Have you ever wondered how fashion enthusiasts and avid shoppers keep up with the rapid-fire trends from runway shows, influencers, and social media? The answer often lies in the world of “fast fashion.” Imagine scrolling through endless feeds of affordable, trendy garments from online retailers or snagging that stylish trench coat at a big-box store’s sale price. It’s a quick and budget-friendly way to stay fashionable.

The fast fashion industry churns out clothes at a pace that’s hard to keep up with, even for the most dedicated shoppers. The aim? To get these trendy designs into your wardrobe while they’re still hot, and at prices that seem too good to be true.

So next time you grab that eye-catching outfit at a bargain, remember there’s a fast-moving, trend-chasing world behind it, constantly evolving to keep your wardrobe fresh. Curious to dive deeper into the world of fast fashion? Join us as we begin our series of newsletters on fast fashion. In this edition, our experts led by Kushal Bhatnagar give a broad view of the industry, comment on the potential evolutions in the future, and define the key success levers for brands.

Fast Fashion in India – The Next Big Thing

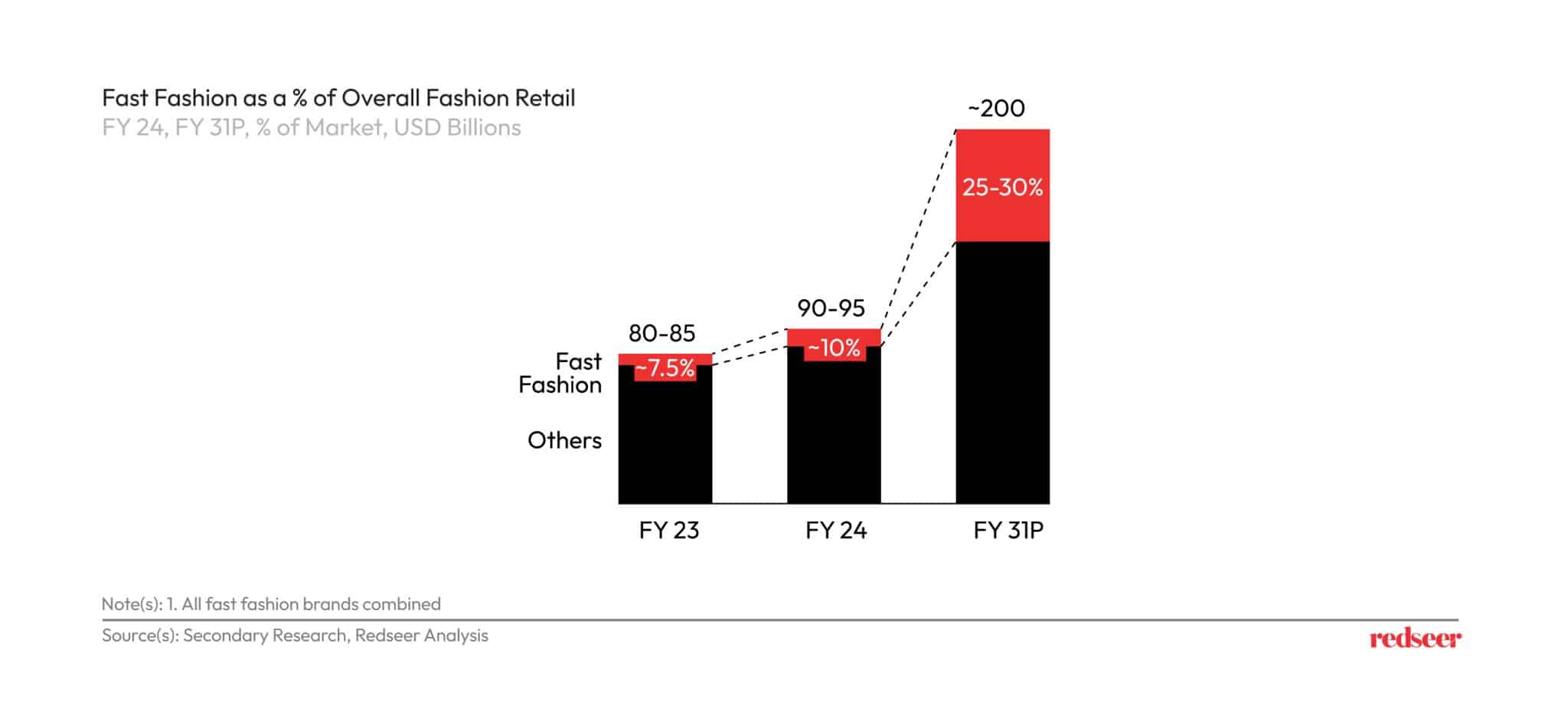

In a year marred by slow consumption, Fast Fashion emerged as the outlier and remained one of the few outperforming sectors in India’s retail market. While Fashion in India saw a flattish ~6% YoY growth in FY 24, Fast Fashion grew at a much faster rate of 30-40%. However, this is just the beginning of Fast Fashion in India. To put things into perspective, the ~USD 10 Bn Fast Fashion market in India is still >3X times smaller than just one brand – Shein, which is one of the largest Fast Fashion brands globally.

