As 2024 draws to a close, India’s consumer landscape reflects an amalgamation of rapid innovation, evolving consumer preferences, and strategic adaptation. Each of the markets we’ve analyzed this year presents unique opportunities, underscoring the importance of deep market insights and targeted strategies—hallmarks of Redseer’s work.

Let’s check out 5 of our standout reports that encapsulate these dynamic changes.

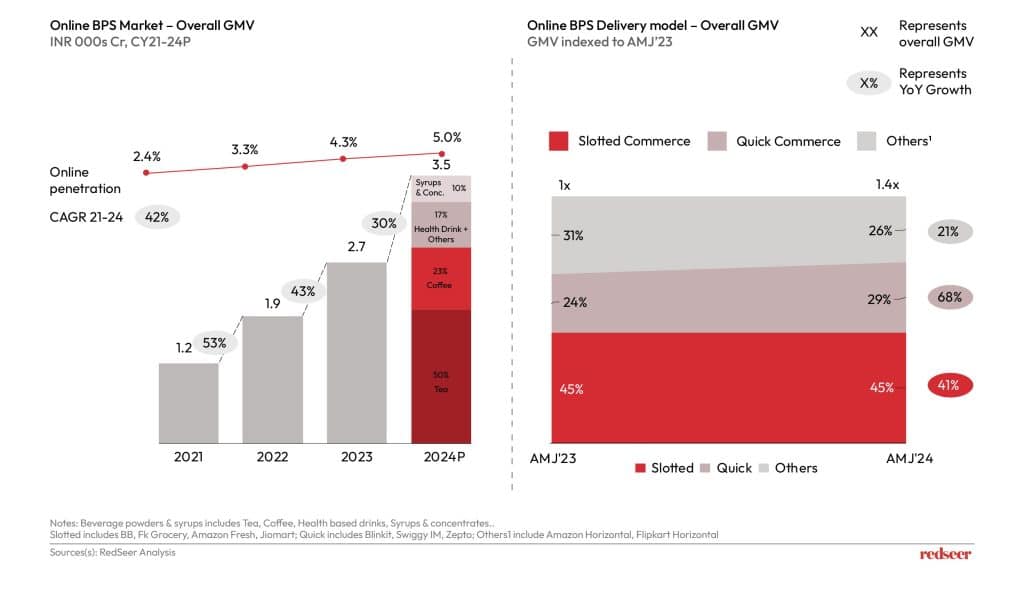

1. How D2C Beverage Brands are Transforming the Online Market for Powders & Syrups

In 2024, India’s beverage powders and syrups market experienced a significant transformation, driven by direct-to-consumer (D2C) brands. Valued at approximately INR 3.5K crore, the market has grown at a compound annual growth rate (CAGR) of around 42% since 2021.

These brands have capitalized on this growth by leveraging e-commerce platforms and quick commerce delivery models to reach a broader consumer base. Their success is attributed to rapid innovation, offering products like cold brews and personalized blends that cater to modern consumers challenging traditional incumbents, prompting a re-evaluation of market strategies… read more

