Wealthtech: Understanding Evolving Consumer Preferences

Wealth is more than a measure of success—it is a resource that demands precise management and strategic allocation. Today, a growing number of individuals are leveraging cutting-edge wealth tech platforms to diversify their portfolios, seeking both innovation and efficiency in managing their wealth.

Want to evaluate new investment and M&A opportunities?

India’s economic growth story has provided fertile ground for this evolution. With a GDP growth rate projected at 6.8%, outpacing both advanced economies and other emerging markets, the country is uniquely positioned to lead the transformation of the Wealth Tech industry.

This shift is being propelled by a burgeoning affluent class, increasing financial literacy, and rapid advancements in digital infrastructure. The number of households earning more than ₹8 lakhs annually has grown at a CAGR of over 12% over the last five years, signifying a dramatic rise in the demand for sophisticated financial tools.

The digital transformation in financial services is a key enabler of this trend. Platforms are disrupting traditional investment paradigms by offering high-tech solutions that simplify the complexity of wealth management. These platforms cater to the tech-savvy, time-constrained executive who values seamless experiences and data-driven insights. From equities and derivatives to mutual funds and beyond, Wealth Tech is democratizing access to instruments, once the purview of institutional investors.

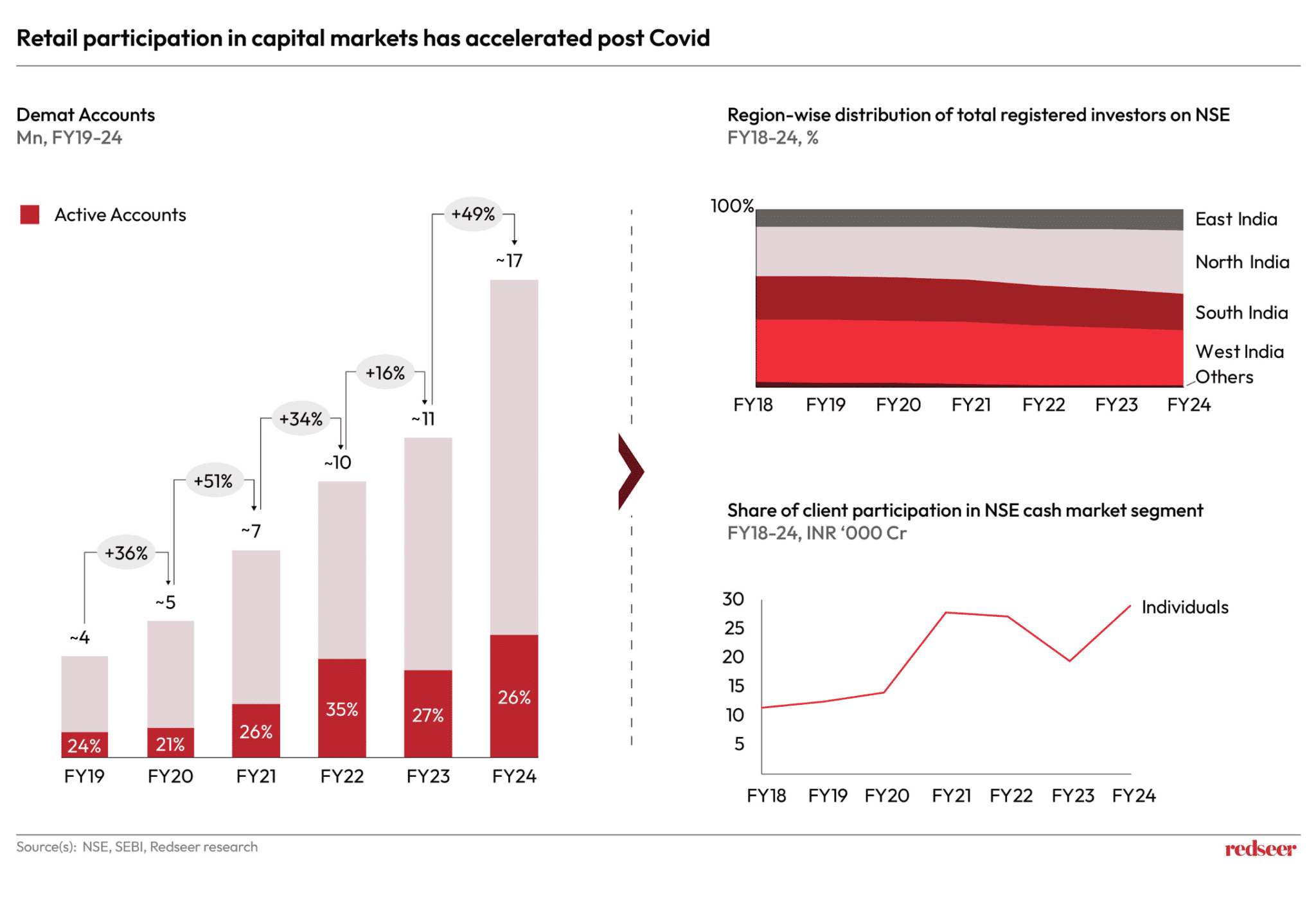

Wealth Tech’s appeal is also about performance, in addition to convenience. Investments in financial instruments now make up 33% of India’s GDP, signaling a marked shift from physical assets to digital portfolios. Retail participation in capital markets has surged post-pandemic, with Demat accounts and mutual fund inflows reaching unprecedented levels. This increased activity is reshaping market dynamics, creating unparalleled opportunities for those at the forefront of innovation.

As the Wealth Tech industry grows, so does its ability to meet the nuanced needs of its clientele.

