Since I was about ten, I’ve imagined many possible careers, but never in law. The idea of sifting through endless legal texts held zero appeal for me and I suspect it’s the same for most people.

Have a question?

Our experts are just a click away.

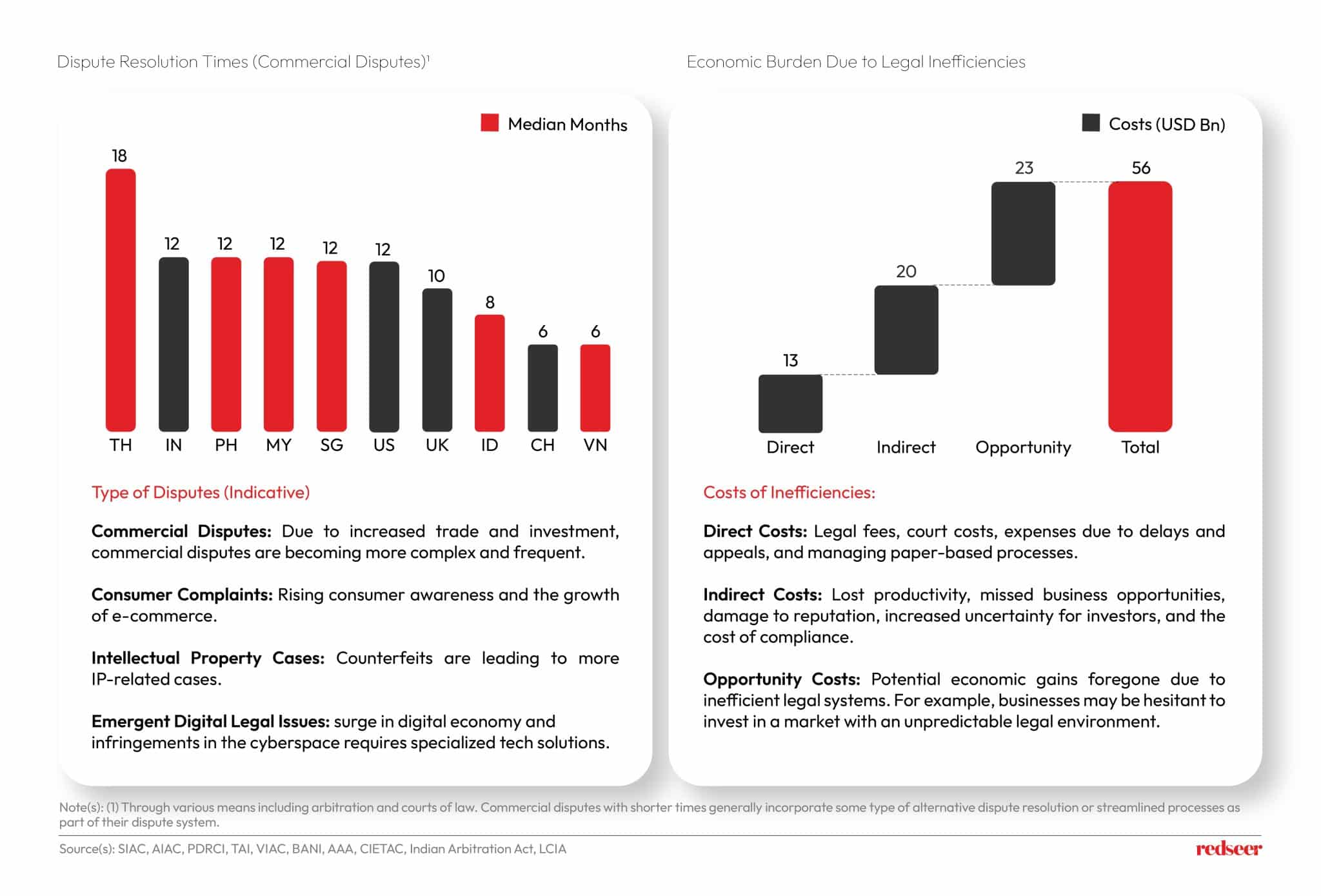

While rules and laws are undoubtedly necessary, they are often complex, cumbersome, and burdensome to navigate. This complexity leads to high economic costs, both direct and indirect, as well as missed opportunities. The total impact adds up to more than a cool USD 55 Bn in Southeast Asia!

