Media these days is abuzz with talk of funding winter and how Indian startups with high valuations and losses are going to struggle if they do not find the path to profitability. Are things really as difficult for the Indian startup ecosystem on profitability front? Let’s take a deep dive into the financials of Indian Unicorns and Soonicorns to see how the Indian startups are doing vis a vis their EBITDA and path to profitability.

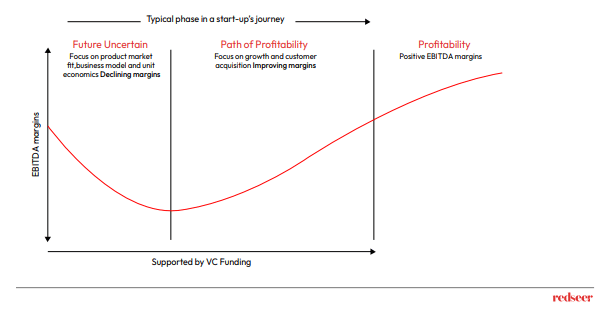

1. A typical start-up’s journey involves 3 phases to profitability during which they are supported by funding & robust strategy

To enable the comparison of hundreds of companies, we divided a typical technology startup journey into three phases. The first phase is one of uncertain future, where the company is looking for the right product-market fit, business model and unit economics. This is followed by a rapid growth phase till the company reaches the third phase of profitable operations. Companies make losses in the first two phases, funded by venture capital. However, the second phase typically will see an improvement in EBITDA margins. Therefore, we label this phase 2 as ‘Path to Profitability’.

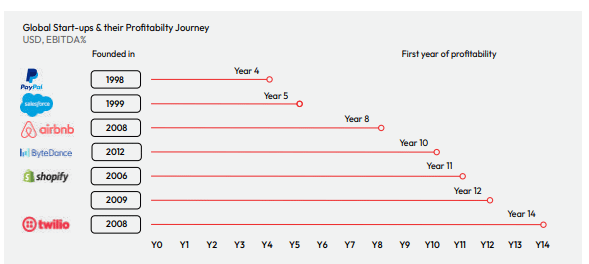

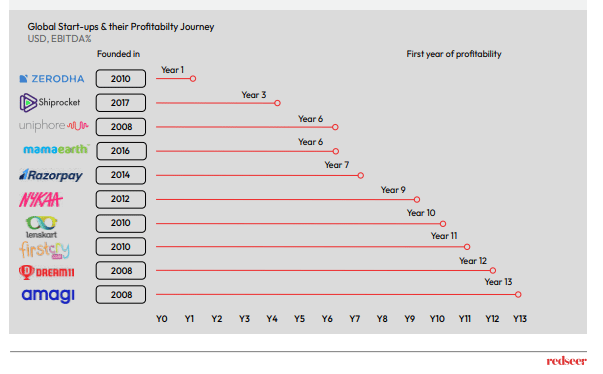

2. Globally, it takes several years for a startup to become profitable, and India seems to be no different

Global most well known tech startups have taken over a decade to get profitable. Indian firms too have followed a similar profitability path across multiple sectors. Indian SaaS startups, which are typically serving US market with lower labour costs have got profitable faster

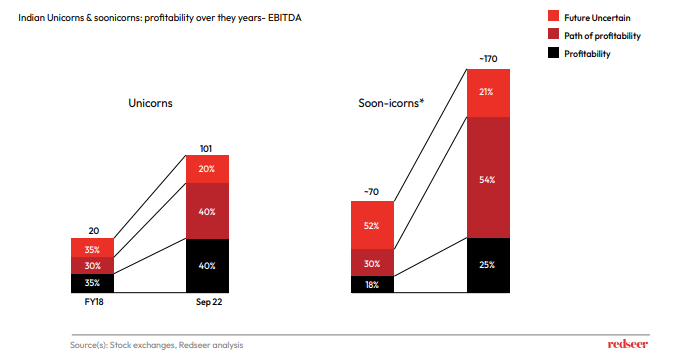

3. Looking deep, a good 80% of unicorns and soonicorns are profitable or on the path

We looked at FY2021 reported EBITDA of ~270 Unicorns and Soonicorns. It was a pleasant surprise for us to note that over 80% of them are profitable or. Further the number of Unicorns and Soonicorns has increased rapidly over the last 4 years.

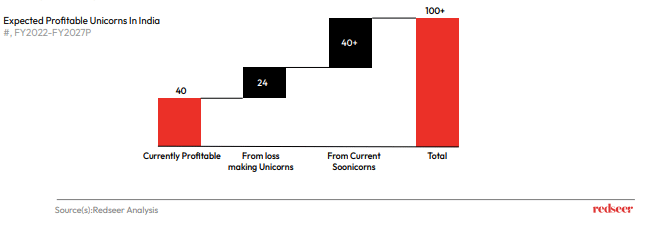

4. And in the next 4-5 years, India is expected to have 100+ profitable unicorns

Funding situation has become difficult this year and expected to be tight for next 3-4 quarters. Indian unicorns, which grew in an easy liquidity environment are facing challenges and taking action to reduce costs and enhance capital efficiency. While some companies will struggle, we expect several of the currently loss-making unicorns to turn profitable and many Soonicorns to also emerge stronger.

These large profitable companies together will have revenues of over $100 bn, provide sizeable employment and capabilities to the country and will have a transformative impact on the economy.