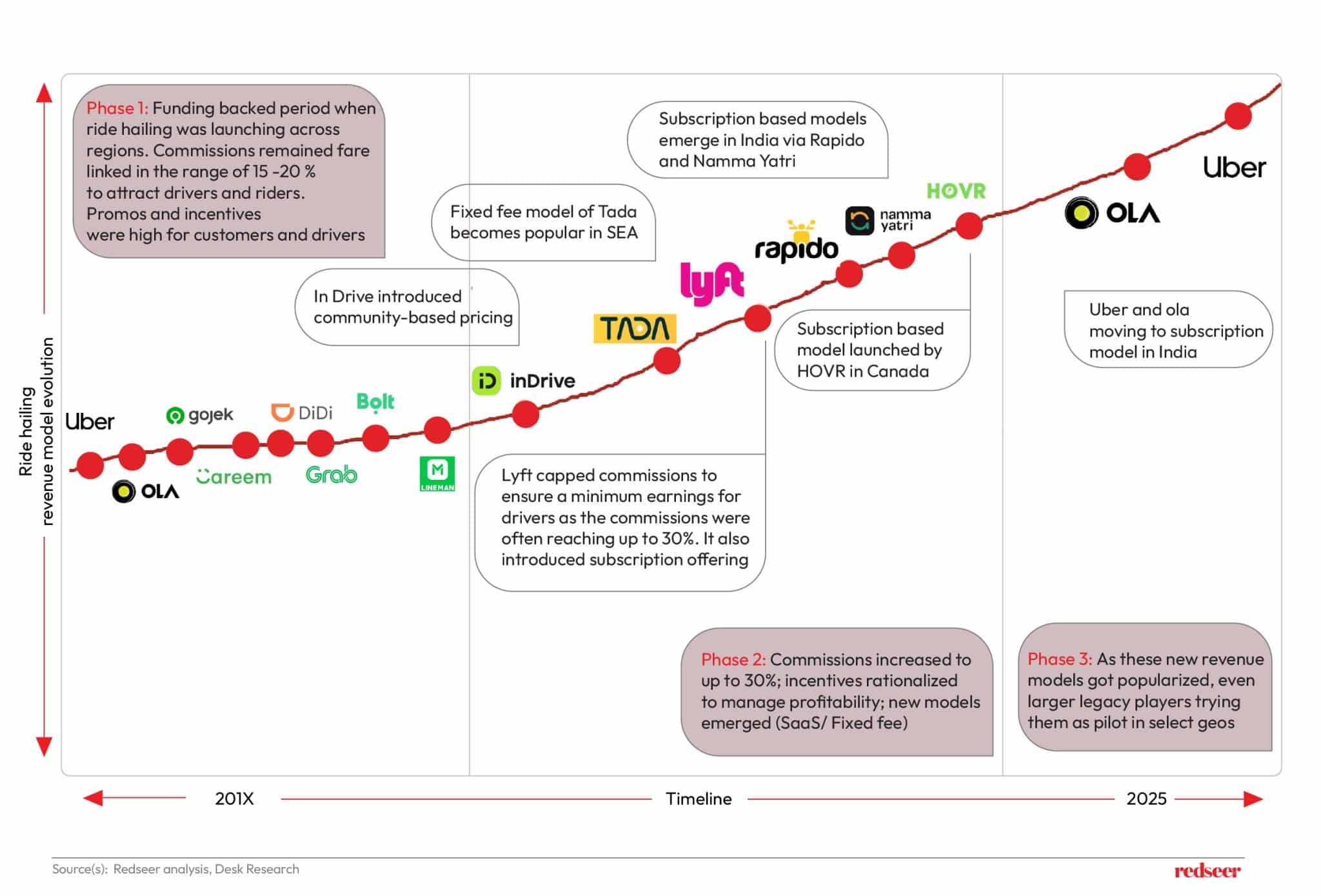

Southeast Asia’s USD 30 billion ride-hailing and food delivery market has grown primarily on the back of a commission-based monetization model. However, we notice ride-hailing platforms worldwide explore subscription and fixed-fee pricing. While these models have mostly been introduced by challengers, some established players are now testing them in select markets and categories.

The promise? Higher driver earnings and a potential solution to food merchants’ concerns over high take rates. If successful, these alternatives could reshape the industry’s economics provided the players manage the monetization gaps between the models well.

