Southeast Asia – The Emerging Hub for Live Experiences

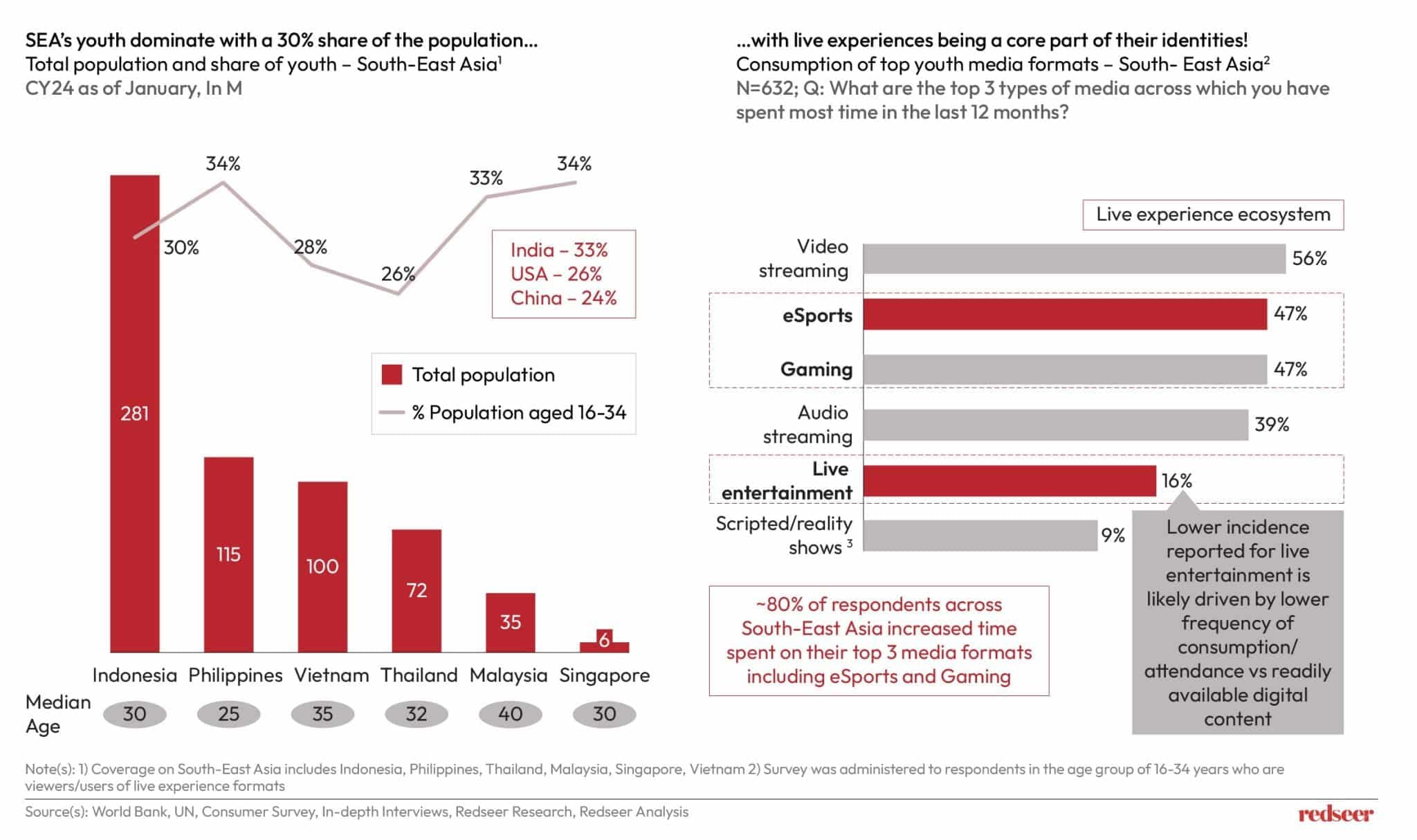

Southeast Asia is poised for a remarkable evolution in its live experience economy, driven by the preferences of its young, digitally connected population. With 30% of the population aged 16-34, close to India’s 33% and surpassing both the US and China at 26% and 24% respectively, the region is seeing a significant rise in demand for interactive formats such as eSports, live entertainment, and hybrid events. Backed by strong government support, infrastructure investments, and increasing disposable incomes, this economy is projected to grow substantially in the coming years.

This article explores the dynamics behind Southeast Asia’s booming live experience market, highlighting growth drivers, challenges, and opportunities for brands, investors, and gaming companies.

Southeast Asia’s youth are fuelling the live experience economy!

Southeast Asia’s youth, accounting for 30% of the population, are the key drivers of this booming live experience economy with Indonesia and the Philippines leading the way with with their youthful demographics. Based on our survey 47% of youth engage in eSports and gaming as part of their top three entertainment formats. This high engagement reflects a growing preference for interactive, community-driven experiences, underpinned by SEA’s high internet penetration and smartphone adoption. For brands and gaming companies, this presents a unique opportunity to capture the attention of an experience-hungry audience.

