If you’ve been following Indonesian current affairs, you might be aware that we are inching closer to the first round of the 2024 Indonesian General Elections in February.

Nearing the end of his second term, President Joko ‘Jokowi’ Widodo has led Indonesia through one of its most prosperous periods of economic growth in modern times. Through investment-friendly regulations and supportive policies, the Jokowi administration has seen the growth of important sectors such as tech and renewables in Southeast Asia’s largest economy. His successors are poised to follow through on his achievements.

In today’s update, we’re sharing a quick outlook on the upcoming elections and how candidates might affect certain business sectors.

01.Who’s who in the 2024 Elections – three popular figures emerge as candidates including two former governors and current minister of defense

The 2024 Elections provides us with popular political figures posied to battle for the presidency.

Anies Baswedan was the governor of Jakarta (2017-2022), known for continuing crucial public projects including launching the city’s brand-new Mass Rapid Transit (MRT) system along with reorganizing its ageing city bus fleet. On the number two ticket, General (Ret.) Prabowo Subianto is running for the second time. Having been defense minister during Jokowi’s second term, he oversaw the modernization process of the Indonesian military.

Lifelong party man Ganjar Pranowo has had an extensive career in public service, having been a member of parliament, then serving as governor of Central Java. As governor, he was known to be a very strong supporter of small businesses.

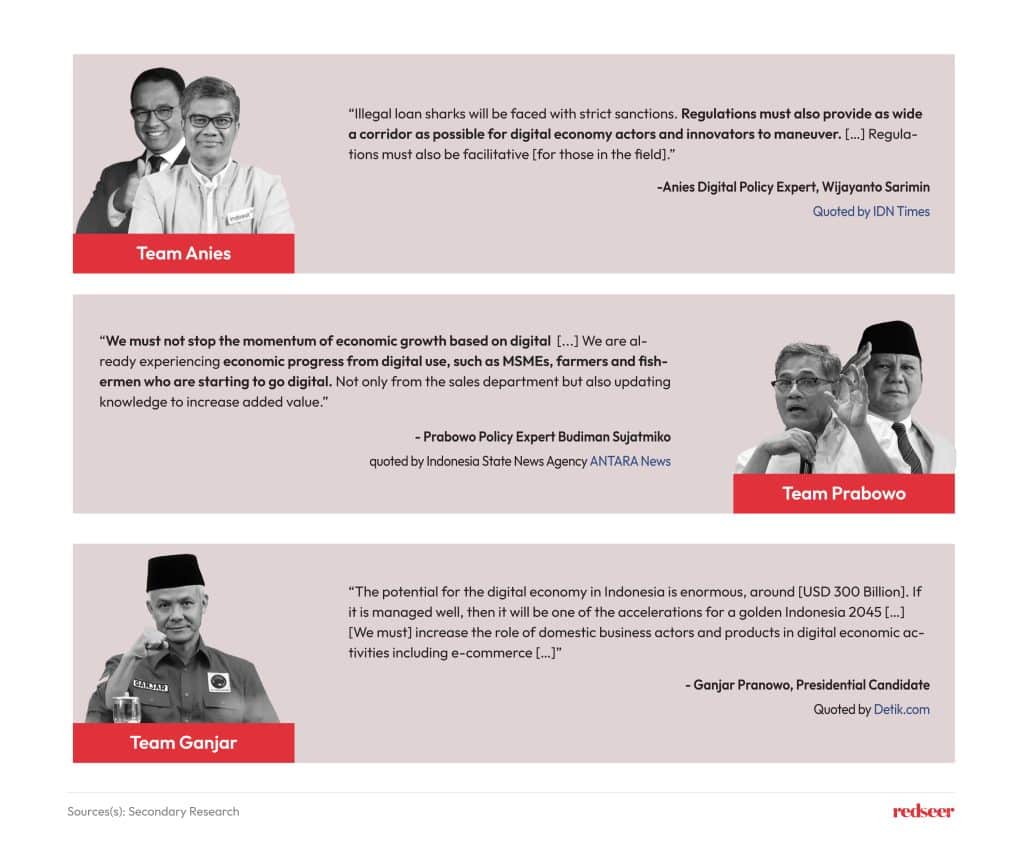

02.In their own words – candidates and their experts agree on importance of digital economy growth, vow to build on Jokowi’s achievements

Direct quotations from each candidate and/or their experts see strong policy positions to continously enable digital economy growth. The Indonesian digital economy grew a staggering ~20% in Jokowi’s second term (2019-2024) with the government actively promoting digitalization. Higher internet connectivity and interest has also seen digital penetration increase by 7x between 2010 and 2022. However, the digital economy only comprises 6-7% of the GDP—indicating plenty of room for growth.