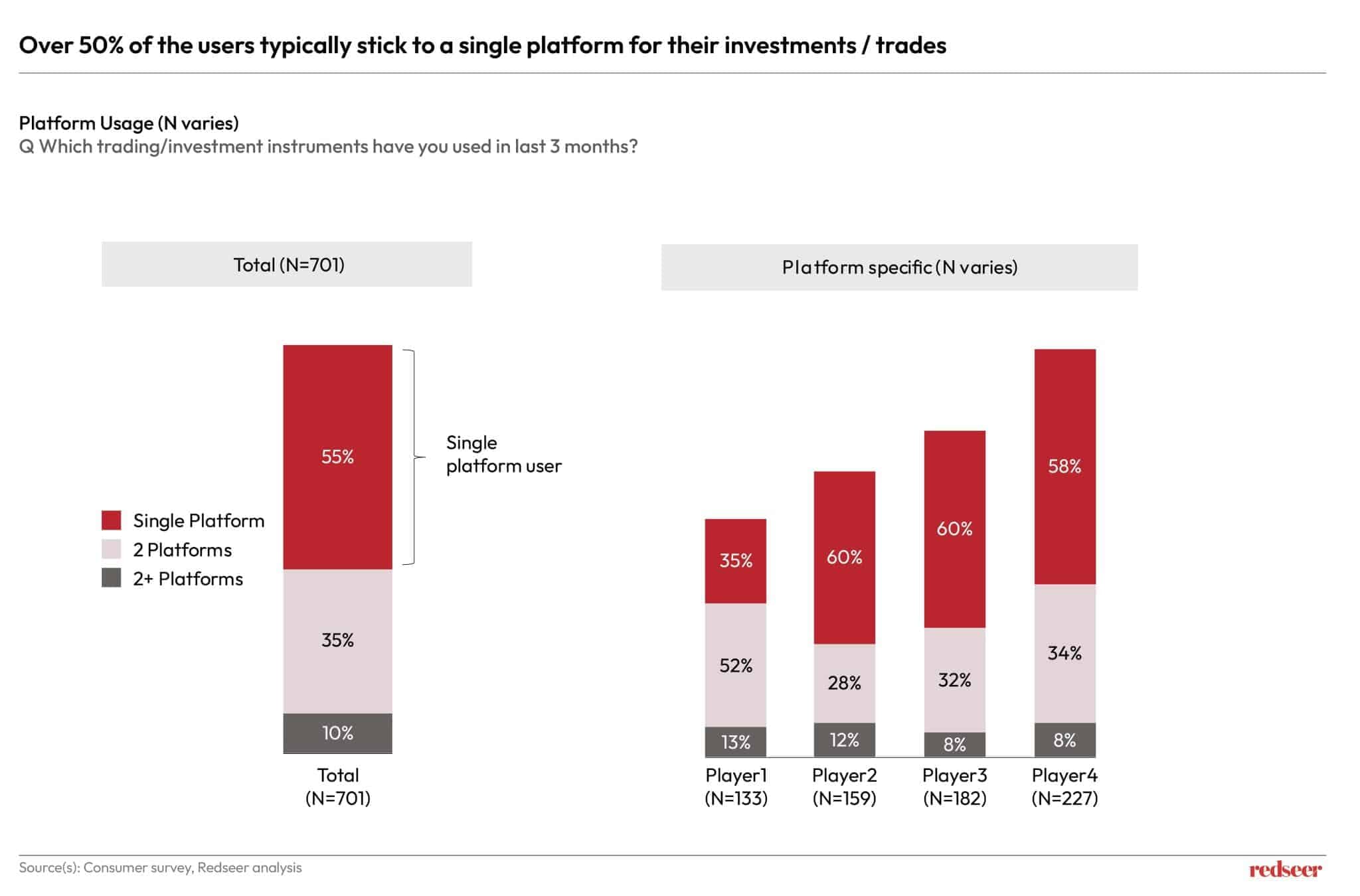

A recent Redseer survey, which included 500+ responses, sheds light on the landscape of India’s broking platforms. The data reveals over half of users prefer sticking with a single platform, reflecting satisfaction, familiarity, or trust in their service provider. This insight provides valuable guidance for brokers seeking to enhance user retention by focusing on personalized experiences and consistent performance.

Further, mobile apps are becoming the preferred medium for trading and investment activities due to their convenience, accessibility, and user-friendly interfaces. This underscores the importance for brokers to invest in robust, feature-rich mobile platforms to stay competitive.

