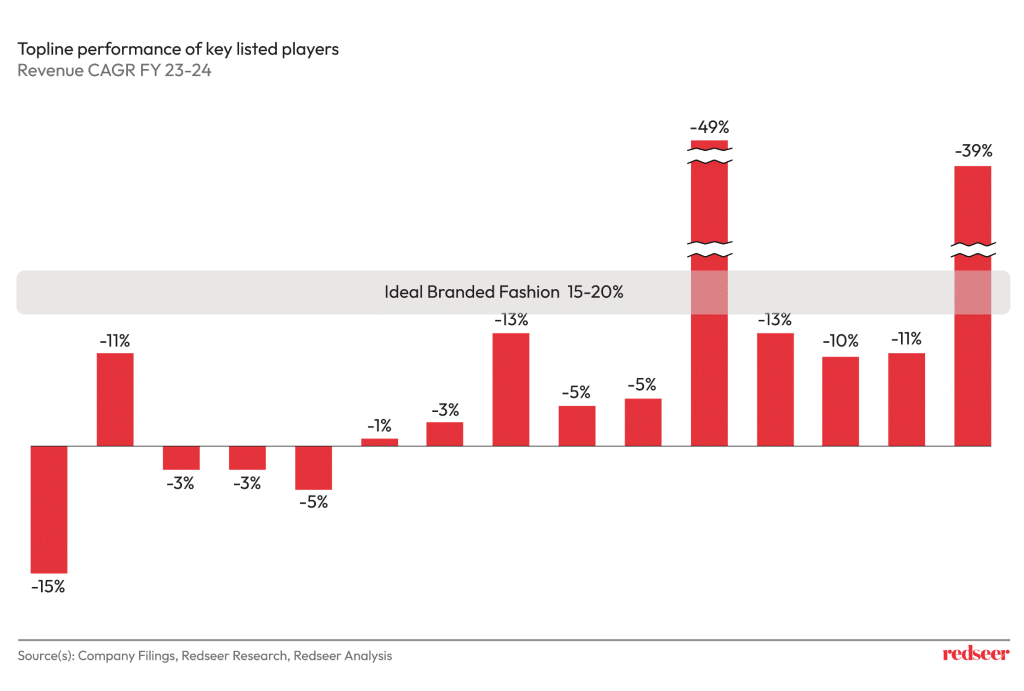

India’s Fashion market has been underperforming over the last 1-1.5 years. Several leading brands are struggling to maintain consistent growth, with revenue growth for FY 2023-24 showing uneven performance across players.

While macro has had its role to play in this underperformance, the situation seems more structural to the fashion industry. During recent years, there have been changes in India’s fashion landscape not just n terms of style and consumer needs but in terms of the fundamental ways in which consumers shop and engage with brands. The rise of digitally native, Direct-to-Consumer (D2C) players has rewritten the rulebook for success, leaving legacy brands scrambling to keep up. Where traditional players once relied on their vast retail networks and loyal customer bases, the new battleground is digital, personalized, and hyper-responsive to trends.

What has changed so drastically? Today’s consumers—particularly the Gen Z and millennial segments—demand more than just quality and price. They expect brands to be agile, trend-forward, and accessible. New-age brands, with their ability to launch collections at lightning speed and engage directly with consumers online, have tapped into this shift, capturing significant market share. Meanwhile, legacy brands, known for their long-standing dominance, are struggling to remain relevant in this digitally driven landscape.

At Redseer, we have been deeply engaged in analyzing these shifts in consumer behavior and industry performance. Our research provides insights and opportunities into the different fashion models across brands and retail touchpoints.

Consumer Demands

Preferences of Indian consumers has been rapidly evolving. Indian consumers are more trend-driven, selective, and digitally adept than ever before. Our research explores the key factors driving consumption behavior across consumer segments. Brands that can successfully interpret and respond to these shifts are well-equipped to thrive in this dynamic landscape.

Indian consumers can be bucketed into six distinct cohorts basis their ages, incomes, living setup, city tiers, and fashion purchase behavior. These cohorts are detailed below:

- Value Hunters – GenZ and Young Millennials with household incomes of less than INR 5LPA across all city tiers and INR 5-8 LPA in Tier 2+ cities.