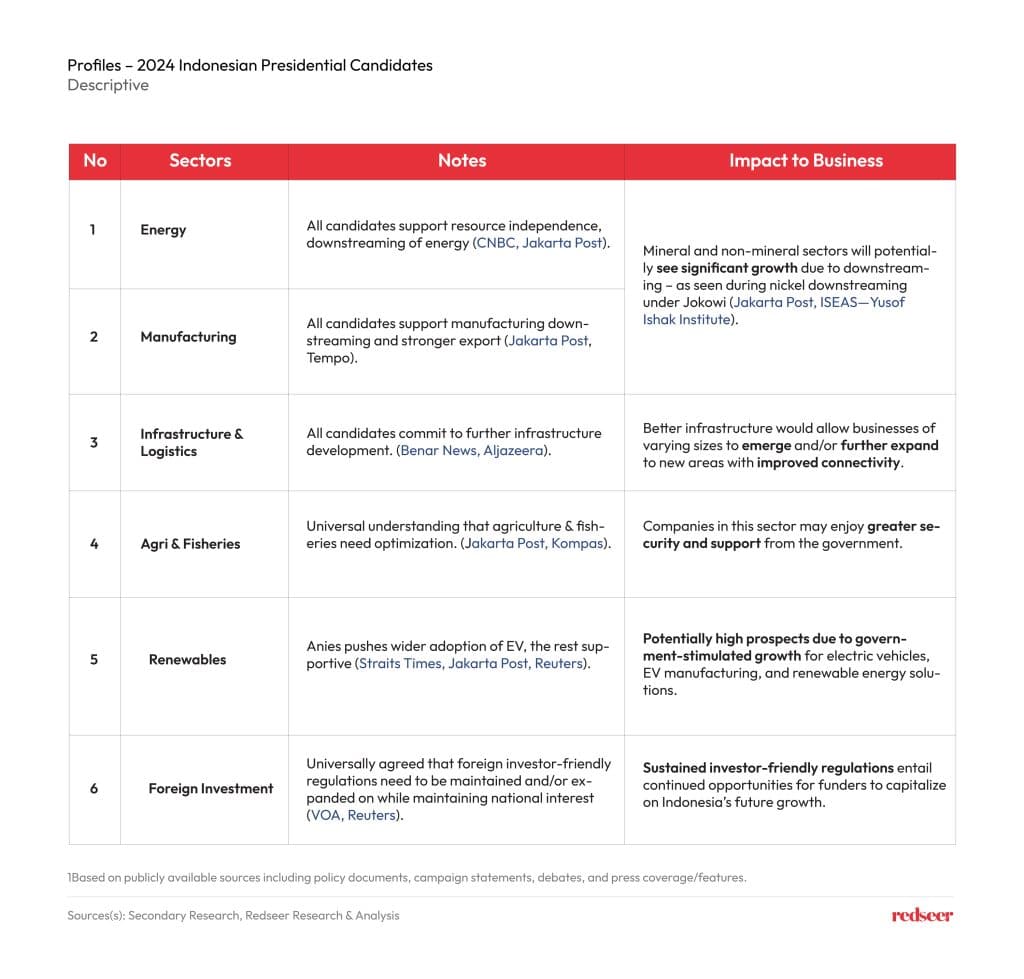

03.Each candidates’ sectoral policy positions are generally trying to improve or continue Jokowi-era policies – interesting themes include infrastructure, logistics, fisheries, and renewables

All candidates bring significant commitments to attract further foreign investment, improve ease of doing business metrics, as well as strong sectoral commitments.

Indonesia is not only the largest but also one of the most exciting economies in Southeast Asia—we hope you find these insights useful.