Southeast Asia and India: Connecting Consumers Beyond Borders

Imagine my surprise on a Mumbai summer break. While browsing the shelves at a retail outlet, I saw Indonesia’s legendary Indomie noodles and those addictive Kopiko candies. After speaking with my friends, I realized Indian personal care companies like Wipro and Marico have been spreading their wings in Southeast Asia for years now – think BioEssence, XMen, Eversoft, and Code 10 brands in Vietnam, Indonesia, and Malaysia.

Want to evaluate new investment and M&A opportunities?

This got us thinking: sure, there are differences between what people consume in India and what Southeast Asia craves, but there’s a surprising amount in common too. With consumers driving economies in both regions, the future for cross-border brands looks promising!

Here’s the thing: thanks to better digital and physical connectivity, it’s easier than ever for consumer brands – to win over customers across the seas. This short note explores the why and how of it.

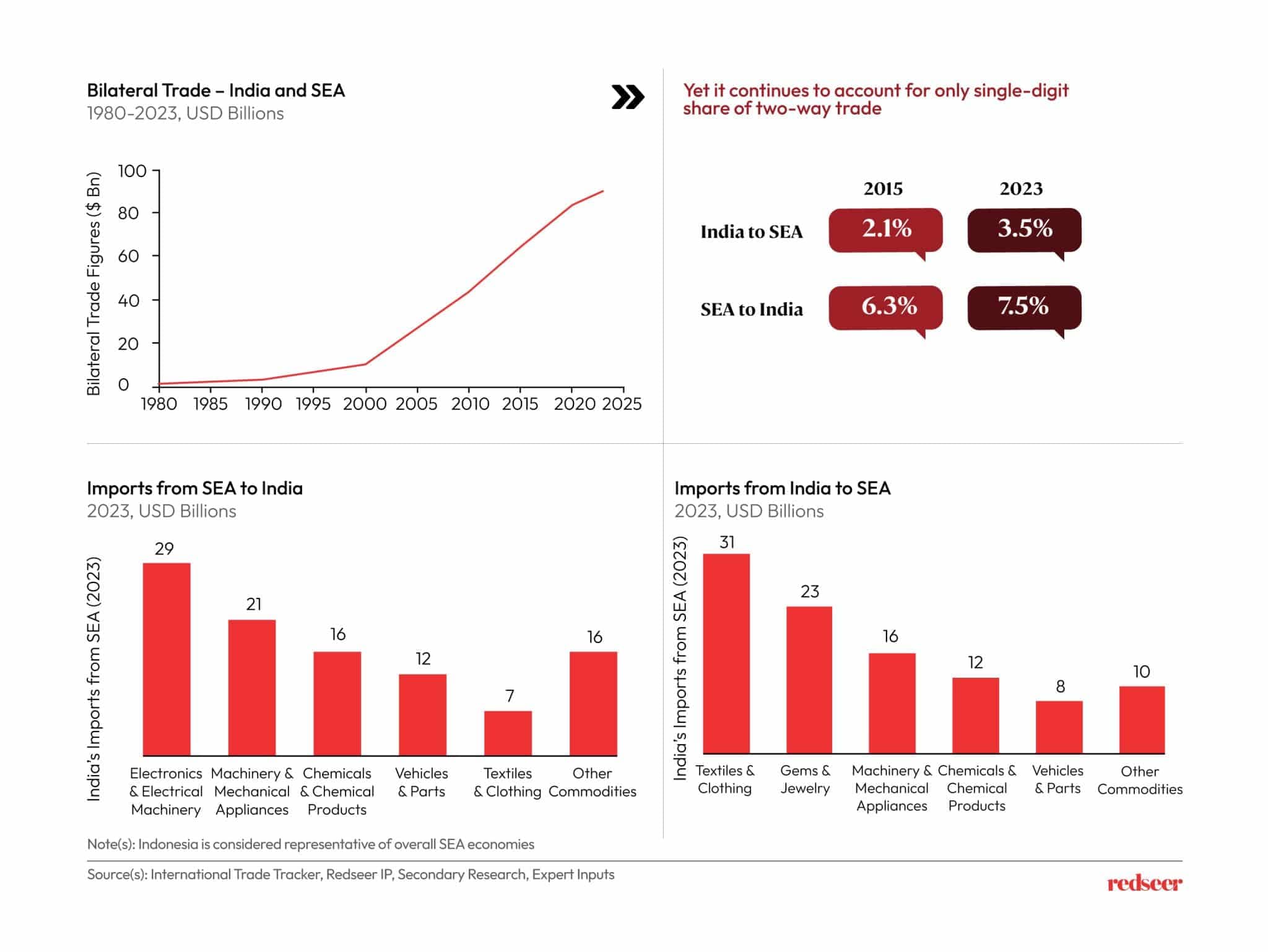

1. Despite increasing cross-border trade, India and Southeast Asia represent a small portion of each other’s overall exports

Trade between India and Southeast Asia go all the way back to antiquity, something well-reflected in today’s trade figures.