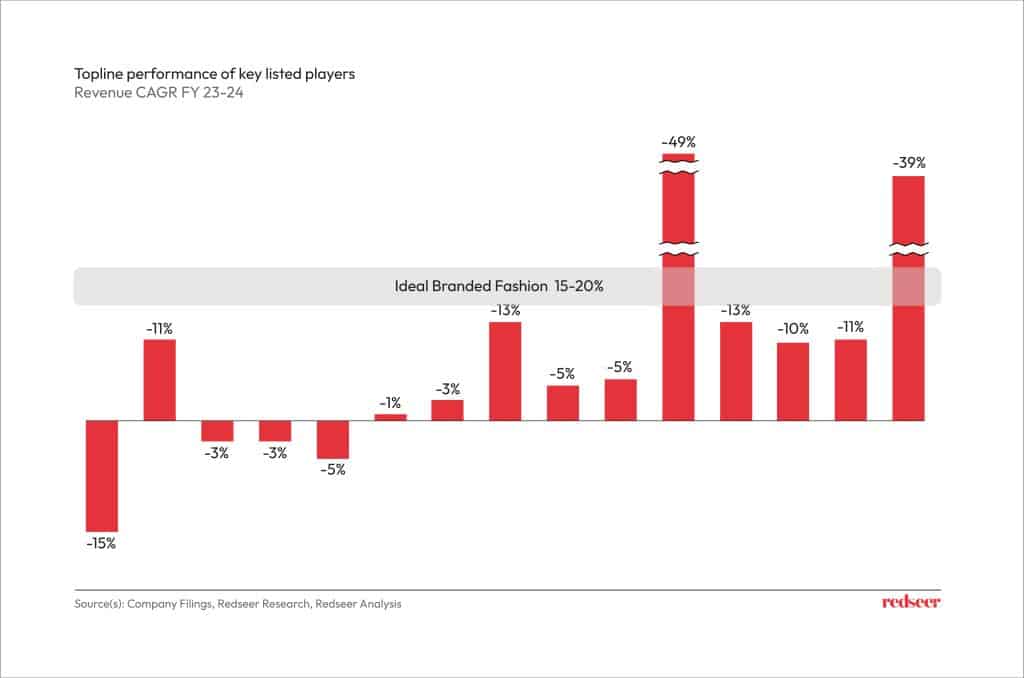

2. Decoding Indian Fashion Landscape: How Can The Fashion Industry Unlock Its Growth Potential?

The Indian fashion industry, which had a fountain of possibilities, has faced challenges in maintaining consistent growth, with publicly listed fashion players showing uneven performance in FY 2023-24. This stagnation is partly due to a disconnect between consumer demand and market offerings.

New-age, digitally native brands have intensified competition by aligning closely with evolving consumer preferences, such as the demand for trendy collections, faster deliveries, and size inclusivity. To unlock growth potential, legacy brands must …read more

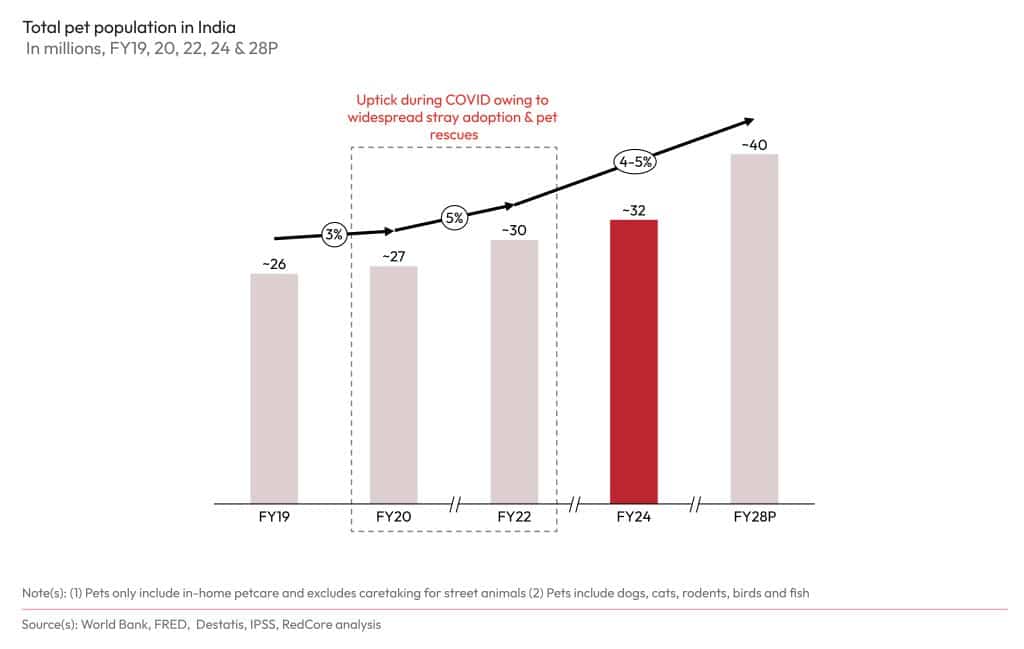

3. From Kibble to Care: Understanding India’s Evolving Petcare Market

India’s pet care industry has seen substantial growth, doubling its market size since FY20 to reach $3.6 billion in FY24. Pet parents are now seeking premium products and services, including health supplements, grooming, and specialized diets. Projections indicate that the market could reach $7-7.5 billion by FY28, presenting significant opportunities for businesses to cater to the evolving demands of pet owners who prioritize their pets’ well-being… read more