Join us as we explore key global ride-hailing trends and their impact on Southeast Asia’s mobility and food delivery landscape.

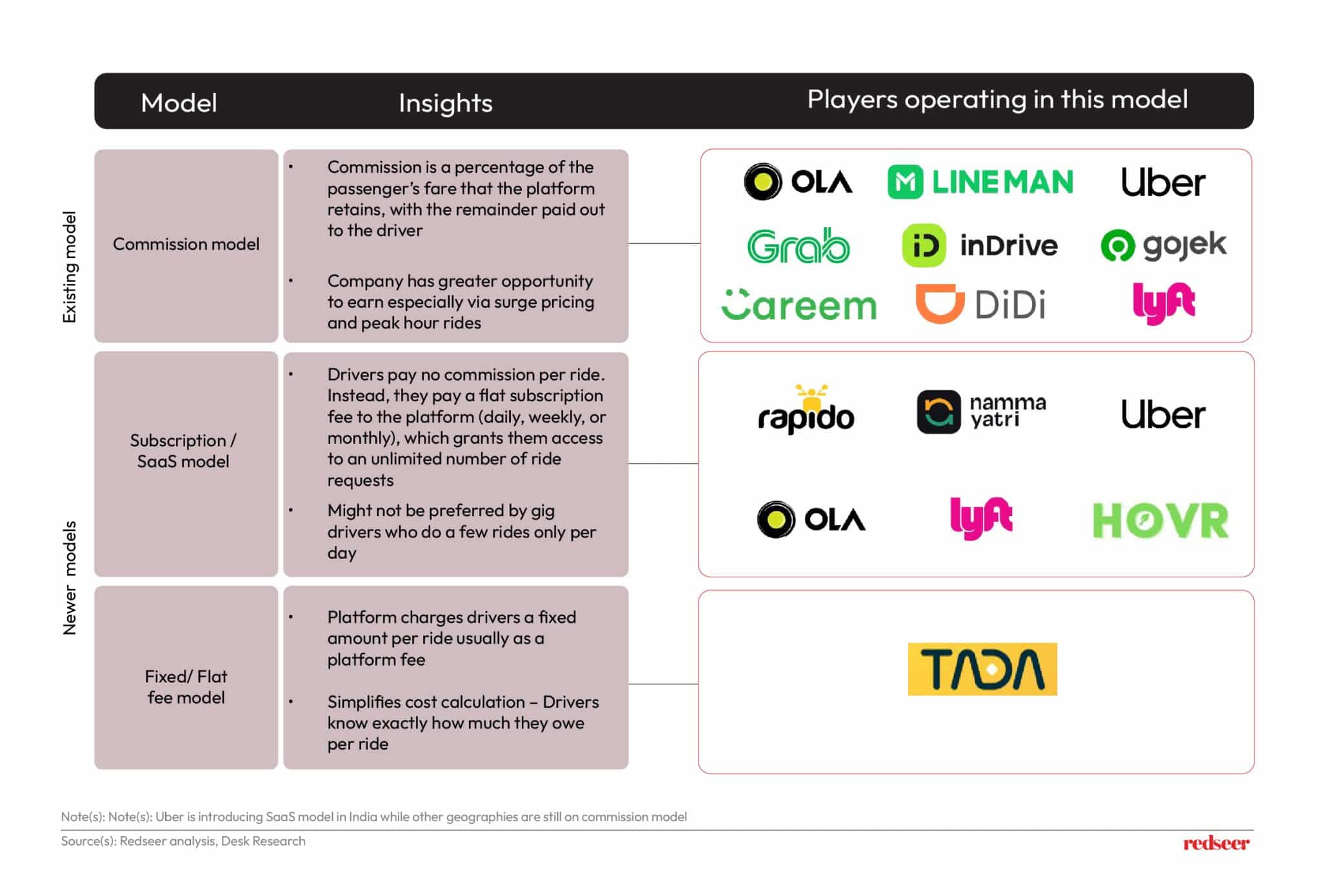

Traditionally commission-based, the ride-hailing industry is now seeing the rise of subscription and fixed-fee revenue models

Globally, the commission-based model remains the dominant revenue structure. However, growing driver dissatisfaction over earnings and rising competition have spurred the emergence of alternative models. To address these challenges, some platforms have introduced SaaS and fixed-fee models aimed at boosting driver earnings and lowering average fares.