Solution? Simpler rules and a technological boost.

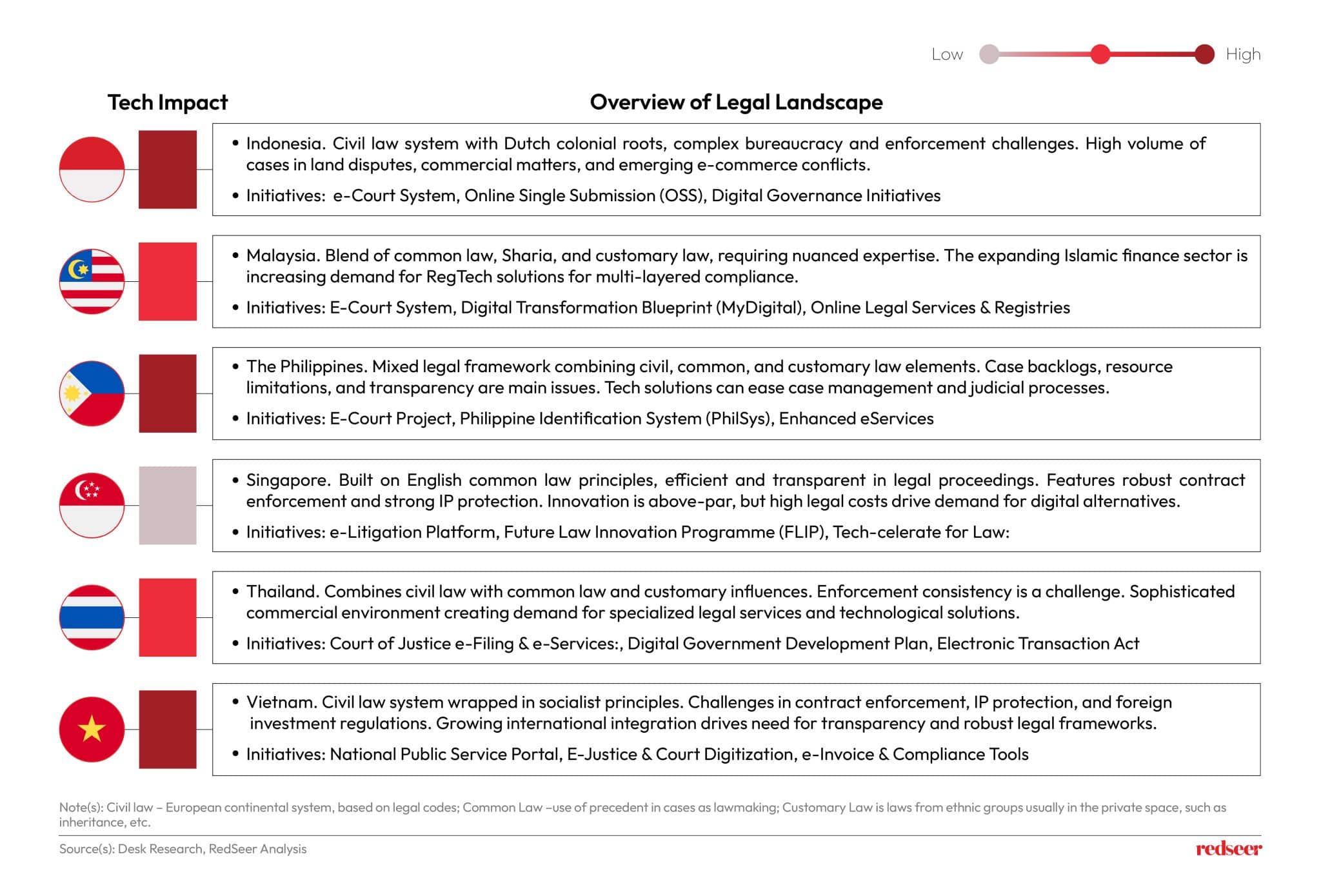

With suitable tech interventions, legal and regulatory tasks can become much more manageable. We think Indonesia, Vietnam, and the Philippines could benefit the most from these solutions.

