Vietnam is at the forefront of a fintech revolution. The structural opportunity in digital banking and insurtech sectors in particular is likely to unfold over the next few years. Accordingly, we expect investors’ interests to sustain in the foreseeable future.

1. Macroeconomic indicators present a conducive landscape for the fintech ecosystem to develop and grow in Vietnam in the coming years

Want to get strategic guidance?

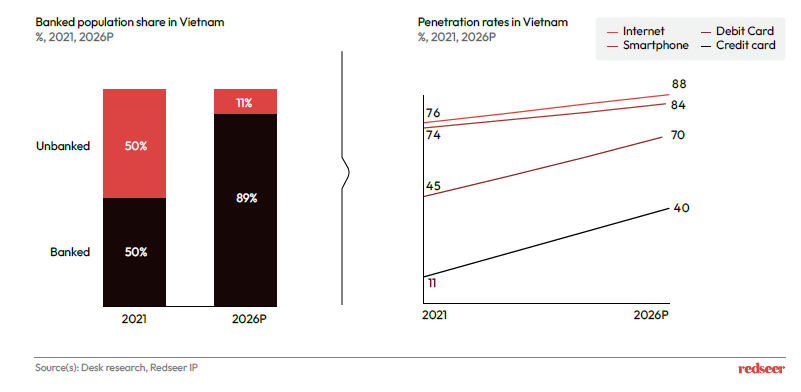

The banked population in Vietnam is expected to rise rapidly (12% CAGR) in the next 5 years, growing from 50% to 90% of the country’s total population. Other macro important indicators such as internet penetration rates, cards penetration etc. present a positive outlook for the development of the fintech landscape in the country.

The low data costs, digitally literate young population and increasing mobile penetration rates augurs well for the adoption of digital services leading to a strong inclination to spend online.

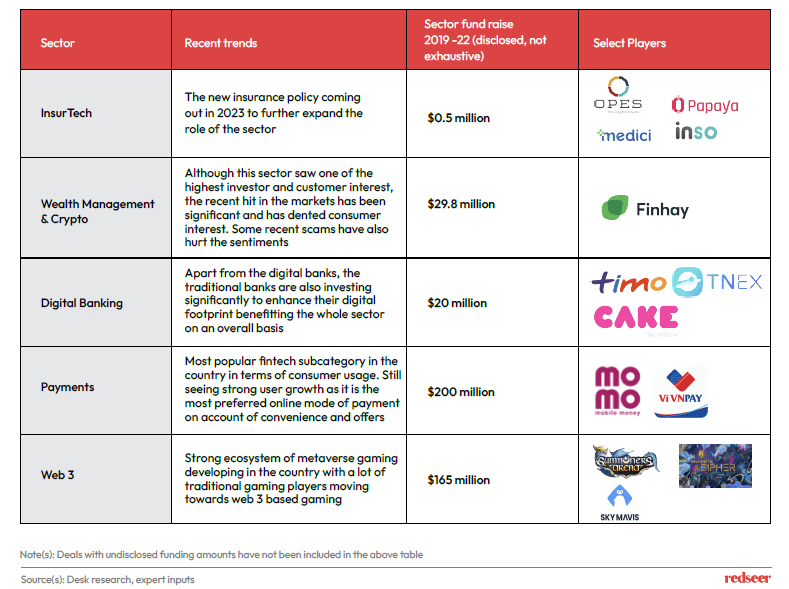

2. Sectors such as digital banking, insurtech, payments and web3 are witnessing many new trends and innovations

Payments and wealth management/crypto investing have been the sectors that have traditionally dominated investments and customer mindshare in the broader fintech landscape in the country. Looking ahead, it will be interesting to track the emergence of other themes such as digital banking, insurtech and web3 which are seeing new innovations and gaining attention from policy makers and customers alike apart from the interest shown by the investing community.