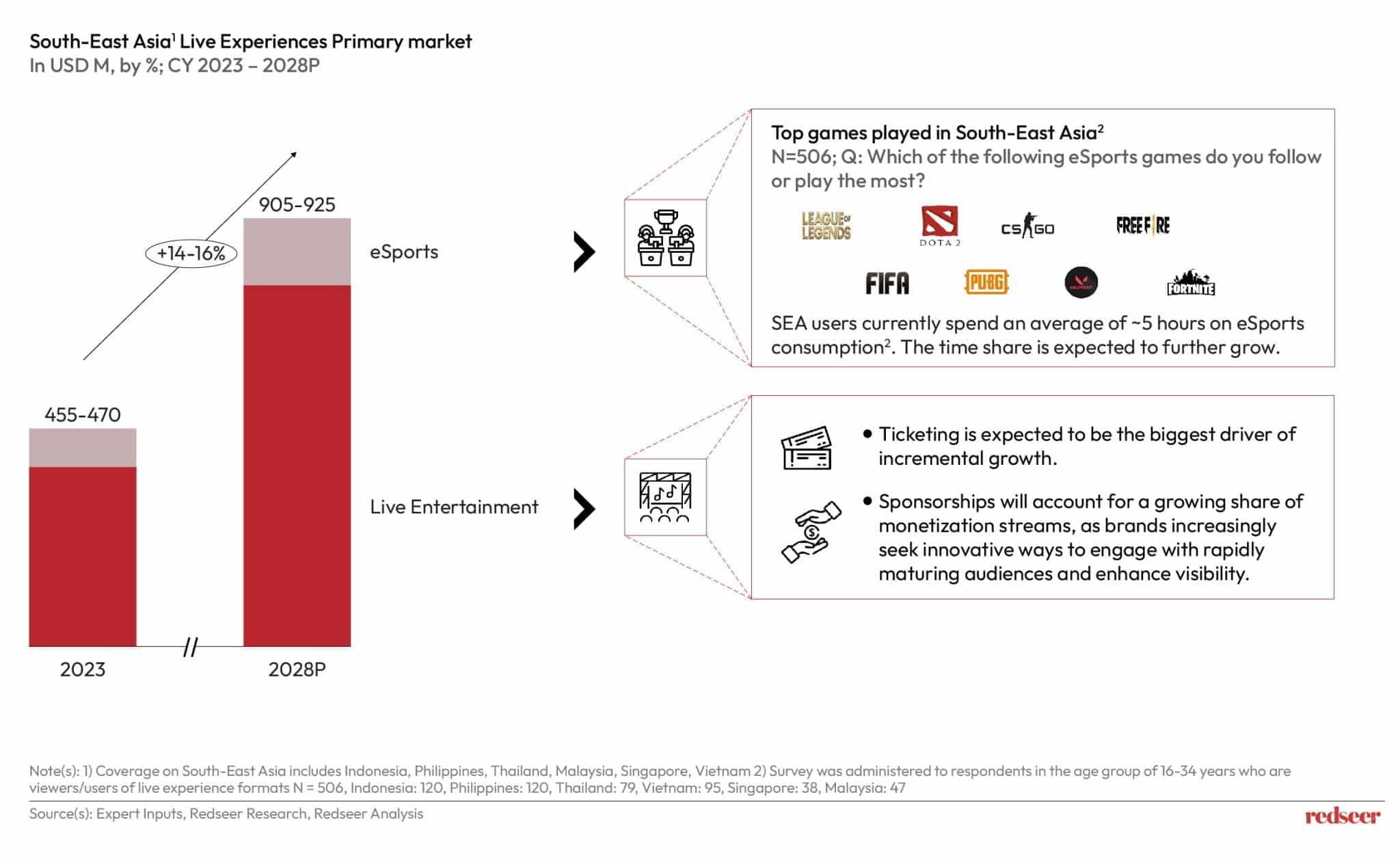

The Live Experiences primary market is set to double to USD ~905 Mn by 2028

Southeast Asia’s live experience market, covering eSports and live entertainment, is set to nearly double in value by 2028, reaching USD 905-925 million. The region’s young consumers are increasingly prioritizing spending on unique and shareable experiences. The rich adoption of social media, K-pop, eSports, and Western pop culture is driving demand for live experiences. Additionally, significant investments in event infrastructure and accessibility are enhancing the quality of live events, making them more appealing to audiences.