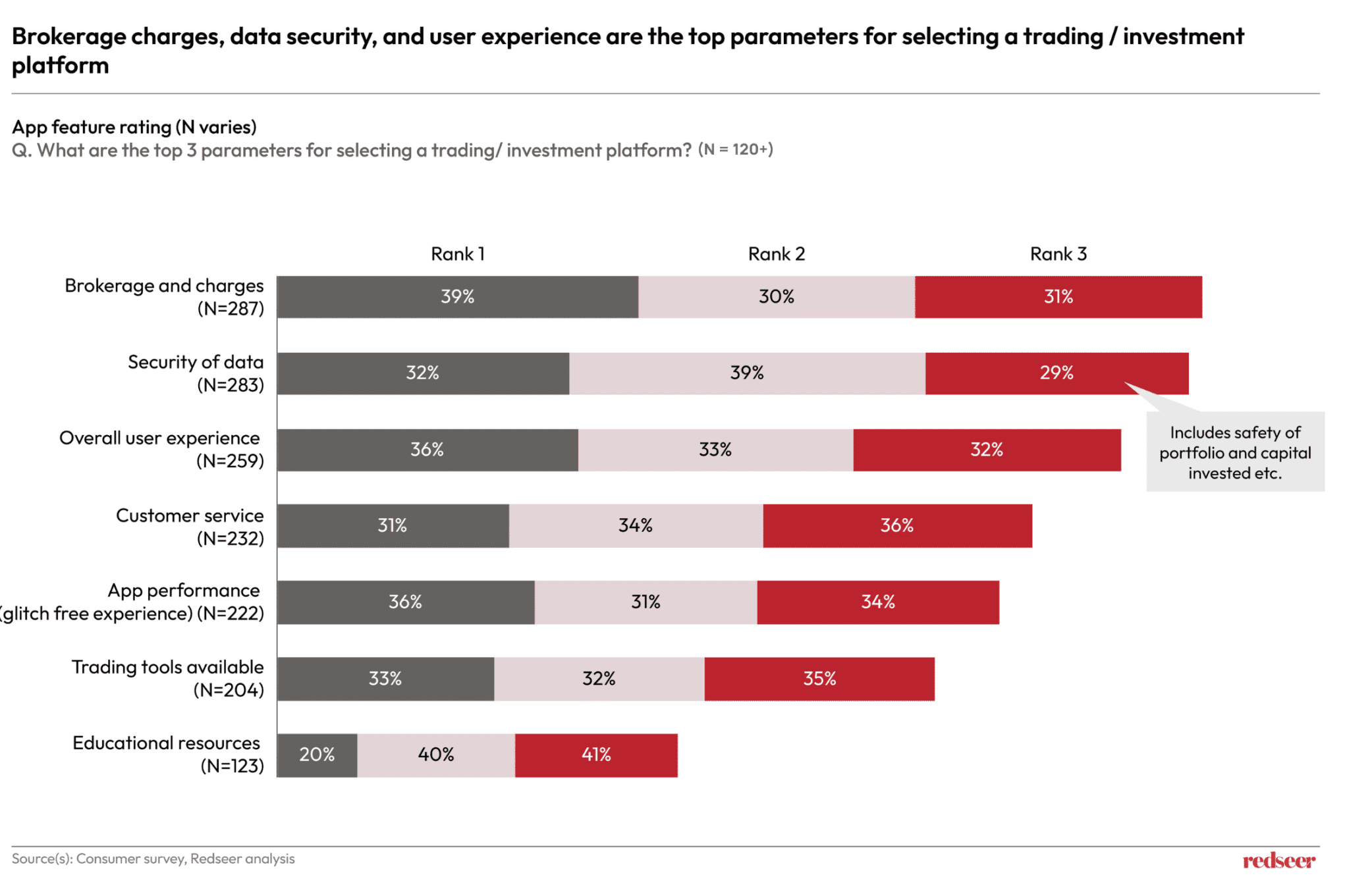

Users prioritize three critical factors when choosing broking platforms:

- Brokerage charges: Competitive, transparent, and cost-effective brokerage charges are crucial, for better returns and a reliable trading experience

- Data Security: Reliability in executing trades, safety of the portfolio, and capital invested

- User Experience: Fast-loading, Intuitiv,e and simple interfaces free of technical glitches are crucial.

This insight suggests that platforms emphasizing these elements will likely gain a competitive edge.

