Understanding regulations is the key to managing business risks. Failing to appreciate regulatory nuances can flip an otherwise promising investment. Look at 2023. The EU launched anti-trust cases against Google, China remained tough on its tech sector, and Indonesia put the brakes on social media companies offering e-commerce. These had meaningful impacts on respective companies and their stakeholders.

Southeast Asia is diverse in cultures, economies, and yes, regulations. Each country and industry have its own rules. Knowing these differences helps in making sound investments and running smooth operations.

In this update, I’m diving into the big picture of the regulations shaping Southeast Asia’s digital world. Plus, getting you up to speed on a hot tech topic right now: AI.

01.Regulations are important as they help drive the level of investments, innovation and productivity in a country

Regulations are a key reason for the economic success of a country.

From the tables below, it is evident that there is a positive correlation between how the regulations are structured in a country and its economic and human prowess. While Singapore is not a surprise in the table, Thailand and Malaysia come out as a major attraction for players looking at geographies in SEA with easier regulatory environment and are currently underappreciated.

Could ease of doing business become the secret sauce of success for SEA countries– a major food for thought for investors and regulators alike.

02.The fast-changing digital sector is pushing regulations to evolve in the region. Regularly reviewing these changes is crucial to managing risks.

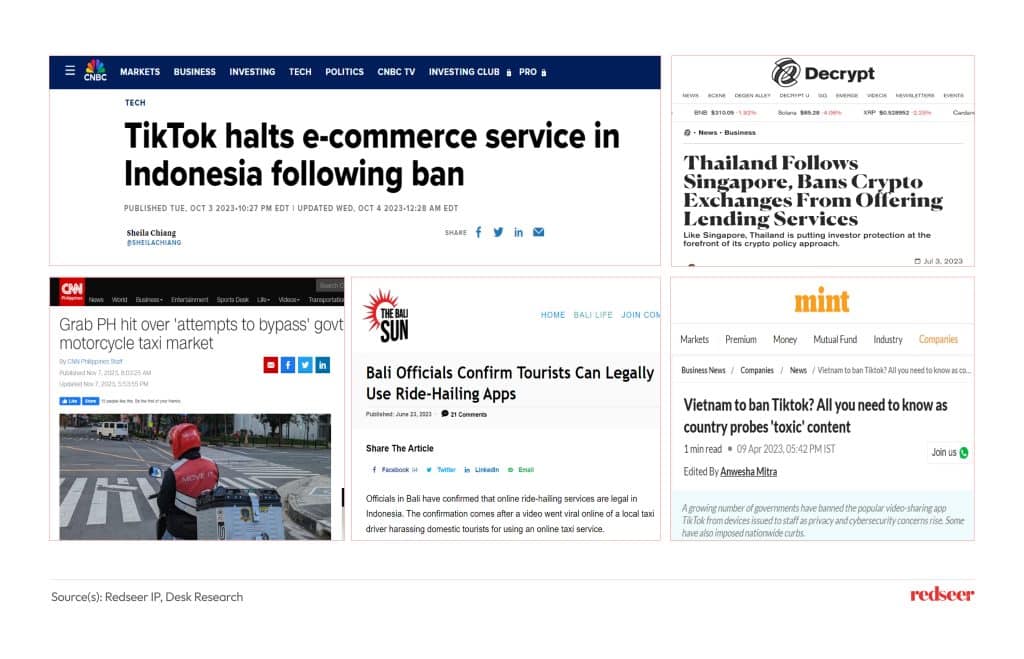

Switching gears and looking at live examples from home – be it ride hailing or e-commerce or fintech, regulations have impacted all sectors of the consumer internet economy. The recent ban on TikTok shop in Indonesia sent shockwaves around the region and the world for all stakeholders who were tracking the rapid rise of TikTok and live commerce in southeast Asia.

Was this the first such regulation, will it be the last such regulation, the answer to both the questions remains a no. The only thing certain is that with ever evolving global business models, geopolitics and emerging technologies – players need to brace themselves for sudden regulatory shocks and be better prepared.

03.Singapore is at the forefront with its progressive and predictable rules. Other countries can raise their rankings by adopting clearer and more transparent rules

