The wellness movement is becoming an essential part of the lifestyles of Gen Z and millennials due to their busy schedules, increasing health issues, and growing awareness. It is not just a trend or about physical health, but it is a deeper connection to the overall well-being of the body, mind, and spirit.

In Indonesia, we have identified four primary segments of the wellness landscape, which include Gym/Athleisure, Nutrients and Supplements, Mental Wellness, and Biomonitoring and Wearables. These segments are likely to experience significant growth in the future. Additionally, we see opportunities for corporate wellness solutions and wellness retreat marketplaces.

01. Starting from a low base, the Indonesia wellness market has a vast potential to offer in the coming years

The global wellness market is worth over $1.8 trillion with almost $1.2 trillion comprising of China and the US only. On the right-hand side graph, we can see that the Indonesia vitamin and mineral (nutrient) market is the largest in the region however the per capita spending is on the lower side. As adoption picks up, we can expect an exponential rise in market size and consumer spending in the coming years.

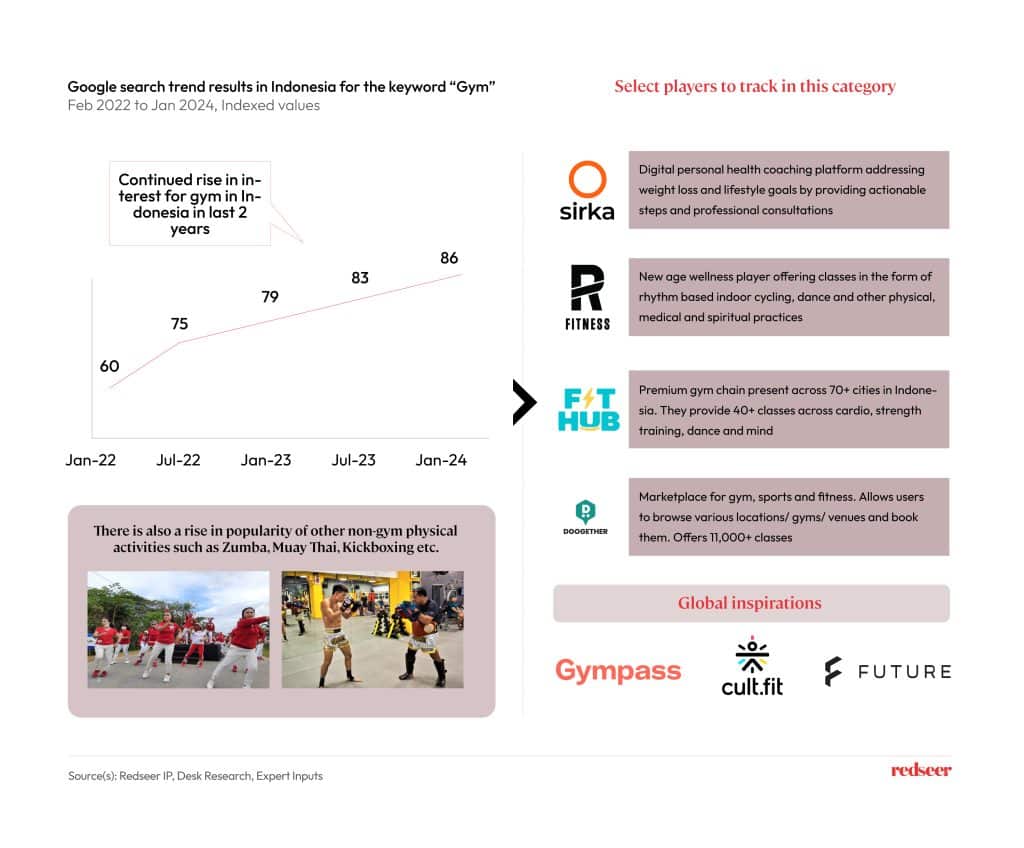

02. Growing middle class, greater awareness, and lifestyle changes are fueling demand for gym and athleisure activities in Indonesia

Gone are the days when fitness enthusiasts would go to plain vanilla gyms to do cardio exercises and strength training. The Gen Z and millennial users of this day want a workout routine that is not monotonous and boring. They want to exercise and work out at studios offering a mixture of gym, Zumba, Pilates, kick kickboxing under one roof. Globally including in Indonesia, we are seeing the emergence of such new-age gym/ fitness players offering a wide gamut of services not just restricted to traditional offerings. After all, who wouldn’t want to have a one-stop solution for their well-being needs. These players work on an omnichannel subscription model allowing users access to their multiple facilities spread across cities/countries.

