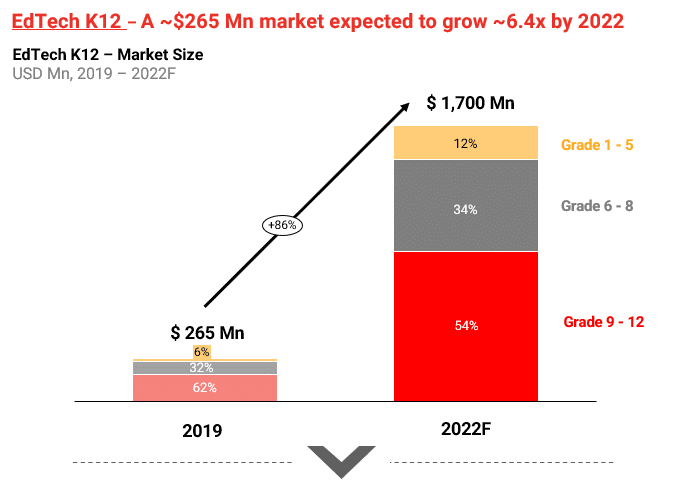

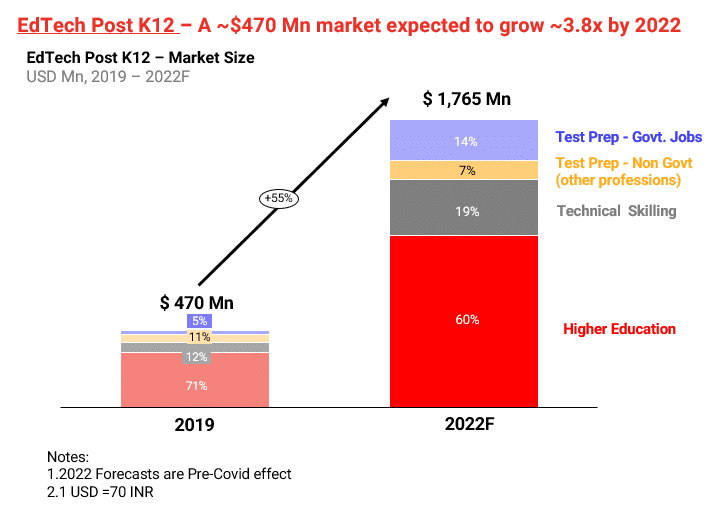

1. India EdTech is a USD ~735 Million market which was forecasted to grow at ~68+% CAGR in pre Covid world

By 2022, online education offerings across grades 1 to 12 are projected to increase 6.3 times to create a $ 1.7 BN market, while the Post-K12 market is set to grow 3.7 times to create a $ 1.8 BN market. This is going to create meaningful opportunity for incumbent players as well as space for multiple new startups.

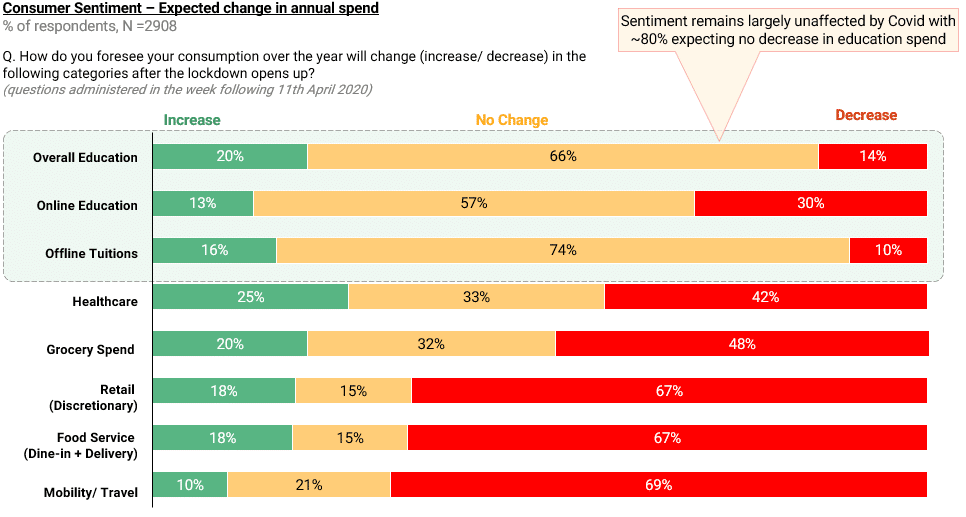

2. Further deep dive on education indicates the resilient outlook for education amidst the pandemic

Highlights:

- Overall education sentiment remains positive

- Online spend will see a correction

- Offline Tuitions will hold fort

Education is one of the only sectors where sentiment remains largely unaffected due to the pandemic. Consumers are willing to cut down on all other discretionary spend first before cutting any spend on education. ~80% expect no decrease in education spend.