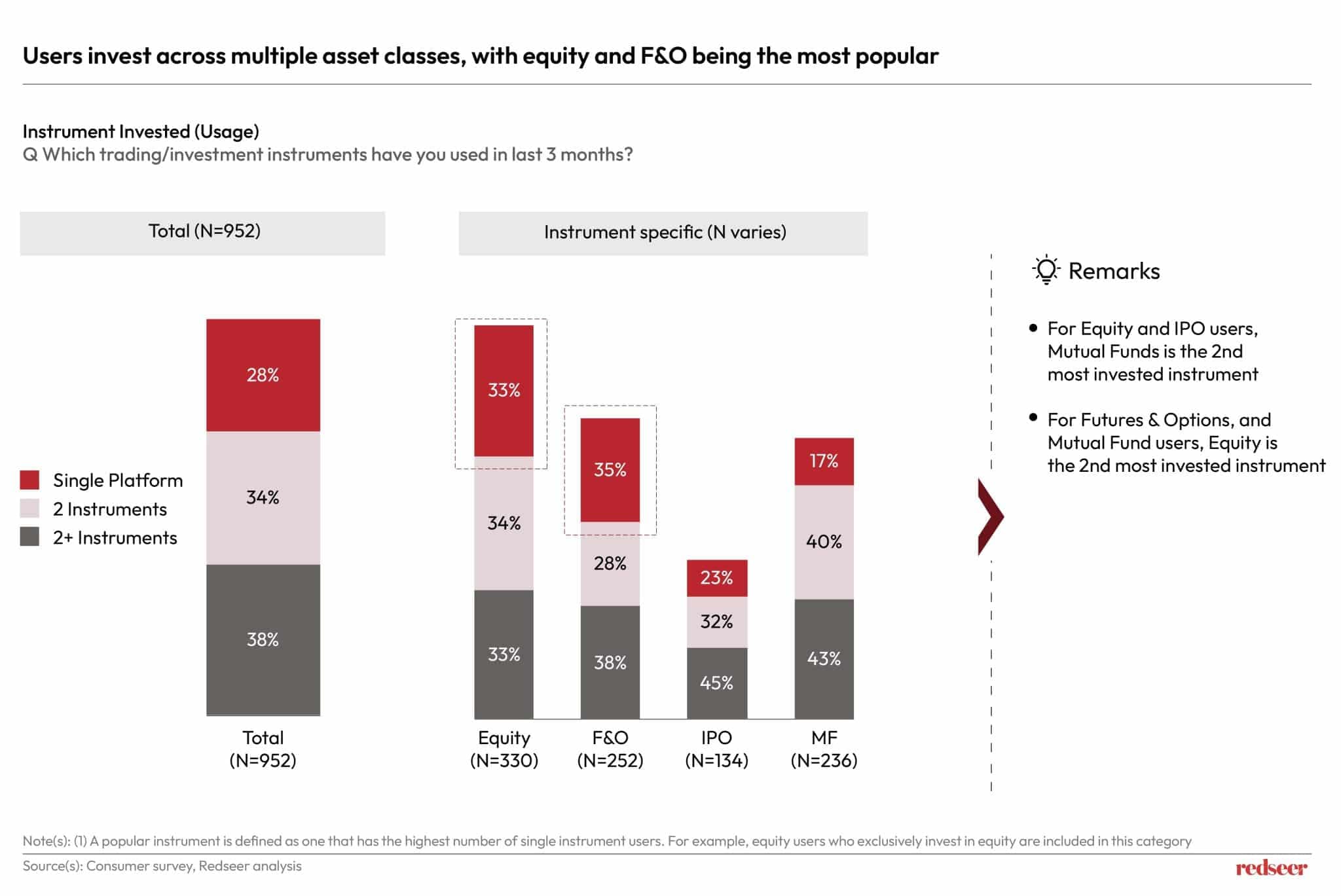

Further, according to the survey, >60% of users access the platform at least once a day with over half spending 10+ minutes per session. Users typically invest across multiple asset classes, with equity and F&O being the most popular.

Personalization is becoming a key differentiator. Users expect platforms to offer tailored investment recommendations, goal-tracking tools, and customizable dashboards to align with their unique financial objectives. Addressing this demand could significantly improve user satisfaction and loyalty.

The younger demographic is gravitating toward modern, tech-driven platforms that offer innovative features like gamified learning, social trading, and sleek mobile apps. This shift points to the need for traditional brokers to innovate and cater to the preferences of tech-savvy users.

Looking ahead for 2025, India’s WealthTech sector holds immense potential. While traditional financial hubs like Mumbai and Delhi continue to drive growth, Tier-2 and Tier-3 cities are emerging as the next frontier. These regions offer untapped markets of first-time investors eager to explore digital platforms tailored to their needs. Additionally, alternative investments such as ESG funds, cryptocurrencies, and thematic portfolios are capturing the imagination of younger, tech-savvy investors.

At Redseer Strategy Consultants, we specialize in helping broking platforms, fintech intermediaries, and investors better understand the market landscape, craft data-driven growth strategies, and conduct thorough due diligence.