India ranks as the sixth largest trading partner among ASEAN member states. Trading figures have also grown in general. Illustratively, India-Indonesian trade has marked a two-fold increase between 2019 and 2023 amounting to USD 28.2 billion. However, despite the growth in absolute figures, their mutual share of trade remains small.

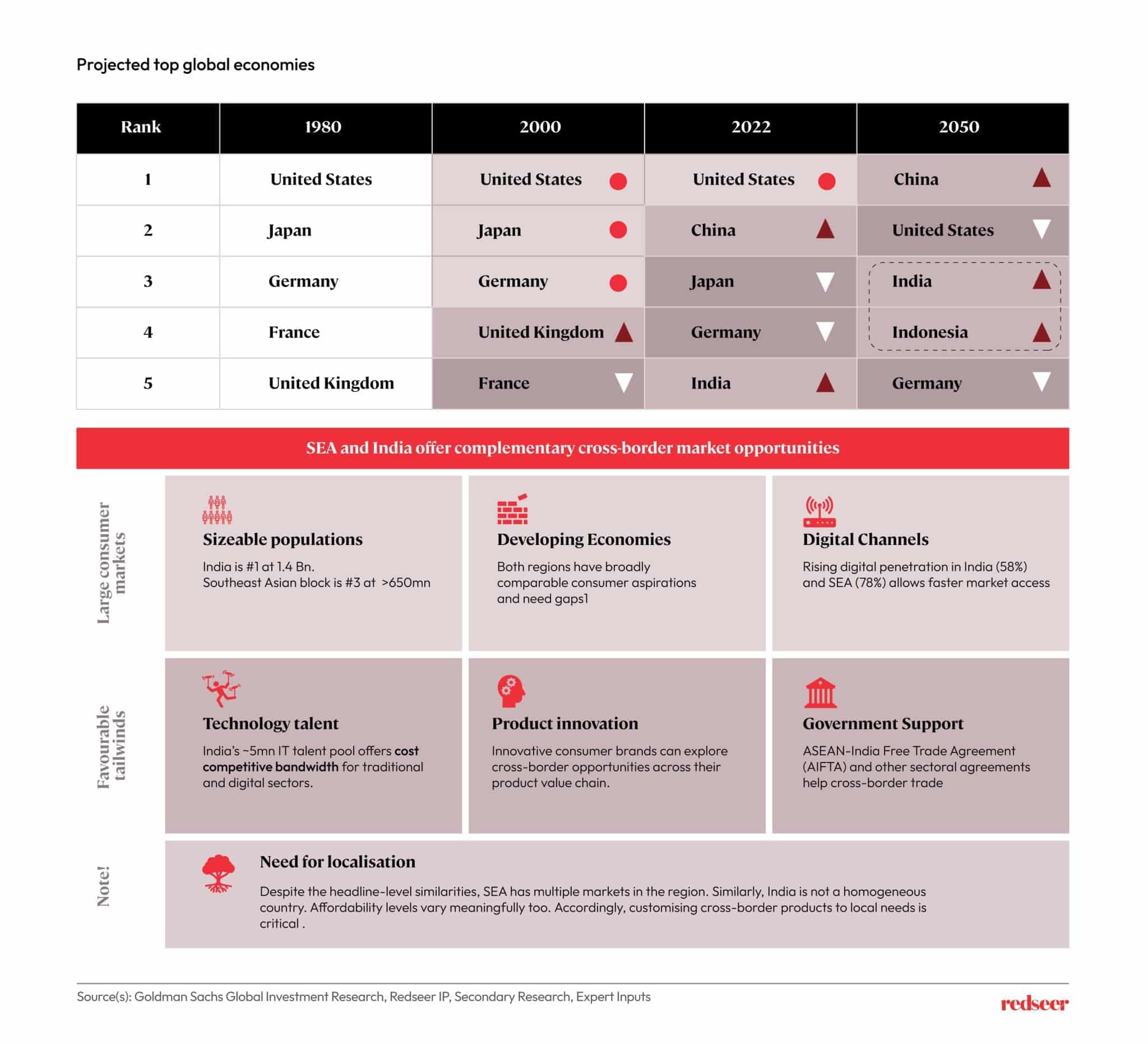

2. However, their consumption-led economies offer opportunities for consumer companies to explore cross-border expansion

India and Indonesia are poised to be in the top-5 global economies by 2050. With consumption accounting for more than 50% of their GDP (excluding Singapore), there could be attractive opportunities for consumer products companies to tap into cross-border demand.