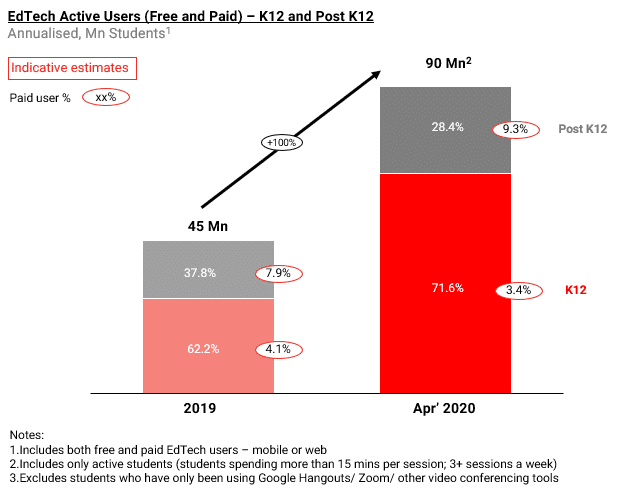

3. COVID tailwinds – Demonetisation moment for EdTech; Userbase doubled in a month from 45 Mn to 90 Mn (double the growth forecasted pre COVID)

COVID has proven to be the demonetisation moment for EdTech. Legacy institutes and traditionalist parents and students who have until now been wary of adopting EdTech, were left with no choice but to embrace digital learning.

EdTech companies too have been agile in responding to the crisis by making their offerings free – resulting in almost 2x rise in EdTech users within a couple of months to make the user base to 90Mn in April’ 20

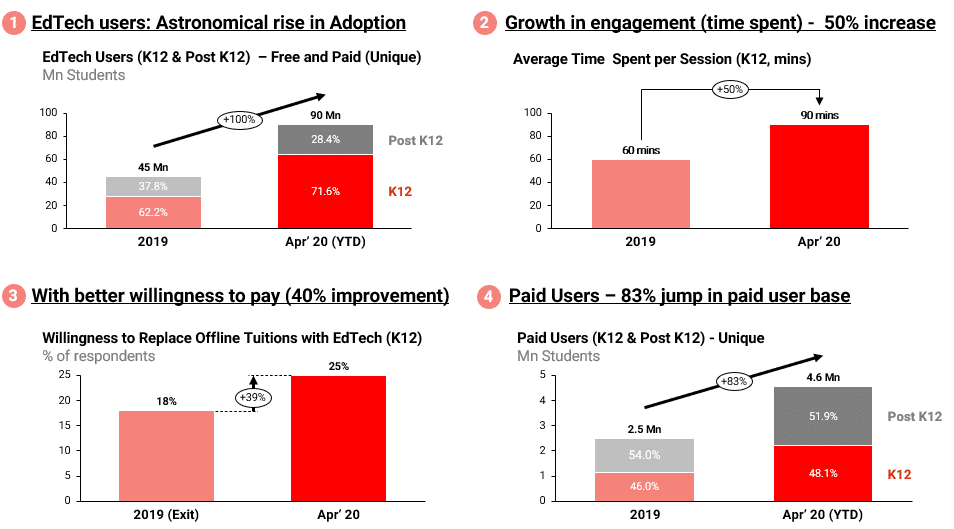

4. All key indicators point to a positive outlook for EdTech in 2020

EdTech grew significantly in April’ 20 – as traditional institutes were forced to close operations and EdTech companies made their offerings free to acquire customers.

It is very important to note that EdTech’s ability to create a lasting impact hinges on it’s ability to replace offline tuitions – we saw the willingness to replace offline tuitions (by EdTech) rise by almost 40% – a positive development that will have much wider implications on long term adoption and willingness to pay.

