Indonesia’s Electric Vehicle (EV) sector faces a chicken-first-or-egg situation. Buyers want better ownership options (financing, resale, etc.) before coming in droves, and manufacturers are waiting for higher sales volumes before ramping up production.

The good news is demand is rising, and the government is stepping in to help. We see the EV ecosystem is charging ahead. How? Read on….

Our previous views on this space can be tracked from here1.

Indonesia Electric Vehicles: Charging Up, SEA Electric Vehicles – Charging Up Part 2, Indonesia Electric Vehicle: Charging Up Part 3

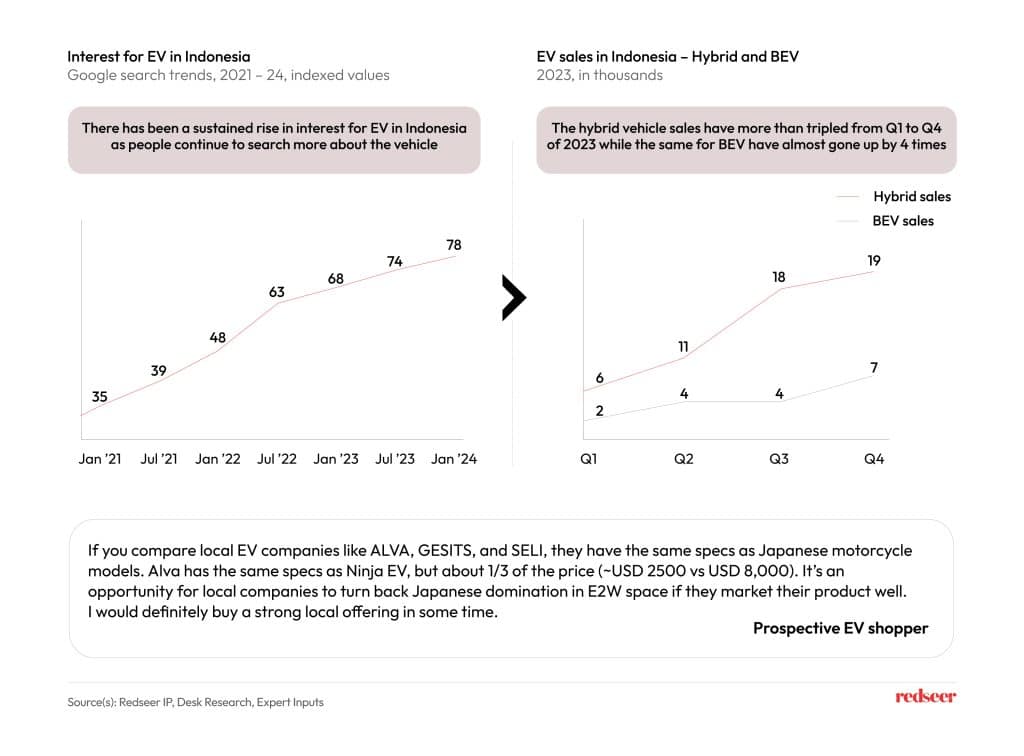

01. Consumer interests and EV sales are on a continued rise in Indonesia; the sector has the right ingredients to deliver structural growth

In Indonesia, consumers are walking the talk. They are searching for EVs online more than ever and at the same time, these searches are converting to sales as well.

