The unfolding opportunity for affordable premium and premium brands in Indonesia

Most discussions about consumer brands in Indonesia often focus on the large mass-market or middle-income segments. We think this perspective grossly overlooks the growing opportunities within the country’s premium and affordable-premium segments, which represent ~USD 70-80 Bn, or around 17-19% of retail sales. This demographic is expanding and has a rising trajectory of disposable income.

Made-in-Indonesia consumer brands in the “Premium” and “Affordable Premium” categories have the potential to expand beyond domestic borders. Brands in these segments are less vulnerable to pricing pressures and can achieve better profit margins compared to their mass-market counterparts.

Over the next three to five years, we expect to see the emergence and scaling of local Indonesian brands across Fashion, Beauty, Personal Care, and select pockets of Fast-Moving Consumer Goods (FMCG), Food and Beverage (F&B), and Home & Living.

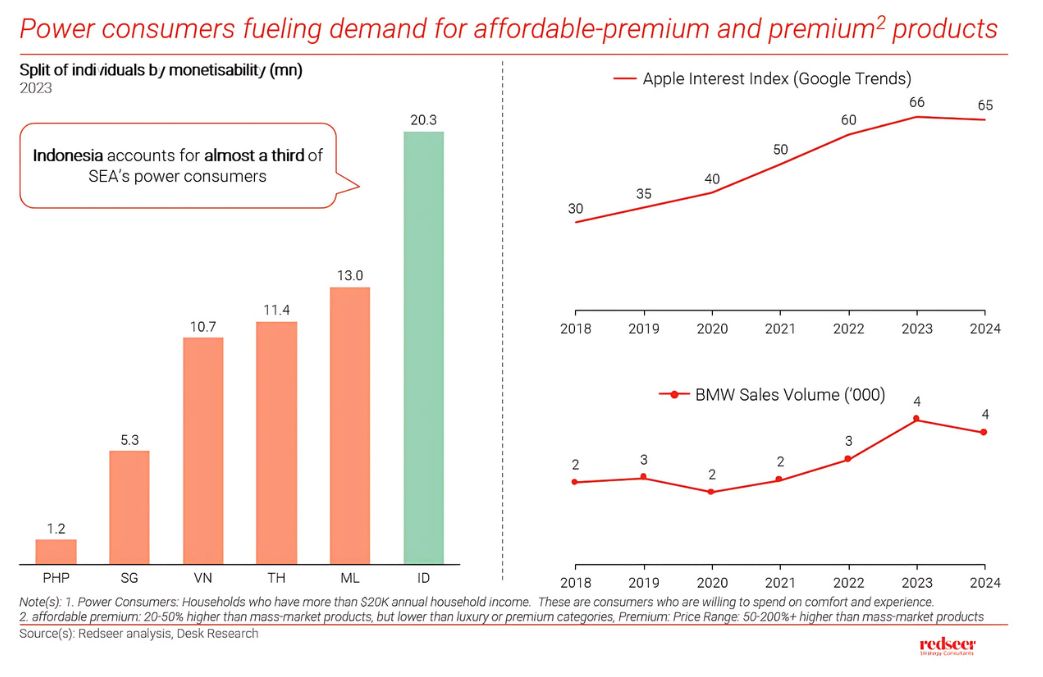

Indonesia is leading the pack of Power consumers¹ in Southeast Asia

Indonesia’s 20 million power consumers¹ are looking for products and services that offer convenience and a great experience. The country stands out in Southeast Asia with a larger base of these high-spending consumers.

