1. Philippines consumer internet space – fast growing consumer internet economy

With a population of 110 million, Philippines is the 2nd most populated country in SEA. 48% of the population lives in urban areas. It has a young population with a median age of ~26 years and is one of the lowest in SEA and among major economies in the region.

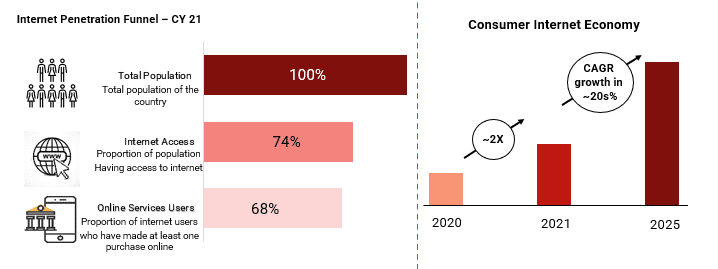

While the digital penetration is relatively low versus other major SEA economies, it is expected to increase going forward. Meanwhile, internet use is one of the highest within those who have access to internet. With an average screen time of 10 hours/ day, Philippines has one of the highest digital consumption in the world.

Overall, the high-single-digit GDP growth outlook for next few years, young population, and increasing digital penetration provide strong tailwinds for the growth of the consumer internet sector. We estimate the GMV to grow at ~20s% CAGR between 2021 and 2025.

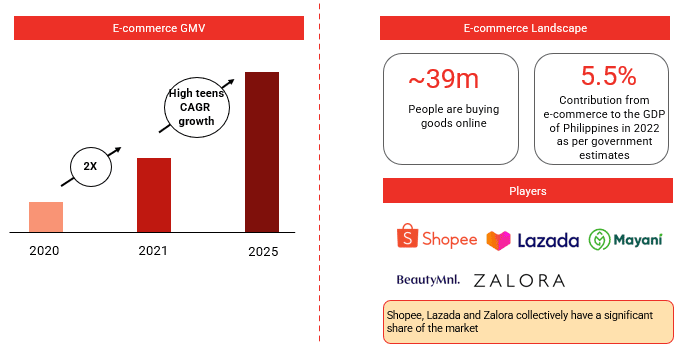

2. E-Commerce continues to be a high-growth segment in the country

The Philippines e-commerce market has been registering double digit growth. The government is also taking various initiatives to boost the e-commerce. In January 2021, it launched the ‘Philippine e-Commerce Roadmap 2022’ to promote e-commerce adoption among SMEs and boost consumer confidence in online shopping. The government hopes to have ~1 million e-commerce businesses in the country by 2022.

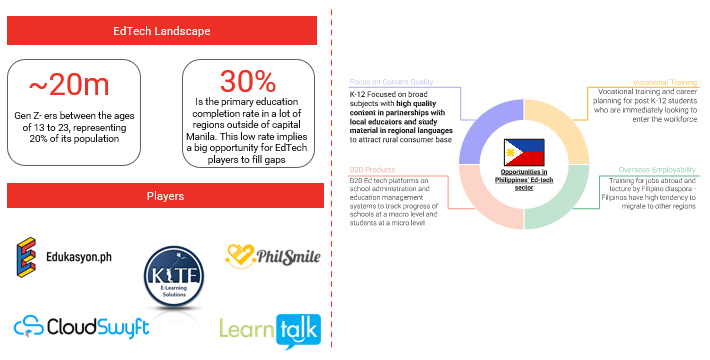

3. Favourable population demographics, inadequate offline infrastructure and the need for vocational training and employability create strong potential for EdTech

The EdTech sector has immense grow potential considering the changing education consumption patterns and the need to continuously upskill oneself to remain relevant in the fast-changing digital economies. Currently the EdTech landscape in Philippines is dominated by local players and the market is heavily fragmented. However, with English being the first language in the country, other global players can also look to enter Philippines.

4. Encouraging economic growth, improving retail expenditure, sustained digitalisation and the presence of large unorganised retail offers fertile ground for eB2B growth

The neighbourhood mom-and-pop (known as sari-sari) stores in the Philippines sell various daily necessity products. There are more than 1.1 million of such stores in the country. Collectively, these account for more than 55% of FMCG sales and are an important part of the distribution channel.

B2B startups are digitizing these stores and offering them higher convenience on pricing, inventory management and working capital loans. Further, value-added services like online telecom and utility bill payments and remittance are valuable add-ons for the mom-and-pop stores.

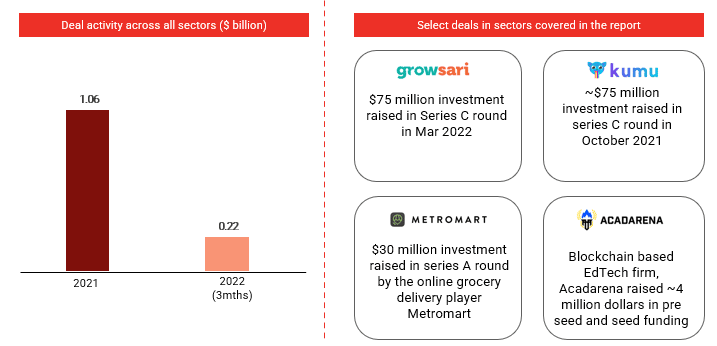

5. Strong fund flows in the consumer internet economy will propel the industry ahead and lay a groundwork for increased market opportunities, penetration and revenue growth in the future

Philippines has seen a bounce back in the deal making and funding activities post covid. E-commerce, FinTech, EdTech, ride-hailing and food delivery space have witnessed notable traction.

Almost 80% of the fund-raising activities carried out in 2021 and 2022 is in the early-stage space. This signifies a healthy momentum in entrepreneurial activities in the country.