust economic upturn in the coming five years. Singapore leads the region with the highest Gross Domestic Product (GDP) per capita, closely followed by Malaysia and Thailand. Notably, Vietnam and the Philippines are set to experience substantial GDP growth, underscoring the region’s overall resilience and potential for dynamic economic expansion. With Indonesia holding the top spot in GDP, and Thailand following closely, Southeast Asia appears primed for accelerated development and sustained growth in the near future.

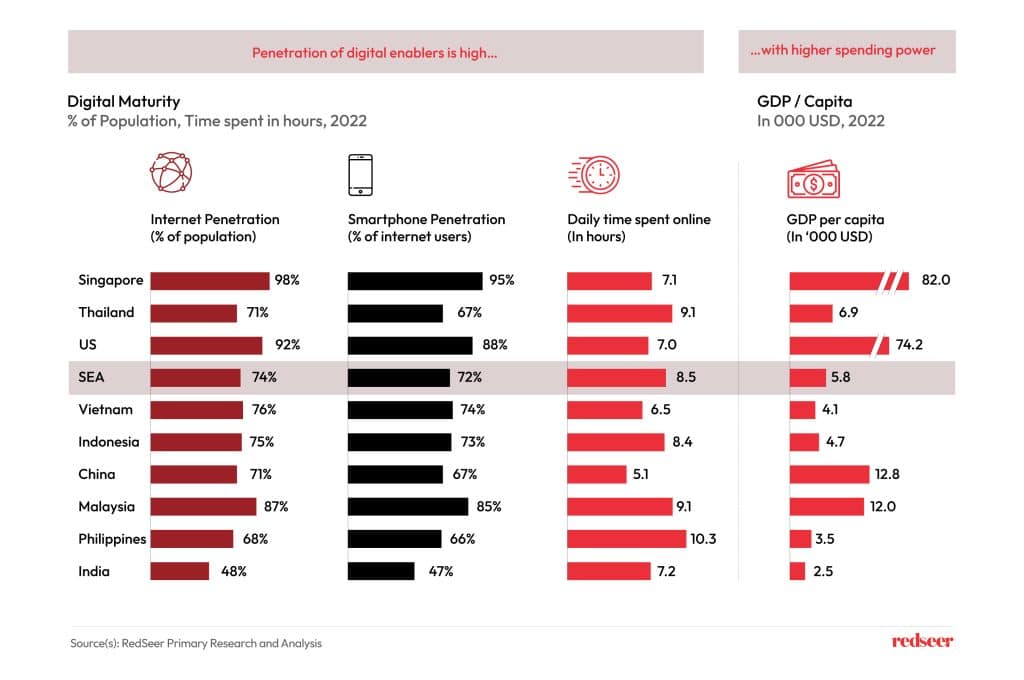

02.SEA boasts of robust digital penetration with high spending power, driving the growth of tech startups

Southeast Asia stands at the forefront of a rapid digital transformation, driven by robust digital penetration and significant spending power across the region. Singapore leads with the highest internet penetration and GDP per capita, creating a fertile ground for tech startups to thrive. The widespread adoption of digital enablers, coupled with substantial spending capabilities, positions Southeast Asia uniquely, presenting a balance that surpasses even developed nations like the United States. Notably, Malaysia and the Philippines, with some of the highest average daily online time, highlight the region’s enthusiasm for digital engagement, making it an opportune time for tech IPOs to emerge and flourish.