Large consumer populations along with increasing digitization, product innovation, and government support make it easier to explore such opportunities now than it used to be before.

However, it is important to localize the product to reflect the differences that exist across these countries as well as within a country.

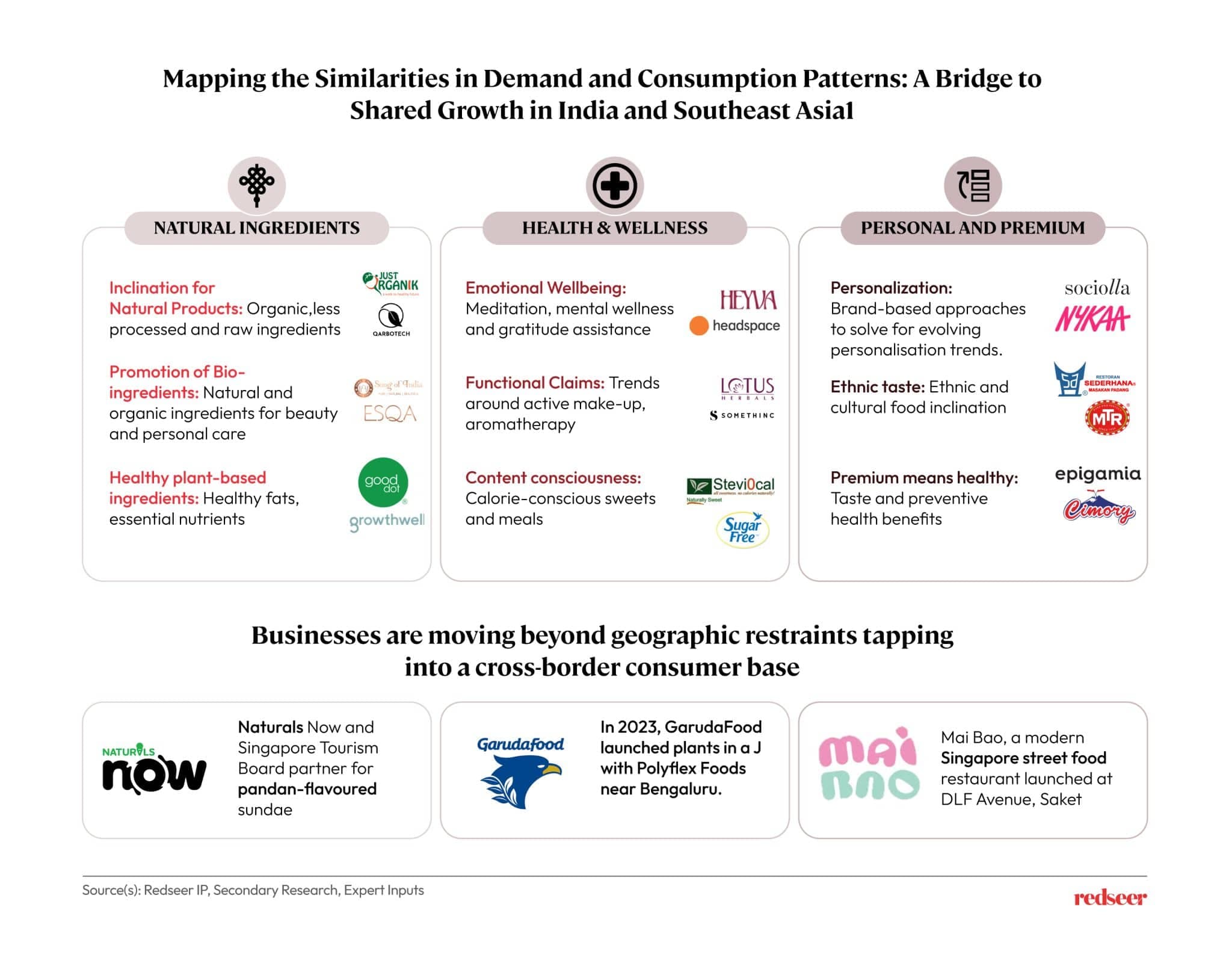

3. Leveraging shared consumer preferences that cut across both regions could be one way to tap into these segments…

We think consumer companies in Retail-CPG, BPC, F&B and Fashion hold significant cross-border growth potential. The relatively large market sizes and fragmented market structures offer opportunities for newer brands to enter and grow over time.

