While exciting and teeming with potential, businesses in the digital, new age, technology-based space are constantly under regulatory scrutiny due to their innovative and disruptive nature.

As regulatory landscapes shift, we introduce a series of newsletters bringing you updates on key policies and laws that may affect new-age players in Southeast Asia.

1. Summary for April 2024: Indonesia to open up digital lending ‘faucet’, Parliament resumes talks on highly-awaited renewables bill

FINTECH SECTOR OVERVIEW

While the Fintech sector has grown significantly over the years, the Indonesian Financial Services Authority (OJK) has enacted measures to protect consumers and foster healthy competition. The government plans to level the playing field by lowering the maximum daily interest rate and expanding the ~USD 138,000 lending cap to support MSME growth.

RENEWABLES SECTOR

Having set out annual commitments to reduce carbon-based energy sources such as coal, the Indonesian government is poised to raise foreign and domestic capital for renewables-based power projects. However, key legislation—the New & Renewable Energy Bill—remains in limbo.

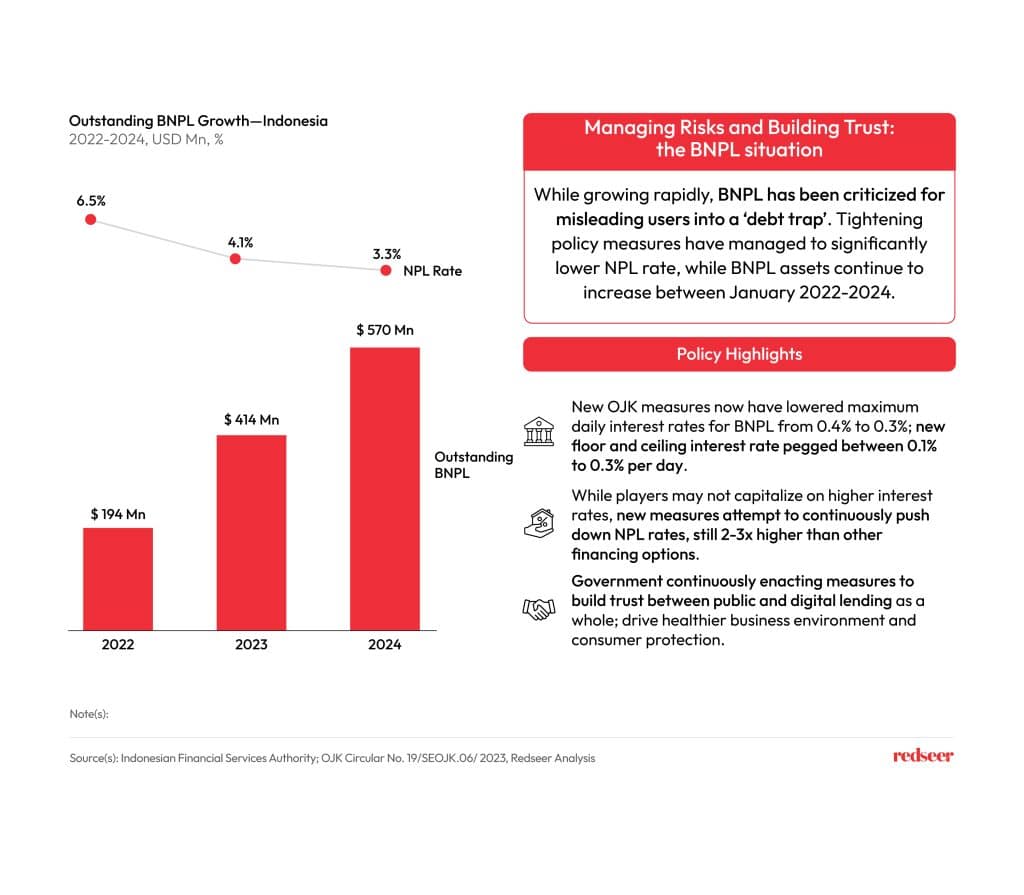

2. Interest Rates are capped at 3% for P2P-based BNPL as the government attempts to build trust between the public and lenders

The Indonesian Financial Services Authority (OJK) had recently lowered daily peer-to-peer-based BNPL interest rates from a previous 0.4% maximum to 0.3% per day. Lender interest rates will be set between the daily rates of ~0.1% (floor) to 0.3% (ceiling).

