The insurtech sector in Southeast Asia is undergoing a transformative phase, driven by emerging models and categories. Recent regulatory changes have paved the way for innovative business models that enhance customer and agent interactions while reducing servicing costs. In this week’s newsletter, we will explore how insurtech companies are shifting their focus from revenue generation to achieving profitability and the exciting path that lies ahead in this evolving landscape. Read on!

This newsletter builds on our earlier note on the Indonesia Insurtech landscape, InsurTech in Indonesia.

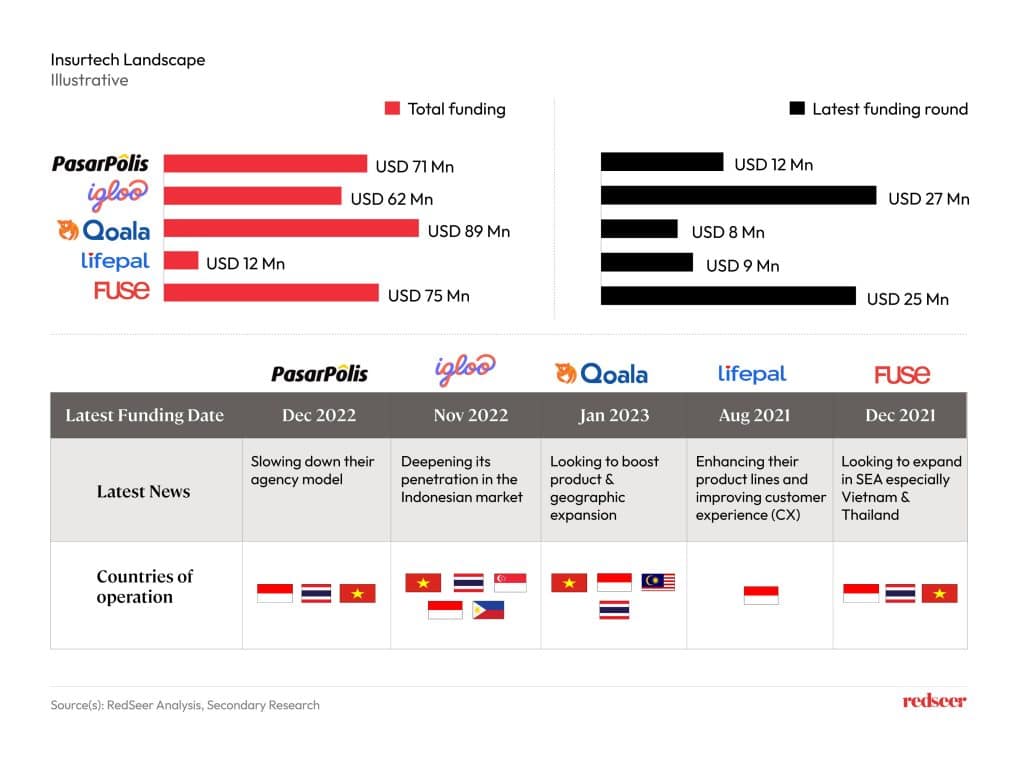

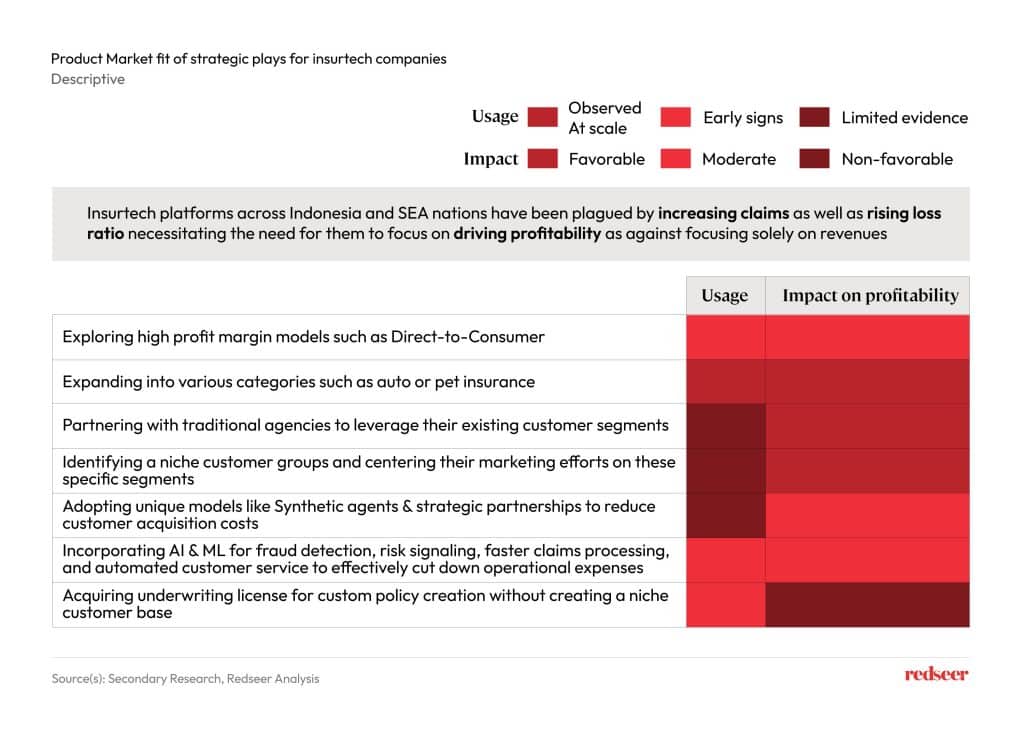

1. Southeast Asia insurtechs are strategically shifting their focus from aggressive expansion to sustainable profitability, amid fundraising efforts, and exploring innovative business models and geographic expansions.

There is substantial growth potential in Southeast Asia’s emerging insurance market, especially in Indonesia, Thailand, and Malaysia. However, the players are understanding the need for innovative insurance products, customer satisfaction, and embedding insurance into everyday activities for cheaper distribution solutions. For example, Pasarpolis’s latest innovation, Tap Partners, targets offline merchants to offer embedded insurance effortlessly, aligning with the industry’s trend towards enhanced customer journeys and digital platforms.

