In the ever-evolving landscape of venture capitalism, the quest for the next big investment opportunity is akin to searching for a needle in a haystack. With countless companies vying for attention, how does one discern diamonds from the rough?

Enter the strategic deal qualification exercise between a leading VC firm and a team of seasoned analysts and data scientists from Redseer, embarking on a groundbreaking study encompassing 500 companies across 15+ industry sectors. Their mission? To identify the most promising investment opportunities through a meticulous analysis of various factors such as financial robustness, market potential, and overall business confidence…

The Birth of a Vision

A leading VC firm recognized the need for a systematic approach to identify investment prospects amidst the uncertainty of the post-pandemic world. With the business landscape evolving at an unprecedented pace, traditional methods of due diligence were proving inadequate. Thus, the decision was made to embark on a comprehensive study, leveraging data-driven insights to informed investment decisions.

To accomplish this, an extensive dataset containing a blend of quantitative and qualitative insights from around 500 companies was collected and examined. These companies, primarily backed at Series A, B, and C stages, represented a broad spectrum of over 15 sectors, encompassing but not restricted to Agritech, Automobile and Mobility, B2B Services, BFSI, EdTech, Emerging Tech, FoodTech, Healthcare & Wellness, Media and Entertainment, and Retail.

Crafting the Criteria

The initial challenge lay in distilling the vast array of data points into a concise set of criteria that encapsulated the essence of investment attractiveness. Drawing upon the client’s objectives and industry expertise, the Redseer team meticulously curated a list of 10-15 criteria, each meticulously chosen to reflect pivotal aspects of company performance and potential.

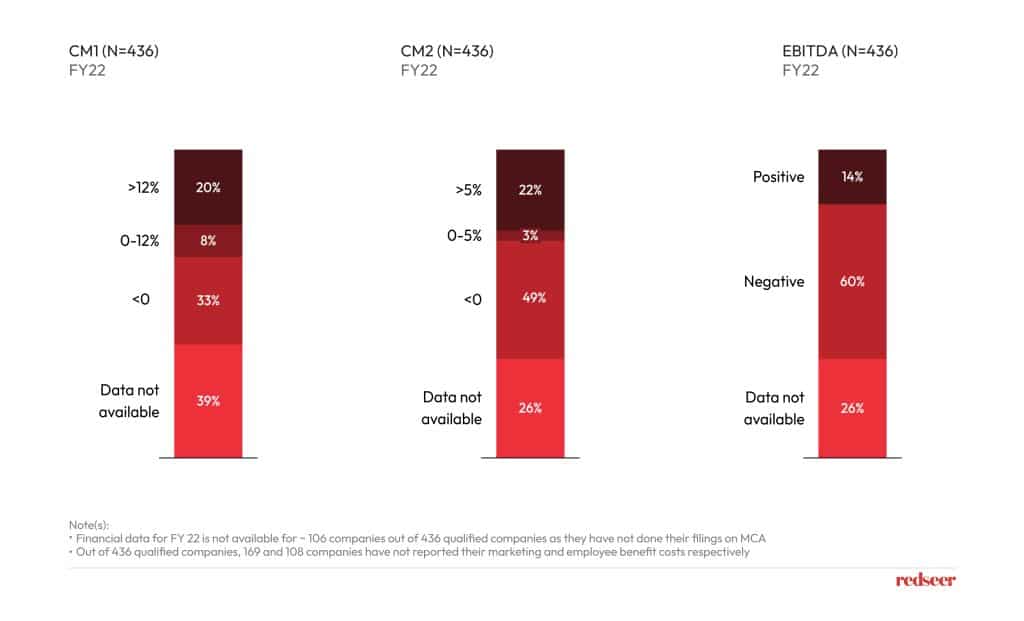

Among these criteria were metrics such as market potential, financial data such as taxes or EBIDTA, Covid resilience, contribution margin 1 and 2, total valuation, company vintage, revenue, and sentiment score. Covid resilience emerged as a critical factor, gauging a company’s ability to weather the storm of the global pandemic and adapt to changing market dynamics. Contribution margins 1 and 2 provided insights into the profitability and efficiency of operations, while total valuation served as a measure of growth potential.

The Data Journey

With the criteria list in place, the team embarked on a data journey, scouring through 500 companies and collating over 5000 data points for a 4-year period. These data points were gathered from various channels such as desk research, Redseer IP, and expert discussions.

