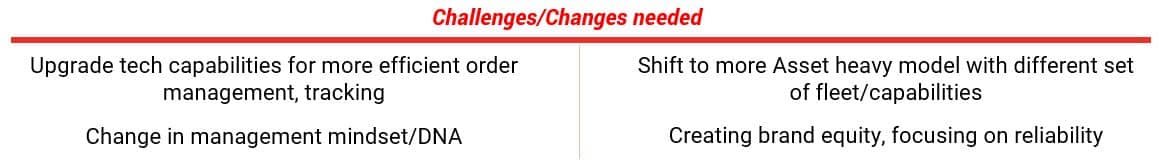

1. ASEAN eLogistics has seen massive growth, accounting for a multi-billion dollar industry in 2019 – we forecast 30-35% CAGR for the next 3-5 year horizon

Indonesia is the largest market in the region, owing to its sheer size and scale of e-commerce when compared to other countries. Differences in rev/parcel are generally driven by typical distances travelled, share of local vs cross border orders (high in case of SG), island vs land infra present (e.g. in ID).

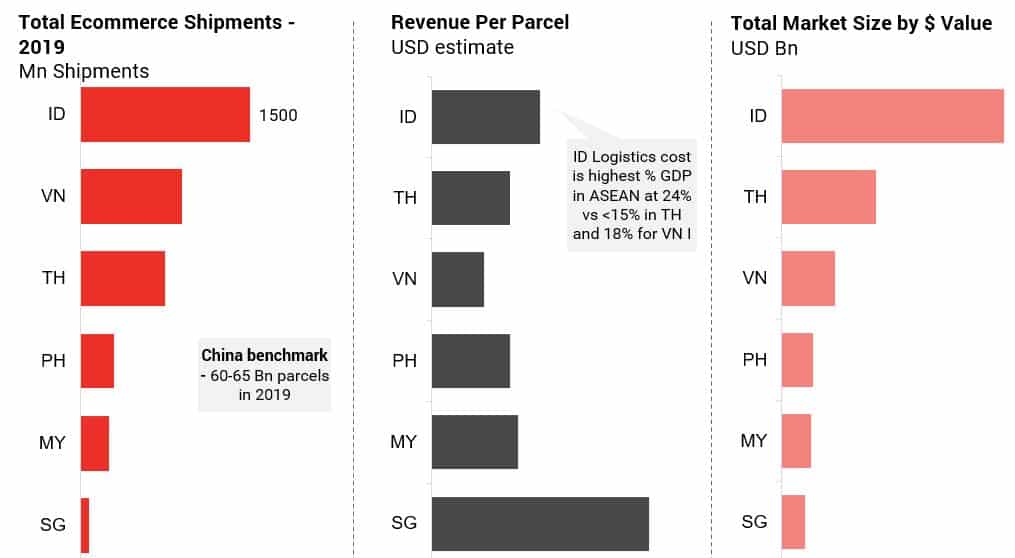

2. Most markets are fragmented with multiple players competing, except Thailand where top two players command majority of the shipment volume

Most e-Logistics markets in the region are characterised by high level of fragmentation and multiple new age players aggressively looking to capture share.

Thailand however is dominated by two traditional players – driven by high coverage, strong TAT and low fees. Also there is limited play of new entrants here due to initial set up challenges.