As technology transforms the legal landscape, a career in law may become more dynamic, efficient, and, dare I say, interesting. Details follow.

We’d love to hear your thoughts on how you see this sector developing.

Legal inefficiencies lead to more than USD 55 Bn in annual economic costs!

77% of costs due to indirect losses and missed opportunities

Consumers and businesses in Southeast Asia lose an estimated USD 56 Bn annually due to legal complexities and delays. For instance, resolving a commercial dispute can take months or even years in some countries, leading to significant financial losses. Furthermore, the lack of transparency and predictability in some legal systems deters foreign investment.

Technological interventions can reduce friction and unlock tangible gains

Vietnam, Indonesia, and the Philippines could benefit the most

Southeast Asian countries maintain distinct legal frameworks while facing common challenges: bureaucratic inefficiencies, prolonged case resolution times, and inadequate digital legal infrastructure.

Legal cases involving consumers, SMEs, and corporations have surged following the implementation of small claims and consumer dispute resolution mechanisms. Improved access to justice has led to increased litigation across all segments. Business disputes, contract breaches, and regulatory compliance cases continue to rise with economic expansion and growing legal awareness.

Key trends include:

- Consumers: Rising litigation in consumer protection, e-commerce disputes beyond platform mechanisms, and financial fraud cases.

- SMEs: Contract enforcement and intellectual property issues represent primary legal concerns

- Corporations: Surge in regulatory compliance cases and data privacy violations due to stricter financial and cybersecurity enforcement

Trivia: A distinctive feature of SEA is the presence of Islamic/Sharia law, particularly in Malaysia, Indonesia, and Singapore with their substantial Muslim populations. This typically applies to commercial matters like banking and transactions, though parties may choose this system. UAE and KSA are major adopters of Sharia commercial laws.