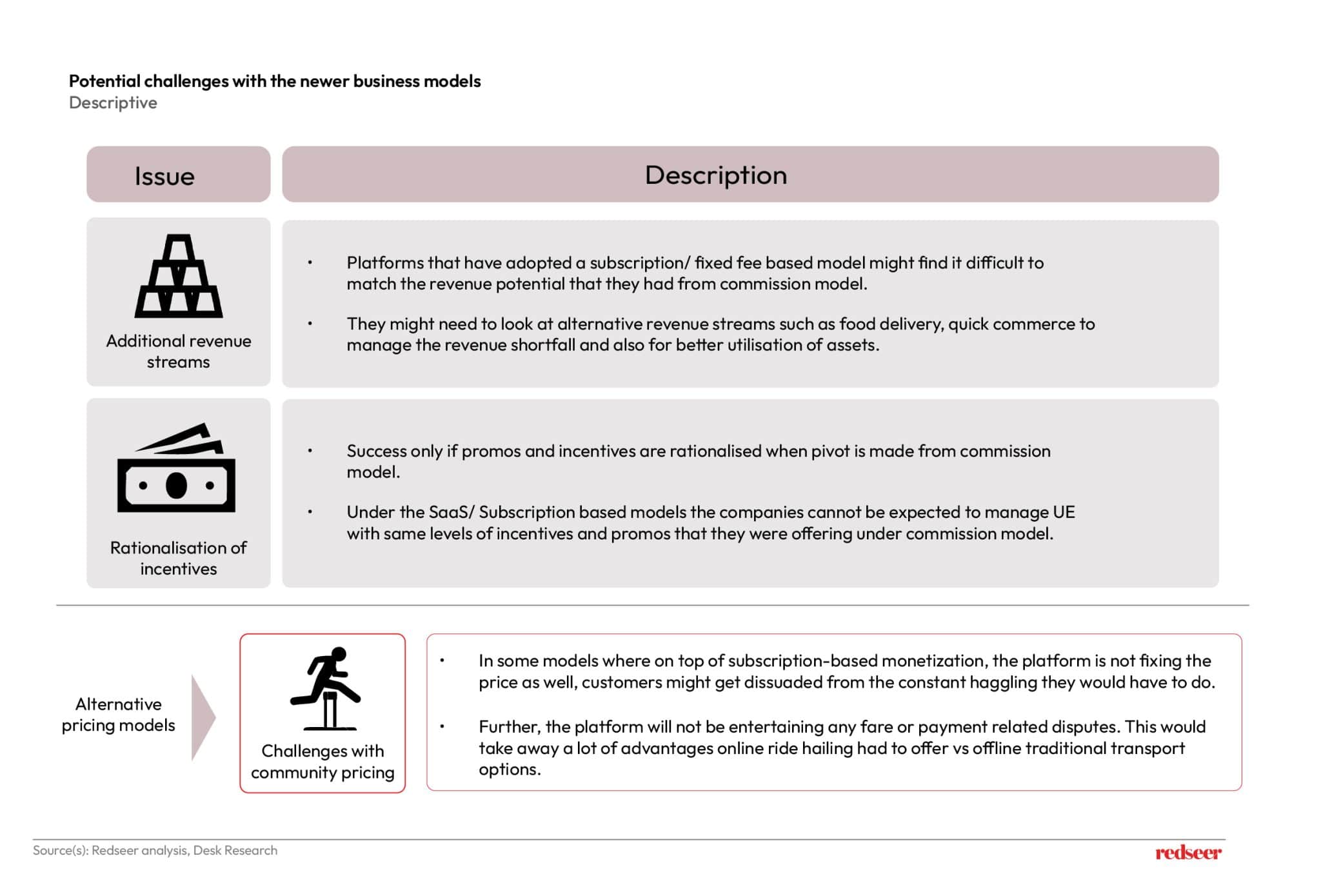

However, as new revenue models emerge, bridging monetization and incentive gap remains crucial

Players moving away from the commission-based model may face challenges in bridging the monetization gap. However, they can extend the SaaS model to food delivery and other allied sectors to maximize asset utilization. Success in this model will depend on effectively managing marketing and incentive costs.