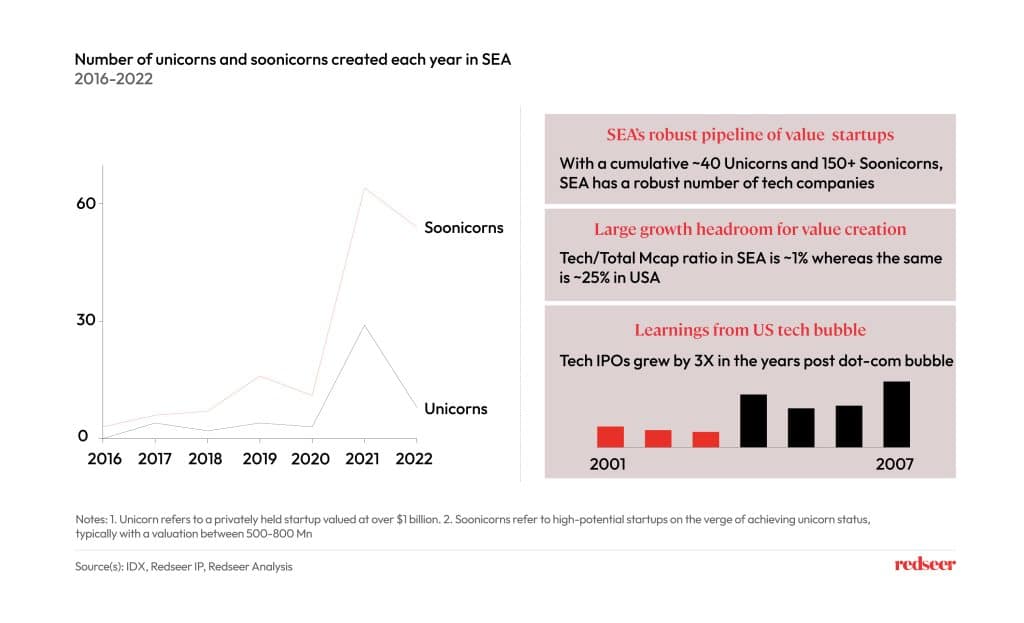

03. SEA’s large base of startups creates strong pipeline of IPOs in the tech sector

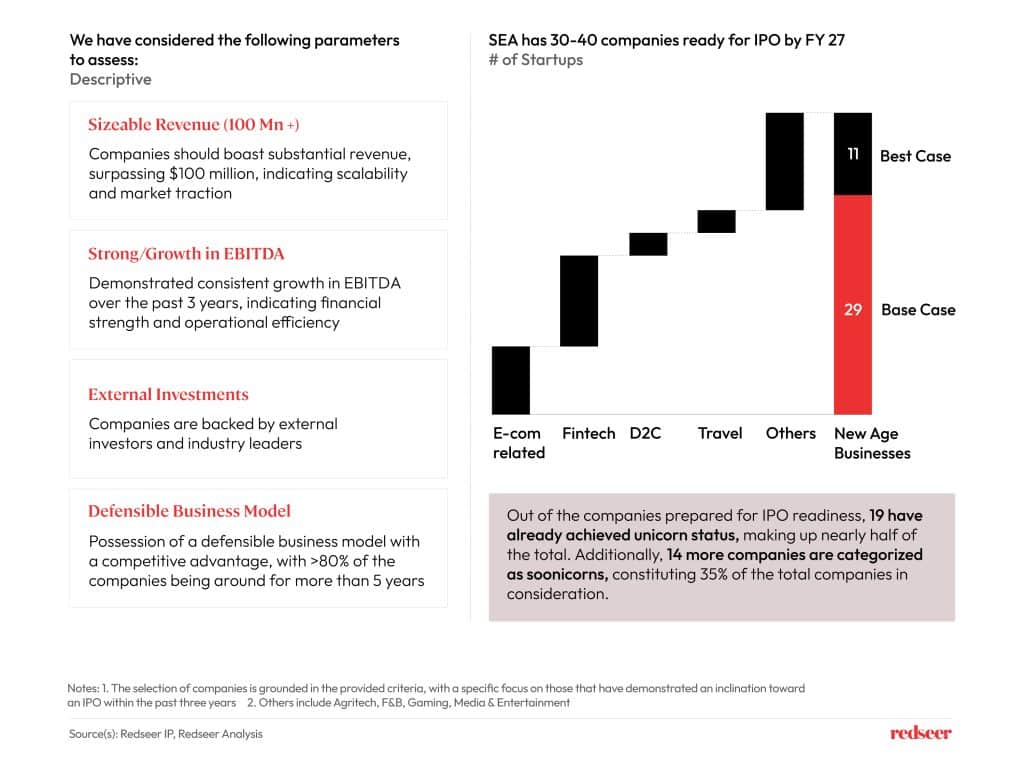

With around 50 unicorns and over 100 soonicorns, Southeast Asia harbors a substantial pool of potential IPO-ready companies. Despite uncertainties like high-interest rates, subdued funding, and limited capital raising activities, the region’s tech/new-age market, constituting only ~1% of the total market capitalization, holds significant growth potential. The subdued new-age tech IPO listings may see a rebound, drawing parallels to the 3X growth in tech IPOs observed in the US post the dot-com bubble, albeit not guaranteed.