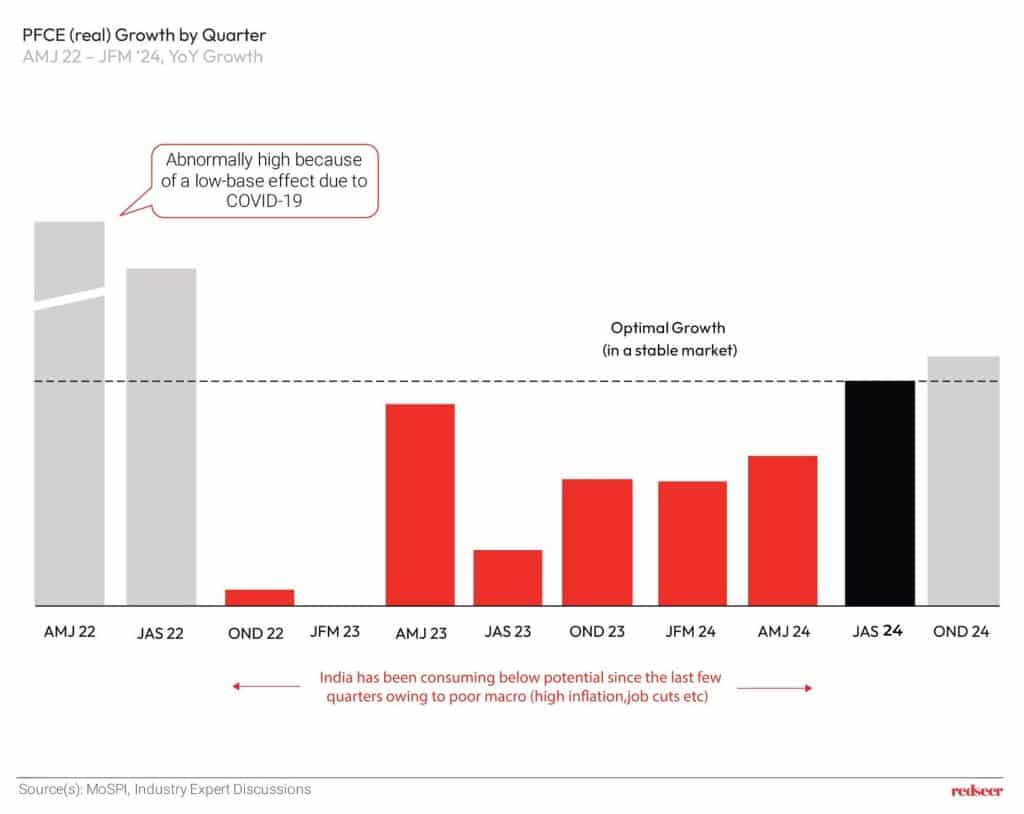

4. Festive 2024: Unveiling India’s Grand Consumption Revival

The 2024 festive season marked a significant revival in India’s consumption patterns. After a period of sluggish growth, real private final consumption expenditure (PFCE) showed signs of recovery, coinciding with the festive period. Factors contributing to this resurgence include decreasing inflation rates, pent-up demand from various consumer segments, and increased rural consumption supported by rising real wages and favorable monsoon forecasts…read more

5. India’s Q-Commerce Ascent: A New Era in Shopping

Have a question?

Our experts are just a click away.

In FY24, the Q-commerce market experienced a growth rate of 70-75%, outpacing traditional e-commerce. This has rapidly become an integral part of urban Indian life, offering expedited delivery services that cater to the demand for convenience. Projections for FY25 indicate continued expansion, with an expected market size of approximately $6 billion.

This growth is driven by an increasing user base, higher ordering frequency, and diversification into non-essential categories. The proliferation of dark stores and a focus on top-tier cities have …read more

Closing 2024: Opportunities Ahead

2024 has been a very important consumer-driven industry as it continues to solidify its foothold. The rise of D2C brands, the evolution of the fashion and petcare industries, a revival in consumer spending during the festive season, and the rapid ascent of Q-commerce all highlight the dynamic nature of India’s consumer market. As we close the year, India’s economy reflects a complex interplay of innovation and resilience. Quick Commerce (QC) has had its breakout year, setting the stage for explosive growth in the coming years, while sectors like value retail and consumer-driven industries continue to perform well.

Looking ahead, 2025 promises robust growth in themes like tech IPOs, manufacturing shifts, and pioneering financial services models, alongside strengthened growth strategies around consumer themes and new-age brands across categories. At Redseer, our insights and strategies are designed to empower businesses to navigate this dynamic environment, ensuring profitability and sustained competitive advantage.

Reach out to us to learn how we can help you drive profitability and sustain competitive advantage in today’s volatile market.