Picture a typical day in the life of a young entrepreneur in Bangalore. He’s juggling the demands of a start-up, a vibrant social life, and the challenges of living alone in a bustling city. He’s just realized he’s out of groceries, and he has no time to visit the supermarket. Or imagine a working mother in Mumbai, who after a long day of work, realizes she forgot to pick up the ingredients for dinner. In these everyday scenarios, quick commerce (Q-commerce) is emerging as a game-changer, promising to redefine convenience and transform lives.

In the evolving landscape of Indian retail, Q-commerce has swiftly transitioned from a novel concept to a crucial part of urban living. It’s the pulse of the new-age consumer, delivering everything from groceries to gadgets at a remarkable pace. This rapid service, which has become a core aspect of daily routines, highlights India’s adaptability and appetite for innovation.

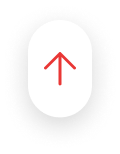

As captured in our last story, the Q-commerce market grew at a lightning pace of 70-75% last year, which was ~5x of e-commerce growth. However, the question still remains on how will its performance fare this year (i.e. FY25) and for how long can it continue at this mind-boggling pace.

Through these series of stories, our experts at Redseer have taken an insightful pass on the above areas. Join Kushal Bhatnagar as he shares our data-backed perspective on the growth of quick-commerce in FY25 and beyond.

Re-capping the rise of Q-Commerce

As we had seen in our previous story, the growth of Q-commerce was driven by the increasing demand for convenient, on-demand shopping solutions, particularly among GenZs and millennials in urban areas. Despite the global failure of similar models, Q-commerce in India was thriving, surprising many industry experts. While the outlook was promising, it was interesting to closely observe the consistency in Q-commerce performance.

What has been fueling the rise of Q-commerce in India, you ask? The key drivers of this fast-paced growth have been the following:

- The rising user base – Average Monthly Transacting Users (MTU) grew by >40% in FY 24

- Habit formation amongst users – The monthly ordering frequency of users has jumped to nearly 6 in FY 24, up from 4.4 in FY 21, as use-cases matured from infrequent top-ups to weekly or even monthly stock-ups

- More spending by users – Event days and category diversification drove up Average Order Values for Q-commerce platforms >15% in FY 24

- Continued domination by Metro cities – The share of Metro cities in the Q-commerce pie was ~90% in FY 24

What Next Year Looks Like for Quick Commerce?