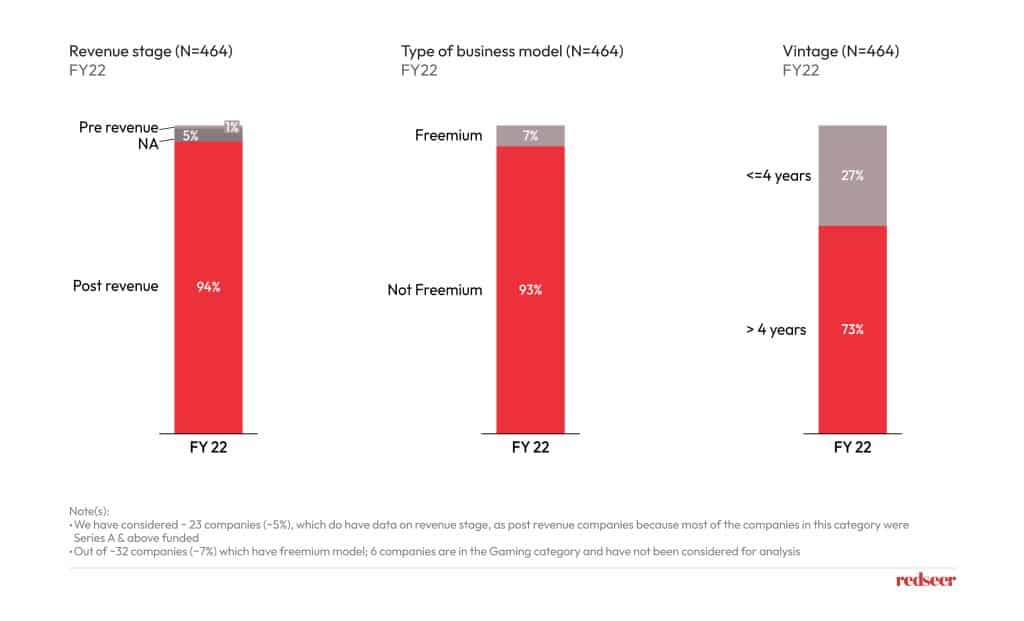

The gathered data points were put through a rigorous screening process using a detailed 15-point checklist framework. Each parameter within this comprehensive checklist was assigned specific weights to ensure a thorough evaluation. The checklist covered a range of assessments, including:

- Filtering out companies in the pre-revenue stage and those operating on a freemium model (applies exclusively to gaming companies).

- Evaluating financial strength based on metrics such as Contribution Margin 1 (CM1), Contribution Margin 2 (CM2), and revenue Compound Annual Growth Rate (CAGR).

- Assessing business confidence through various factors including company vintage, resilience to COVID-19 impacts, total valuation, sentiment score, and cash equivalent differences.

Unveiling the Insights

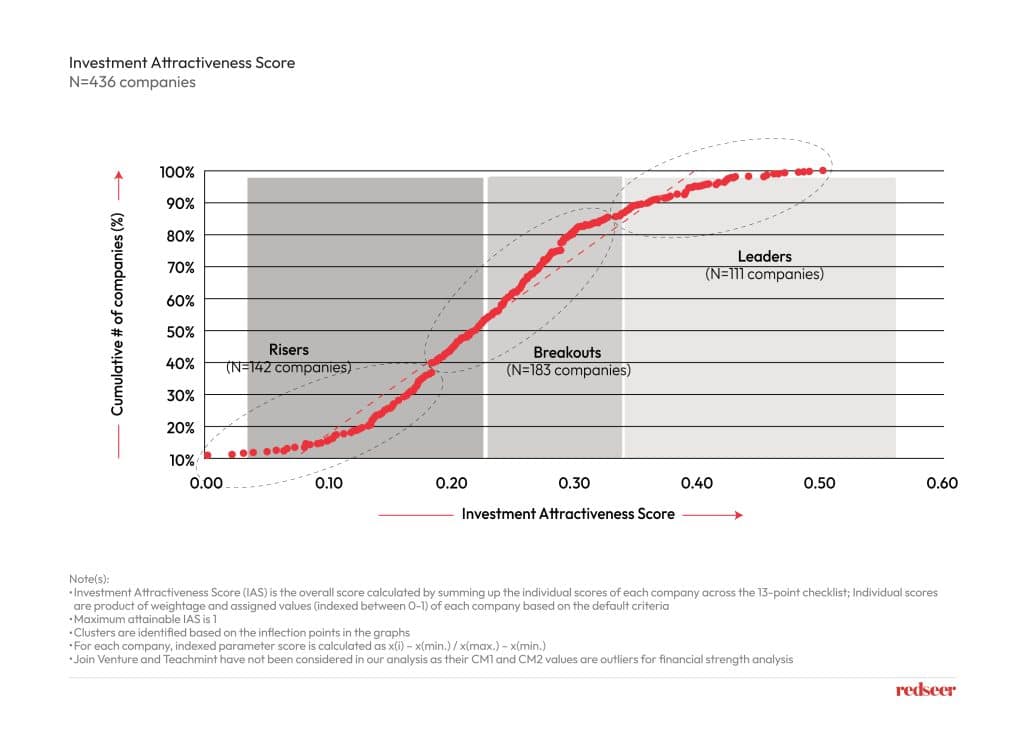

The culmination of this joint effort was the unveiling of the Investment Attractiveness Score, a proprietary metric that served as the cornerstone of a leading VC firm’s investment strategy and scored all the companies on a scale of 0-1 based on their cumulative performance across all the above metrics.

Diversifying the Global Funding Pool

Using the Investment Attractiveness Score, we grouped the companies into three categories: “Leaders,” “Breakouts,” and “Risers.” We identified these groups by analyzing a graph, where the x-axis represented the IAS and the y-axis showed the total number of companies. These categories are defined as follows:

Leaders: These are the trailblazers, boasting an IAS exceeding 0.3. They’re setting the pace and grabbing attention.

Breakouts: Think of them as the rising stars, with IAS values ranging from 0.2 to 0.3. They’re on the brink of something big, catching the eye of savvy investors.

Risers: These companies scored below 0.2 on the IAS scale. They might be underdogs now, but don’t count them out—they’ve got potential waiting to be unleashed.

To summarize approximately 150 companies are on the rise as Risers, 180 are gearing up as Breakouts, and 120 are leading the charge as Leaders.

What stood out you may ask? The BFSI, Retail, and B2B Services sectors stole the show, boasting the highest number of companies leading the charge in the coveted Leader cluster. It’s like they’re saying, “Watch out world, here we come!” These sectors are definitely where the action is at.

As a part of this successful deal evaluation study, the message is clear: in an era defined by uncertainty and volatility, data-driven insights hold the key to smarter investment decisions. For VC firms and investors seeking to navigate the labyrinth of opportunity, the alliance between a leading VC firm and our team of experts offers a beacon of hope.

If you too are seeking to unlock the secrets of investment success, we invite you to join us on this transformative journey. Contact us today to discover how data-driven insights can propel your investment portfolio to new heights of success