- Millennial Nesters – Older Millennials with families with household incomes of less than INR 12 LPA across all city tiers.

- Style-Conscious Shoppers – GenZ with household incomes of INR 5-8 LPA in Metro and Tier 1 cities and 8-12 LPA across Tier 2+ cities.

- Refined Style Seekers – Young Millennials with household incomes of INR 5-8 LPA in Metro and Tier 1 cities and 8-12 LPA across Tier 2+ cities.

- Fashionable Affluents – GenZ with household incomes of > INR 12LPA.

- Classy Affluents – Millennials with household incomes of >INR 12 LPA.

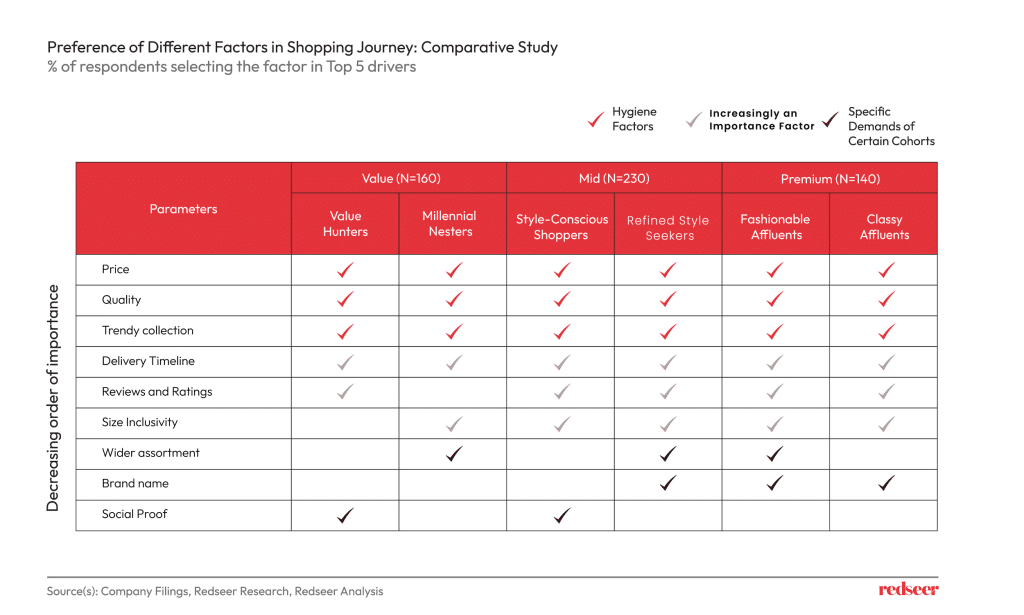

Parameters important to the Indian consumers while making fashion purchases:

- Price and Quality: These remain fundamental hygiene requirements across all consumer cohorts.

- Trendy Collections: From budget-conscious buyers to luxury seekers, consumers of all cohorts are increasingly looking for fashion-forward collections that align with the latest trends.

- Delivery Timelines: Spoilt for choice by the quick commerce revolution, Indian consumers across all cohorts increasingly want faster deliveries.

- Reviews and Ratings: Another critical factor of most consumer cohorts as they want to make more informed choices.

- Size Inclusivity: Indian consumers are increasingly preferring brands that offer more inclusive sizes catering to the Indian body. As such this is becoming an increasingly important factor across most cohorts.

Cohort-Based Targeting is the way forward for Brands

As distinct consumer cohorts have different needs and preferences, to succeed in India’s fashion market, brands have started offering personalized experiences, rapid trend adoption, and digital-first engagement strategies.