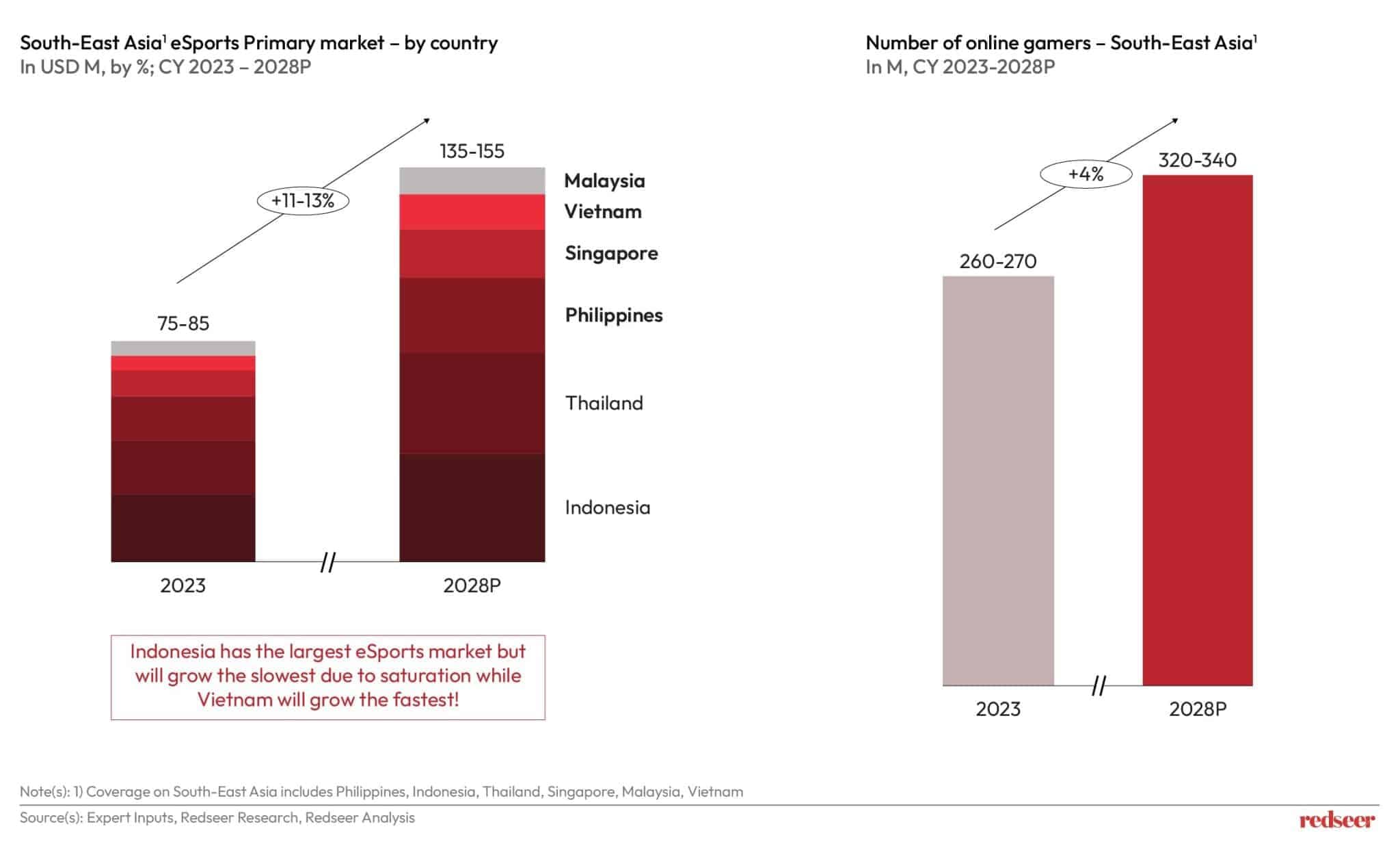

eSports is gaining traction in SEA with ~340 Mn online gamers projected by 2028 as well as considerable regional government support

SEA’s eSports market is growing rapidly, with revenues expected to increase at an 11-13% CAGR from 2023 to 2028. The number of online gamers will rise from 260 million to 340 million during this period. The region’s young population, strong cultural affinity for gaming, and increasing disposable income are key drivers of growth. The widespread adoption of smartphones and affordable internet has made mobile gaming more accessible. While Indonesia currently leads the market, Vietnam is expected to grow the fastest due to lower saturation levels.