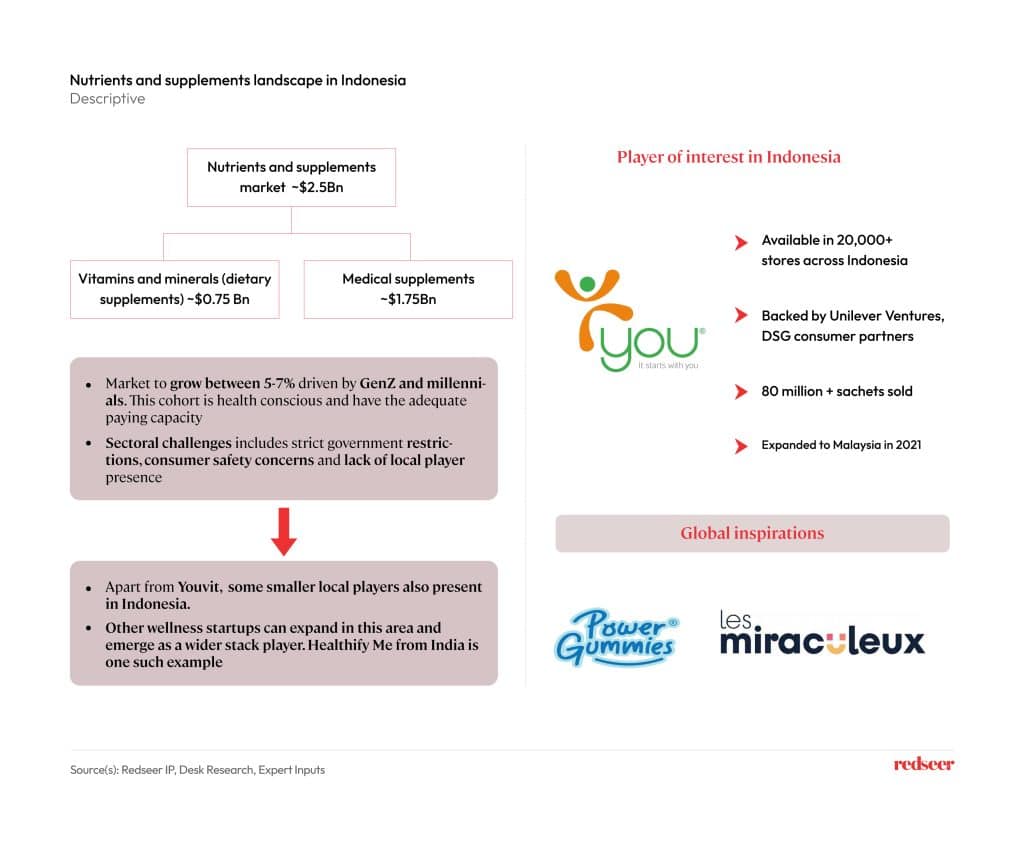

03. With focus shifting towards preventive healthcare, consumers in Indonesia are adopting nutrients and supplements as part of their daily diet

As per the Indonesia Ministry of Health, 90%+ Indonesians are not eating enough fruits and vegetables in the country, thus lacking the essential supply of vitamins and minerals in their body. This presents an opportunity for nutrient and supplement players to step up and help alleviate the gap in people’s diets in Indonesia. The market for vitamins and nutrients in Indonesia includes a range of products such as Vitamin A, B, C, D, E, and K, along with other minerals and compounds. Increasing health consciousness and factors such as sedentary lifestyles and changes in eating habits are driving the market growth for nutrients and supplements in Indonesia.