Legacy players like Ola, Uber (India), and Lyft, along with challengers like Rapido, Hovr, and Tada, are experimenting with non-commission-based models

The chart shows that outside India, non-commission models are primarily driven by new challengers. However, in India, even major incumbents are experimenting with SaaS and fixed-fee models.

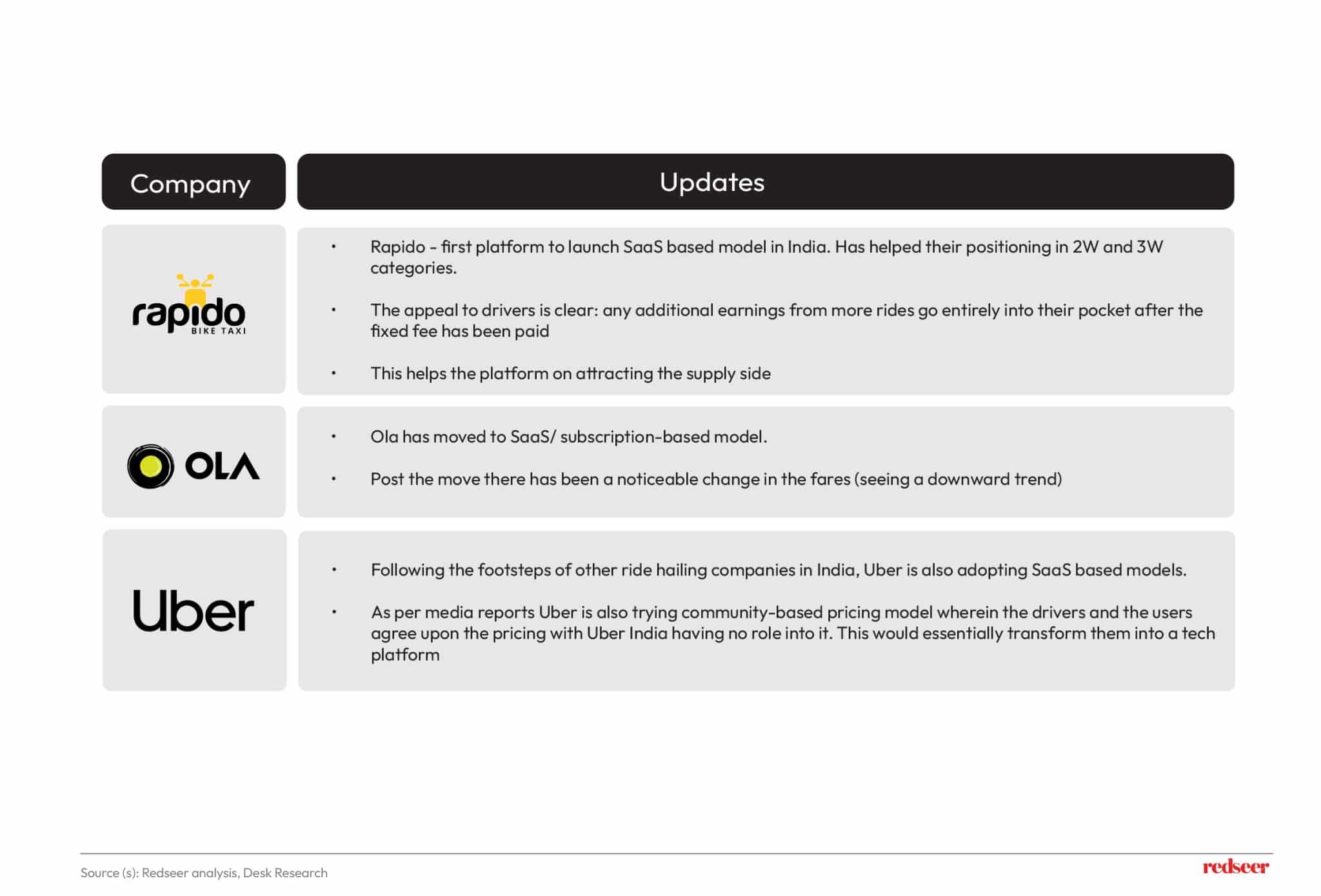

Interestingly, subscription/SaaS-based models are gaining rapid traction in India following its introduction by a challenger brand

India presents a unique case with all players rapidly moving towards a complete SaaS/ subscription-based model away from a commission-based model. SaaS model has worked well for Rapido. The company has made gains in market share across categories as of Feb 2025. Ola has also moved to SaaS model, and now Uber has also announced plans of offering SaaS/ Subscription based model.