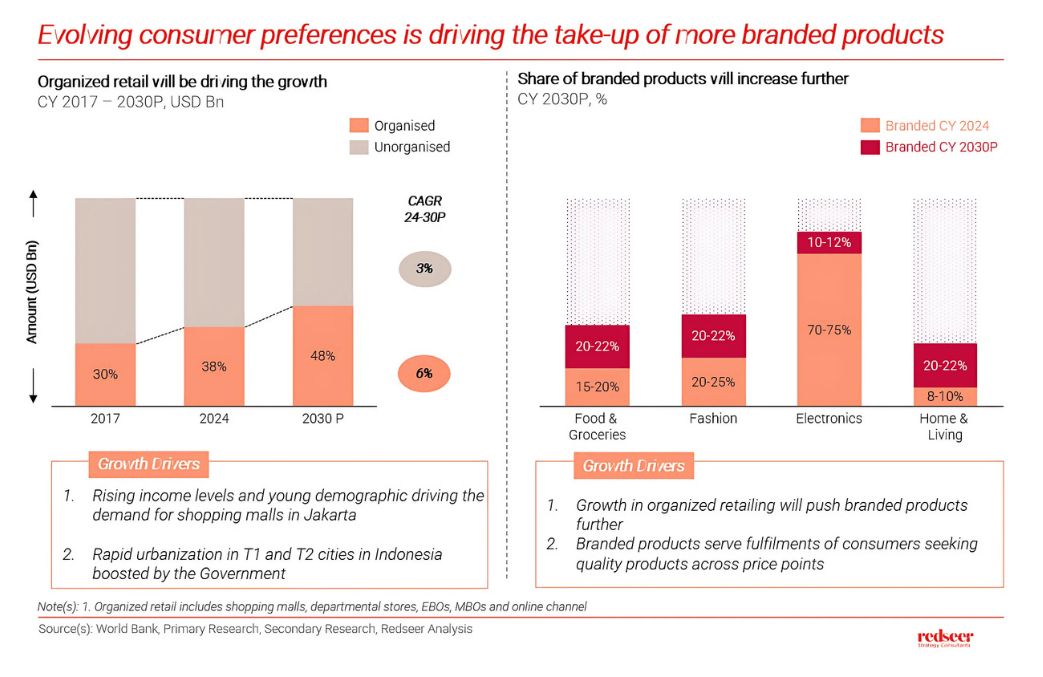

Where Organized Retail and Branded Goods are deepening their penetration…

At the same time, more brands are entering the market, supported by a growing and more structured retail distribution network. Several factors are driving this trend, helping sustain the rising demand for branded products across various consumer categories.

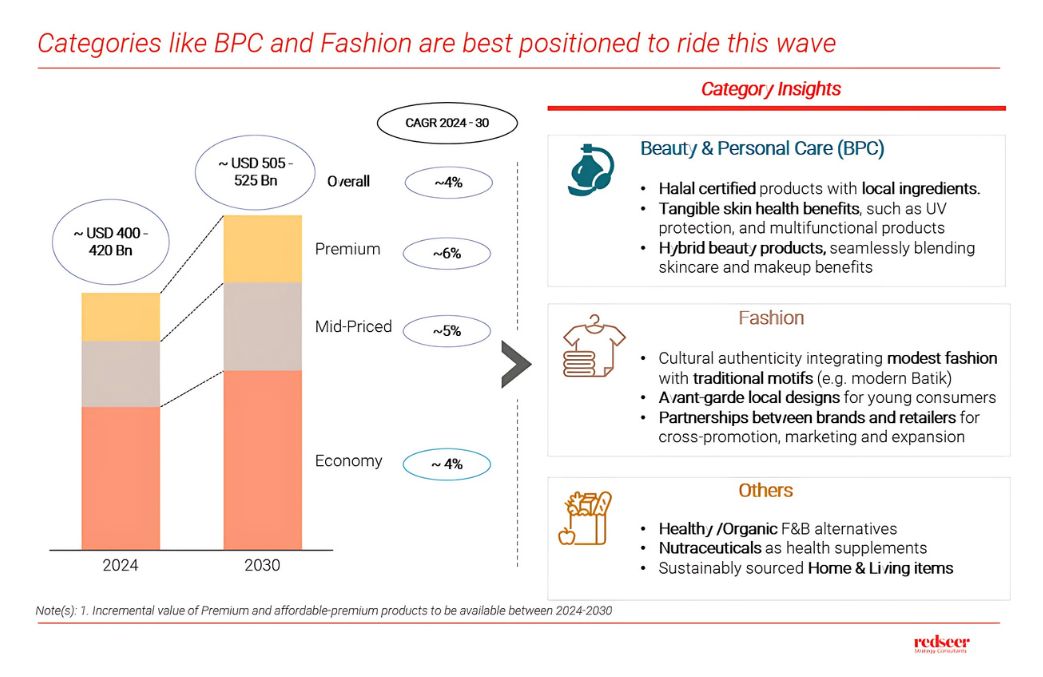

And creating USD 30 Bn Product Premiumization1 opportunity in the country

Introducing products in the premium and affordable-premium segments can capitalize on the growing demand for high-quality, curated offerings across different categories.

Beauty & Personal Care and Fashion stand out as the most promising opportunities. These sectors benefit from access to local raw materials, skilled talent, and relatively lower capital requirements compared to more capital-intensive industries. Plus, they allow brands to incorporate local cultural and socio-economic influences into their products.

Beyond that, there are still untapped opportunities for premium brands in FMCG, F&B, and Home & Living.

