Indonesia’s beauty and personal care (BPC) market is experiencing steady growth, driven by functional categories, increasing demand for halal-certified products, and the growing prominence of local brands. Homegrown players like Wardah, YOU, Something, and Scarlett are steadily challenging global giants, offering tailored solutions that align with consumer preferences for affordability, authenticity, and cultural relevance.

However, navigating this evolving landscape requires a balanced approach to growth, visibility, and profitability. This article explores the market’s key growth drivers and strategies, offering a roadmap for brands and investors looking to tap into Indonesia’s immense potential.

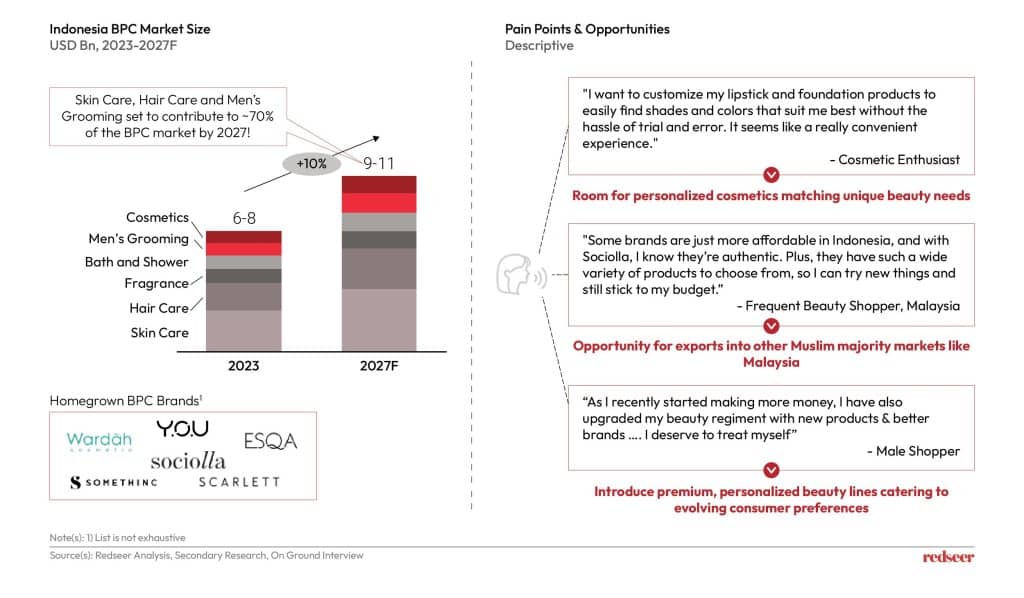

1. The Indonesian BPC market is growing with clear category leaders

Indonesia’s BPC market is set to reach ~USD 9-11 Bn by 2027, growing at 10% annually. With skincare, hair care, and men’s grooming set to contribute ~70% of the market, the focus remains on functional and essential categories. As consumers prioritize quality and value, the market is poised for sustained expansion, driven by an increasingly diverse product mix catering to evolving needs.

