Indonesia’s healthcare infrastructure lags its counterparts and falls short of WHO benchmarks, signaling a clear need for enhancement. With prevailing health system challenges and a demographic set to age by 2030, the time for Indonesia to act is now. This newsletter zeroes in on healthcare expenditure, private sector contributions, and the evolving trends in the field.

01. Growing public awareness, aging population, increasing diseases and programmed immunisations are key factors driving the growth of healthcare spending

Rising public awareness is key in steering people to prioritize healthcare spending. There’s a notable shift from corrective to preventive healthcare, focusing on early detection and wellbeing over treatment costs. Structural shifts like an aging population, disease increase, and routine immunizations are also fueling healthcare growth in the country.

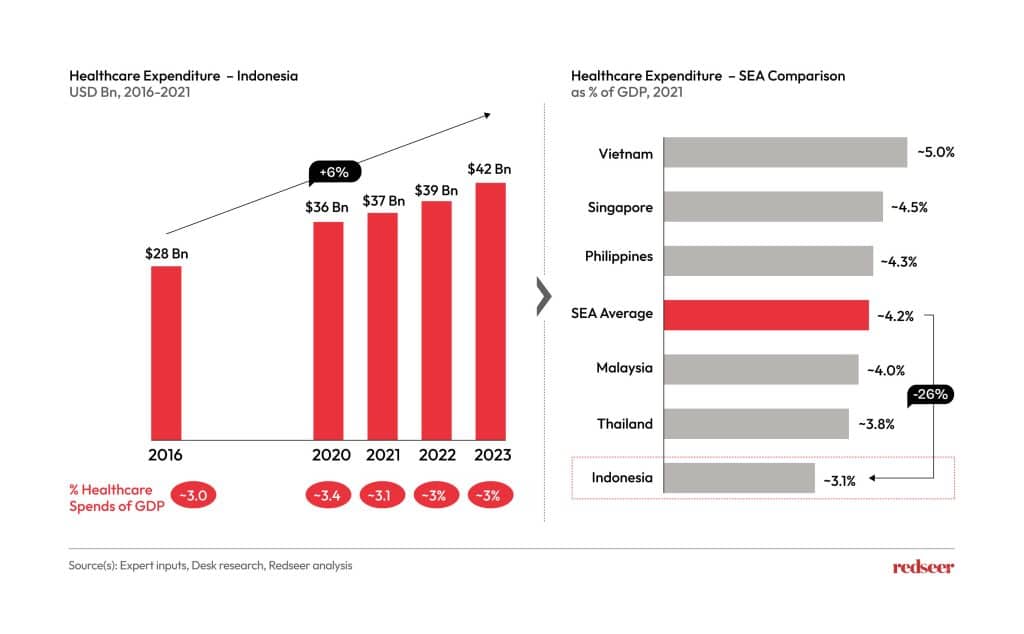

02.Accordingly, Indonesia’s healthcare spend is on the rise. However, it still lags its peers in Southeast Asia

Indonesia, the world’s fourth-largest populous nation and a rising economic powerhouse, faces a critical healthcare challenge. The nation’s current healthcare provisions fall short for its vast population, urgently needing private sector intervention and support. Its healthcare spending lags behind regional counterparts. Additionally, with a swiftly aging population and high smoking rates, Indonesia confronts a surge in chronic diseases, escalating the demand for specialized services and medications.