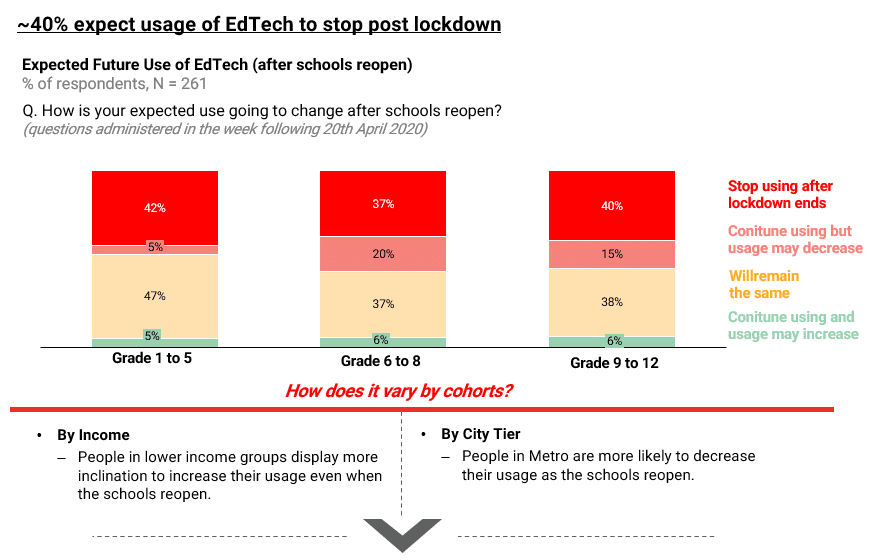

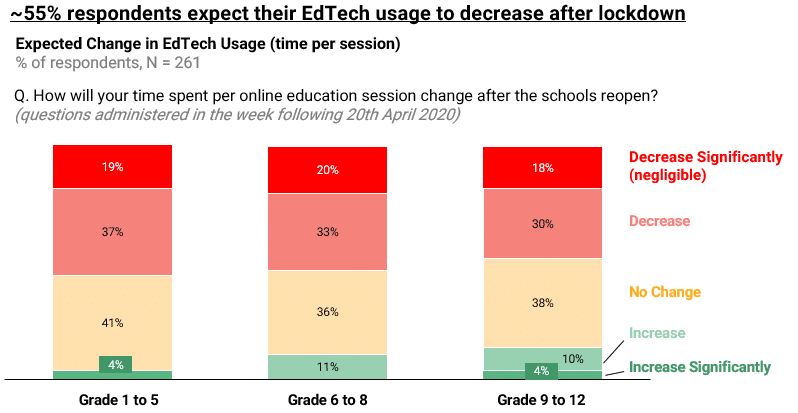

5. However K12 EdTech platforms will have to control the churn post lockdown – 40% of new user base might churn; time spent on platforms to comeback to ~70 min

EdTech platforms must not get complacent and continue to focus on providing superior customer experience in order to retain the uptick from COVID and limit customer churn.

Our research indicates that ~40% users might stop using EdTech after restrictions are lifted and their engagement time will fall by ~20%

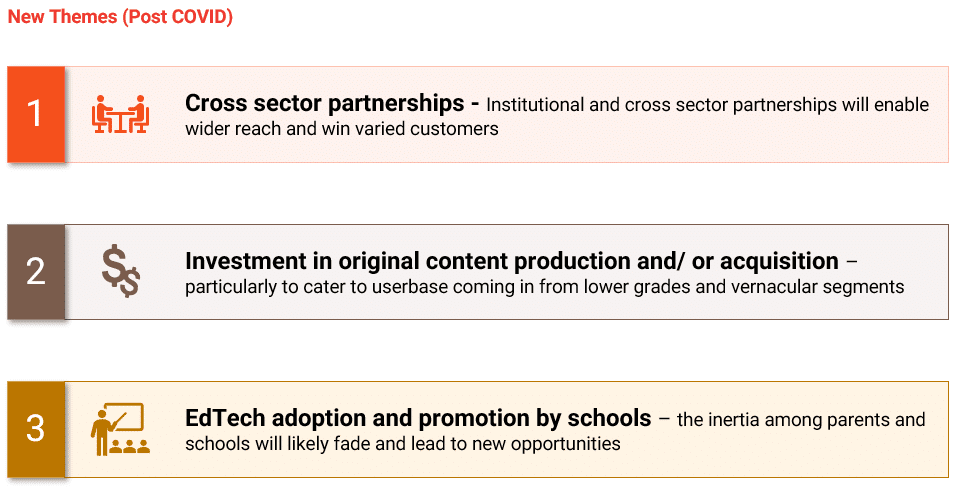

6. Meaningful changes to play out for EdTech in a post COVID-19 world

Meaningful changes are going to play out in EdTech in a post COVID world as the much more larger and diverse new EdTech customer base forces EdTech platforms to adapt. The inertia to embrace EdTech among parents schools, and universities is fading and will lead to new opportunities and market creation. We will also see much more partnerships and investments in content as EdTech companies goes after the new customer base.

7. EdTech in India: An Omidyar Network India – RedSeer Perspective; The most detailed and comprehensive view on EdTech in India

Catch all of this and more in our recently released report on EdTech in partnership with Omidyar Network India – the most detailed and comprehensive view on EdTech in India.

This report is the product of year long in-depth research on EdTech in India and is very exhaustive in nature. Your one resource to learn more and declutter many aspects about the EdTech opportunity in India.