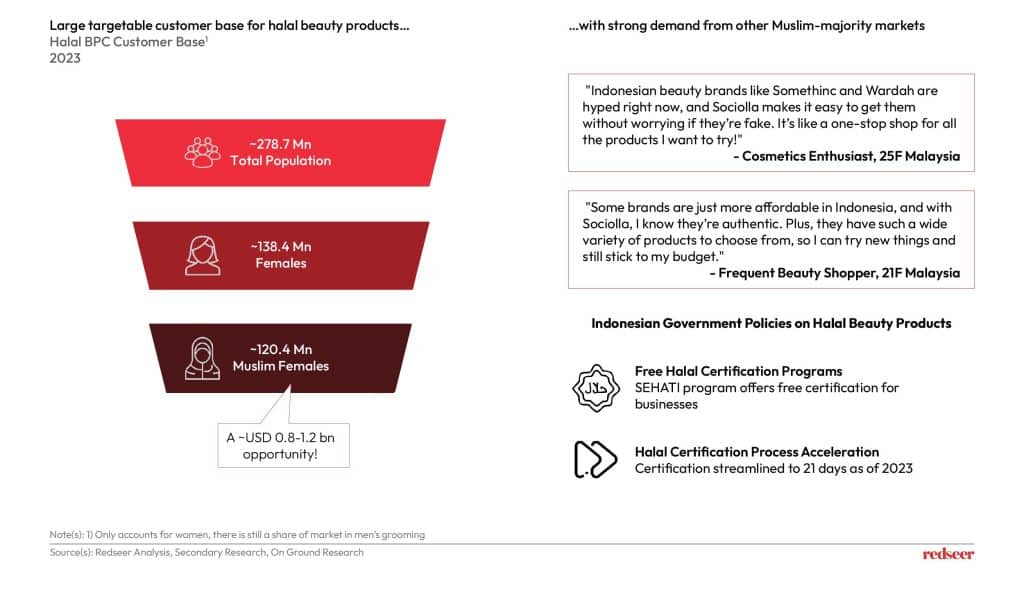

2. Halal beauty products are unlocking massive market opportunities

Want to get strategic guidance?

The halal beauty market offers a significant growth opportunity in Indonesia, home to over 120.4 Mn Muslim females. Government initiatives, such as the SEHATI program and streamlined certification processes, have made halal-certified products more accessible. Brands like Wardah are not only meeting domestic demand but also successfully expanding into neighboring Muslim-majority markets like Malaysia.

This growing regional momentum positions Indonesia as a key halal beauty hub, providing both local players and investors with opportunities to scale and lead this culturally significant segment.

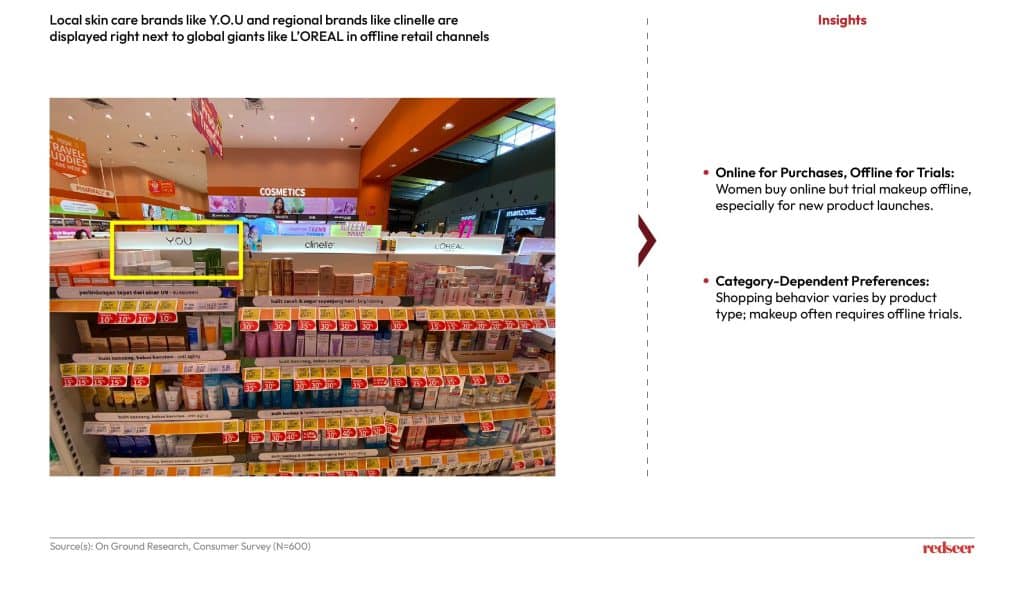

3. Rising local & regional brand visibility across offline retail channels!

Local and Southeast Asian brands are steadily gaining prominence in offline retail channels, sharing shelf space with global giants like L’Oréal. This increased visibility reflects rising consumer trust in brands that align with local needs—such as halal certifications and climate-specific formulations.