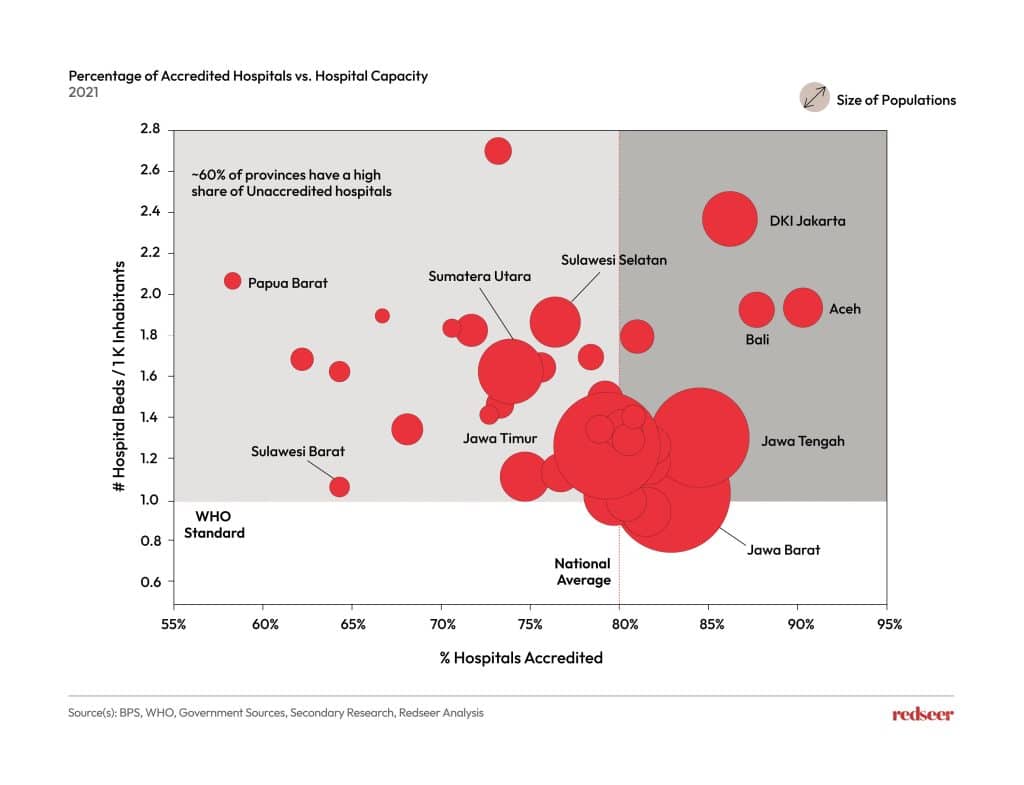

03. And the impact of low spending levels can be seen on the healthcare infrastructure outside key provinces

In Indonesia’s approximately 3,000 hospitals, a startling 75% lack accreditation. About 60% of the 34 provinces fall below the national accreditation average of 80%, impacting around 40% of the population. These figures underscore the urgent need for a revamp in Indonesia’s healthcare spending and its allocation. Quality healthcare is primarily clustered in Java, leaving regions like the Maluku Islands and West Papua with scant access.

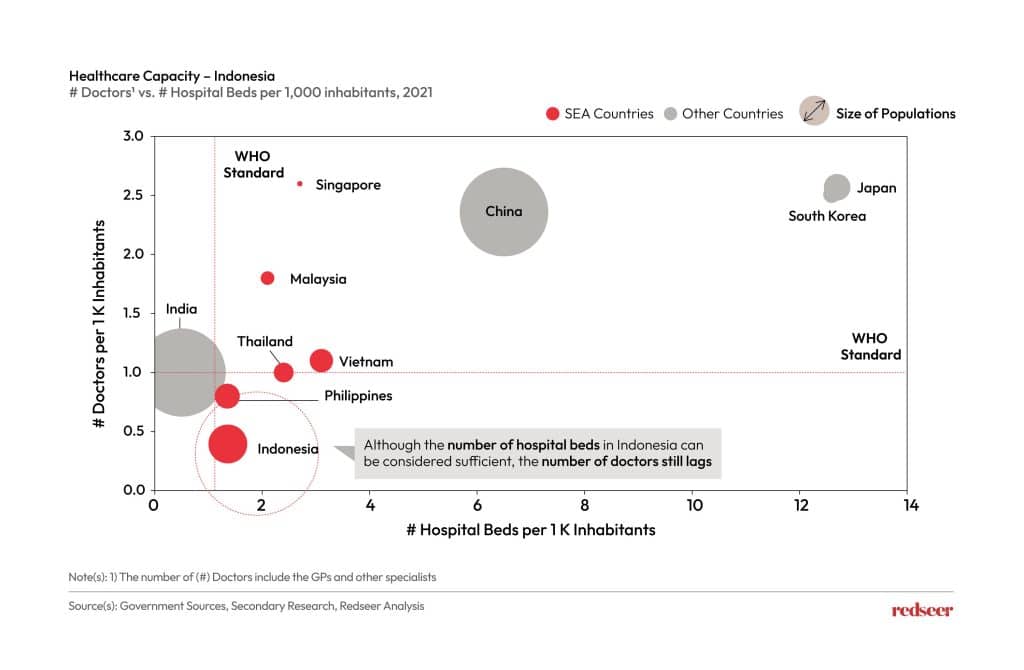

04. Doctors’ availability is an area of concern in Indonesia – lagging levels in many developed and developing countries

Indonesia faces a stark doctor shortage compared to many nations, largely due to lengthy medical licensure procedures. This shortfall is exacerbated by the uneven spread of healthcare workers, creating regional gaps in accessing quality medical care.

With around 216,000 doctors – including 166,000 general practitioners and 50,000 specialists – Indonesia is short by approximately 60,000 doctors to reach the World Health Organization’s advised doctor-to-population ratio of 1:1,000.