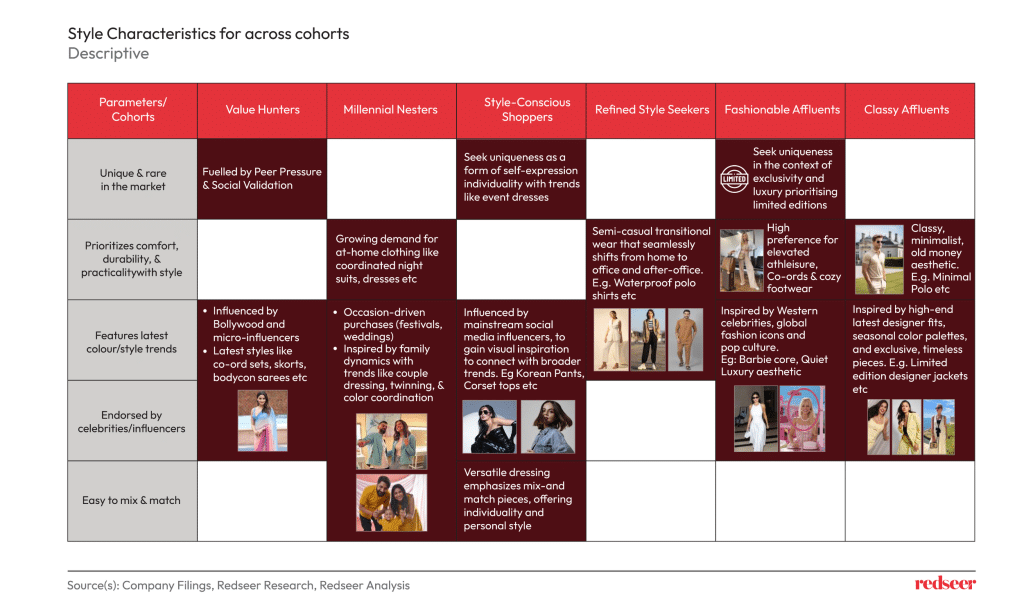

Different consumer cohorts have different style and trend preferences. Our research suggests the following trend drivers:

- Value Hunters: Driven by peer pressure and social validation, this cohort is heavily influenced by Bollywood and micro-influencers. They seek affordable, trendy styles like co-ord sets, skorts, and bodycon sarees. New-age brands cater to them by launching frequent, inexpensive collections that tap into popular trends.

- Millennial Nesters: This group prioritizes comfort and convenience, often purchasing at-home clothing like coordinated night suits and occasion-driven outfits for weddings and festivals. Their preferences are shaped by family dynamics, favoring trends such as couple dressing and twinning.

- Style-Conscious Shoppers: For this cohort, fashion is a form of self-expression. Influenced by social media, they seek unique, statement pieces like event dresses, corset tops, and Korean pants. New-age brands meet this demand with versatile collections that blend individuality with current trends.

- Refined Style Seekers: These consumers need semi-casual attire that transitions seamlessly between work and social events. They prefer practical, stylish clothing like waterproof polo shirts that suit multiple settings. Brands targeting this group emphasize versatility and functionality without compromising on style.

- Classy Affluents: Known for their minimalist “old money” aesthetic, classy affluents favor timeless, high-end pieces like minimalist polos and limited-edition designer jackets. Their preferences are guided by craftsmanship, seasonal color palettes, and understated luxury.