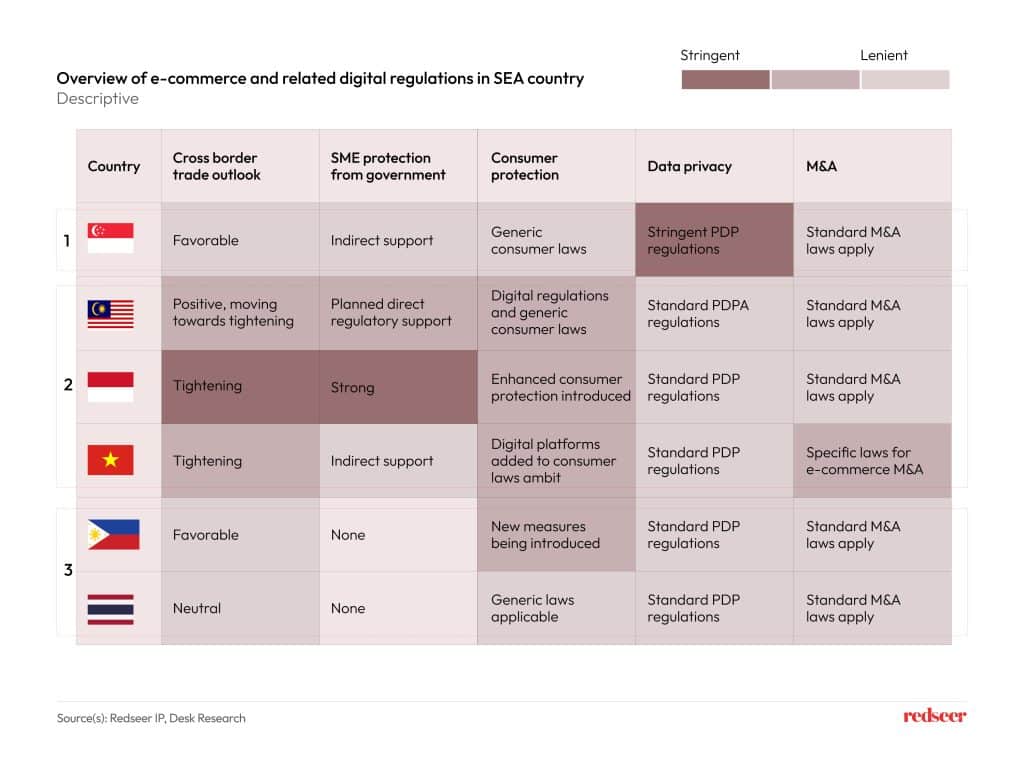

The SEA countries can be broadly categorized into three cohorts from the below table:

Cohort 1: Progressive, proactive, and open geographies: Singapore remains the most open market in the region with minimal regulatory friction.

Cohort 2: Geographies that were open earlier but are now increasing the regulatory barriers: Malaysia, Indonesia, and Vietnam

Cohort 3: Open but less active (on the regulatory front) geographies: Philippines and Thailand

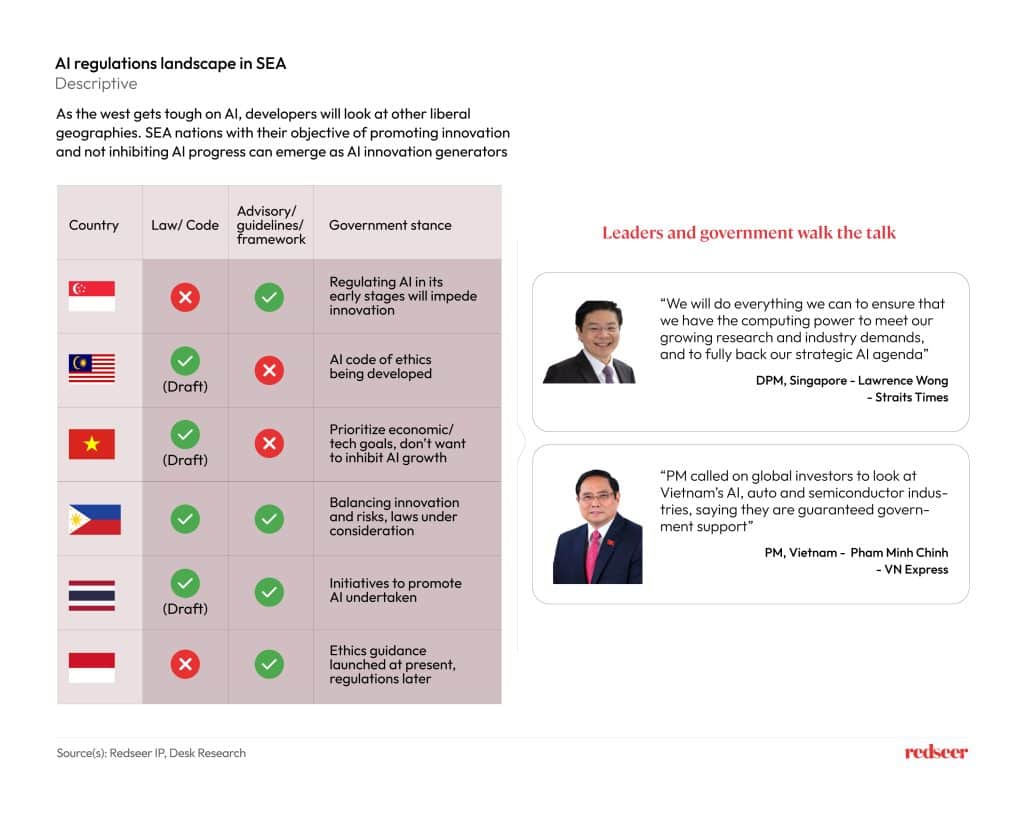

4. AI: Southeast Asian countries adopting a liberal approach to stimulate growth and unlocking innovation in this promising field

The approach of SEA towards AI is characterized by a focus on creating a balance between promoting economic growth, enhancing AI-related skills and competencies, and establishing ethical and governance frameworks for AI applications, starkly different from the stringent approach adopted by EU lawmakers.

The framework for SEA countries is more about providing general guidance that respects the unique cultural and legal contexts of each country. On the other hand, EU is strictly categorizing AI activities under various risk heads ranging from low risk to high risk and unacceptable risk.

All in all, it would be safe to say that we can expect some interesting Chat GPT style AI innovations to come from within the SEA region!!