As consumers seek authenticity and affordability, local players like YOU and regional players like clinelle are resonating with loyal audiences by addressing cultural expectations and functional demands. This growing prominence in retail channels signals an important shift, with regional players now challenging even established international competitors.

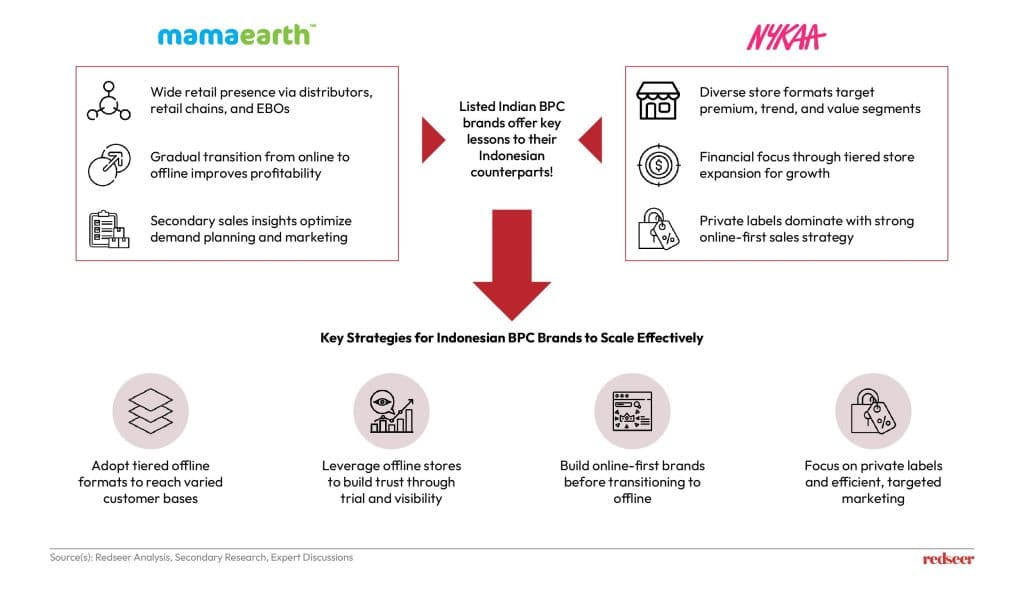

4. Key lessons from Indian BPC players for Indonesian brands

To unlock their full potential, Indonesian BPC brands can draw inspiration from successful strategies implemented by Indian players like Nykaa and Mamaearth. Nykaa’s adoption of tiered offline formats—ranging from premium to value segments—has allowed it to reach diverse customer bases effectively, while Mamaearth’s gradual transition from online-first to offline expansion improved profitability and visibility. Both brands have leveraged private label products and targeted marketing to build trust and scale efficiently. For Indonesian brands, balancing omnichannel growth, building trial-driven offline formats, and focusing on innovation in private labels will be key to capturing market share and driving sustainable success.

Indonesia’s BPC market stands at an inflection point, with homegrown brands like Wardah, YOU, Something, and Scarlett leading the way through culturally relevant and affordable solutions. This growth aligns with broader consumer trends, as Indonesian shoppers increasingly prioritize tangible skin health benefits, such as UV protection, and seek multifunctional products that simplify routines. Hybrid beauty products—seamlessly blending skincare and makeup benefits—are emerging as a game-changer, appealing to both skincare enthusiasts and makeup lovers.

This shift presents a unique opportunity for brands to differentiate themselves through hybrid innovations, natural formulations, and sustainable practices, building deeper consumer loyalty. For investors, Indonesia offers immense potential, not just domestically but regionally, through cultural ties with markets like Malaysia and Thailand. By strategically supporting brands that prioritize innovation, trust-building, and regional scalability, investors can unlock long-term value and position themselves at the forefront of Indonesia’s rapidly growing BPC market.