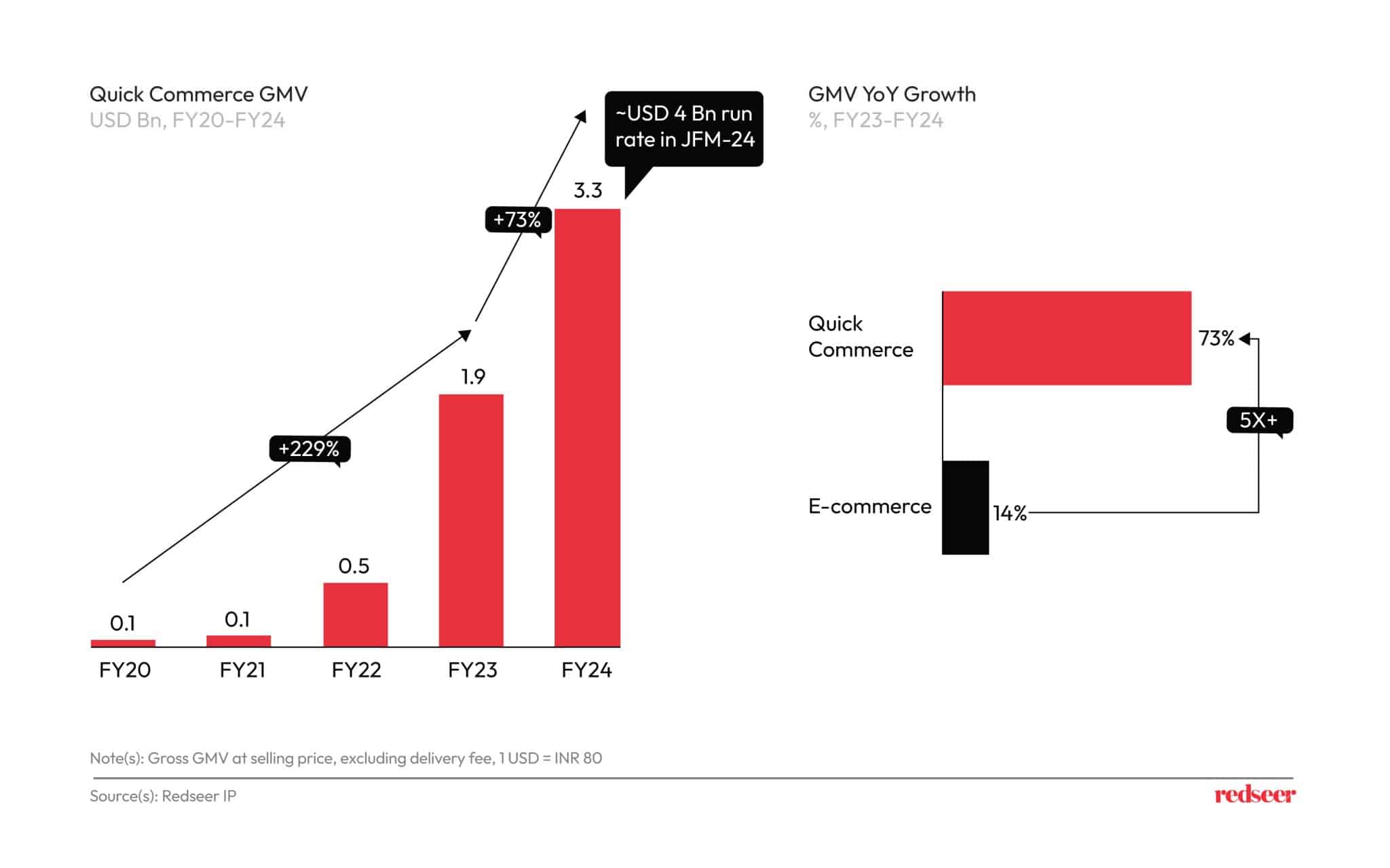

It doesn’t look like there’s anything stopping the rapid growth we are seeing in the Q-commerce industry. Our projections indicate a 75-85% growth in the Q-commerce market in FY 2025, with ~USD 6 Bn GMV. This will happen on the back of ~5 Mn new Monthly Transacting Users (MTU). Further, existing MTUs are expected to spend ~20% more on Q-commerce, driven by stronger trust & habit formation towards platforms, experimentation with newer propositions (e.g. sustainable products, health focus, cafe), and expenditure across non-essential categories such as beauty, home decor, gifting, and other general merchandise.

To cater to the growing demand, Q-commerce platforms are expected to add at least 500 new dark stores across the country, with a focus on the top 30-50 cities. Further, existing dark stores are expected to deliver higher throughputs, thereby resulting in a stronger economic profile for the platforms.

When is This Boom Going to Stabilise?