Driven by the immense headroom for growth here, we project that Fast Fashion could potentially be a massive USD 50 Billion+ opportunity by FY 31.

But what exactly constitutes Fast Fashion, you ask? There are five key elements, which are essential to build a Fast Fashion brand:

- Timely Trend Identification

- Rapid Prototyping & Production

- Nimble Supply Chain

- Attractive Pricing

- Effective Customer Engagement to drive virality

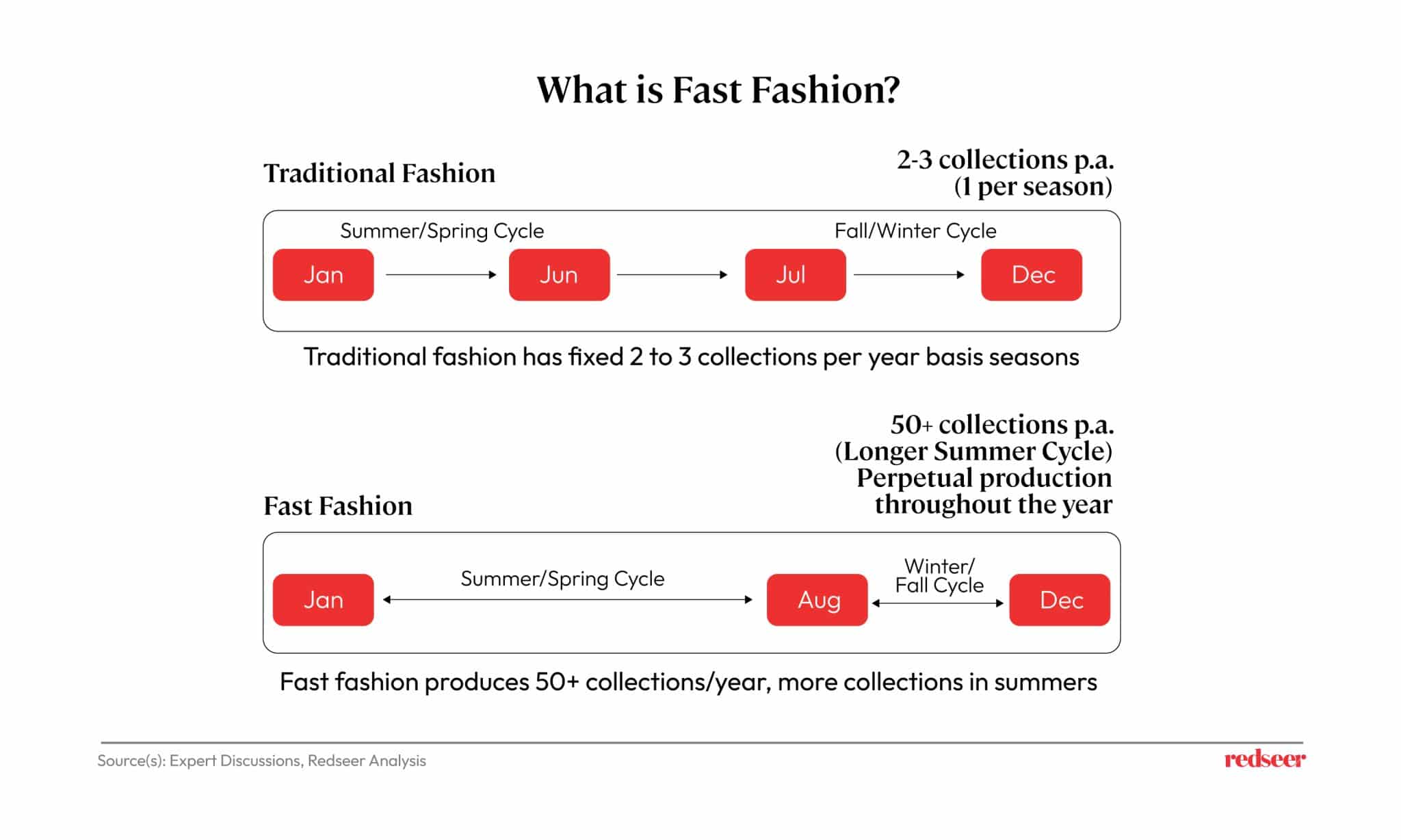

Enabled by the above, Fast Fashion brands can churn out more than 50 collections/year, unlike traditional Fashion brands which produce only 2-3 collections/year.

