Baht Bytes: Spotlight on Thailand’s On Demand Services

“Can Thailand, the second-largest economy in Southeast Asia spring a surprise in the consumer internet space?” queried our friend at a regional Venture Capital. As we looked for answers, we could not miss the country’s high household affordability levels and the digitally well-connected population. As we dug in, we noticed that while there have been only a few sizeable startups in the past, the situation is evolving fast, offering a glimpse of what could be in store.

Have a question?

Our experts are just a click away.

On zooming into two relatively larger sectors – online ride-hailing and food delivery – we noticed that the need for convenience and the consumers’ ability to pay for it is driving rapid growth in those two segments. Together, the two sectors have scaled ~ USD 5 Bn in size and are on track for sustained growth.

Unsurprisingly, both sectors have attracted interest from new competitors. However, the market leaders have consolidated their position in recent years. Weaker players are exiting and creating an opportunity for others to focus on profitability.

The emerging pattern suggests that by right sizing the market opportunity, differentiating from competition, and maintaining a keen focus on profitability we could find more consumer internet success stories coming out of Thailand…and the rest of Southeast Asia.

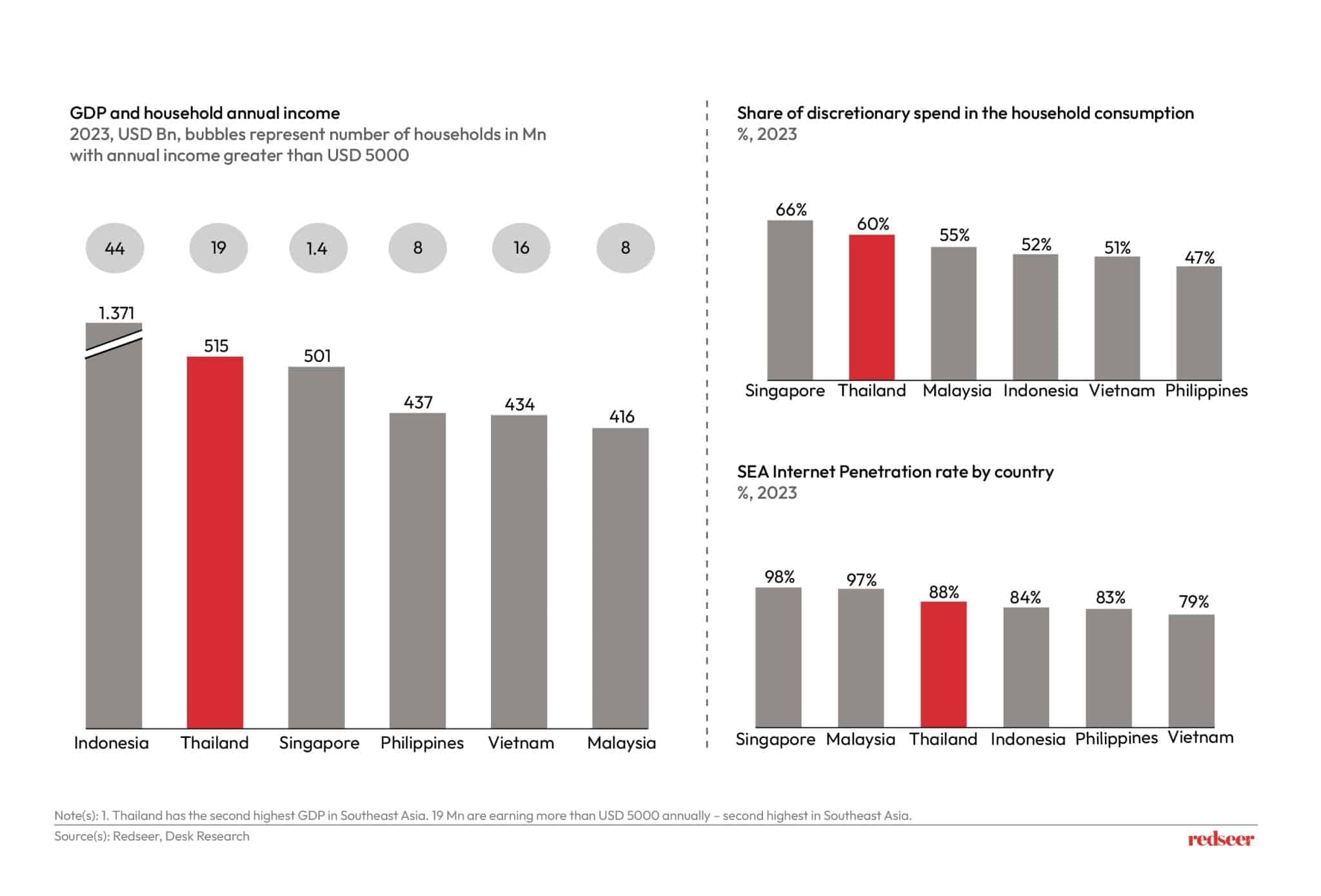

1. Thailand is large, well-off1 and digitized

USD 500 Bn+ economy, high affordability1 and internet penetration presents opportunities for consumer internet companies

Thailand is the second-largest economy in Southeast Asia in terms of GDP. With 19 Mn households having annual income greater than USD 5000, Thailand is a robust middle-income country offering various opportunities to the online sector. These 19 Mn households account for ~90% of the Thai households and in absolute terms, this number is behind only Indonesia in the region.

Further, in terms of discretionary spending as a % in the overall consumption – the country again ranks second. This demonstrates the ability of the population to spend on discretionary items like ordering food online, online streaming, and travel, among others.