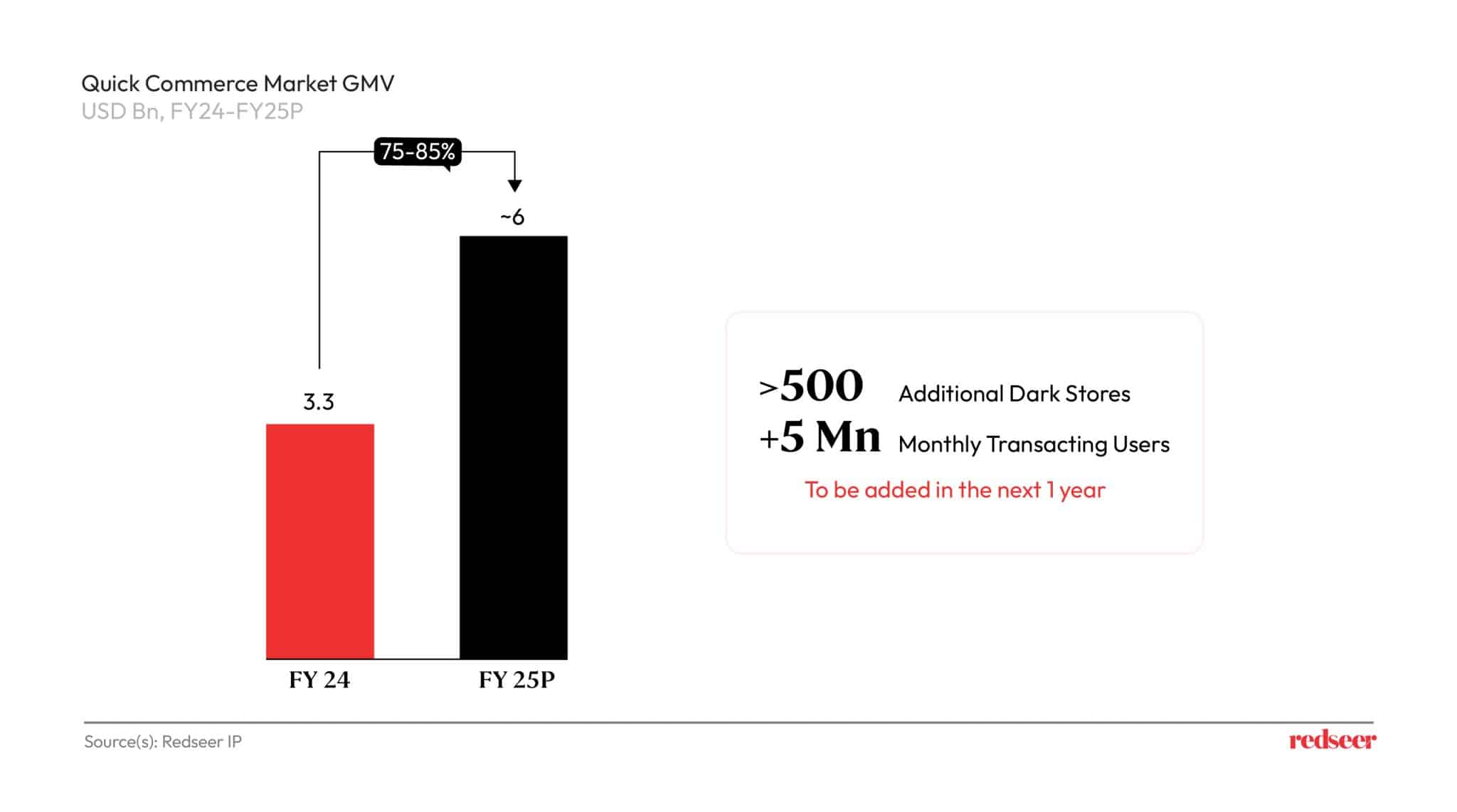

This aggressive growth spree is expected to continue for the next couple of years, which will see Q-commerce reaching ~20 Mn MTUs by FY26. Post this, the user growth (and hence the market growth) is expected to stabilize a bit, as indicated by the correction in food delivery growth beyond the ~20 Mn MTU mark.

The majority of the new users are expected to come from the top 30-50 cities, as for the next couple of years, Q-commerce plays beyond the top 50 cities are likely to stay confined to experimentation. We can expect to see stronger headways in smaller cities FY27 onwards, but it will require platforms to tweak the current dark-store-based model, given it may not be viable in less dense markets.

Can Q-commerce platforms leverage India’s vast Kirana network for fulfillment in the smaller cities? There is significant skepticism associated with this idea (looking at how other online platforms have failed to scale sustainably in this domain), but Q-commerce platforms could just surprise us like last year 🙂

Potential Innovations in Q-commerce this year

From selling iPhones to air coolers, cracking Valentine’ day to World Cup bonanza, and providing cafe to printouts, quick-commerce has surprised us all and exploded the limits most of us imagined. On similar lines, we’ve identified the following bets that Q-commerce could (or could not) venture into this year. While each of them comes with its share of execution challenges, they could just be the next big things in Q-commerce:

- Could walking into your favorite brand’s local store, not physically, but virtually through a Q-commerce platform be a reality?

- Could Q-commerce eat into the early-morning essential subscription (milk, eggs, bread, etc.) space?

- Will the rise of Q-commerce lead to the emergence of a new breed of Q-commerce first brands?

As we stand on the brink of this retail revolution, Q-commerce is not just a trend, but a testament to India’s adaptability and innovation. With its exponential growth and potential for further expansion, it’s clear that the future of retail is here. Prepare for a world where shopping is redefined, and the future of retail arrives at your doorstep, faster than ever before. This is the dawn of Q-commerce – where every second counts and the future is now.

Fascinated by the rapid evolution of Q-commerce? Connect with our industry expert, Kushal Bhatnagar, for deeper insights into this retail revolution. Don’t miss out on the future of shopping—subscribe to our newsletter today for the latest trends and updates in the Q-commerce industry.

Stay tuned to our quick-commerce series wherein in the forthcoming editions, we will unravel (a) the extent to which it can disrupt the non-grocery categories and (b) what it takes for brands to maximize the available potential. Keep reading.