Recent trends in the online payments’ ecosystem have brought much change to how consumers carry out their day-to-day transactions. From UPI and digital wallets to BNPL, online payments have come a long way to make life easier for both consumers and businesses. In response to increasing users, fintech companies are also gearing up to meet the demands of future customers through convenient and innovative financial services.

So how can businesses position themselves to make the best out of the emerging ecosystem around online payments? That is precisely the question Jasbir S Juneja, Partner at Redseer, answered in our recent report in collaboration with Plural by Pine Labs. In this article, we offer a glimpse of the future of online payments in India.

1. India is on a fast-track path to becoming a digital economy

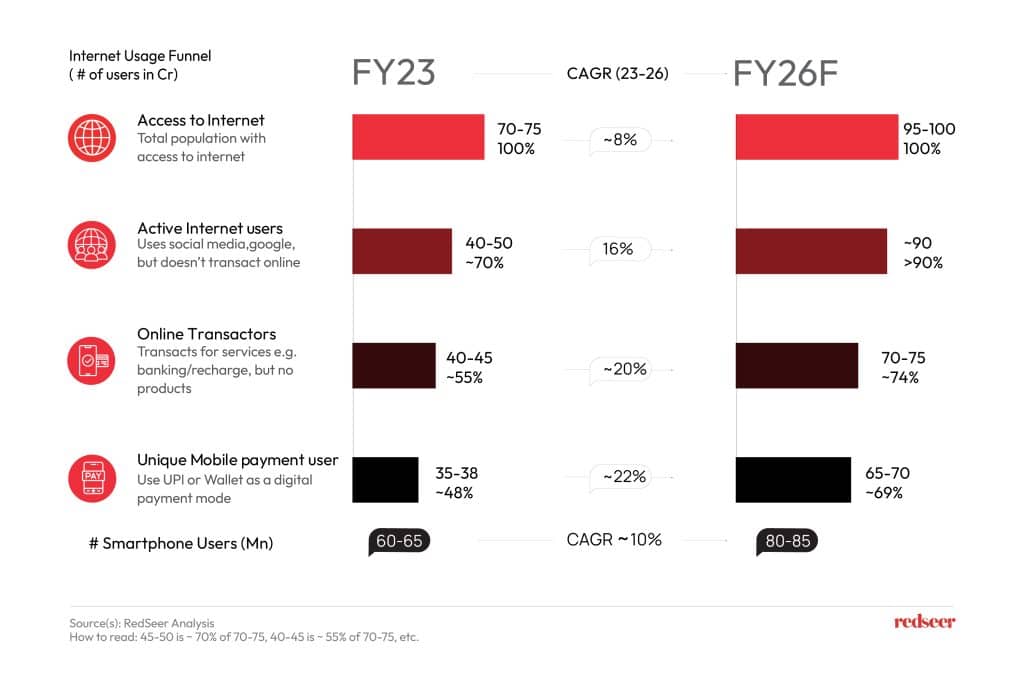

India is on a path to become a strong digital economy soon, with more than 70 Cr existing internet users and a total population of 140 Cr steadily upgrading to digital modes of communication and banking. Internet and smartphone penetration, coupled with government policy and secure technologies, are the main drivers of digital payments in India. However, the widespread adoption of digital payments during COVID also set the wheels in motion. First-time e-Commerce users along with regular online shoppers, boosted digital payments, with digital payment adoption showing a steady incline.

Furthermore, online shoppers are expected to grow by 50% by FY26, with customers from Tier-2 and smaller cities driving major e-Commerce growth. As more customers adopt digital payment methods, businesses are also leveraging technology that enables digital transactions. We estimate that about 85% of businesses will be digitally enabled by FY26.

2. Digital transactions in India have surpassed INR 3.2K Lakh Cr so far in 2023

The ‘Digital India’ programme, launched by the Indian Government in 2015, has been a catalyst in the growth of digital payments in the country. The program has been successful in promoting a ‘faceless, paperless, cashless’ environment in India. For instance, P2M payments witnessed a boost through QR codes, particularly in the retail sector. The popularity of these payments in retail has had a significant influence on the digital payment landscape in the country. We estimate that digital transactions in India will touch 4K Lakh Cr by FY26 from ~3.2K Lakh Cr estimate in FY23.