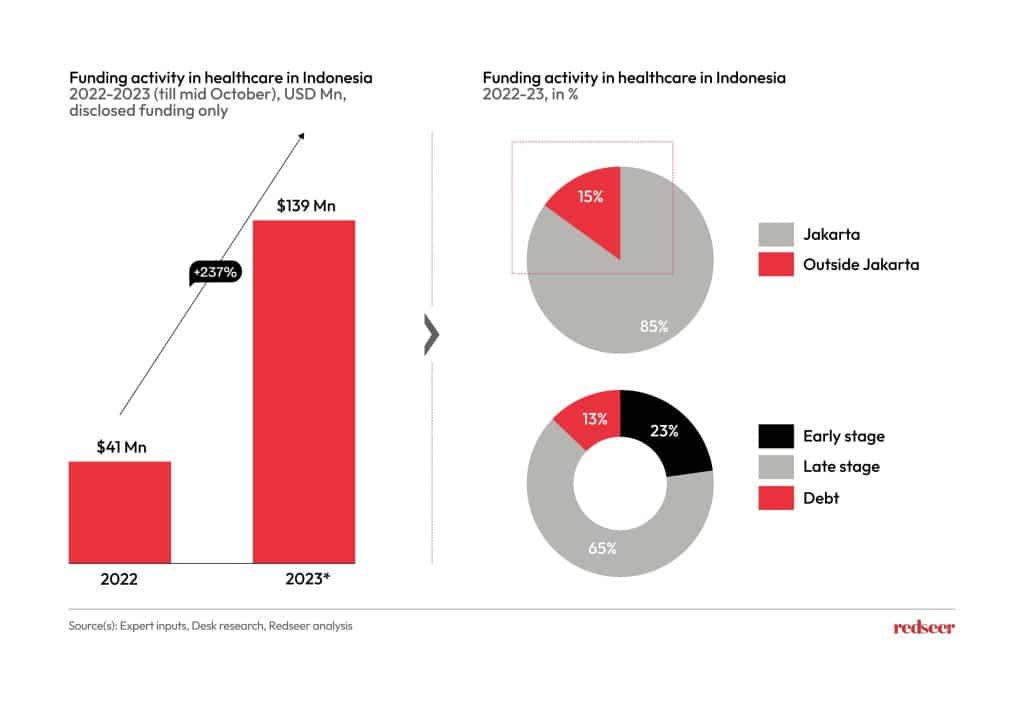

05. While healthcare funding has been growing, most of it is flowing to Jakarta; government should incentivize investments in other parts of the country

In the first 10 months of 2023, healthcare funding tripled compared to the entirety of 2022. Unique to this sector, there’s a notable tilt towards higher investment in late-stage rounds rather than early stages. Yet, a considerable portion of these investments is concentrated in Jakarta, suggesting a need for government action to encourage funding in other regions of the country.

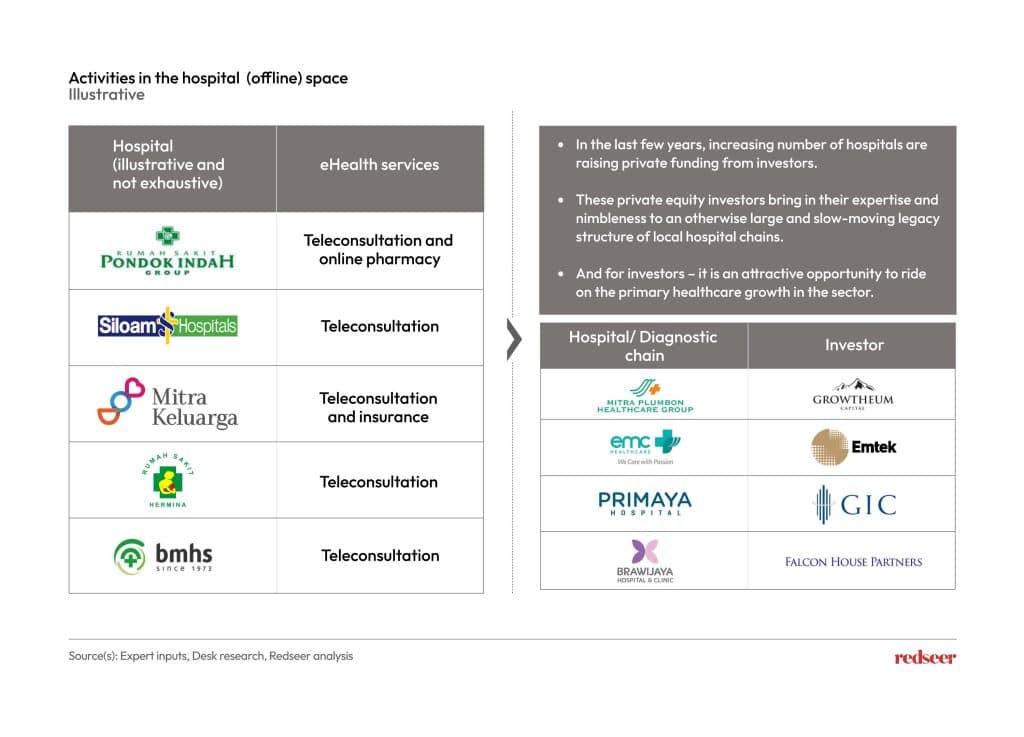

06. Another trend being observed in Indonesia healthcare space is the consolidation, digitization, M&A and investment activities in the offline hospital chains

As these chains embrace digitalization and scale up, their goal is to become top choices for both local and international medical tourism.