E-commerce Logistics parcel split by player

Billions of Parcels, 2019 CY Estimates

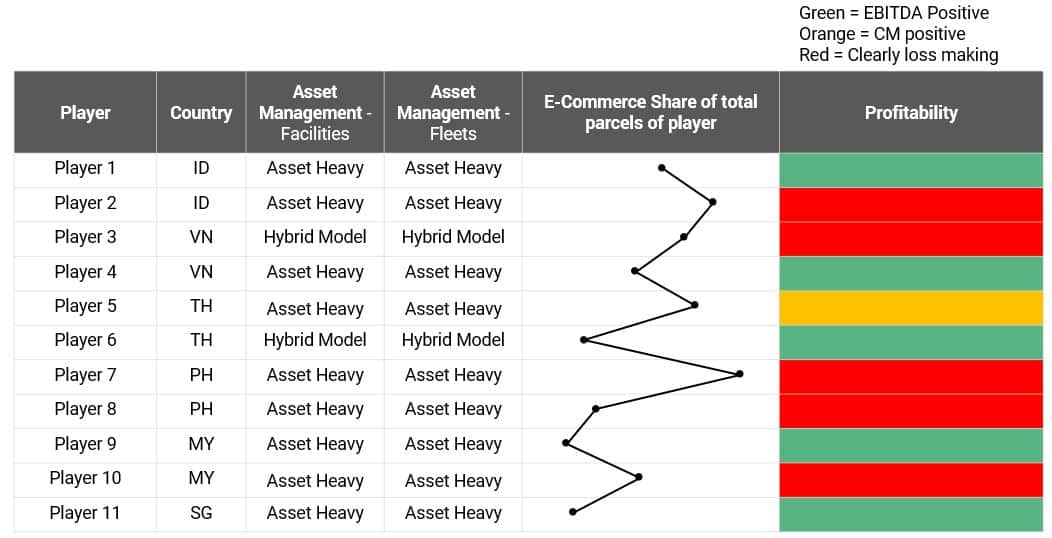

3. Leaders in e-commerce logistics seem to have asset-heavy models – a model preferred by companies in presence of external funding sources

Both new age and legacy players have opted for relatively asset heavy plays across countries backed either by a) strong existing asset base in case of legacy players and b) funding support for new age players.

Asset mix

Top 2 eLogistics players across countries

Note:

- Asset heaviness determined by percentage of facilities (warehouses,. Hubs, etc.) and fleet (trucks, vans, etc.) excluding two wheelers operated on the company payroll

- >70% by volume is asset heavy, <30% by volume is asset light

4. The explosive growth has come at the cost of profitability for e-commerce focused players – however, we do expect a) reduction in rebates + b) better operational efficiency at scale, to help improve unit economics

The massive growth seen in eLogistics has partly been on the back of aggressive discounting and rebates offered to eCommerce players.

However, dominant market shares in the eLogistics space help command better rates – thereby, helping profitability.

Additionally, players with strong B2B operations are doing relatively better on profitability due to their well oiled operations in the more predictable B2B/Trucking side of business.

In future, we do expect improvements on the Unit economics side however, as reduction in rebates coupled with economies of scale and more efficient usage of Tech, will help drive better margin realisation.

Note:

- Players listed here are not based on pecking order in the industry (overall and for each country).

- Asset heaviness determined by percentage of facilities (warehouses,. Hubs, etc.) and fleet (trucks, vans, etc.) excluding two wheelers operated on the company payroll; >70% by volume is asset heavy, <30% by volume is asset light

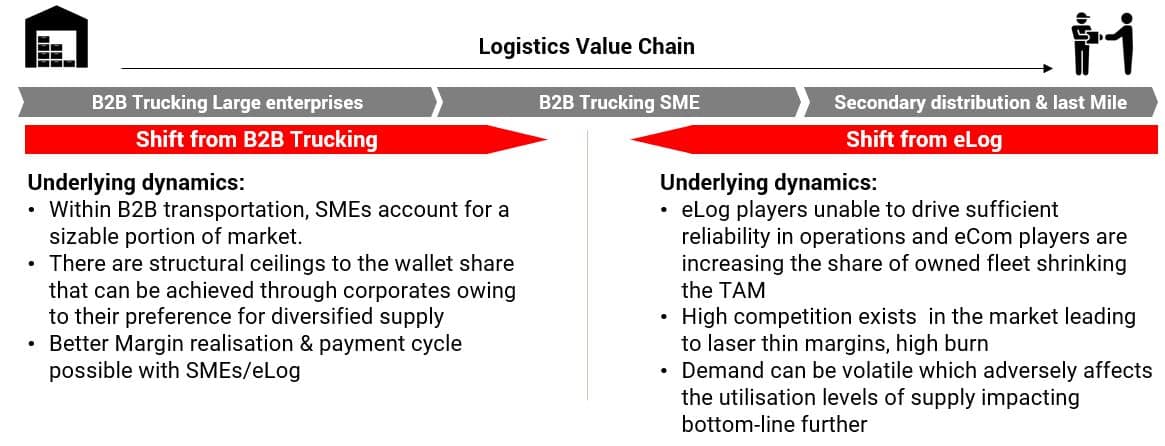

5. Asset heavy B2B players are looking to expand into the SME/e-commerce segment to drive volumes, while e-logistics players are looking at servicing B2B segment for better profitability

We do see an interesting trend playing out where B2B trucking focussed players are exploring the SME/eLogistics segment actively and the reverse is also playing out where eLogistics players are trying to move up the value chain.

There are a few players who have been able to successfully make such transitions – however it is important to note some key challenges to be overcome to effectively expand in the logistics value chain for both types of players.