A relatively new phenomenon is taking Bharat content consumers by storm, absorbing over an hour of their time on a daily basis. Original, premier and linguistically diverse content guided by cutting-edge NLP/ML algorithms finds its way to this incredibly diverse demographic and elicits higher rates of engagement. India’s very own Short-Form Video (SFV) platforms are the phenomena in question. These platforms have been well received by a community of 250 million people, 65-70% of whom reside in Tier-2+ cities. They are now the hottest target for the nation’s advertisers given their penchant for content consumption and their increasing levels of disposable income.

New-age digital influencers rule the roost on these platforms, showcasing their creativity and talent to a massive audience. They serve as the growth engine of SFV platforms and have with them the ability to influence the purchasing decisions of millions.

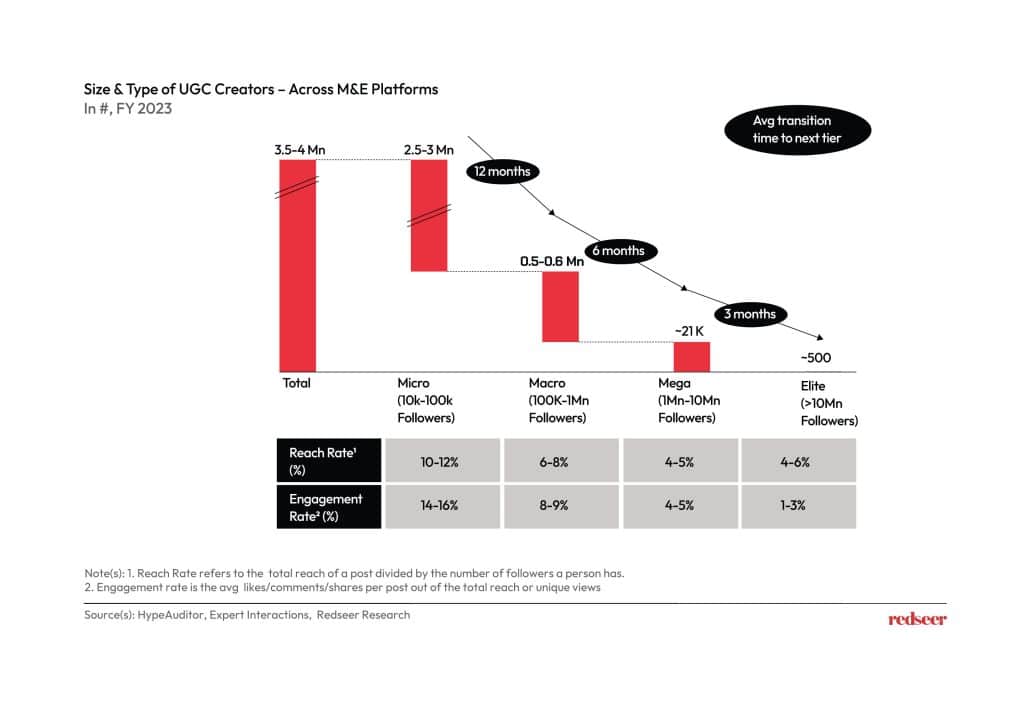

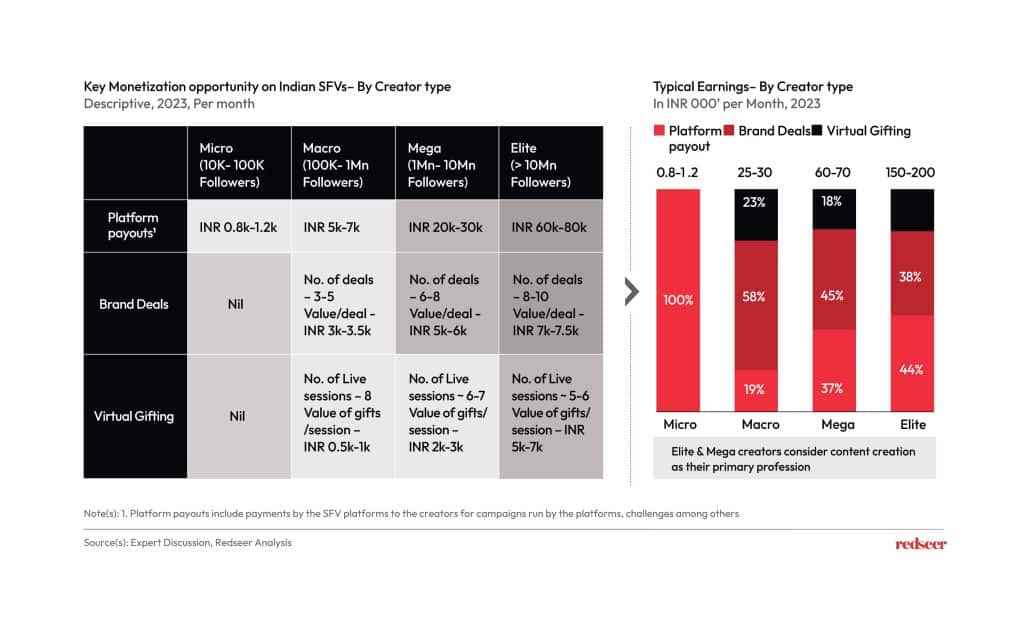

SFV Influencers are categorized into Micro, Macro, Mega and Elite on basis of their following and diversified income sources

The platforms host four influencer categories starting from the Micro influencer who slowly but surely builds up a follower base of 10k-100k, and levels up to the Macro (100k-1Mn), Mega (1Mn – 10Mn) and Elite (> 10Mn) influencer pools. Virality occurs when original content accompanied by the appropriate tags fetches influencers more visibility and engagement among the audiences. As influencers move up the ranks, optimizing content for reach and engagement becomes a collaborative responsibility with the platforms.