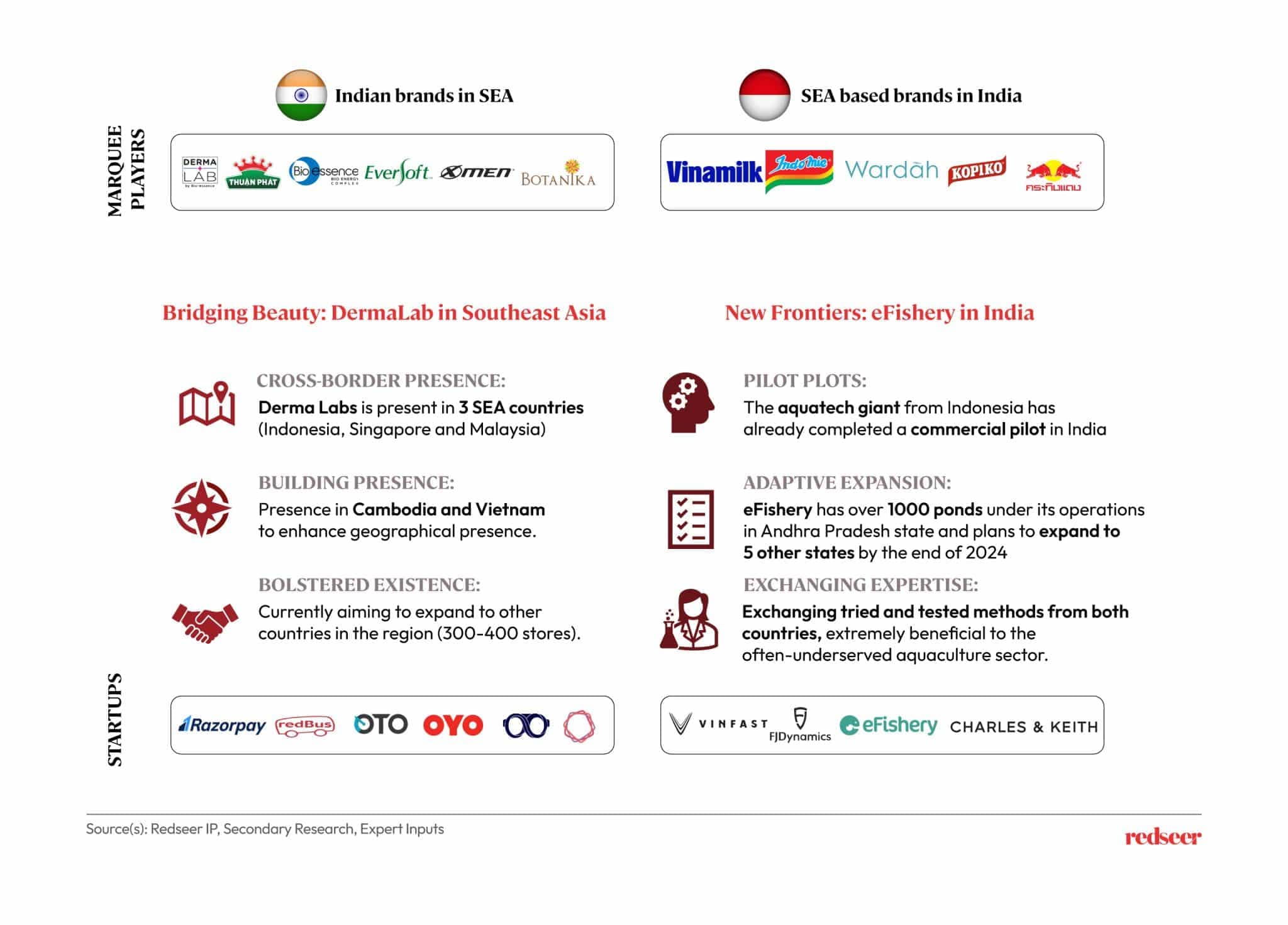

4.…while a few companies have expanded their presence, there is room for more to follow

Traditional consumer brands from Southeast Asia such as Indomie and Kratingdaeng have a presence in India. Similarly, consumer products from India-based companies such as Marico, and Wipro have a presence in Thailand, Vietnam, and Indonesia through local brands.

