How to unlock the USD 23 Bn Electric 2W opportunity in Indonesia?

Indonesia’s electric two-wheeler (2W) market is poised for growth, with government support and rising consumer interest driving momentum. However, key challenges—such as pricing concerns, range limitations, and resale uncertainties—are slowing widespread adoption. Addressing these factors will be crucial for realizing the market’s full potential.

In this update, we focus on the primary barriers to adoption and consumer perceptions, drawing on insights from on-the-ground research. The goal is to highlight what needs to be addressed to unlock this USD 23 billion opportunity.

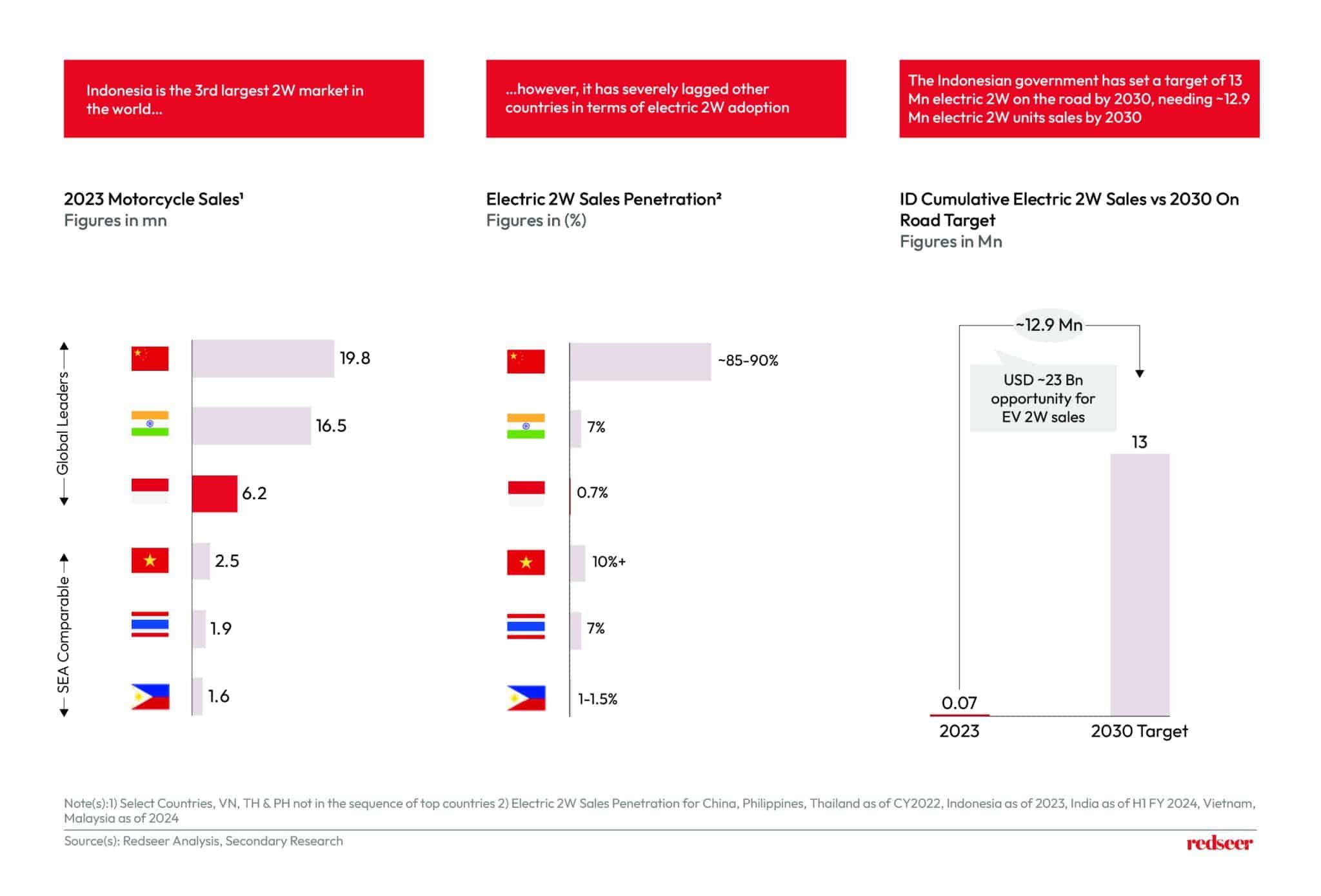

1. Despite being the 3rd largest two-wheeler market, electric 2W adoption in Indonesia lags severely! It’s a USD ~23 Bn opportunity ripe for unlocking

Build new product innovation and market strategy.