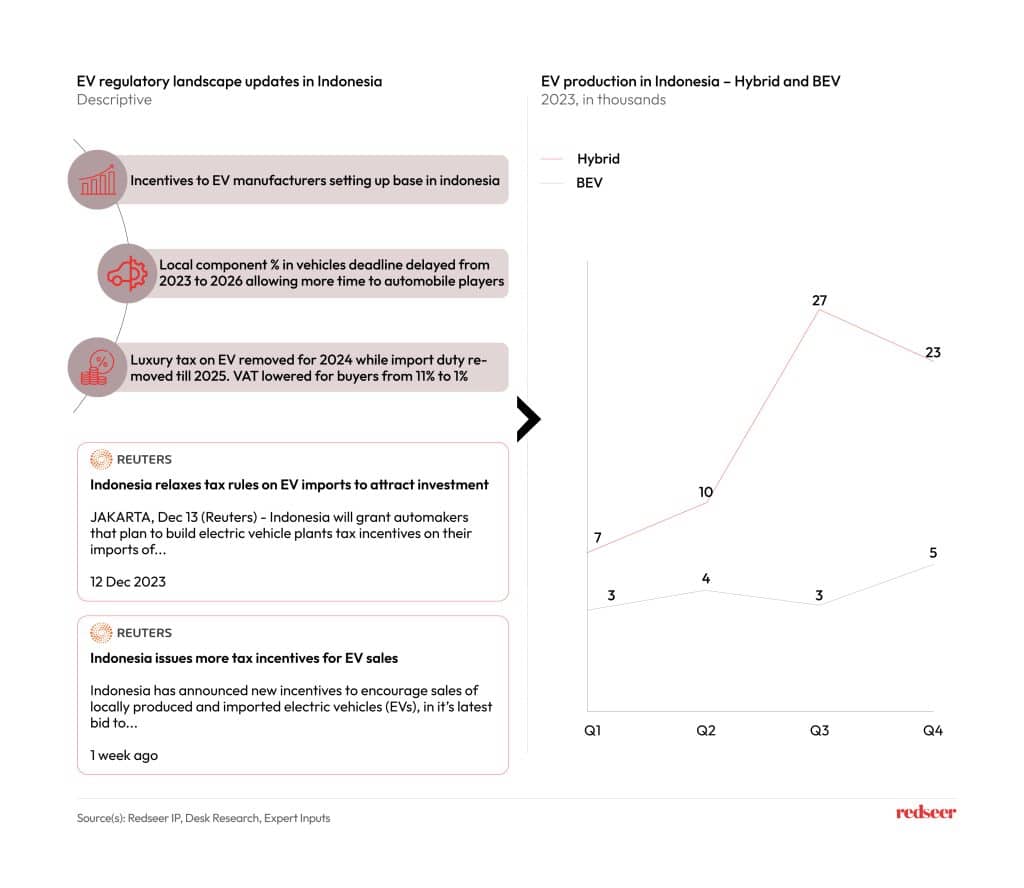

02. And on the supply side; we are seeing tailwinds from regulators that are aiding EV production in the country

To encourage the adoption of EVs in the country, the government has introduced a new set of demand and supply-side incentives. BEV production continues to rise, with sales > production – earlier years’ inventory is being cleared by automakers.

Hybrid while some rationalization happened in Q4, we expect production to pick up again as seen in other geographies like the US where now hybrid sales are increasing despite a decline in EV sales.