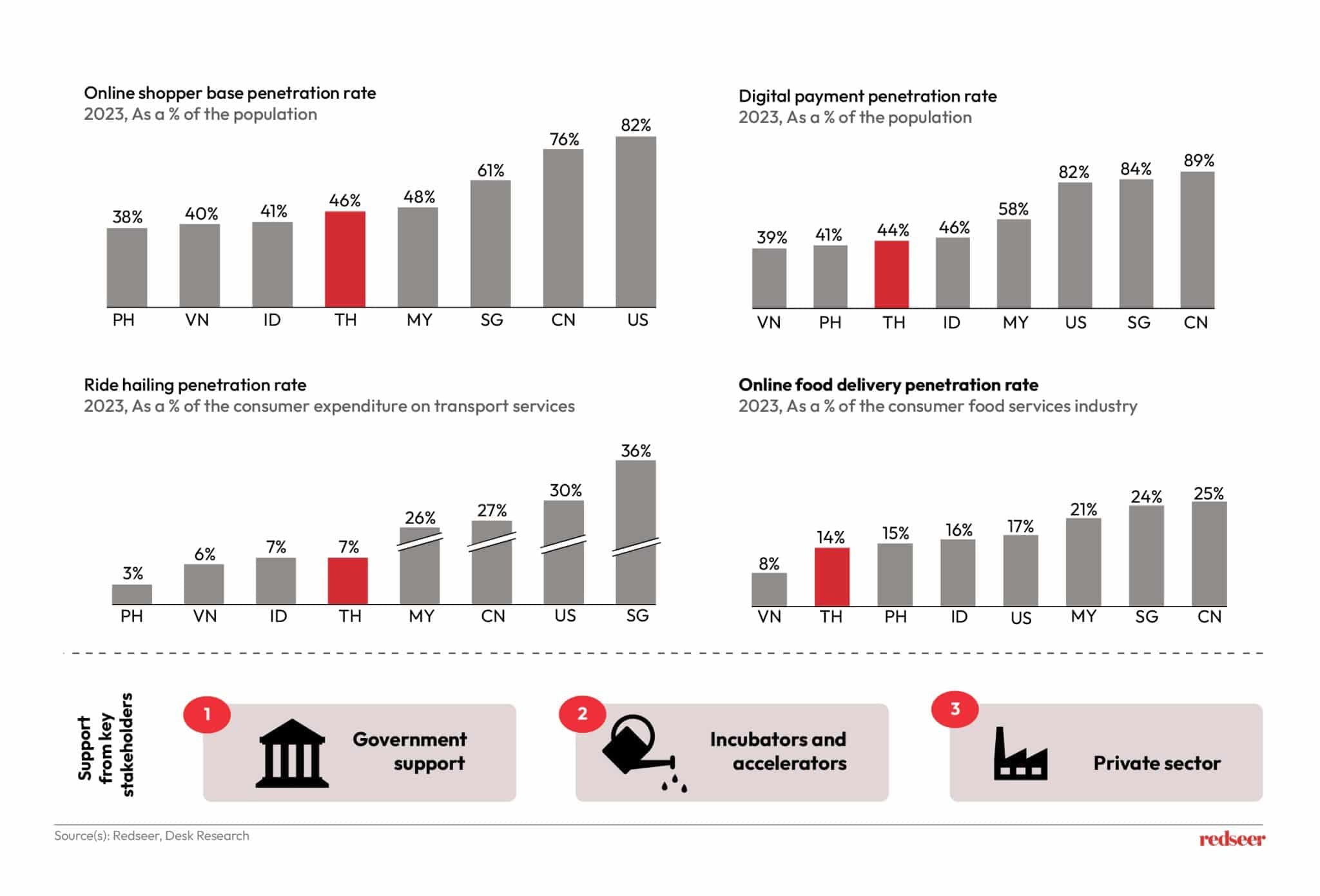

2. Consumer digital services are taking off…

Benchmarking digital penetration rates with peer countries suggest significant headroom for growth backed by coordinated support from key stakeholders

The consumer internet sectors in Thailand are largely underpenetrated compared to peer countries in the region. The sectors provide vast untapped potential for players to capture in the coming years. On top of that Government, Private Sector and Start-up builders’ collaboration is creating new opportunities for the ecosystem.