Indonesia is the world’s third-largest two-wheeler (2W) market, however, when it comes to electric 2W adoption, Indonesia has barely scratched the surface. With a penetration rate of just 0.7%, far behind China’s overwhelming 85-90%, India’s 7%, and even Southeast Asian counterparts like Vietnam at ~10%+ and Thailand at 7%. Indonesia has a lot of ground to cover.

Despite this gap, things are evolving fast. The Indonesian government has set a bold target of 13 million electric 2W units on the road by 2030.

While the market has been growing rapidly at a CAGR of ~178%, the base remains small, and our on-ground research suggests that there are some key bottlenecks that need to be addressed.

2. Price, Performance & Range Anxiety are key points for consumers

Despite government incentives and subsidies, the transition to electric 2Ws in Indonesia has been slow. This stems from some key concerns amongst consumers: poor infrastructure, high upfront costs, battery reliability issues, and anxieties around vehicle range and resale value.

On-the-ground, many consumers feel that charging infrastructure is still insufficient, making Electric 2Ws inconvenient for daily use, particularly in rural areas. Electric 2Ws are often seen as luxury items, out of reach for most everyday users. For ride-hailing drivers, performance concerns are evident—some have noted that limited range and slower speeds are key drawbacks. In fact, customers have been known to cancel rides after learning the vehicle is electric, reflecting broader concerns over reliability for longer distances or peak-hour demands.

These barriers must be addressed through improved infrastructure, cost reductions, and a clear narrative around the long-term value of electric 2W ownership.