3. With the current low penetration (~2-3%) rate of insurtech in Vietnam, a healthy growth can be expected in the coming 5 years

While near-term investments could be sluggish due to macro headwinds, the long-term outlook remains promising due to the chronic supply-side challenges in the traditional financial networks. The insurtech market is still in a nascent stage with the industry expected to grow at a fast pace (4-5x in next 5 years) as the adoption of digital channels for insurance offerings rises. The insurtech landscape has fair presence of local as well as regional players. The regional players started off by partnering with regional platform-based companies such as grab, Shopee etc. However, now they are also partnering with local Vietnam based companies.

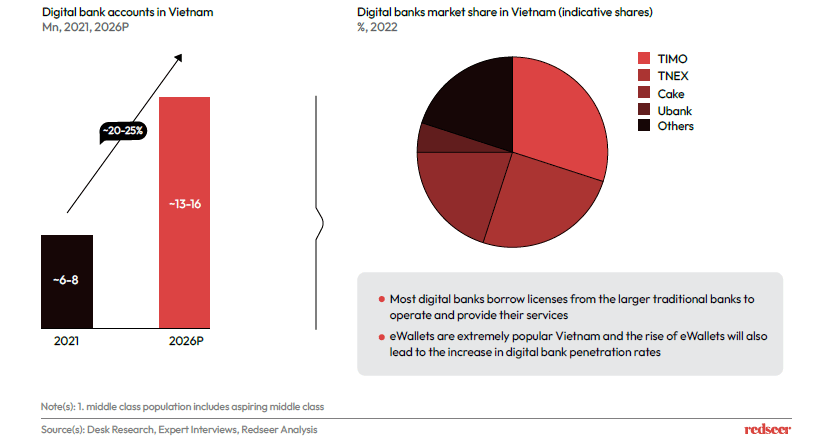

4. Digital bank accounts are expected to grow at a CAGR of ~20-25% in the coming 5 years to reach over 13 million accounts by 2026

eWallet usage will be the primary driver of rise in digital banking accounts in the country apart from the broader macroeconomic considerations such as rising smart phone and internet penetration, adoption of digital banking by larger traditional banks and the overall developments in the digital ecosystem in the country.

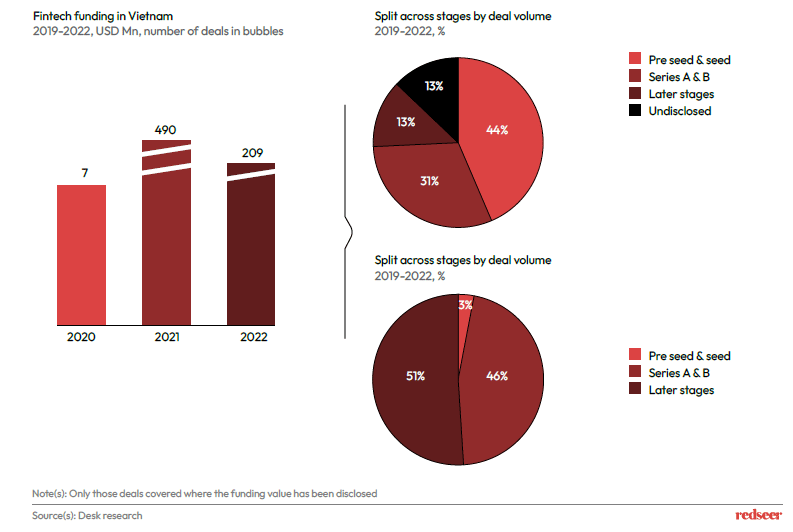

5. Fintech in Vietnam saw an explosion of funding in 2021 with record funds flowing in the sector

For the fintech sector in Vietnam, 2021 was an extraordinary year with a record value of deals happening in the sector. In terms of stage-wise split, pre-seed and seed stage deals dominate the funding landscape in the country in terms of number of deals. However, in terms of value, it is the series A onwards deals that constitute the largest portion of the split.