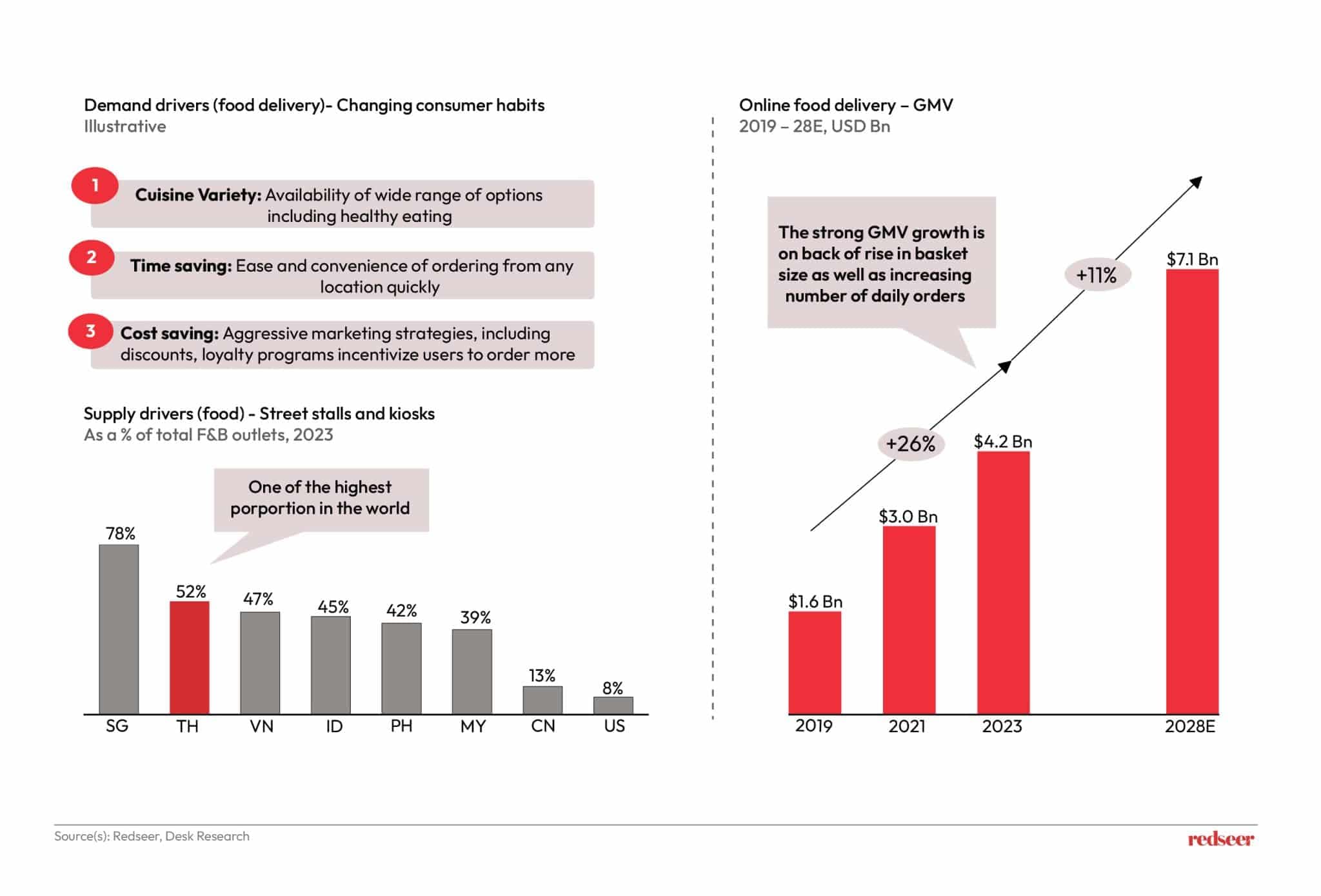

3. …and On-Demand Sectors are gaining scale at rapid clip led by online food…

Segment is already towering at $4.2 Bn, and the expected growth rate continues to be in double digits

The GMV growth for food delivery is driven by multiple demand and supply side factors, such as:

Demand drivers

Urbanization, changing lifestyles, healthy eating/ multi-cuisine eating options delivered quickly and conveniently

Supply drivers

With highly fragmented nature of the F&B outlets in Thailand, the services of food delivery players become extremely crucial