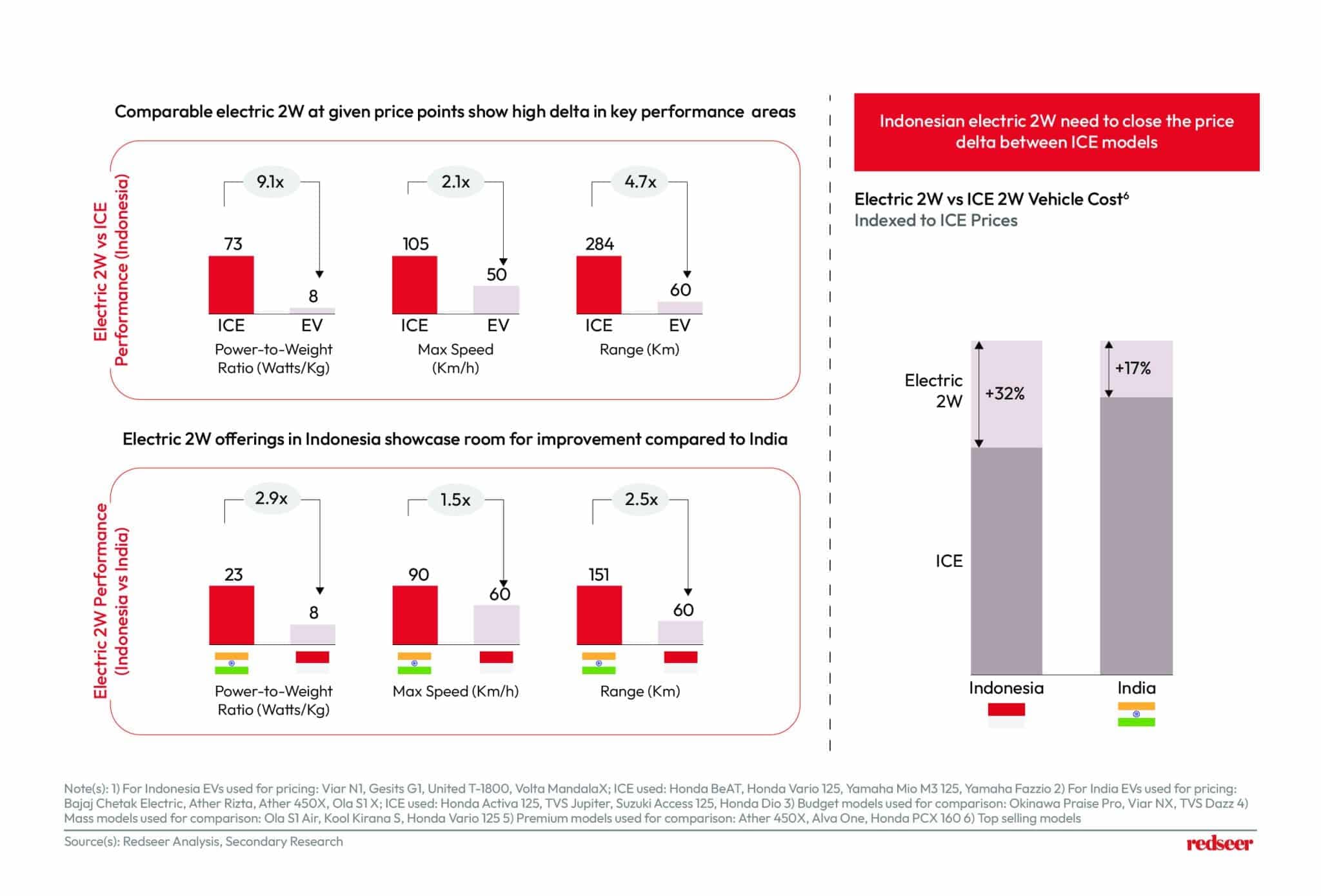

3. Indonesia electric 2W offerings need to improve their performance & pricing to consumers

In Indonesia, electric 2Ws lag traditional ICE motorbikes not only in terms of pricing but also in terms of performance. Electric 2Ws cost 32% more than ICE vehicles but deliver significantly lower power-to-weight ratios, maximum speeds, and range.

A look at India makes this even more evident, where Electric 2W pricing is closer to that of ICE vehicles, and performance metrics are more favorable. Bridging this performance gap and bringing down costs will be crucial if Indonesia hopes to foster widespread adoption of electric two-wheelers.

4. Battery Swapping – could be the answer to B2B adoption. However, consumers current experience leaves a lot to be desired

When it comes to maintaining their electric 2Ws, Indonesian consumers generally prefer charging over battery swapping. This is largely due to the underdeveloped swapping infrastructure. Most charging stations are in poor condition or are difficult to access, especially in rural areas.

For businesses operating large fleets (B2B), battery swapping can significantly improve efficiency, uptime, and cost-effectiveness. It also brings down the initial buy-in cost for the consumers which is often cited as a big detractor.

Minimizing downtime and ensuring that fleets are operational without long charging breaks is critical for logistics and ride-hailing industries.