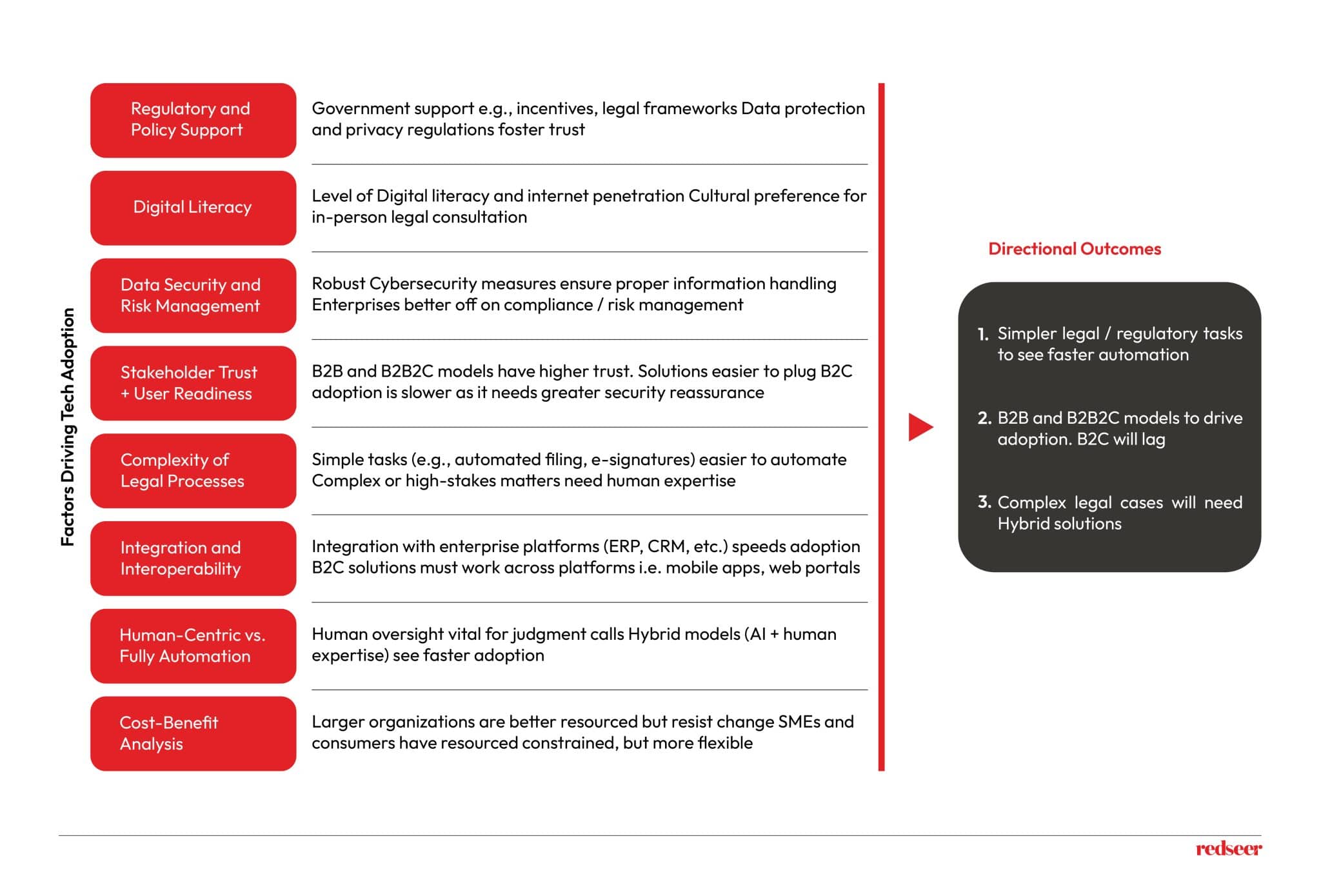

Regulations, digital reach, and enterprise readiness to drive widespread adoption

Simple tasks and B2B models to lead tech integration in legal

The adoption of RegTech and LegalTech is influenced by several factors, including regulatory support and clarity, digital penetration, and the willingness of corporations to integrate technology quickly.

The economics of adopting technological tools compared to relying on human capital (likely cheaper in the short term) and cultural preferences also play a crucial role as well.

Overall, we expect that simpler legal and regulatory tasks will experience faster technology adoption, particularly among large B2B and B2BC companies.