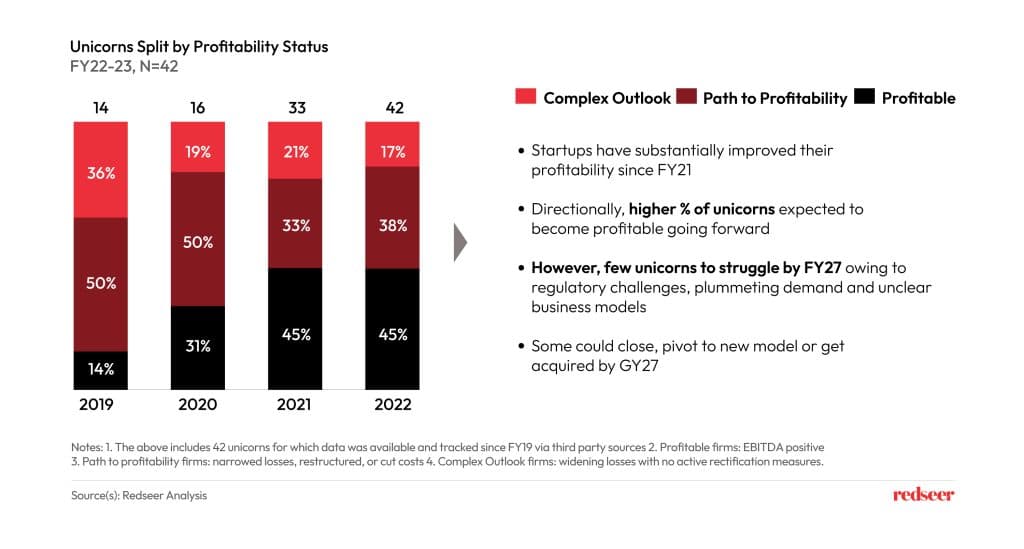

04. Given changing macro landscape, SEA startups have been focusing on profitability. This will result in a sizable pipeline of IPO-ready companies

New-age tech players have been focusing on profitability with decisive calls to optimize costs with one eye on maintaining sustainable growth. This will result in a sizable pipeline of IPO-ready companies in the next 5 years. Our study concludes that startups have substantially improved their profitability over the years. However, multiple things must fall in place for success. ~20% of the unicorns will likely struggle under regulatory challenges, unclear business models, and plummeting demand. Some of these are expected to close, pivot to new models, or get acquired.

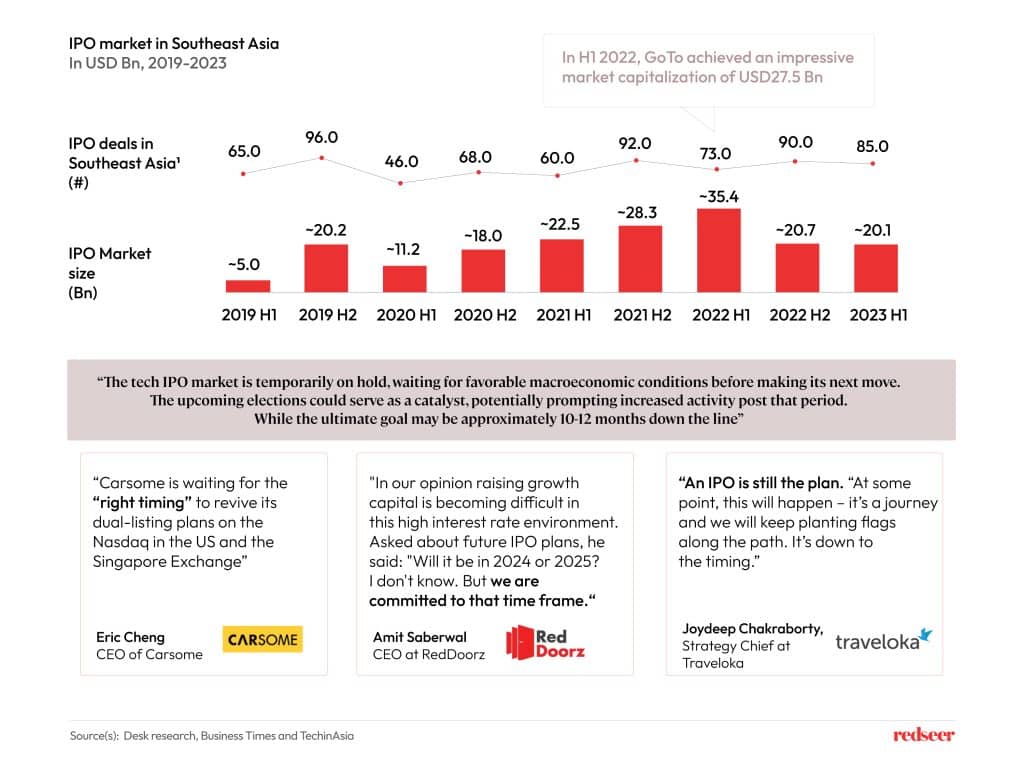

05. In H1 2023, the SEA IPO market demonstrated resilience with 85 offerings and a US$20.1 billion market cap, largely driven by non-tech IPOs. Anticipating a tech resurgence once the macro-outlook stabilizes

