The Shifting Landscape of Study Abroad: Why Are Indian Students Turning to New Global Learning Destinations?

Indian students have always eyed the US, UK, Australia, and Canada for higher studies. While regulatory changes in these countries are expected to slow market growth in the short term, studying abroad remains a strong long-term opportunity, projected to grow from $38 billion in FY2024 to $58 billion in FY2029.

Build new product innovation and market strategy.

In one of our previous articles titled Capitalising on the Rapidly Growing Indian Study Abroad Market, we discussed the resurgence of the Indian study abroad market in 2022, which surpassed pre-pandemic figures. This newsletter focuses on how the evolving regulatory environment in mature education hubs (Australia, Canada, New Zealand, UK, US) will structurally impact this market. As these hubs become increasingly competitive, companies must reassess their strategies to stay ahead.

At Redseer Strategy Consultants, we view this as a pivotal moment for the study abroad sector. This evolving market presents opportunities for innovation and growth. We’re here to help you navigate these changes, refine your strategy, and unlock new growth avenues. Don’t just adapt—thrive in this dynamic environment with Redseer by your side.

Our latest study reveals a shift in preference towards emerging hubs (non-mature education hub countries), which are expected to see a student flow growth of 11-13% CAGR between FY24 and FY29.

The Indian Study Abroad Market: A Robust Long-Term Opportunity

As we already know, the Indian study abroad market witnessed a strong recovery post-COVID pandemic, with Indian students flocking once again to mature education hubs like Canada, the UK, and Australia, surpassing pre-pandemic levels. This resurgence was driven by multiple factors, such as long-standing demand-side tailwinds in this market, increasing household incomes, easier access to formal credit, and several international factors, including lenient immigration policies in countries like Canada and the UK, as well as the global anti-Chinese sentiment.

Yet, as 2024 unfolded, the market faced a new set of challenges. The regulatory environment in the Big 4 countries—Canada, the UK, Australia, and the US—began to tighten, compounded by mounting economic/political pressures. For example, Canada plans to cap student visas, which will reduce international enrollments by 35% over the next two years, while Australia has increased financial requirements for obtaining visas and restricted geographic movement after attaining post-study work rights.

While these measures aim to ensure the sustainability of the overall market, they limit its growth potential in the short term. In contrast, emerging education hubs such as Germany, Ireland, France, and Italy are thriving. Despite the overall market growth expected to slow down to a 2% CAGR between FY2024 and FY2029P, these emerging hubs are gaining traction and are expected to grow at an impressive 13% CAGR.

The Rise of New Education Hubs for Indian Students

The share of “Rest of the World” countries is projected to grow significantly, rising from 26% in FY2024 to 38% by FY2029. This shift signifies a broader trend toward diversification in global education. Favorable government policies, lower tuition fees, and higher industry acceptance of foreign students are making new destinations such as France, Germany, Ireland, and Italy.

For instance, Germany offers courses in engineering and data science, whereas, for Ireland popular courses are in IT and Business Management. Additionally, countries such as Russia, Bangladesh, Georgia, Kazakhstan, and Kyrgyzstan are becoming popular choices for medical education.