Micro influencers rely on platform payouts for income while Elite influencers making 1.5-2+ Lakh per month diversify into brand deals and virtual gifting

The Micro influencer who is in the pursuit of increasing their follower base isn’t necessarily the first choice for branded campaigns, and platform payouts serve as their primary source of income. Macro, Mega and Elite influencers diversify their income sources across brand deals and virtual gifting in addition to platform payouts, making INR 1.5-2 lakhs and upwards per month. However, it is likely that content engagement and reach will decline as Micro influencers work their way up to Elite Influencer status. In such conditions, the increase in follower numbers becomes a favourable metric to gauge campaign impact. Branded campaigns on SFV platforms usually tap into the higher end of the influencer pool and take on multiple formats including product placements, affiliate marketing, giveaways, contests and live streaming/live commerce events.

Startup funding winter, growth of eCommerce and regulatory changes in Real Money Gaming will drive growth for SFV platforms in FY24

FY23 saw a slowdown in the advertising sector and a pattern of muted growth is expected to continue into FY24. Three key factors appear to have contributed to this trend while inadvertently playing to the advantage of SFV platforms : a) the funding winter in the startup space which has privileged profitability over advertorial spending, b) the growth of eCommerce platforms with superior ad performance metrics which has redirected advertorial focus from traditional platforms, c) the levying of a 28% GST and tax provisions on Real-Money Gaming (RMG) platforms which were previously major sources of revenue.

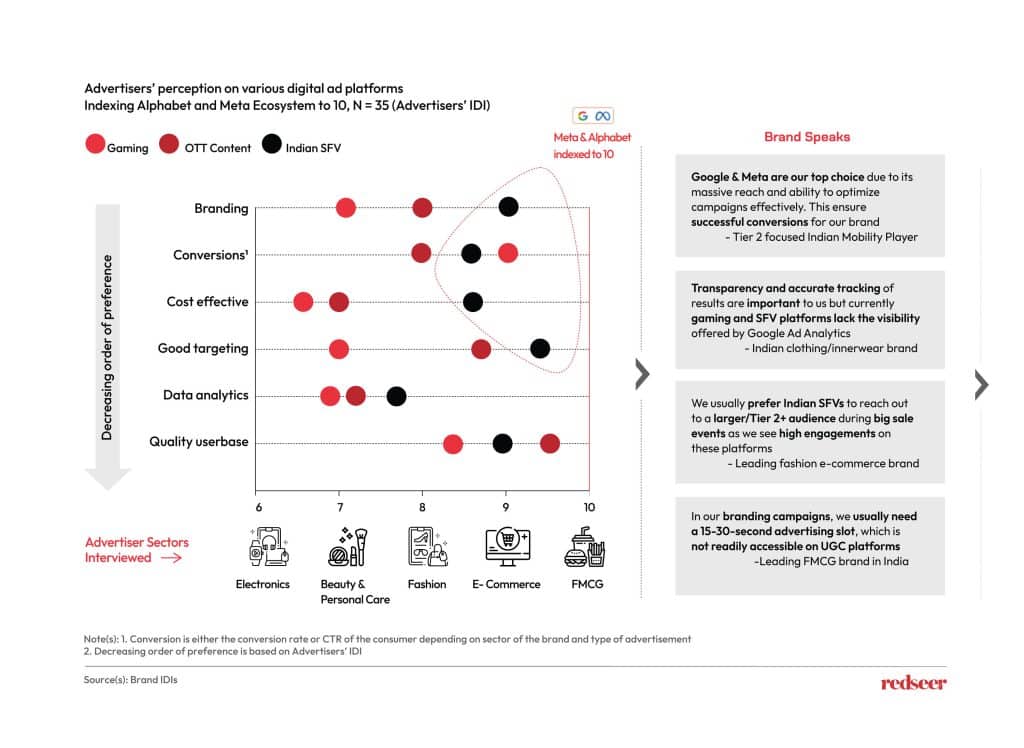

Brands are now customizing their strategies to fully adapt to the value proposition that SFV platforms offer across branding, conversions, cost-effectiveness, and targeted advertising. Entities in the Electronics, Beauty and Personal Care (BPC), Fashion, Fast-Moving Consumer Goods (FMCG), and eCommerce spaces are already riding the SFV wave.

Tiktok’s flywheel model currently guides SFV monetization pathways, ad revenues and influencer marketing. Live commerce is a long way off

Monetization is relatively nascent on Indian SFV platforms and it is currently restricted to ad revenue and influencer marketing. The platforms operate with TikTok’s (figuratively) patented flywheel effect which is designed to increase momentum across content generation, influencer development, and commercialization efforts. The live commerce model is yet to take shape. Advertisers also face challenges in terms of identifying effective content formats in addition to limited visibility into campaign performance, conversions and engagement rates.

Although there are many nuances to playing the SFV game, the promise that these platforms hold is infinite. Don’t just take our word for it! Keep an eye out for the consumer brands that are showcasing their creativity and amassing influence through multiple formats on these platforms.