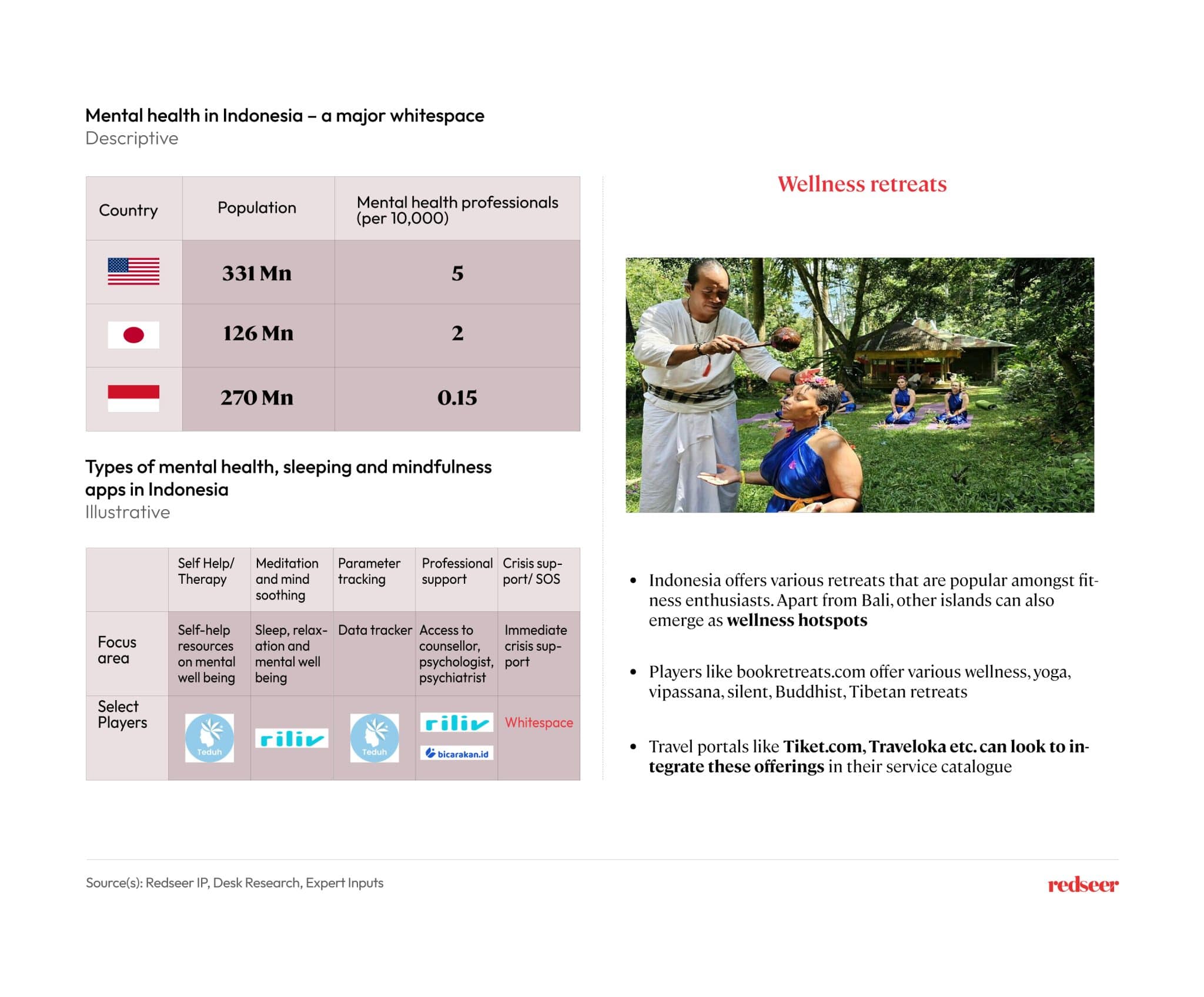

04. Considering the population size and the number of patients, there is a huge opportunity for mental health players in Indonesia – currently there is minimal presence of local players

In 2018, the Indonesia Ministry of Health estimated that 12 million Indonesians were suffering from depression, and less than 3% sought professional help. This number has only increased by 2023. Despite an overwhelming level of gap between the demand for mental health services and its supply, Indonesia has seen very limited emergence of domestic mental health platforms. While regional and global mental health platforms do exist, the benefits that a local player can provide in terms of cultural nuances and domestic understanding are profound. Thus, a major whitespace exists.

05. The biomonitoring and wearables landscape in Indonesia is dominated by foreign players with very limited local presence

Within the biomonitoring and wearables space – most Indonesians are using either expensive devices from global MNCs or the cheaper alternatives provided by lesser-known Chinese brands. The local players are missing due to their inability to compete with global giants on technology and with Chinese counterparts on cost.