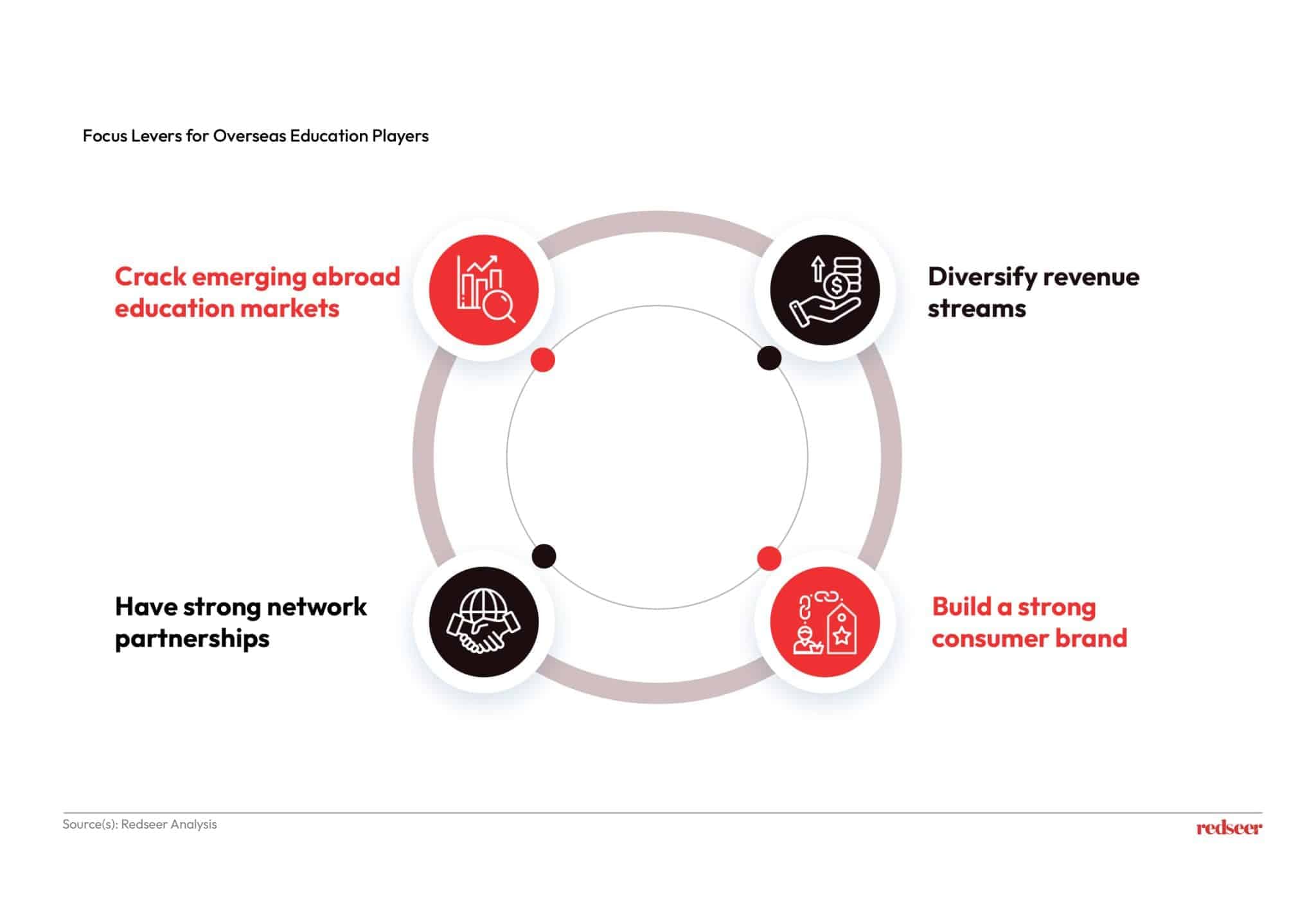

Thus, players need to evaluate their strategies in this evolving market and focus on four key levers of success to establish a strong growth trajectory.

Strategic Considerations for Education Service Providers

Firstly, as the market undergoes structural changes, it is essential for players to shift their focus toward rapidly growing and relatively untapped markets. While competition remains intense in established destinations, emerging regions such as ANZ and new hubs like Germany and Ireland are relatively untapped. To succeed, players must forge strong partnerships with universities in these countries and collaborate with DSAs and aggregators who have a targeted focus on these niche regions.

Secondly, the market presents significant opportunities for service diversification. As the market matures, students are looking beyond traditional education loans and increasingly demanding additional services such as insurance, credit cards, visa processing, and housing support. Furthermore, given the slowdown expected in the near term, players can look to expand into related loan categories, including domestic education loans, e-learning loans, and institutional loans, among others.

Strong network partnerships will be crucial for success in the study abroad sector. Financiers will need to establish robust local and regional ties with DSAs, aggregators, and counselors to create an effective lead-generation ecosystem. Counselors should analyze the university and course trends for each country and strategically build university partnerships to maximize their agency revenue potential.

Finally, study-abroad players must strengthen their consumer brand. This involves focusing on both online and offline channels: optimizing SEO, leveraging social media, and maintaining a user-friendly website online, while also running targeted offline campaigns such as educational fairs. To sustain a high Net Promoter Score (NPS), players should address key consumer pain points, such as improving turnaround times (TAT), ensuring disbursement consistency, and enhancing process transparency. By doing so, they can foster greater trust and satisfaction, leading to increased referrals and brand loyalty.

Pioneering Tomorrow’s Education Landscape with Redseer’s Strategic Insight

The overseas education landscape is rapidly shifting, and study-abroad players must adapt to thrive. Here’s what you need to consider:

Are You Targeting the Right Markets with the Right Offerings?

Are the emerging hubs such as Germany, Ireland, etc. part of your growth strategy? Are you tied up with the right universities in these markets?

Is Your Consumer Brand Funnel Optimised?

Are you receiving enough direct traffic on your website? What portion of it is getting converted?

Are You Tapping into the Complete Customer Wallet Share?

Customer spending in studying abroad is not only limited to counseling and financing but also includes ancillary services like insurance, visa processing, and housing support. Are you plugged into these offerings?

Have You Built the Right Partnerships?

Success hinges on having strong local and regional networks. Are your partnerships with DSAs, aggregators, and counselors robust enough to support effective lead generation and market presence?

Now is the moment to reimagine your strategy in the global education market. At Redseer Strategy Consultants, our team stands ready to empower your business with data-backed insights and strategic foresight. Connect with our associate partner, Kushal Bhatnagar, and let’s explore how we can make a lasting impact on your market position.

Written by

Kushal Bhatnagar

Associate Partner

Kushal has worked with funds as well as corporates across the eHealth, Hyperlocal, eGrocery, Fintech and beauty & personal care verticals. He gained immense experience in global healthcare consulting and has been able to bring that knowledge to build the digital healthcare practice here.

Talk to me