Performance Insights: Legacy vs. New-Age Brands

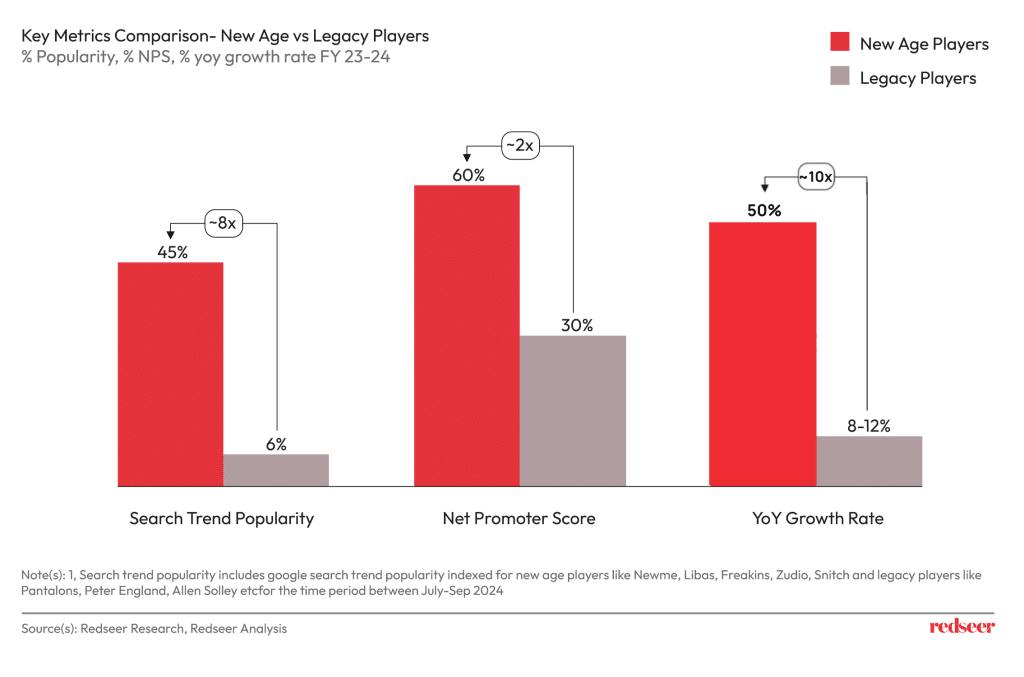

Our research reveals key performance gaps between new-age and legacy brands, particularly in growth, popularity, and customer satisfaction:

- Search Trends and Popularity: Google Trends data shows a sharp increase in search popularity for new-age brands, driven by their ability to meet the evolving demands of trend-conscious consumers. Searches for new-age brands have seen a substantial uptick in recent times, while those for legacy brands remain flat or declined.

- Net Promoter Score (NPS): New-age brands outperform legacy players in terms of NPS, largely due to their trend-first approach and strong customer engagement. These brands excel in influencer marketing, driving higher customer satisfaction and loyalty. Legacy brands face challenges in adapting to the fast-paced, trend-driven expectations of today’s consumers, resulting in lower NPS scores.

- Revenue and YoY Growth: Driven by this higher popularity and consumer satisfaction, new-age brands have grown at an average of 50%, growing much faster than legacy brands between FY 23 and FY 24. This growth is fueled by frequent product launches and agile offline expansion strategies. Legacy brands, on the other hand, have struggled to keep up due to slower production cycles and supply chain limitations.

Key Success Drivers for New-Age Brands

Several factors have enabled new-age brands to capture market share at the expense of legacy players:

- Speed to Market: By optimizing supply chains, new-age brands can launch new collections every 2-3 weeks, compared to the traditional seasonal cycle of legacy brands. This agility enables them to quickly respond to trends and keep their collections fresh.

- Trend-First Approach: New-age brands have mastered the ability to identify and capitalize on micro-trends. For instance, brands like Snitch quickly launch collections aligned with Y2K and streetwear trends, ensuring they stay relevant to younger, fashion-forward consumers.

- Consumer Engagement: Digital engagement is a key driver of success for new-age brands. Through influencer collaborations, customer-generated content, and creative digital campaigns, brands like The Souled Store and NewMe have built strong customer loyalty and repeat purchases. This high level of engagement helps these brands achieve better NPS and customer retention rates than their legacy counterparts.

Navigating a New Fashion Landscape with Redseer

The Indian fashion industry is evolving at an unprecedented pace, driven by rapidly changing consumer preferences and the rise of new-age brands. While legacy brands have struggled to keep up, they still possess valuable assets—such as brand heritage and broad retail networks—that can be leveraged for growth. By adopting agile strategies, enhancing digital engagement, and improving supply chain flexibility, legacy brands can not only compete but thrive in this fast-changing landscape.

At Redseer Strategy Consultants, we offer deep industry insights and actionable strategies that help both legacy and new-age brands navigate this dynamic environment. Whether it’s modernizing legacy operations or scaling a new-age player, our tailored solutions provide the tools businesses need to maximize growth and stay ahead of market trends. Reach out to us to learn how we can help you drive profitability and sustain competitive advantage in today’s fashion industry.