Our insights, backed by extensive research and user surveys, offer a comprehensive view of the evolving WealthTech ecosystem. From analysing user behaviour and market trends to identifying growth opportunities and competitive advantages, we provide actionable strategies that drive sustainable growth.

Whether you’re looking to refine your platform’s offerings, expand your market reach, or assess investment opportunities, Redseer is your trusted partner in navigating this dynamic space.

The implications are clear: India’s WealthTech sector is not merely an industry but a force shaping the future of wealth management. Navigating this space requires strategic foresight, a commitment to innovation, and a keen understanding of evolving consumer preferences. The opportunities are vast, but so is the responsibility to build platforms that empower and inspire trust among a growing base of sophisticated investors.

In a world where wealth is not just accumulated but optimized, the question for India’s investors is no longer where to invest, but how effectively technology can help manage and multiply their financial legacy.

Connect with us today! Let’s understand your business and explore bespoke strategies for your business’ growth potential! Schedule a consultation with our experts! Now!

Written by

Jasbir S Juneja

Partner

Jasbir is a Chemical Engineer with a bachelor's in technology from the Indian Institute of Technology. Jasbir has worked with numerous high-profile clients in every industry to develop result-delivering strategies at Redseer Strategy Consultants.

Talk to me

UAE Ramadan 2026: Steady mood, sharper channel choices, and community-led influence

Meeting India’s Protein Goals: Lessons from the Branded Egg Market

The Sorted Generation: Gen X as India’s Hidden Consumer Powerhouse