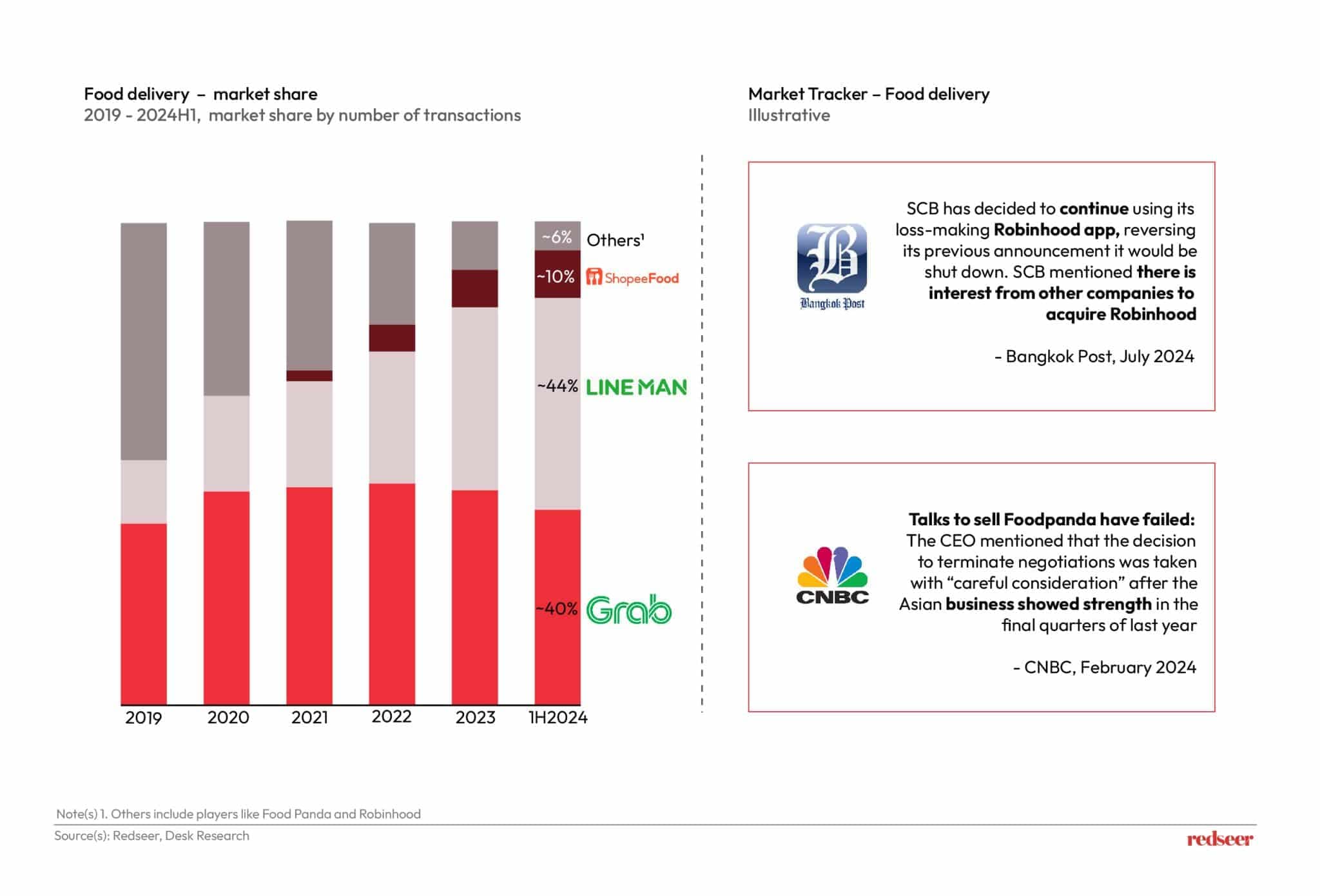

4. …. with competition remaining dynamic for the segment

Market leaders are demonstrating strong network effects and scale benefits to consolidate position

The competitive landscape in Thailand has been evolving quite rapidly, with the top two players swapping positions in terms of market share. This is a result of strategic M&A activity for LINE MAN in 2020 leading to improved operational synergies for them. Meanwhile Shopee Food, leveraging its horizontal platform capabilities and user base is on the rise. Overall, the market appears to converge towards a duopoly structure, with a potential third contender.

Strategies working well for the leaders:

- Spreading delivery assets across food and ride networks to optimize cost

- Optimizing the take rate strategy i.e. balancing low-commission model with regular pricing to build up supply pools