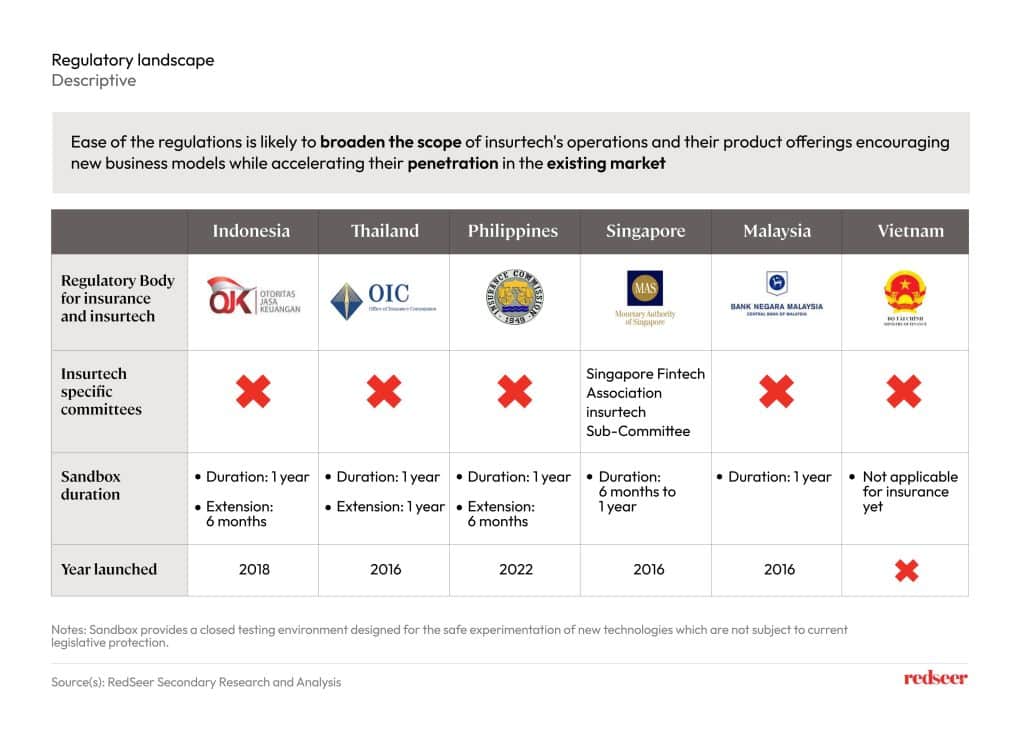

2. Singapore’s proactive regulatory support and investment in technology infrastructure position it as a leading hub for insurtech startups

The objective of sandbox regulation is to foster innovation among companies with genuine value propositions while providing a controlled environment for their ideas to scale up in a larger market. Singapore has set a noteworthy precedent by being at the forefront of fintech regulations and actively supporting startups, further illustrating its leadership in fostering innovation across various financial sectors.

While Vietnam is taking steps to establish a regulatory sandbox for fintech in the banking sector, it’s crucial to acknowledge that fintech innovations extend beyond banking, including areas like insurtech. To fully embrace fintech’s potential, Vietnam may need to expand its regulatory framework to accommodate diverse financial subsectors. Countries like Indonesia, the Philippines, and Thailand have already paved the way by opening sandboxes for insurance players, fostering an environment conducive to new business models in the insurance sector.

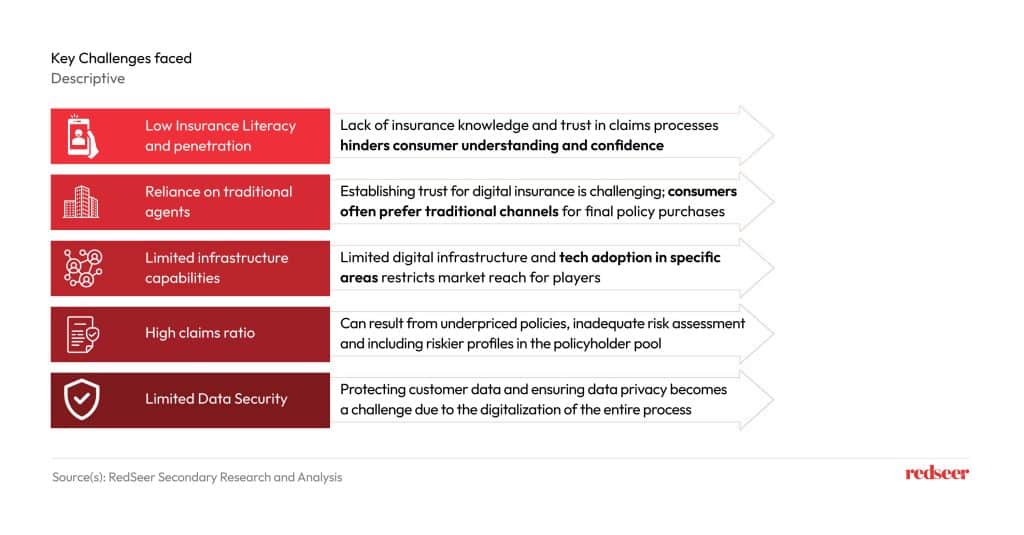

3. Insurtech must address low insurance literacy, enhance digital infrastructure, and innovate in risk assessment to thrive amidst high claims ratios

The insurance landscape requires fundamental changes to address critical challenges, including low insurance literacy among consumers, emphasizing the need for robust education initiatives. Additionally, there’s a pressing demand for enhancing digital infrastructure capabilities to expand outreach effectively. Furthermore, the insurtech industry must grapple with high claims ratios, necessitating innovative risk assessment models and improved underwriting practices to ensure long-term sustainability and competitiveness in the insurtech space.