The change is the Indonesian government’s latest attempt to crack down on ‘loan shark’ plays seen in the early days of the Indonesian fintech space, creating a more certain and fairer playing field for all. (read more: Financial Services Authority Circular 19/SE.OJK/2023)

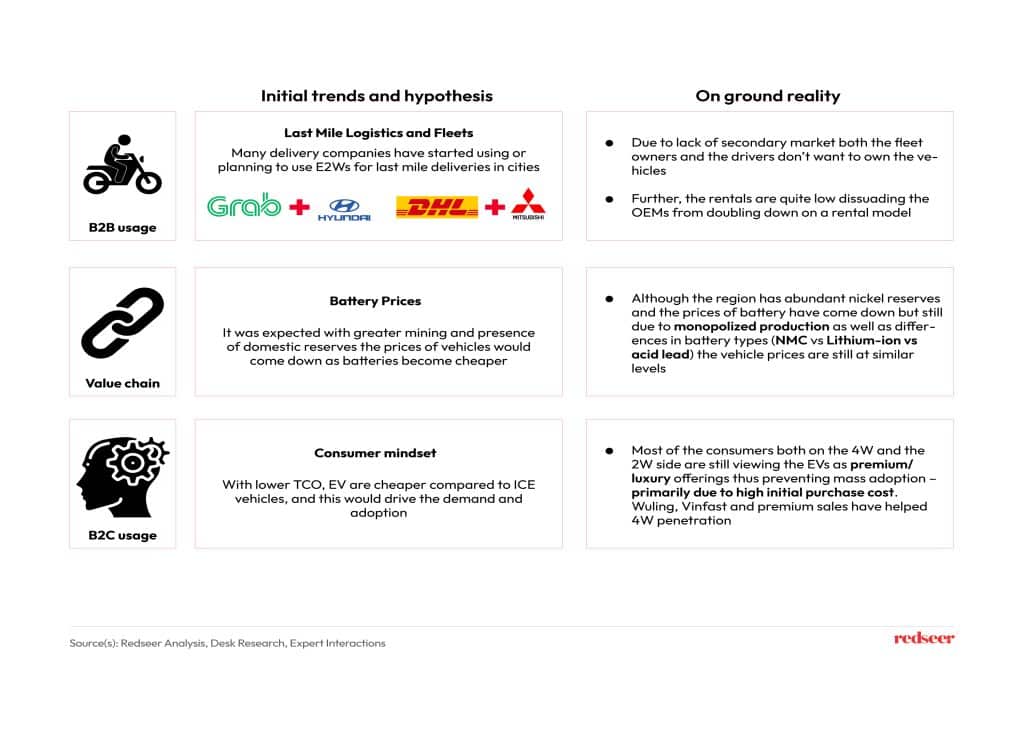

3. Government looking to open faucet for P2P-based digital lenders—higher funding cap for productive loans, MSME priority

Fintech lenders might see new opportunities arise as the OJK looks to lift certain caps and moratoriums in the lending space, aimed to further boost SME productivity.

Potential policy shifts include an (i) increase in the maximum credit limit per creditor for productive loans beyond the present IDR 2 Billion (~USD 150,000) cap and (ii) a lift on the moratorium on new business licenses for digital lenders/P2P platforms with specific focus on productive, MSME loans.

This shift is brought by strong public interest and demand for digital lenders, aimed to propel further growth for present players and foster healthy competition within the industry.

