Electronics are among the top-selling items in the e-commerce market in Indonesia, accounting for nearly ~25% of the total GMV, and this trend is only expected to continue in the future!

In this article, we explore the potential for direct-to-consumer (D2C) brands in the electronics market and the factors that may drive their adoption over established incumbents.

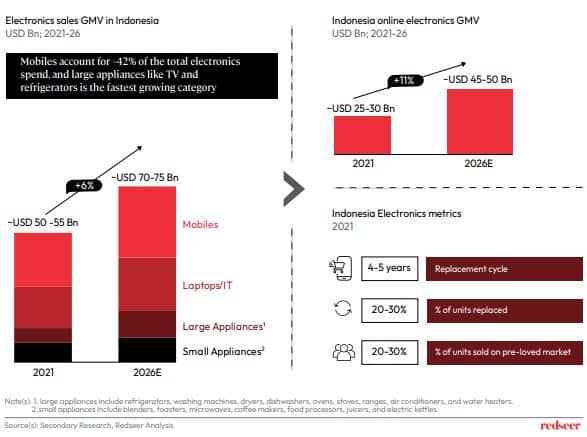

1. The Electronics retail market will represent a ~$70-75 Bn opportunity by 2026 in Indonesia, online electronics highlighting an 11% CAGR growth

Want to evaluate new investment and M&A opportunities?

The consumer electronics market in Indonesia is growing at ~6% CAGR from 21-26 but the online market is expected to grow at a much higher rate of ~11%. Consumers are increasingly embracing omnichannel options, combining online and offline channels for a seamless shopping experience. E-commerce players with a strong omnichannel presence are seeing higher customer retention due to their ability to offer convenience and flexibility across channels.

The replacement cycle for mobiles is around 2-2.5 years, while large appliances are replaced every 6-7 years, with an average being 4-5 years among all the categories. The percentage of units replaced is much higher for mobiles compared to the average and lower for large appliances. Additionally, the pre-loved market for mobiles accounts for 70-80% of units sold, while for other categories it stagnates at 20-30%, making mobiles the most lucrative category.

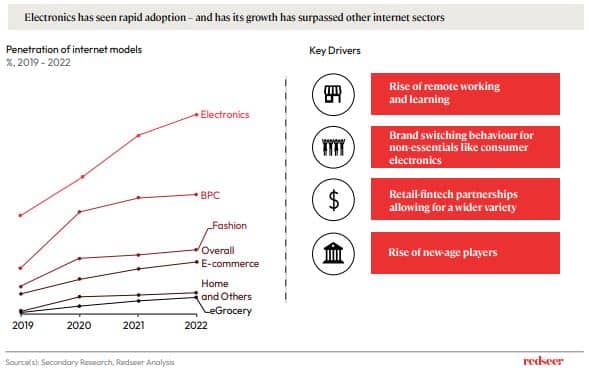

2. The pandemic drove the adoption of online electronics models; we expect the market to continue to see a growth going forward

Increased disposable income and lifestyle changes brought on by the pandemic have led to a rise in spending on electronics products in the region. Retail-fintech partnerships have played a crucial role in making electronics devices more affordable for a broader segment of society, thus fueling demand. In addition, the emergence of new players in the market has also contributed to improving accessibility to these products.

Recent trends in Indonesia’s e-commerce market include a rise in remote work and learning, leading to increased laptop and phone penetration. Consumers are turning to online channels for wider selection and lower prices. This shift has resulted in strong customer loyalty to e-commerce companies, as shoppers report higher levels of satisfaction when shopping online compared to in-store.

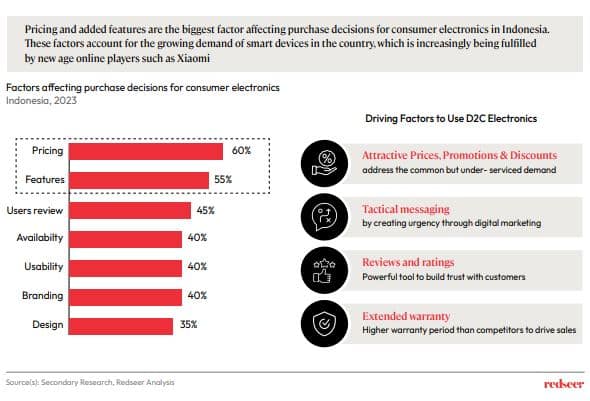

3. D2C companies are changing the game by redefining consumer expectations through competitive pricing and innovative products

D2C electronics companies have the potential to disrupt the retail industry in Indonesia. With consumers increasingly prioritizing pricing and features over brand name, D2C companies can offer high-quality products at lower prices, making them more accessible to a wider audience. By utilizing tactical messaging and limited-time offers, these companies can create a sense of urgency among consumers. Additionally, offering extended warranties, product reviews, and ratings can build trust and confidence in the customer’s purchase, leading to increased customer loyalty and recommendations to others.

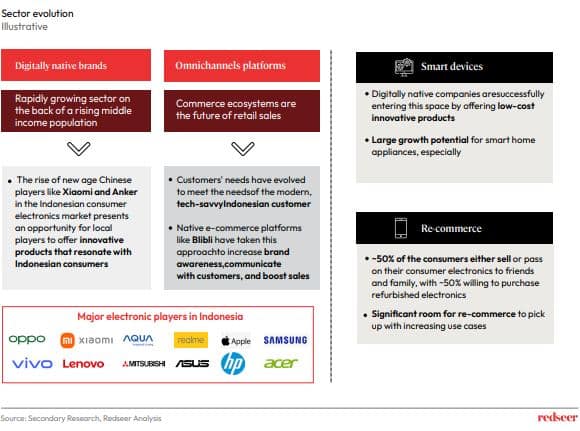

4. Indonesia’s electronics market is adopting omnichannel platforms and D2C brands; Success of Prism+ in Singapore and BoAt India can be replicated in this ripe market

DNBs (Digitally Native Brands) stand out from traditional brands as they are marketing-focused organizations that have optimized their entire marketing approach for the online ecosystem, while large retail brands have less agility and view online sales as only a small part of their overall business

As seen by the success of new age players in other markets, such as Prism+ in Singapore, BoAt in India, and Xiaomi in China, there is significant potential for similar growth in Indonesia’s consumer electronics market.