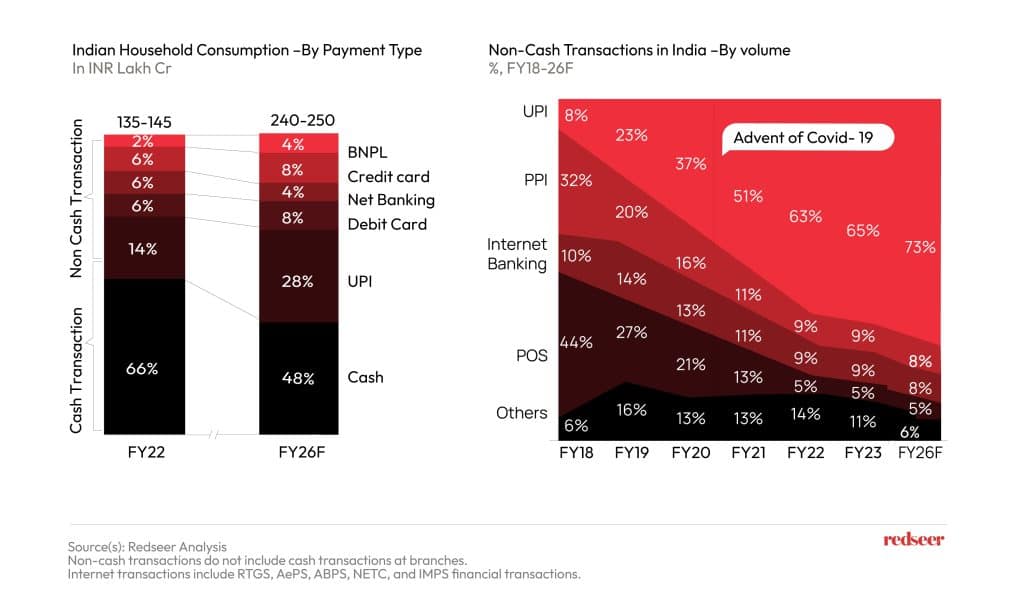

3. Indian households which already make ~35% digital transactions are expected to cross~50% by FY 26

Indian households contribute significantly to digital transactions, with P2M payments accounting for a major proportion. The convenience of mobile phone payments has contributed to the growth of P2M payments. For instance, digital payment methods are used by customers in 80% of transactions in grocery, food delivery, and travel. Solutions from the payments industry, such as UPI, BBPS, and BNPL, have already been well-received by consumers, and there’s growing anticipation that emerging technologies such as e-RUPI and wearable devices will have the same effect.

4. While UPI captures the biggest share of digital payments, Embedded finance and emerging trends will further boost digital spending

Since the introduction of UPI in 2016, it has outperformed every other form of digital transaction thanks to its ease of fund transfer across bank accounts. UPI has also been a facilitator of the ‘Bharat Bill Payment System (BBPS), linking payment services with utility providers. Embedded finance refers to integrating financial products and services such as credit, insurance, payments, and lending into the purchase journey on non-financial platforms. BNPL has gained popularity among Gen Z and Millennials as a convenient financing option, allowing them to spread out payments for their purchases.

Additionally, emerging trends like e-Rupi, wearable-payment device, voice payments and biometric payments will boost customer experience and can increase loyalty and digital spending. Retail e-Rupi witnessed ~800K transactional volume within two months since its launch and the Indian wearable market, valued at INR 1.1 Lakh Cr in FY22, is projected to reach INR 1.4 Lakh Cr by FY2030.

In all, the emergence of technology which is convenient and secure will be embraced by consumers going forward. Businesses that can integrate these technologies into their payment strategies are positioned to gain much in terms of streamlining operations, cost reduction, and customer satisfaction.