Stepping off the plane in Hanoi, I was amazed by the airport’s quiet efficiency. It was clean and functional but without any frills or extravagance. This “practicality” appeared to be a defining trait of the city. A relentless focus on work and progress.

Want to get strategic guidance?

Vietnam’s economy has grown on the back of traditional sectors like Consumption, Manufacturing, and Tourism. However, this is changing.

Local players in AgriTech, Digital Media / SaaS, Electric Vehicles, FinTech, Logistics, etc., are gaining scale, signalling a shift toward a more dynamic and innovation-driven future.

My friends in Vietnam suggest that if the government policies turn more business-friendly and capital flows more freely, the emerging sectors could grow faster, unlocking Vietnam’s next phase of growth. More details below…

A Remarkable Story of Economic Growth

From a modest USD 31 Bn economy in 2000 to a robust USD 433.7 Bn in 2024, Vietnam’s growth has been exceptional. Per capita income has soared more than tenfold, from USD 433 to USD 4,500. This growth has been broadly distributed, with policies driving equitable economic benefits, somewhat reminiscent of China’s economic model.

Strong Cultural and Economic Ties with China

Hanoi, with its proximity to China, displays strong cultural and economic ties. Chinese culinary influence is pervasive, with many restaurants catering to tourists and business travelers.

Korean restaurants are also common, reflecting the growing number of South Korean visitors. The architecture, cuisine, and urban planning in the southern part of Hanoi reflect the influence of French colonial rule in the country.

Regional economic hubs

While Hanoi remains significant, Ho Chi Minh City outpaces it in economic vibrancy, serving as the primary business hub in Vietnam. Many companies establish themselves in Ho Chi Minh City before expanding to other regions like Hanoi and Da Nang.

Regional economic hubs

While Hanoi remains significant, Ho Chi Minh City outpaces it in economic vibrancy, serving as the primary business hub in Vietnam. Many companies establish themselves in Ho Chi Minh City before expanding to other regions like Hanoi and Da Nang.

Thriving F&B Businesses

Coffee shops are ubiquitous, with shops available every few meters in Hanoi. Leading F&B chains:

- Highlands Coffee: over 800 stores nationwide

- Trung Nguyen Legend Coffee: ~700 stores

- Phuc Long Coffee & Tea: >150 stores in 2024

- Other leading restaurant chains include Pho 24, Golden Gate Group, Kichi-Kichi

Some of these companies have achieved sufficient scale to attract Private Equity investments. We expect the F&B sector to attract more investments going forwards.

Booming Tourism Sector

Vietnam is expected to welcome 17 Mn international tourists in 2024, surpassing Singapore’s numbers. The tourism industry, contributing ~ USD 27 Bn to the economy, is seeing a surge in visitors from South Korea, China, India, and beyond. The country ranks as the third-most-visited in Southeast Asia, with a 40% increase in international visitors from 2023.

The Manufacturing Powerhouse

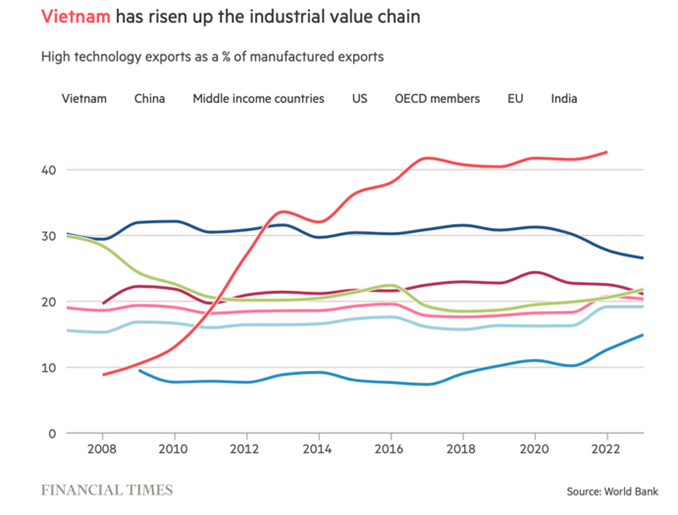

Vietnam is rapidly becoming a global manufacturing hub, contributing nearly 25% of the GDP and attracting significant foreign investment, USD 23.5 Bn in 2024.

With competitive wages, a strategic location, and the “China-plus-one” strategy, Vietnam is a preferred manufacturing base. Its key export items include smartphones, clothing, and furniture.

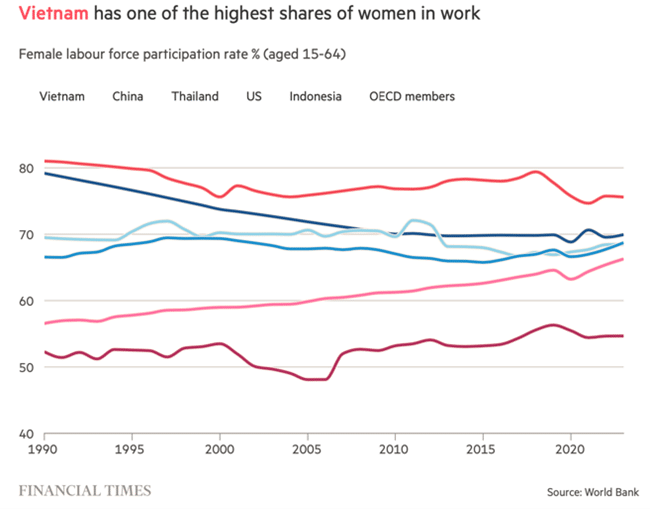

Vietnam’s high female workforce participation and low labor-related issues are helping it build its manufacturing capabilities rapidly. In Hanoi, it’s common to see women riding bikes to work, a symbol of the country’s dynamic labor force.

Looking Ahead: Opportunities and Hurdles

Near-term Focus: Mitigating Geopolitical Risks

Vietnam’s export growth to the US is remarkable, but managing trade risks is a key concern. Exports to the US reached $136.6 billion in 2024, with a record trade surplus of $123.5 billion.

Medium-term Focus: Regulatory Environment and Access to Capital

Vietnam has made strides in improving its business environment, ranking 70th in the World Bank’s Ease of Doing Business report (2020). However, challenges remain in areas like resolving insolvency and starting a business, where Vietnam ranks 122nd and 115th globally, respectively. Access to domestic capital remains constrained, creating opportunities for startups that can secure international investments.

Longer-term Focus: Enhancing Education and Skill Development

Vietnam excels in primary education but faces challenges in tertiary education and English proficiency. The enrollment rate in tertiary education is only around 30-35%, and English proficiency lags behind peers like Singapore and the Philippines. The demand for English language training is high in major cities like Hanoi and Ho Chi Minh City.

Vietnam’s Rise Calls for Investor Attention

Vietnam’s rapid modernization is unlocking new opportunities and propelling the country onto the global stage. Its deepening role in global supply chains and rising foreign investment make it a market that demands attention. Investors who leverage its strengths while navigating its complexities stand to gain in this dynamic and fast-evolving economy.