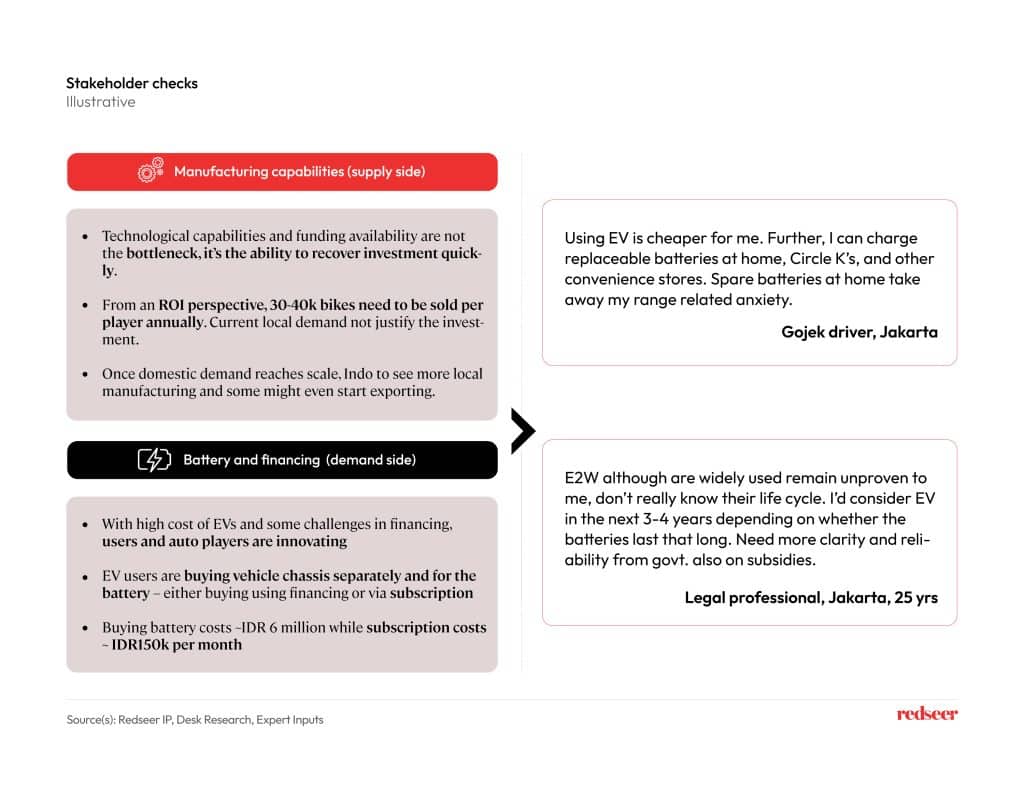

03. Suppliers are waiting for demand to hit a certain threshold before pumping in investments towards local manufacturing

On the supply side, to get better ROI the manufacturers are waiting for demand to reach a certain scale before they shift manufacturing in-house. The consumers on the other hand are using innovative means to tackle the high upfront cost of buying an EV.