Newer companies such as VinFast (Vietnam) and E-fishery (Indonesia) are making some inroads into India. Likewise, companies such as CarDekho (operating under ‘OTO.COM’), Oyo, Lenskart, and RazorPay have also built a significant local presence in Southeast Asia.

Improving logistics connectivity and rising digital penetration between the two regions could make it easier for consumer brands to explore cross-border options.

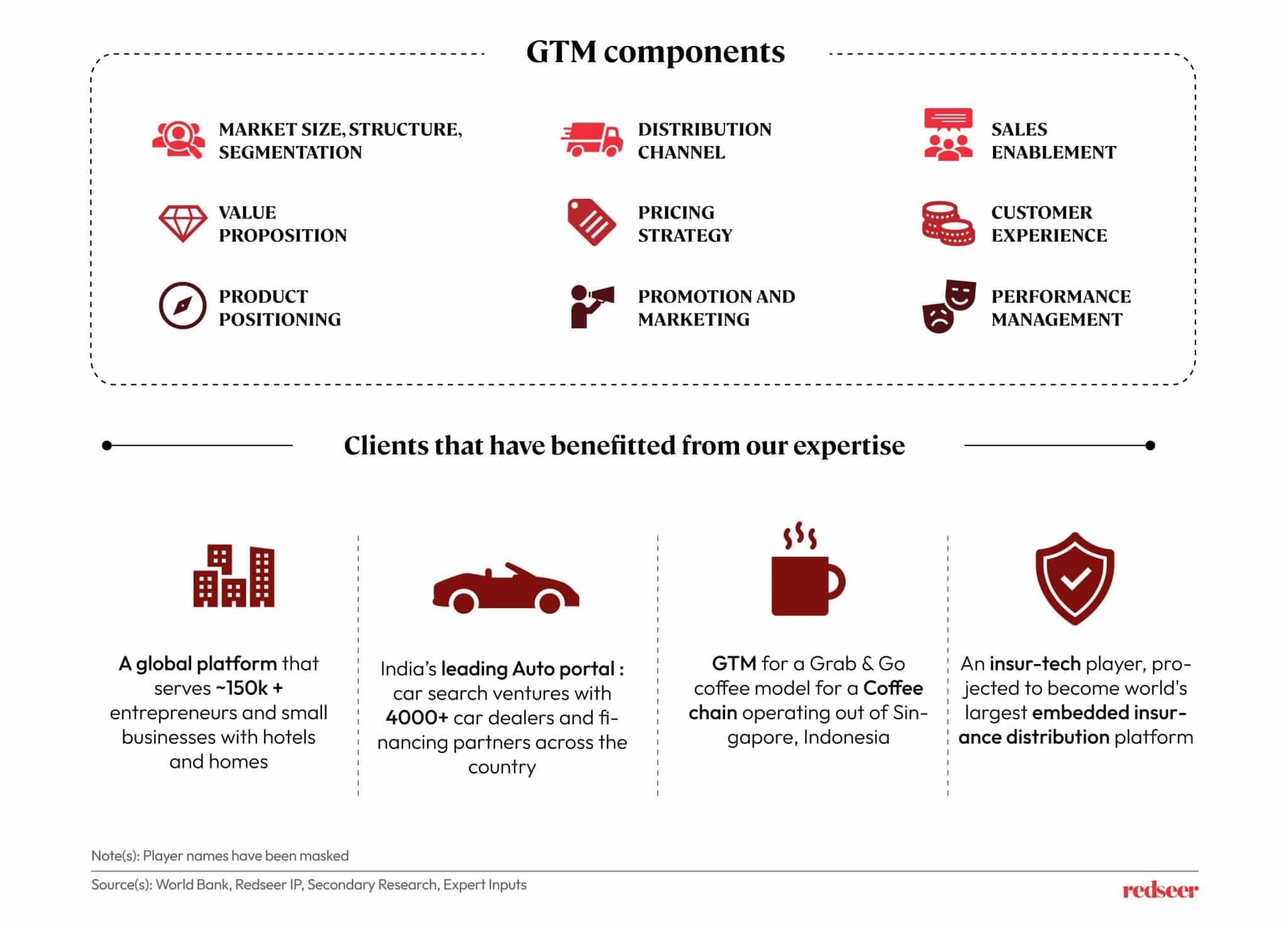

5. A well-conceived and executed cross-border Go-To-Market (GTM) strategy can help to make this a reality

Redseer has a strong local presence across both regions and has demonstrated partnerships with ambitious companies exploring go-to-market opportunities in these regions.

Stay tuned for more Southeast Asia updates—subscribe to our newsletter today.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me