Quick Commerce (Q-Com) is transforming the retail landscape by providing ultra-fast delivery and convenience, often in as little as 10 minutes. By 2025, it’s projected to represent a $6 billion market in MENA, surpassing 10% of the region’s online retail share. With rapid growth across categories, evolving consumer preferences, and innovations in delivery modes, Q-Com is emerging as a major force in the next retail revolution.

Want to get strategic guidance?

In this edition, we’ll explore the rapid evolution of the MENA Q-Com market. Here’s what you can expect:

- The impact of non-grocery categories like Pharmacy in Q-Com

- UAE’s disproportionate contribution to the MENA Q-Com market

- Potential future innovations in the space

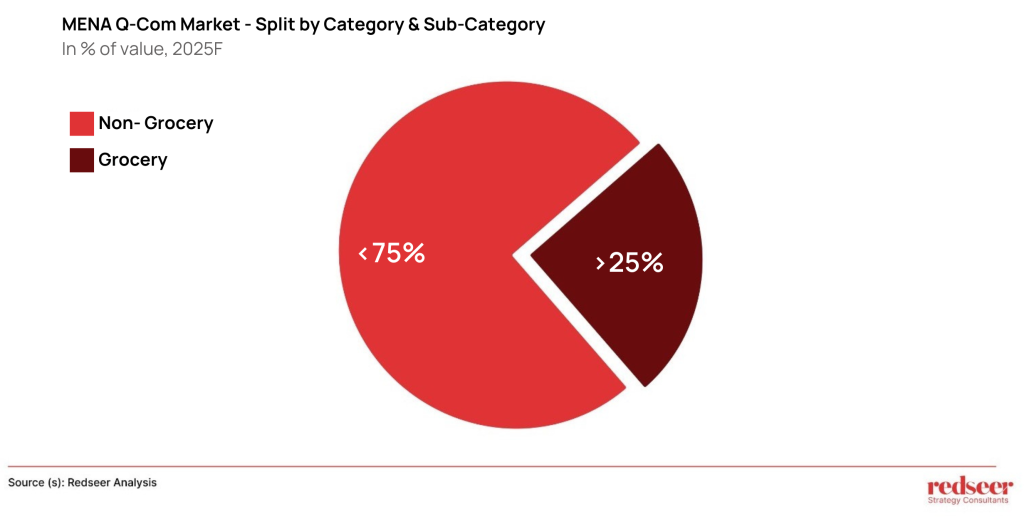

Did you know? Non-grocery will account for >25% of Q-Com Retail spend in MENA in 2025.

Non-grocery quick commerce is set to capture over 25% of the MENA Q-Com market by 2025, fueled by shifting consumer preferences and higher profit margins. In Saudi Arabia and the UAE, pharmacy leads the non-grocery segment, while beauty and personal care emerge as the next major growth driver. Even electronics is gaining momentum as convenience becomes a top priority for consumers and providers continue to innovate to meet demand. This diversification highlights Q-Com’s evolution beyond its grocery-first origins, positioning it as a transformative force within the retail landscape.

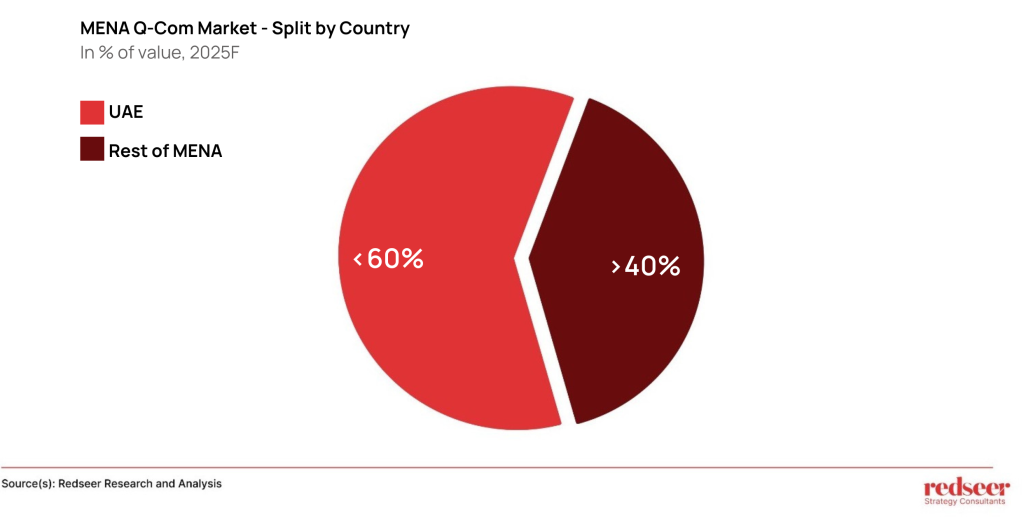

UAE boasts of the largest market and will contribute to >40% of MENA Q-Com in 2025P

The UAE dominates the Q-Commerce landscape in MENA and will account for more than 40% of the market by 2025. This leadership is fueled by high urbanization, extensive internet penetration, and strong consumer spending power. In its early years, growth was largely driven by rapid adoption. However, as the segment matures, the focus has shifted to increasing wallet share. Consumers are now placing orders more frequently and exploring non-grocery categories, which have become a significant growth driver. With approximately 30% of the UAE���s Q-Com market stemming from non-grocery categories, the country stands out as the most mature Q-Com market in the region, setting the benchmark for innovation and diversification within the sector.

Opportunities for “Quick” Beyond Traditional Delivery

By leveraging existing infrastructure and venturing into innovative service extensions, Q-com platforms can adapt to evolving consumer needs, while driving new revenue streams.

Here are two standout examples from global markets that illustrate how Q-Com can transform into comprehensive hubs for instant services:

- In-(Dark) Store Kitchens: Indian Q-Com brand Zepto has introduced in-store kitchens, branded as Zepto Cafes, within its dark stores. These Cafes offer ultra-fast-food delivery, faster than standard food delivery times, alongside Zepto’s grocery and non-grocery offerings. With over 100 Cafes and growing rapidly, this model maximizes infrastructure use, increases customer retention, and meets the surging demand for convenient dining options.

- Multifaceted Service Model: In China, from on-demand retail and hotel bookings to 30-minute home appliance deliveries through partnerships like Midea, Meituan has evolved into a hub for instant services. This multifaceted approach not only unlocks diverse revenue streams but also enhances platform stickiness and usage.

Platforms in our region have already started taking steps toward similar innovations, paving the way for Q-Com to redefine convenience in entirely new ways.

The ongoing expansion of Q-Com is poised to redefine the retail landscape, transforming how consumers shop, and businesses operate. One thing is certain: “quick” is here to stay.

We hope you found these insights useful. We actively track the MENA quick commerce market. Please feel free to reach out to us for a more detailed discussion.