Brands’ Right to Win in the India Fast Fashion Market

What will make brands successful in this exciting market?

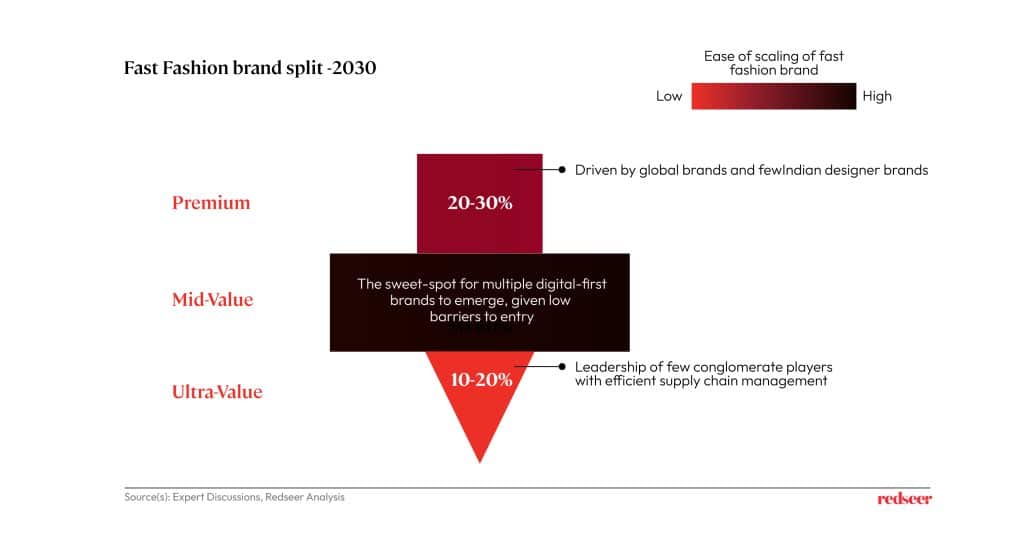

Basis their price-point, Fast Fashion brands are classified into 3 types: Ultra-Value, Mid-Value, or Premium. Each segment requires brands to build distinct business model / operating model strengths, in order to create a successful play.

For an Ultra Value brand, like Zudio, supply chain nimbleness becomes the single most important lever, enabling brands to launch low-priced products profitably. This is typically achieved by brands operating on a massive scale as it helps them outweigh certain costs. Therefore, building a scalable brand in this segment will require large-scale investments and we expect this segment to be led by larger conglomerates.

For Premium brands, like Zara, their brand recall and loyalty are the biggest moat. Riding on the premiumization wave amongst India A consumers, we expect this segment to see a healthy flow of brands, including global brands and a few designer Indian brands.

The Mid-Value segment, which includes brands like H&M, Snitch, etc., is the space where we see a high proliferation of digital-first brands. In addition to the low entry barriers, the customers in this segment are also fairly experimental. As a result, the mid-value fast fashion space is expected to stay highly competitive, and brands with unique & value-adding positioning are expected to appeal strongly to customers.