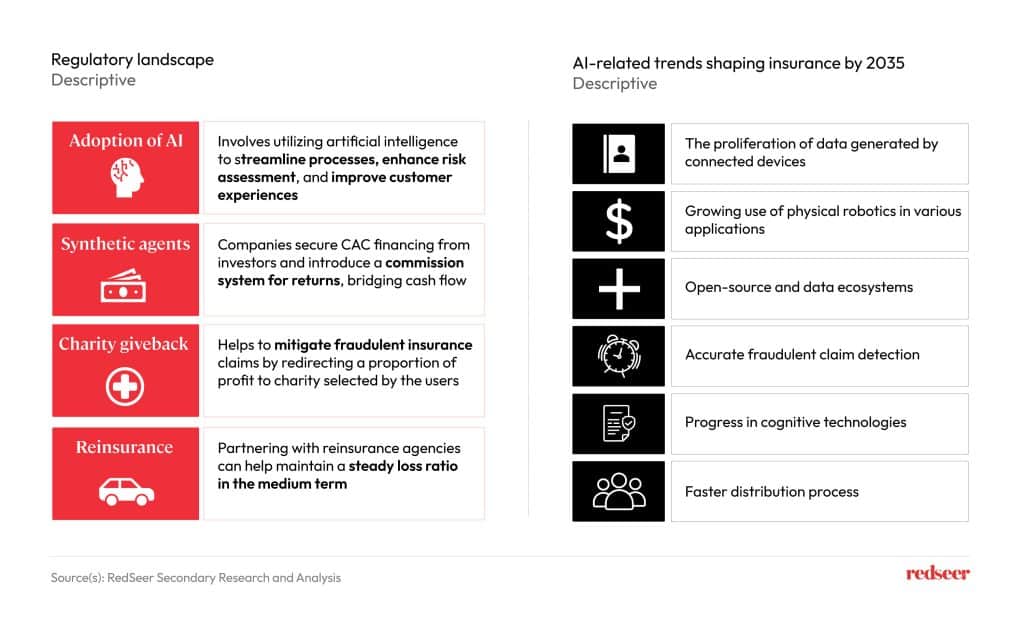

4. The adoption of AI bolstered by complementary measures such as the integration of synthetic agents can help insurtechs in reducing costs and refining audience selection

As AI integration deepens in the industry, insurance executives need to grasp its impact on claims, distribution, and underwriting, adapting skills, tech, and culture for future success. In customer service, AI-driven chatbots provide efficient, round-the-clock support to policyholders. AI-powered fraud detection algorithms enhance security by identifying potential scams and fraudulent activities. For claims processing, AI streamlines and accelerates the settlement process, reducing administrative overhead. This transformative technology also aids in more precise underwriting, tailoring insurance policies to individual customer needs. US based insurtech, Lemonade, has been continuously leveraging AI to cut costs and drive savings, and the same can be utilized by Southeast Asian insurtechs to reduce costs in the long term.

5. Lower loss ratios and tech-led efficiency to be the path for profitability and long-term sustainability for insurtech players.

By harnessing advanced data analytics and understanding consumer behavior, insurtechs can better predict and manage risks, resulting in reduced claim payouts and lower loss ratios. Furthermore, streamlined digital processes lead to operational efficiency gains, cutting administrative costs. This improved risk management and cost control not only drive profitability but also enhance customer satisfaction with faster claims processing and tailored insurance solutions. Ultimately, this tech-driven approach positions insurtech firms for sustainable growth in the insurance industry.