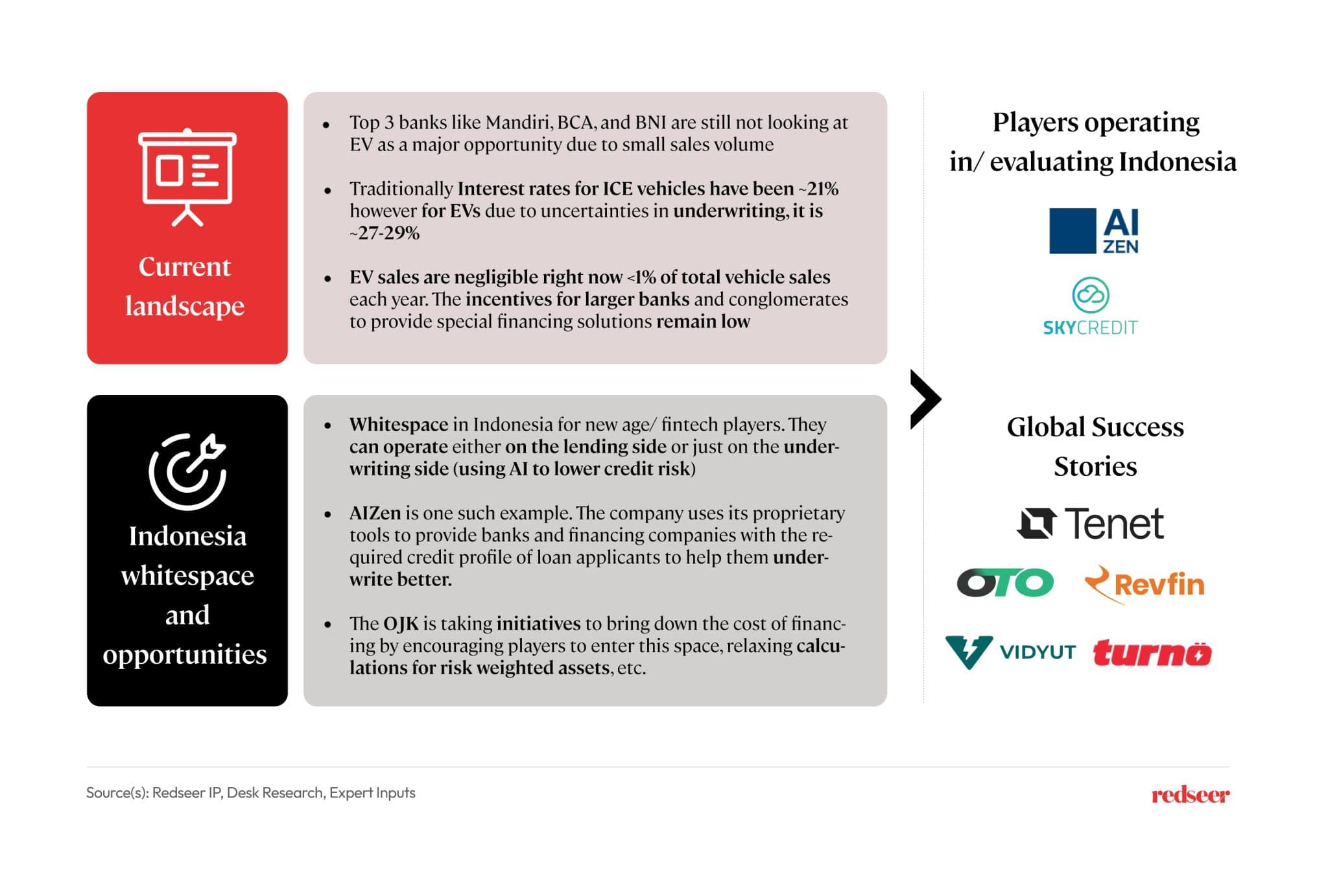

04. Within EV financing; white space exists with multiple innovations happening both on the lending side as well as underwriting processes

EV financing differs from traditional vehicle financing in the following areas:

- Data points required for underwriting/ risk management.

- Estimating residual value and secondary sales prospects.

New-age players are much nimbler, and quicker, and have lower barriers making them more effective and efficient. They can provide services on the lending side or even at the backend sharing critical underwriting data points with traditional financers aiding the growth of the green credit sector.

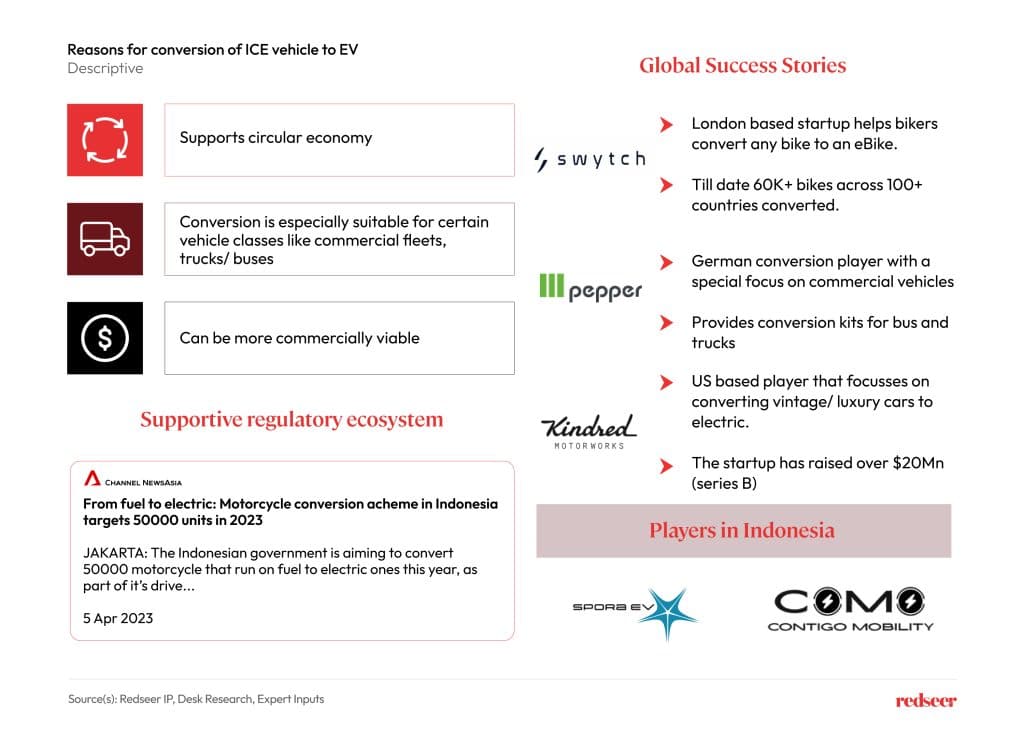

05. Indonesia with a dominant 2W market and proactive conversion scheme from the government is an appropriate market for conversion players to operate in

Converting an ICE vehicle to an EV instead of buying a new one has many benefits both from a consumer as well as environmental standpoint. It is also an effective way of preserving vintage or classic vehicles by increasing their lifespan. Conversion is the most effective for commercial vehicle fleets such as trucks, buses, etc. as the cost differential for conversion of 2W vs buying new E2W is not much.