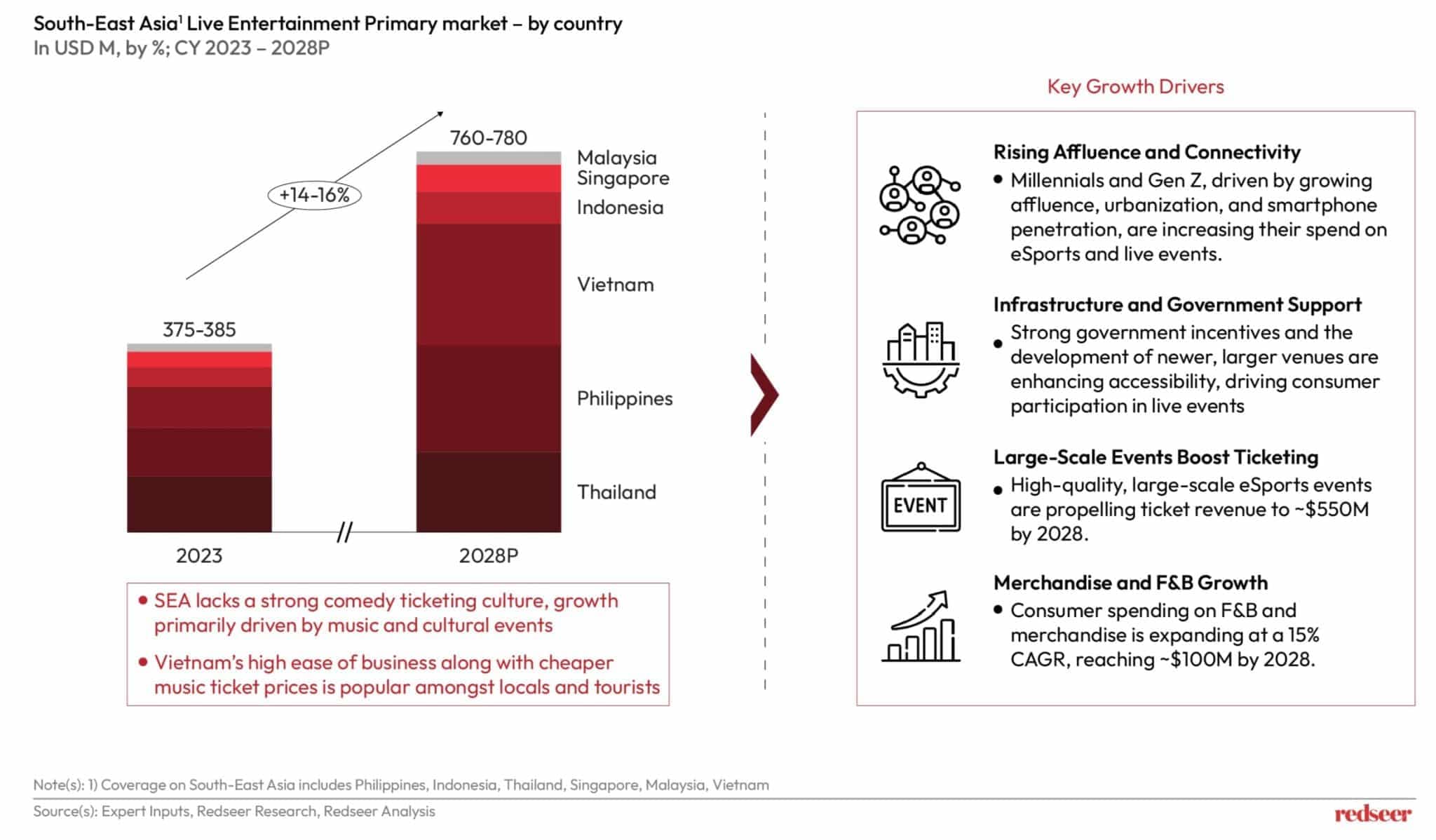

Live Entertainment set to be worth USD ~770 Mn by 2028

Want to get strategic guidance?

The live entertainment market in Southeast Asia, projected to reach USD ~770 million by 2028, is being shaped by rising affluence, connectivity, and supportive government initiatives. Millennials and Gen Z are driving demand for music and cultural events, while improved infrastructure and newer, larger venues are enhancing accessibility across the region. Revenue growth is fueled by large-scale events, expected to contribute USD ~550 million in ticket sales, alongside expanding F&B and merchandise spending at a CAGR of 15%. Vietnam, with its affordable ticket pricing and high ease of doing business, has become a standout market for both locals and tourists. This evolution highlights an opportunity for brands to leverage live entertainment as a dynamic channel for engagement and revenue generation.

Southeast Asia’s live experience market is at an inflection point, driven by a young, digitally savvy population and a growing preference for interactive content. With eSports and live entertainment gaining momentum, the region presents a compelling growth opportunity across ticketing, sponsorship, and ancillary revenue streams such as F&B and merchandising.

Markets like Vietnam are accelerating growth through affordable ticketing and favorable business environments, while Indonesia continues to attract global attention through large-scale events. To capitalize on this momentum, brands must align with evolving consumer preferences for immersive experiences, while investors have a window to back scalable ventures that drive both engagement and economic impact. By prioritizing accessibility and innovation, stakeholders can position themselves to lead the future of entertainment in Southeast Asia.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me