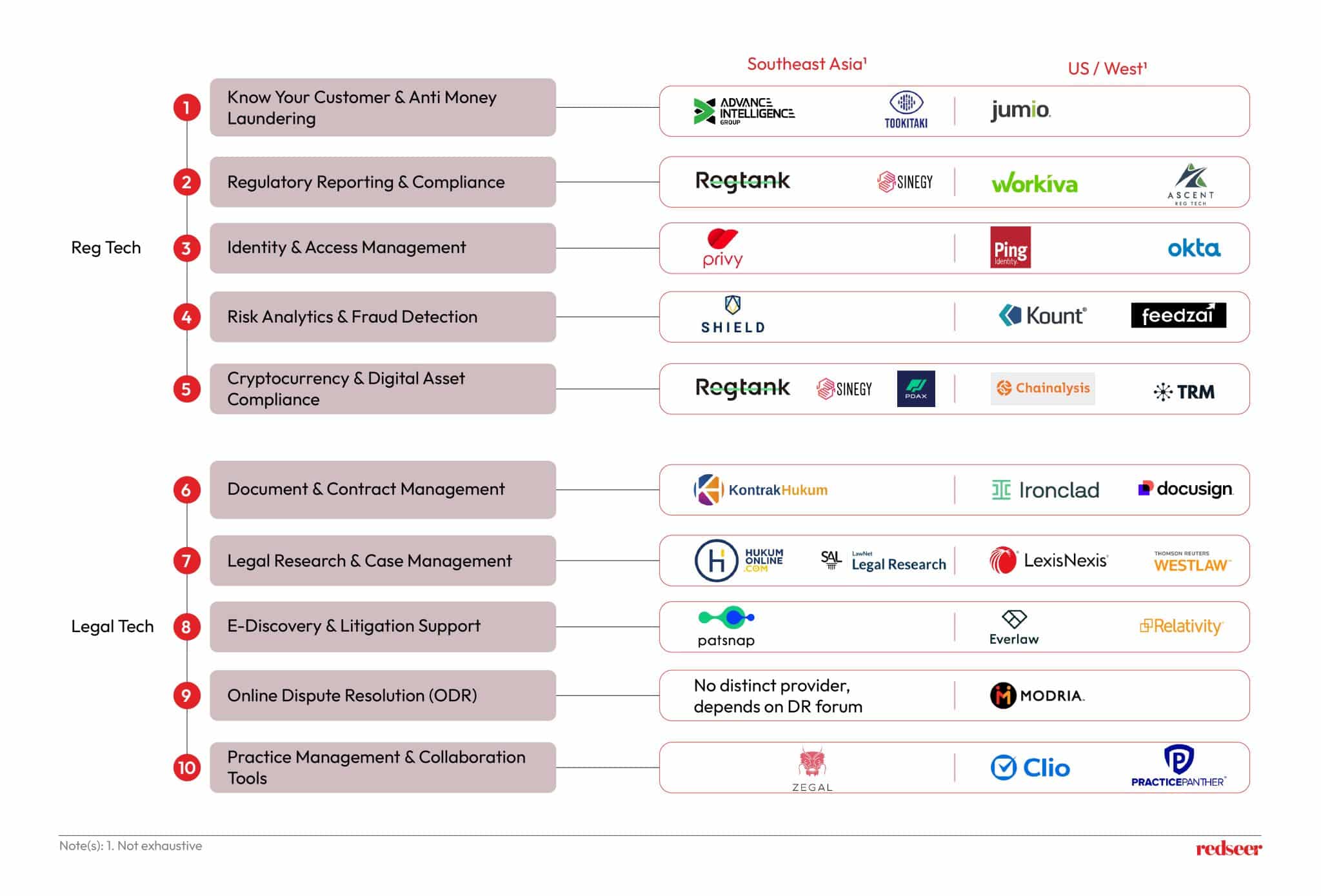

Legal and Regtech applications set to proliferate in Southeast Asia

Leading US/Western players highlight the sector’s growth potential

LegalTech and RegTech ecosystems are inherently national, shaped by distinct legal systems and regulations. This creates opportunities for local innovators to address market-specific challenges.

Beyond serving law firms, these companies can tap into Southeast Asia’s accelerating digital initiatives—particularly in Indonesia, Malaysia, and Vietnam. For instance, Indonesia’s Supreme Court (Mahkamah Agung RI) introduced an e-court system for remote hearings, yet behind-the-scenes processes remain outdated, underscoring opportunities for LegalTech and RegTech to streamline public services.

While the U.S. enjoys robust investment, established digital frameworks, and a strong compliance culture, Southeast Asia’s RegTech and LegalTech sector is expanding rapidly but remains uneven. Countries like Indonesia, Vietnam, and the Philippines hold vast potential for efficiency gains, though success depends on local governments embracing tech-driven models.

Singapore is at the forefront in the region, offering fertile ground for RegTech and LegalTech to flourish. Leading players such as PatSnap and TookiTaki provide an interesting template for other startups in the region to extend their reach to multiple countries.