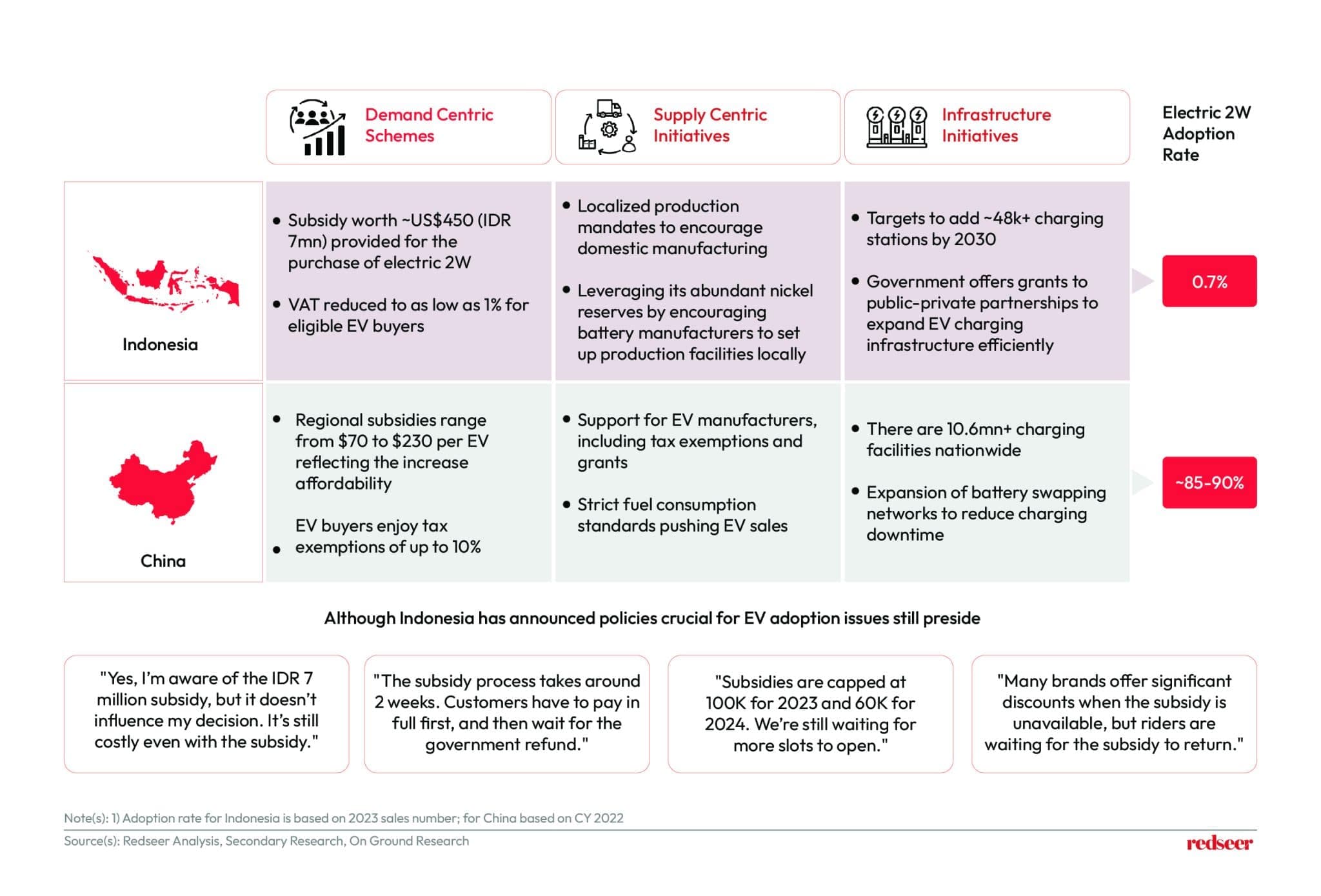

5. Policy support is crucial for Indonesia’s electric 2W adoption – issues like subsidy delays, capped quotas, and upfront costs need to be taken care of

Indonesia’s policy framework for electric 2W adoption is commendable, but it needs refinement. The government provides subsidies worth US$450 for every electric 2W purchase and VAT reductions to as low as 1% for eligible buyers. Yet, the reality is that subsidies are capped and delayed, leaving many would-be buyers waiting for the next batch of available slots. China’s successful EV policy offers a blueprint: with over 10 million charging facilities and extensive subsidies, the country has shown how crucial comprehensive, sustained policy support can be in driving EV adoption.

To mirror China’s success, Indonesia needs faster subsidy processing and a more robust charging infrastructure to handle the anticipated surge in demand. If these issues are addressed, Indonesia’s road to electric 2W adoption could significantly accelerate.

Indonesia is at a pivotal moment in its journey towards widespread electric 2W adoption. While the market is rife with opportunity, unlocking its full potential requires targeted action. The country must focus on lowering costs through local innovation, leveraging its natural resources (like nickel) to build a robust domestic battery industry. Enhancing infrastructure for charging and swapping, streamlining subsidies, and creating community engagement through events like electric 2W Sunmori rides can help shift consumer perception and build trust.

Opportunities for companies lie in addressing key pain points in the market. For instance, businesses can explore developing battery leasing models to reduce the high upfront cost burden on consumers. Companies focusing on infrastructure development, such as expanding battery swapping stations and providing portable charging solutions, can capitalize on the rising demand from urban riders. Furthermore, offering integrated services like EV-specific insurance, financing options, and dedicated after-sales support can open new revenue streams while building long-term customer loyalty. For brands – awareness campaigns around the quality of the vehicles and introduction of guaranteed buyback schemes could address perceptions issues.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me

Value Retail: The Quiet Force Reshaping MENA’s Consumer Economy

India’s Defence DeepTech Flywheel: The $6Bn Market Nobody’s Watching

Ready-to-Eat Brands Are Leaving 85% of Addressable Consumers on the Table