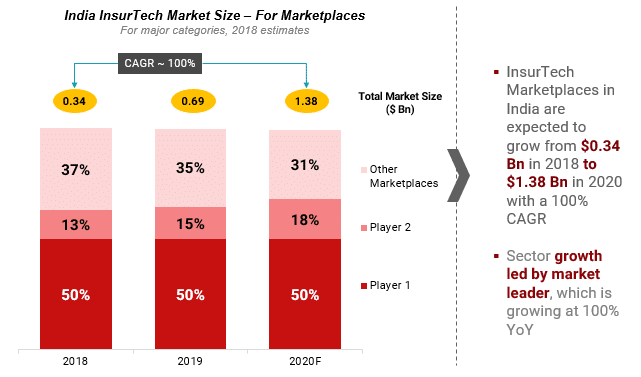

1. InsurTech marketplaces are growing 100% y-o-y driven by strong growth of both incumbents and new entrants

Published on: Aug 2019

- Key growth driver of sector incumbents is wide coverage viz strong presence in most insurance categories, across insurance providers

- An additional growth lever is a strong focus on customer service enabled by a large agent network covering life and non-life policies across multiple insurers

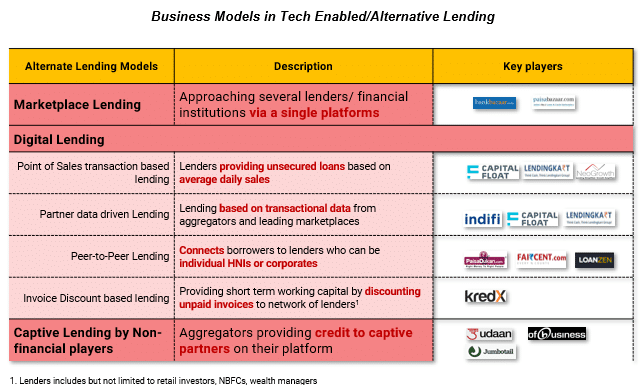

2. India’s tech-enabled/alternative lending market is being driven by multiple business models

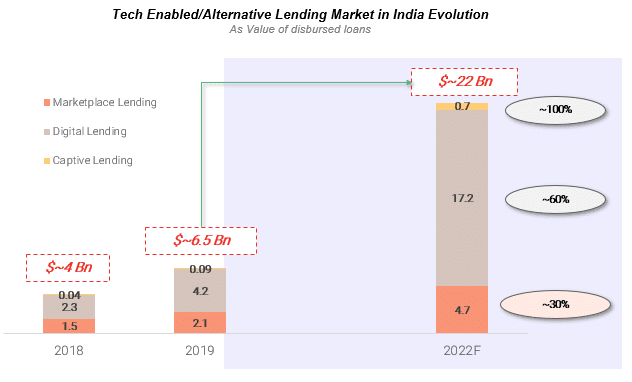

3. With increasing MSME digitization, tech-enabled lending is disrupting the status quo and expected to become 3x-4x by 2022

- The market is seeing a shift from aggregator-based models to transactional models

- Evolving models in digital lending are solving the lead generation/sourcing challenge and hence expected to grow at a higher rate

- ofCaptive lending will see growth due to supply chain integration by e-commerce players

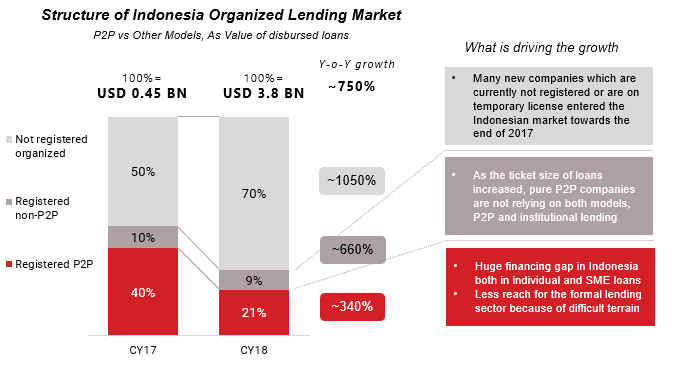

4. SEA Perspectives- Indonesia’s tech-enabled lending market has been growing explosively driven by P2P models

Indonesia tech-enabled lending market has been growing massively, driven by below growth engines-

- Drivers from the demand side (loan taker) – Huge unaddressed credit need in the ‘missing middle’ segment

- Drivers from supply-side (loan provider) – High share of affluent/mass affluent financial assets are in deposits, most of the higher yield investment products (e.g. MF/ retail brokerage) still have marginal penetration