Yet, domestic brands are missing out on this structural uptrend, which if …

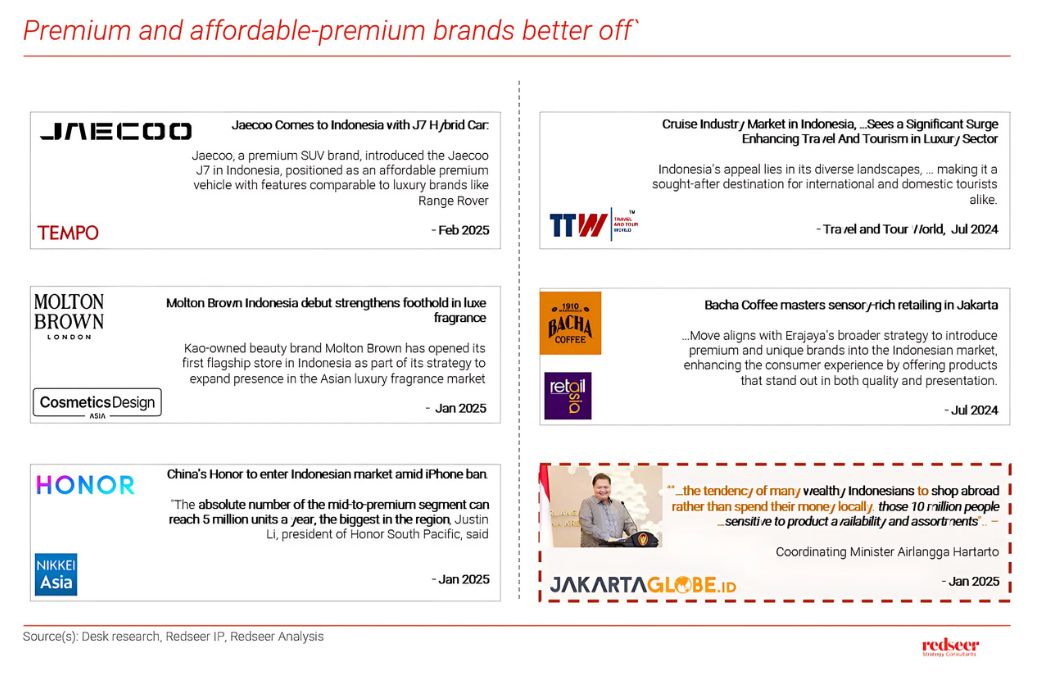

Our research shows that international brands have taken a big share of the premium and affordable-premium market, leaving local brands with a lot of ground to cover. In fact, even finding premium product launches from Indonesian brands online wasn’t easy.

On the other hand, international brands are actively launching new products or opening retail outlets to target this segment.

Even with new brand launches, a large portion of spending in the premium and affordable-premium segments still happens overseas, meaning a big opportunity remains untapped in the local market.

… tapped into can unlock a global market for Made-in-Indonesia brands!

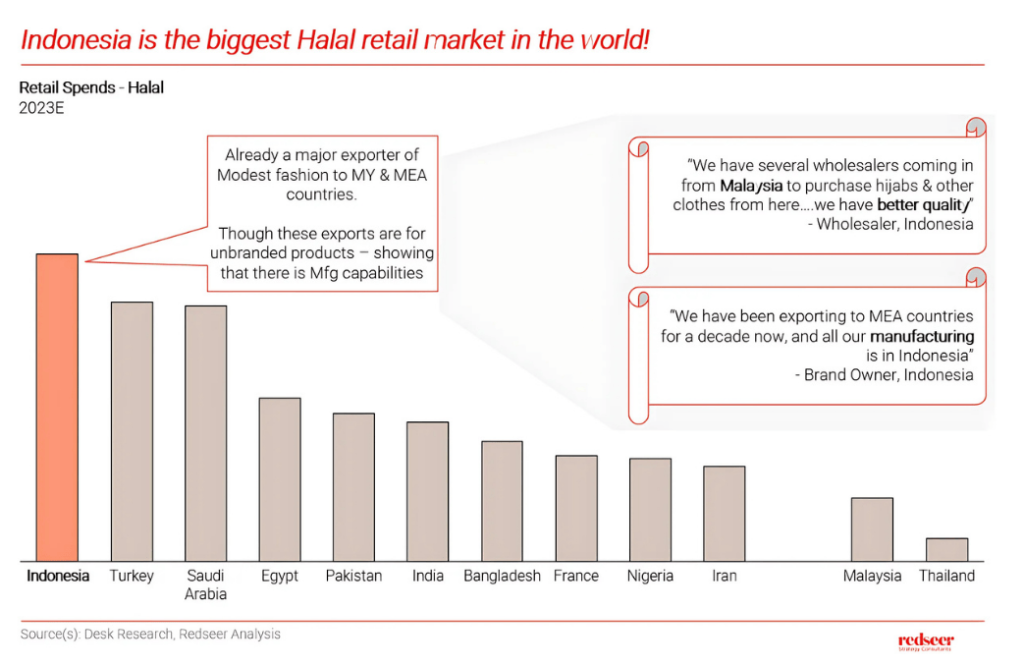

Indonesia can leverage its unique position in the global market. It’s not only one of the biggest domestic markets for Halal products, but it also boasts strong manufacturing capabilities.

This combination positions Indonesia as a potential major exporter to Malaysia and many Middle Eastern countries. However, a large portion of these exports are currently unbranded, presenting a significant opportunity for Indonesian brands to go global.