Identification of new trends remains the core driver for Fast Fashion brands

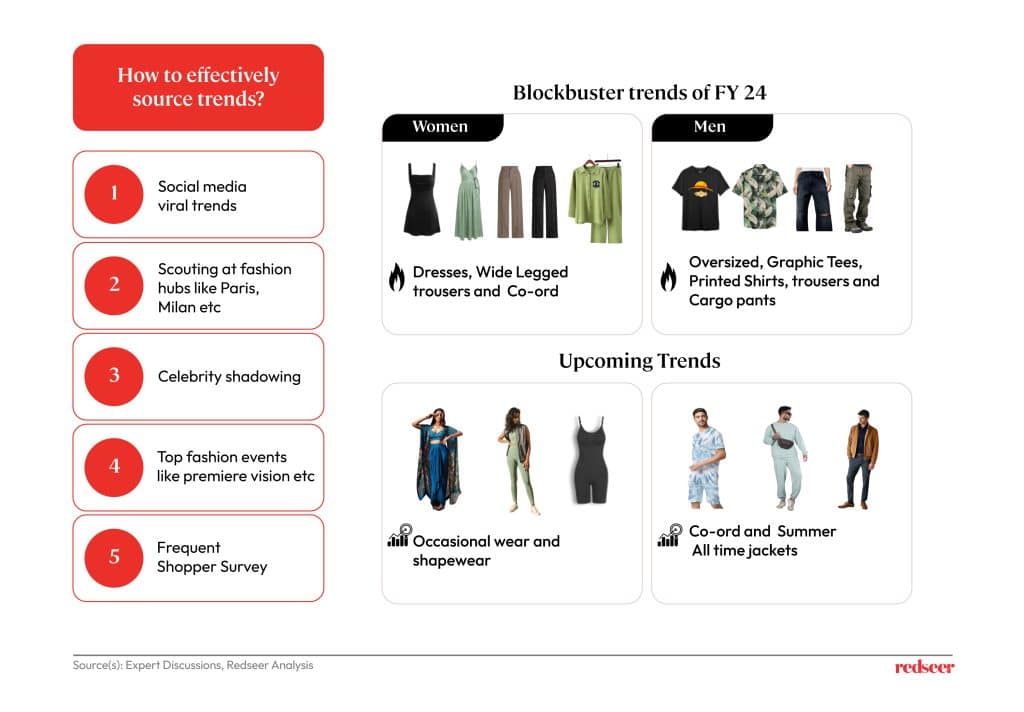

Irrespective of which of the above segments they belong to, Fast Fashion brands in India have one core driver, which is the art and science of identifying new and upcoming viral fashion trends.

But how do brands do this? Well, this is an ever-evolving step in the value chain, that varies by brand, but some common sources are highlighted in the chart below.

The Hot Favourites For Millenials and Gen Z

A major trend in men’s fast fashion in FY 24 has been oversized T-shirts, graphic t-shirts, printed T-shirts, trousers, and cargo pants. We think that the next major fashion trend in men’s Fast Fashion could potentially be Co-ords and Summer/All-Time Jackets.

As far as Women’s Fast Fashion trends in FY 24 are concerned, Dresses, Wide-Legged Trousers, and Co-Ords dominated buying choices. We think that Occasional Wear and Shapewear would be the next big disruptors in this category.

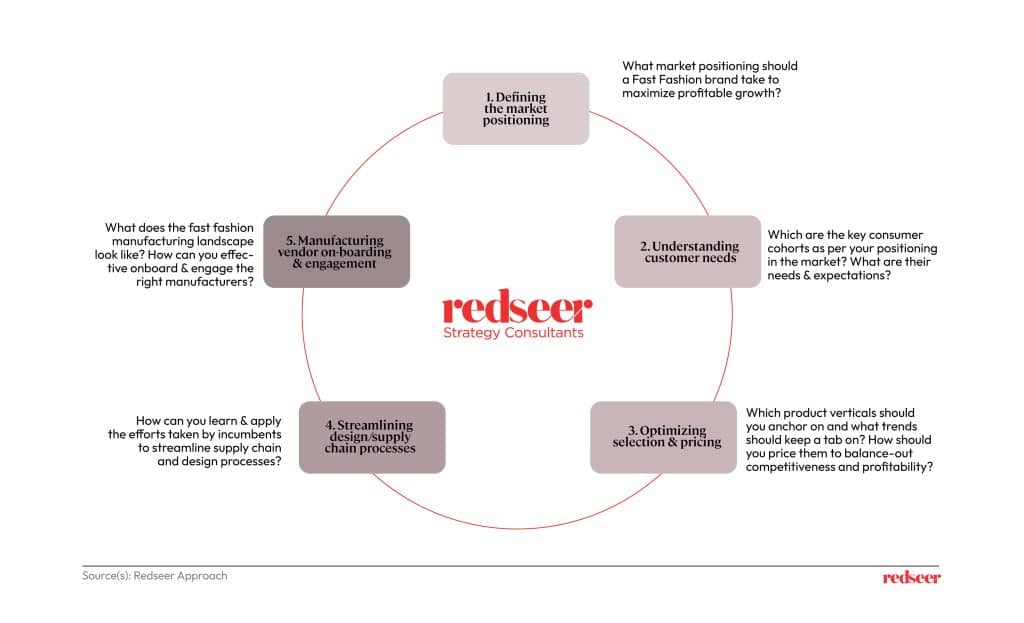

How can Redseer help to build and scale a Fast Fashion brand in India?

The time to build a Fast Fashion brand in India is now. Our team is ready to lend expertise to help you establish a Fast Fashion venture. These are some of the areas:

From quick trend identification to rapid prototyping and mass production, attractive pricing, and a strong online community, fast fashion brands have mastered the art of staying relevant and desirable. Whether it’s Zudio, Zara, or H&M, each brand has a unique approach to carving out its niche.

As the fast fashion industry continues to evolve, staying ahead of new trends will remain crucial. The growth potential is immense, driven by a young, fashion-conscious population eager to embrace the latest styles.

Dive deeper into the insights we’ve shared and reach out to us for newer disruptive fashion trends. Let’s seize the opportunity to be part of this rapidly expanding industry.

Await for our next story for more detailed insights into the vibrant Fast Fashion space in India.

Follow our retail expert Kushal Bhatnagar for interesting insights or subscribe to our weekly newsletter for more updates.