5. And similar trends being observed in ride hailing as well

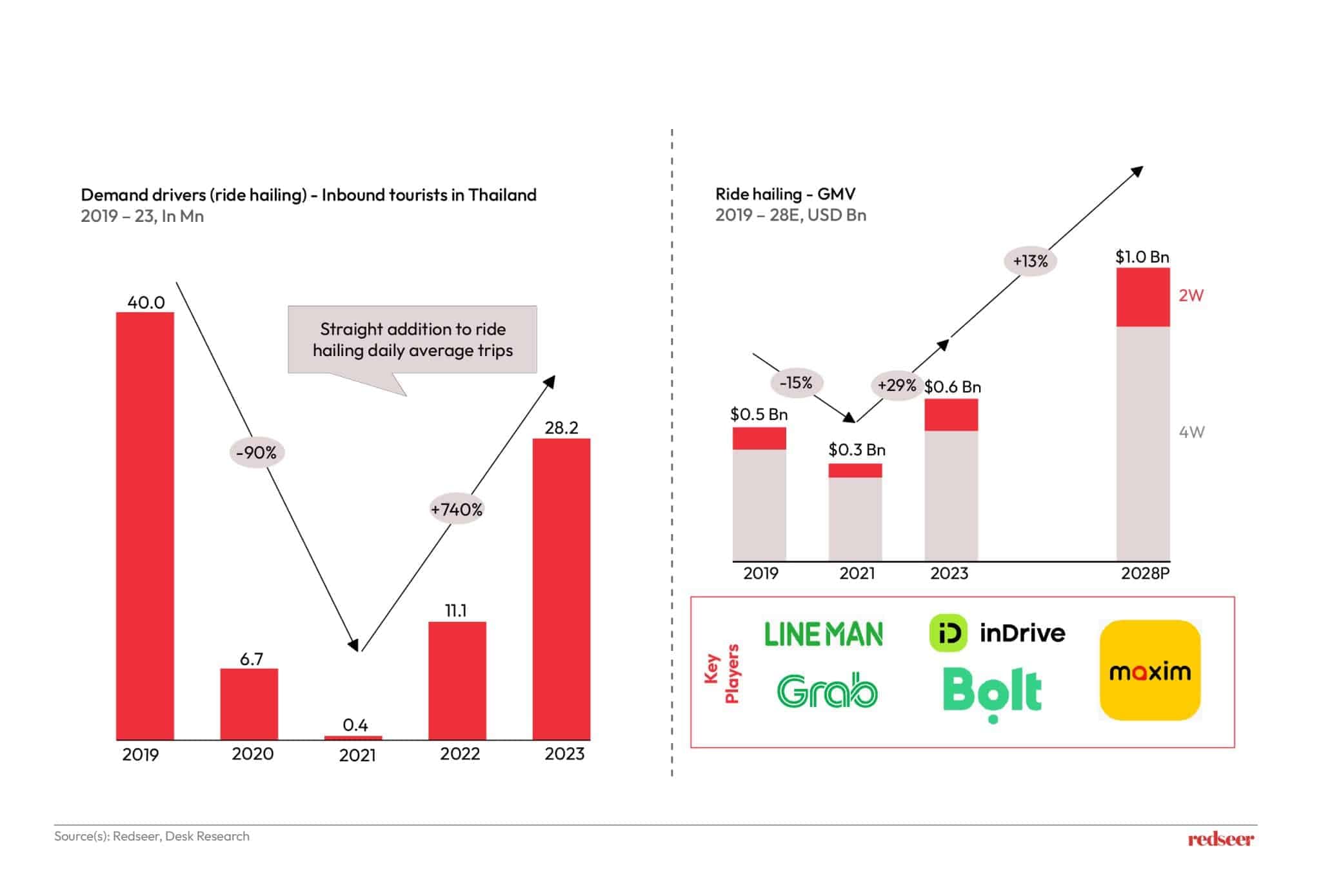

Ride hailing market is poised to double in next 5 years to emerge as a billion-dollar opportunity

The ride hailing market expansion is led by factors such as a resurgence in tourism, a rise in vehicle and driver availability, changing population behavior and other strong demand/ supply influences.

In ride hailing, competition has been in the flux but that has not stopped the top 3 players from consolidating their market position – collectively holding ~85%+ market.

LINE MAN has been effective in leveraging its existing fleet in Bangkok. It would be interesting to see how it scales up across the country by leveraging its experience and extensive food-delivery network footprint.