In the first half of 2023, Southeast Asia witnessed a robust IPO market with 85 offerings, collectively amounting to a substantial market cap of US$20.1 Bn. However, the tech IPO landscape seems to be momentarily paused, awaiting more favorable macroeconomic conditions before initiating significant moves. Despite the overall resilience of the IPO market, tech companies like RedDoorz, Carsome, and Traveloka have expressed their intent for potential IPOs but are strategically holding back, awaiting an opportune market environment. While the current tech IPO activity may be restrained, the substantial pipeline and the statements from key players suggest an optimistic outlook, hinting at a potential surge in tech IPOs in Southeast Asia over the next five years as the macroeconomic landscape improves.

06. E-com related, Fintech and D2C are amongst the most promising categories to produce IPO ready companies

Apart from the already listed/soon to be listed new-age companies, there are ~40 new-age business that will get IPO ready by FY27. Businesses with the highest potentially IPO-ready companies are FinTech, and E-commerce related and D2C. These startups are selected for their impressive performance, featuring substantial revenues exceeding USD 100 Mn, a resilient business model, positive EBITDA, and sustained growth. Achieving this entails not just impressive figures but also a commitment to various intangible factors.

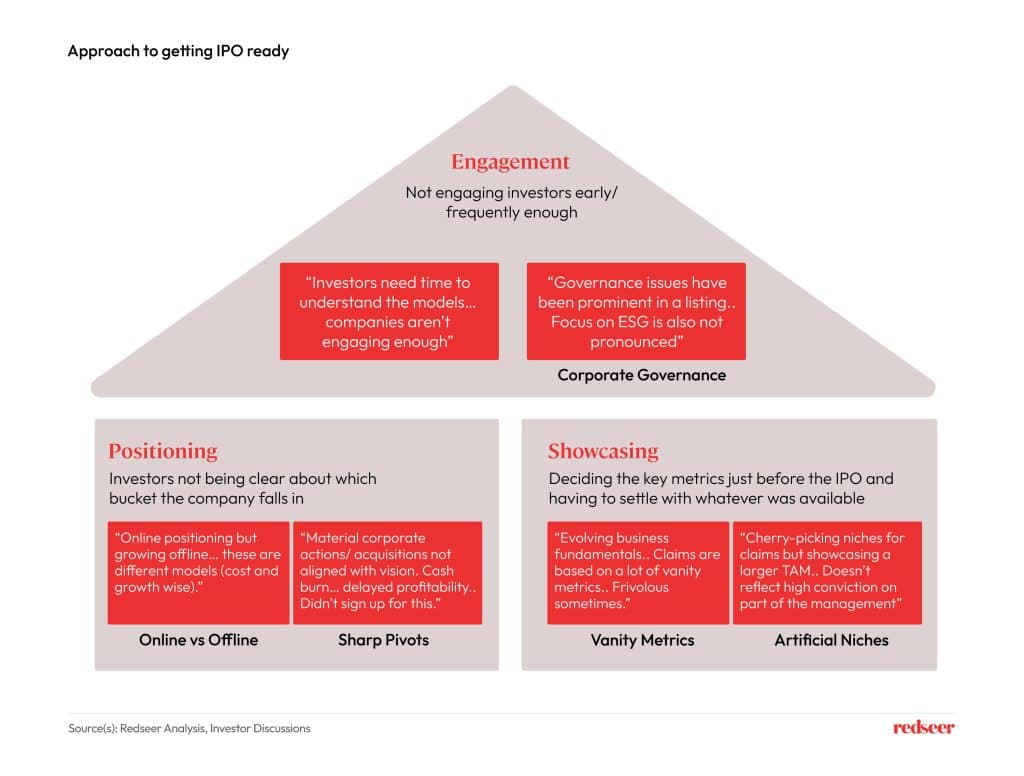

07. And below are a few key learnings on how IPO-bound companies can improve their IPO readiness

Improving across the key metrics requires planned efforts over at least 2-3 years for the numbers to be sustainable. However, more importantly, being able to position the company in the right bucket in the investor’s mind while showcasing why the companies are best-in-class in the buckets is paramount. All while engaging the broader investor community (including the public market investors) years before the IPO, as it takes time for the investors to truly absorb, understand and familiarize themselves with the business models and comfort with corporate governance. Therefore, Positioning the company well, showcasing their abilities through the right metrics and Engaging investors continuously as they travel this journey towards IPO should be one of the mantras of IPO-bound companies.