Electrification of vehicles in India is still at a nascent stage compared to countries such as Norway and China. While the four-wheeler electrification has been slow, the spotlight of the consumer EV revolution in the country is on two-wheelers (2W) at the moment. Ownership cost savings of electric 2W ranging from 20-70% over petrol 2Ws have piqued the interest of the average buyer, while the B2B players have already jumped on the opportunity.

At Redseer, we’ve been closely monitoring the country’s electric 2W landscape, and we see areas that need much improvement to truly unlock its potential. Read on to learn the key insights of our recent report on what the future of electrification of 2Ws has in store for India – 2030.

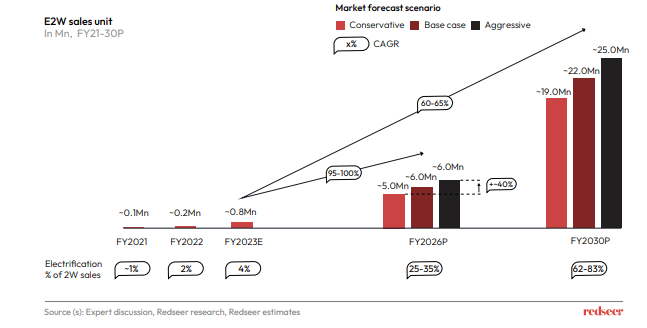

1. E2W sales volume in India is expected to reach ~22 Mn by 2030

India is the largest 2W market in the world, with an estimated 375-400 Mn 2Ws on the road. With affordability being the biggest driver of 2W sales among consumers, cost savings brought about by ownership of E2Ws are expected to drive growth. Adding to that is the faster adoption of E2Ws by B2B players, such as food aggregators and last-mile delivery services, owing to the low cost of ownership.

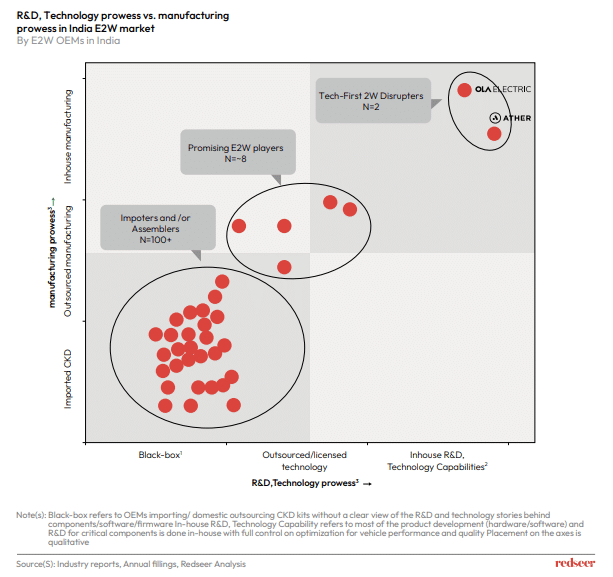

2. For sustained growth, localization and integration is the way to go for E2W makers

Given the relatively lower barriers to entry, the E2W market has seen hundreds of entrants. Most of these players are ‘assemblers’ who import a significant portion of their components and even technology from China and other countries. Given the government’s push for indigenization and OEMs’ own need to protect from supply shocks we will see a lot of growth in localization. Consumers will also reward the more integrated and sophisticated players as not only will such OEMs be able to provide a more cost-effective product but also offer a superior experience that builds on in-house capabilities to improve and innovate.

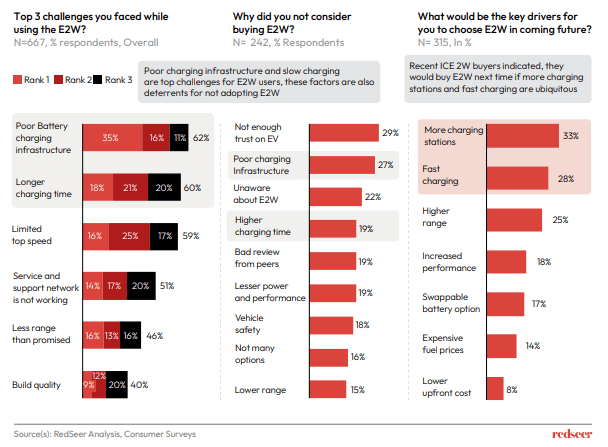

3. Despite tailwinds, adoption contingent on customers’ “Peace of Mind”

Battery performance, charging times, and range remains the primary challenge for both existing E2W users and prospective buyers. While the range of most E2Ws exceeds the average distance travelled by over 90% of their consumers, ‘range anxiety’ still remains. Reliable charging infrastructure is needed o to build user confidence on E2W as a fully viable mode of transport.

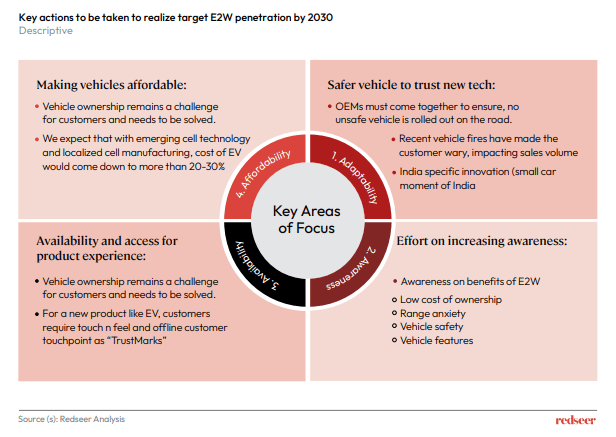

4. It’s essential for the E2W ecosystem to adopt these 4A’s to achieve 80% electrification by 2030

Individual creators and influencers with sizable followers create and share consumable content such as posts, memes, videos, vlogs, product reviews, and live streams. These attract a niche audience who relate to the content and interact with it regularly. Brands often find that content generated by micro and macro influencers gives the biggest ROI on advertising.

The 4A’s: Adaptability, Awareness, Availability, and Affordability is a complete approach to persuade consumers to switch to E2Ws in the coming years. By making grounds on improved safety and reliability, increased awareness, ease of availability, and lowered prices, it is possible to push for 80% electrification of sales by 2030.

It’s also essential to add that the government has been the fundamental enabler for the early adoption of EVs with FAME and PLI schemes. It is crucial that the government continues incentivizing switching to E2Ws to encourage consumers.

EVs could help India by reducing its energy dependence on fossil fuels. While there are other steps in the journey besides EV adoption, a confluence of efforts by OEMs, infrastructure builders and regulators can ensure a greener future for the country.