6. Tailoring success: Leveraging ODS learnings across sectors and boundaries

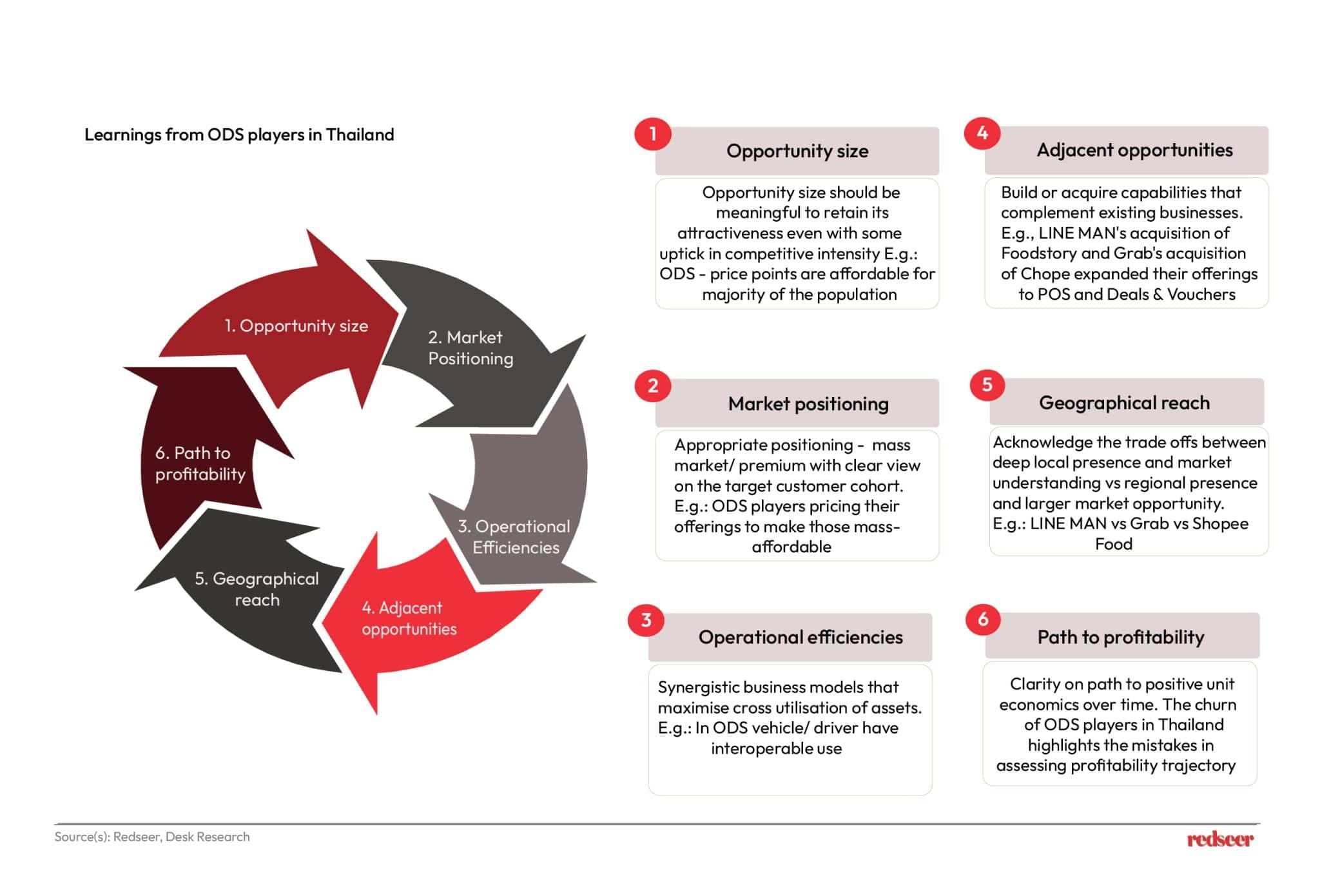

Thailand’s ODS sector underscores the importance of aligning market potential with company strengths

The diagram encapsulates strategic insights from Thailand’s on-demand services sector. Strategic market positioning should be meticulously aligned with targeted customer segments, whether mass or premium, ensuring value propositions resonate with broader demographics and at the same time leads to a large opportunity size. Furthermore, a balanced approach to geographical expansion is also recommended, integrating deep local market presence with broader regional ambitions, as shown by how local player like LINE MAN has managed their deep understanding of local markets to accelerate growth recently. Lastly, a disciplined path to profitability is vital.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me

Saudi Q-com Regulations: Ending the Subsidy Era?

Quick Commerce Finds Its New Normal with Scale, Mix, and Momentum

India Fashion: Why Growth Is Concentrating at the Bottom of the ASP Curve