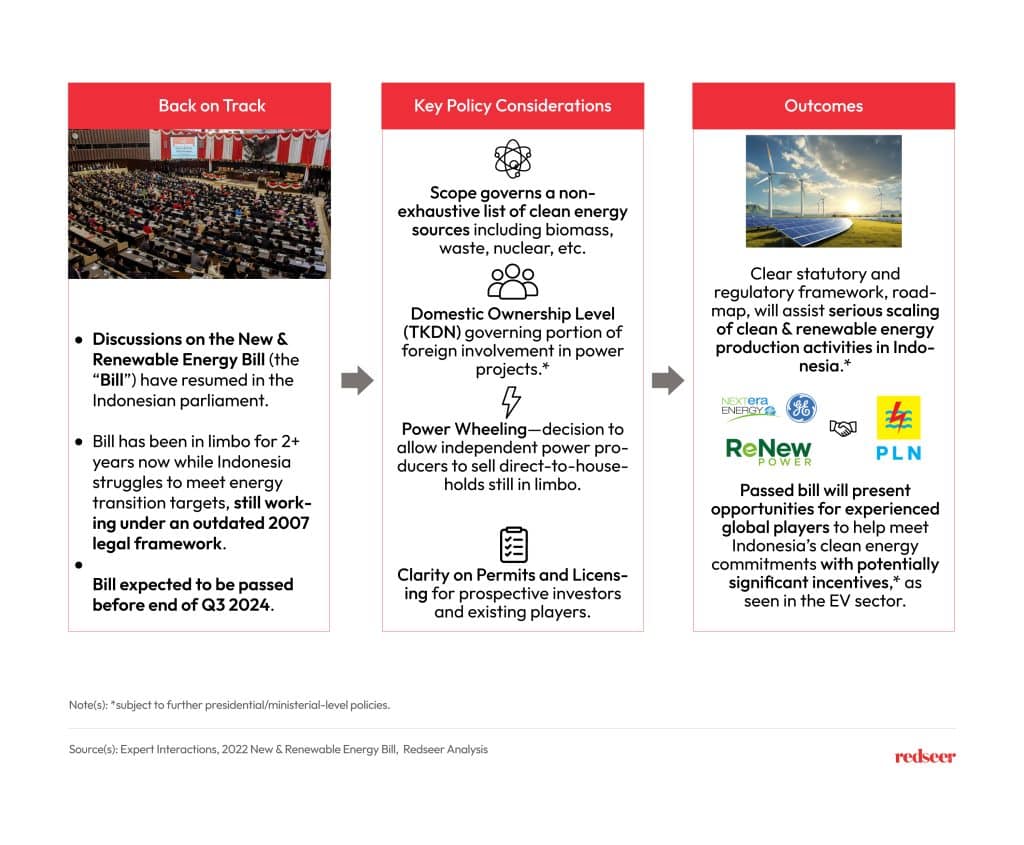

4. New & Renewable Energy Bill back on track following post-election delays—enactment in 2024 expected due to urgency

The Indonesian parliament (DPR) has resumed talks regarding the New Energy & Renewable Energy Bill (the “Bill”), a vital piece of legislation that would lead to carbon-to-green conversion efforts following the Glasgow COP 26 conference in 2021. As of now Indonesia still relies on the Energy Act of 2007 (Law No. 30/2007) as its main statutory provisions, considered outdated for the growing renewables sector.

Several key discussion points are of high interest, including:

- Domestic Ownership Level—as the electricity sector is constitutionally mandated to be under state control in Indonesia, the Bill will regulate how and to what extent foreign businesses can invest in the renewable energy sector. While power stations are operated by the state, private players are involved as independent power producers.

- Power wheeling—The Bill presently considers power wheeling mechanisms which allow the direct transfer of generated electric power from private renewable power producers straight-to-consumer.

- Expanded permits and licensing authorities specifically for new and renewable-based power producers, along with a more concrete verification, testing, and monitoring mechanism.

- Tax, Import, and Other Incentives as government plans to kickstart a renewable revolution—patterning the high-growth, highly incentivized electric vehicle sector in the country.

The Bill is considered a priority legislation and should be reasonably expected to be enacted before the end of Q3 2024 when newly elected members of parliament will be sworn into office.

Enactment would result in an opening for foreign and domestic investors to initiate new and renewable energy production projects—subject to implementing regulations and technical guidelines that would most likely come out in late 2024. We will most likely see more IPP (Called ‘PJBTL’ contracts) arrangements coming from new/renewable sources in the coming years.