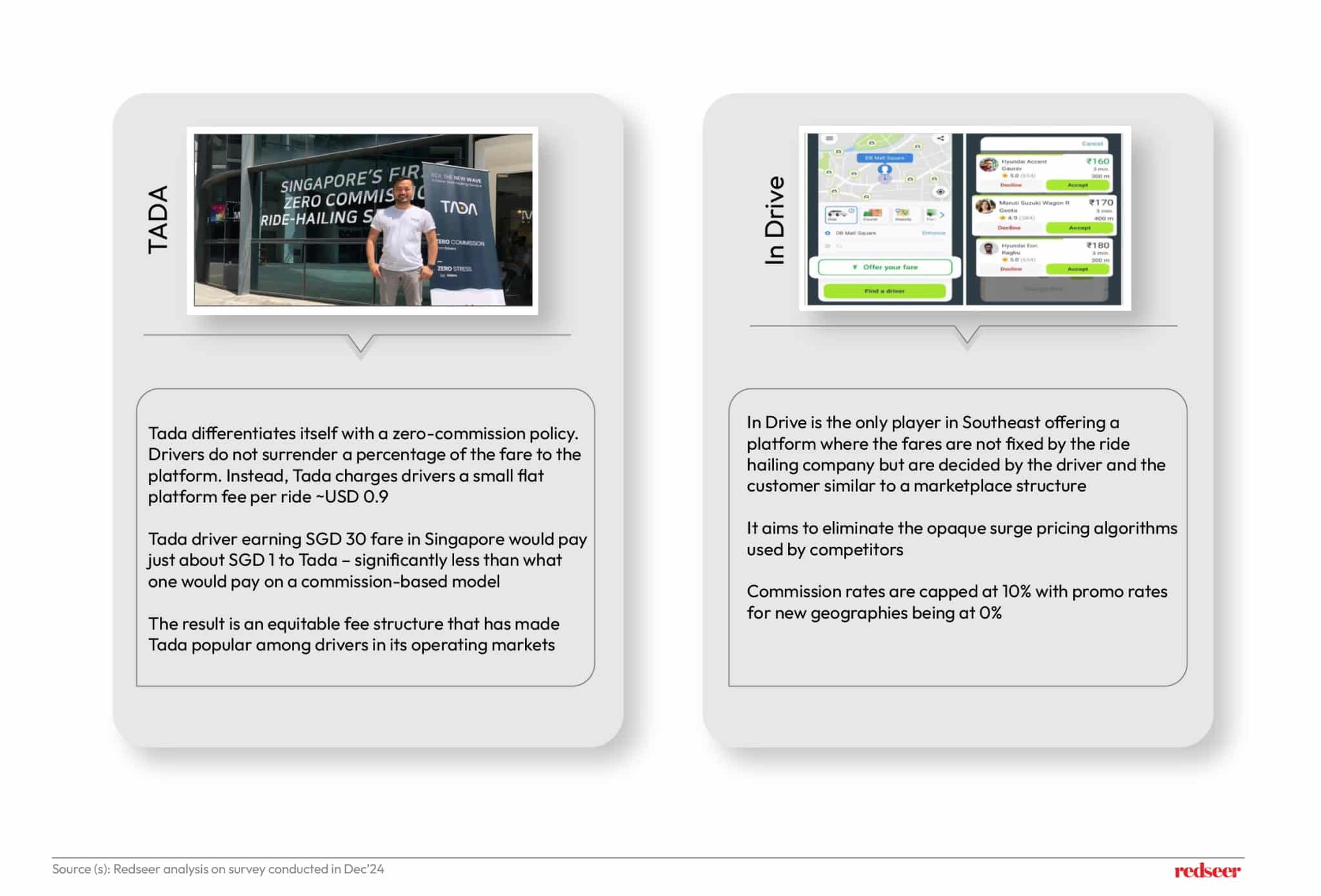

But alternative revenue models are still untested in SEA, with Tada being the only player adopting a non-commission model

There hasn’t been a significant pivot in Southeast Asia’s ride-hailing market yet. Tada remains the only player operating on a non-commission model, while InDrive is experimenting with a community-based pricing approach. It will be interesting to see if larger players in SEA follow suit and adopt SaaS or fixed-fee models